It’s easy to see click-and-order stores take up space in the digital realm. Witness those potential customers stumble upon ecommerce platforms and drool over goods or items?

Chances are that these consumers end up placing their orders online. In just a few days, someone will knock at their doors to hand up their much-coveted goods or items. Either they pay for these products via cash on delivery (COD) or they’ve already done so digitally beforehand.

Welcome to the ecommerce world!

This sector has been booming, ballooning online sellers’ pockets while sufficing consumer needs. But every now and then, we see trends in the industry come and go. That said, payment solutions are something to look forward to in ecommerce.

But as far as payment solutions are concerned, what do you offer as an online seller? On the other side of the spectrum, how will you pay for ecommerce products as a consumer moving forward ?

Let’s explore the upcoming payment trends in ecommerce for the year 2026. They’ll help you make informed selling or buying decisions. Keep reading to learn what payment solutions to expect next year—and beyond.

Ready? Let’s dive right in!

Top payment trends to expect in 2026 for ecommerce

The ecommerce industry has indeed come a long way, now poised for continued growth and expansion.

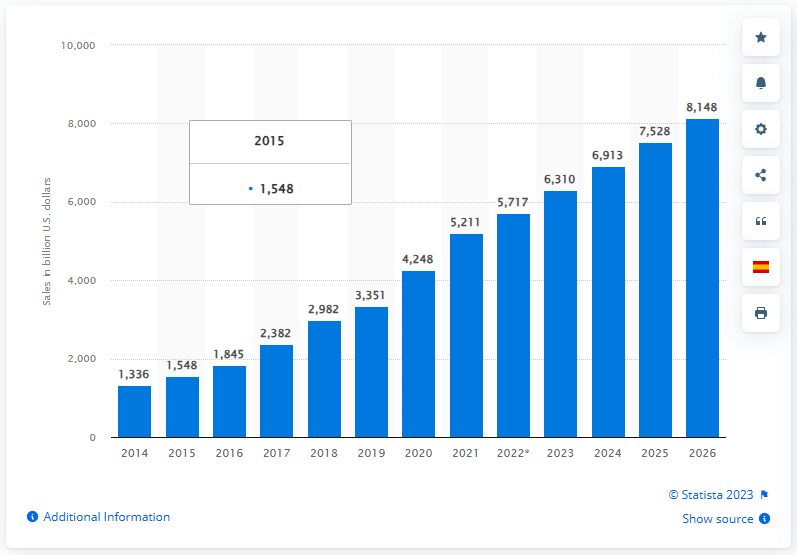

Unconvinced? Take the statistics from Statista: The global ecommerce sales might grow from $5.2 trillion in 2021 to $8.1 trillion in 2026.

But wait, there’s more: It could increase by over 55% in the next few years.

Of course, payment solutions can make a massive difference in ecommerce businesses. For online sellers, they can bring in more money for their click-and-order stores. On the flip side, these solutions can help consumers pay online without toil and sweat. What a win-win for both parties!

So, what can we expect for payment solutions from ecommerce next year? Let’s cut to the chase—here are some of the top predictions or future trends you better know:

1. The prevalence of contactless and mobile payments

Have you noticed the gradual rise of online banking? What about contactless payments in today’s society? Bet you’ve done so, whether you’re an entrepreneur or consumer!

Thanks to mobile phones with Near Field Communication (NFC) technology, they’ve made these payment solutions plausible in ecommerce. However, expect this trend to be more prevalent in the next few years as we head towards a digital and cashless society.

Shawn Plummer, CEO of The Annuity Expert, recommends adopting contactless and mobile payments for ecommerce as early as next year.

Online sellers should invest in the technology that allows these payment options to gain a competitive edge. Not only are they convenient and seamless for consumers, but these options define and shape our future transactions. To thrive and survive as an ecommerce business, you’ve got no choice but to keep up!

2. The use of pay-by-bank services for online purchases

As the name would imply, the pay-by-bank service allows customers to pay for goods or items using their bank accounts. With this payment solution, you don’t need a credit or debit card to purchase online. You can simply transfer money from your bank account to that of the seller. Painless and easy, right?

Here’s what to expect—the widespread use of pay-by-bank services in the next few years.

Heed the advice from the Financial Brand’s news report: The pay-by-back services will continue to accelerate next year.

This market growth is due to the following factors:

- Real-time payment rails have been expanding. They’ve become readily available worldwide.

- Customers have been avoiding interest rates and processing fees. They keep these in mind without compromising their access to funds.

- Key players have been democratizing payment solutions. This means making various payment portals, methods, and options more accessible.

- Consumers lean towards a shift in ecommerce. Think of transitioning from regular subscriptions to micropayments.

- We can all expect anticipated changes in the financial sector. A perfect example is Elon Musk’s banking goals and ambitions.

3. The rise of cross-border payments in ecommerce

The advent of globalization has paved the way for people to do business online amid the geographical distance. How the world has turned into a global village!

Many online sellers now cater to a global market through ecommerce platforms. They serve customers with a digital platter, no matter where they are in the world. This scenario has led to cross-border payments in ecommerce.

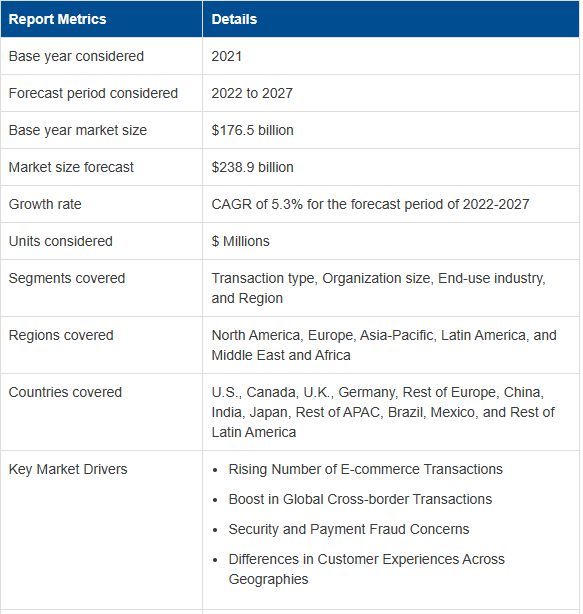

Cross-border payment solutions will start to become more apparent next year. The numbers from BCC research don’t lie:

The global market could grow from $176.5 billion in 2021 to $238.8 billion by 2027. It might expand at an annual growth rate of 5.3%.

However, online sellers should know the exchange rates and fees involved in this global setup. More importantly, they mustn’t fall short on the legal and regulatory requirements for cross-border transactions.

On the contrary, consumers should prepare for related fees and rates when purchasing online. Otherwise, they won’t see their much-coveted goods or items delivered straight to their doorsteps.

4. The use of digital wallets among consumers

Digital wallets have become one of the payment methods in ecommerce. Interesting, right? However, expect the wide adoption of these wallets in ecommerce among organizations and consumers next year and in the future. Consider having and maintaining your aptly called e-wallets as early as now!

For the uninitiated, digital wallets are also known as electronic wallets, which are precisely what they are. They allow you to securely store your bank details in the software or app. From there, you can use these stored information pieces for easier and faster transactions.

Below are some of digital wallets’ best features:

- Payment information storage: Digital wallets let you store payment information like credit card details, bank account information, and even cryptocurrencies. Necessary info is always at hand!

- Contactless payments: They allow you to buy goods or items digitally without close contact. This setup works best for the ecommerce industry!

- Online and in-app payments: They enable customers to buy products online using apps on their mobile devices. What a sure-fire convenience!

- Peer-to-peer transactions: They make it easy for consumers to transact with each other. Think of doing bank transfers from one person to another via digital wallets. Painless and easy!

5. The emergence of buy now, pay later (BNPL) market

Have you heard of the buy now, pay later (BNPL) scheme? There’s no need to stress, but it’s exactly what it sounds like: buy now, pay later.

In ecommerce, BNPL allows consumers to make online purchases. These customers can pay for the purchased products later in various ways—hence, the name. Here’s how:

- Short-term installments: These BNPL plans let you pay for goods or items in four installments. Often, you don’t have interest charges, although other options may be available for you.

- Monthly payments: These BNPL plans are ideal for big purchases. Why? They let you make staggered payments between six and 36 months. However, anticipate possible interest charges.

- Deferred-interest credit: This BNPL is a form of financing many ecommerce businesses offer. With this option, you pay no interest as long as you can repay them within a certain period.

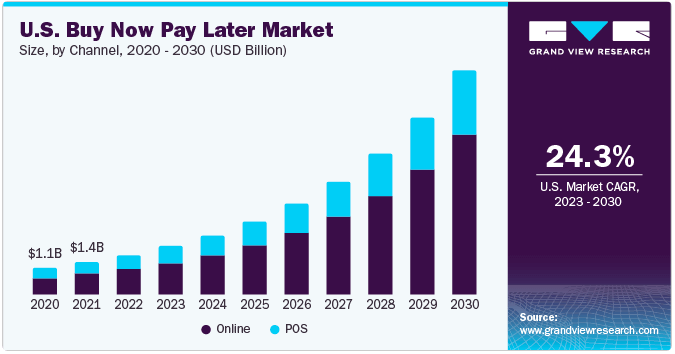

The BNPL market has much in store for us in terms of growth.

Take the facts and figures from the Grand View Research: Its global market could grow from $6.13 billion in 2022 to $7.63 billion this year. That is not to mention that it might reach $38.57 billion by 2030 at a 26.1% compound annual growth rate (CAGR).

6. The adoption of digital currency in ecommerce payments

There’s no denying the impact of blockchain technology on financial transactions. In fact, cryptocurrency has already caught the whole world by storm despite its alarming controversies. And this virtual currency applies to the ecommerce industry as well.

Ecommerce crypto involves digital currencies like Bitcoins and Ethereum used to pay for goods or items purchased from online stores. Think of the proliferation of cryptocurrencies for ecommerce, such as the following:

- Bitcoin (BTC): It’s the most popular cryptocurrency globally. Of course, it’s the original one introduced back in 2009. And it’s never faltered since then!

- Ethereum (ETC): It’s currently the second most popular digital currency worldwide, next to BTC. But what sets it apart from others is that it’s also an online platform.

- Litecoin: It’s one of the pioneers in the crypto market. In fact, it’s considered the ‘lite’ version of BTC for those who want ease of use and utmost convenience.

However, the question is whether cryptocurrencies will penetrate the ecommerce market. The truth is that digital currencies have already entered this market. It’ll continue to do so in a few years to come.

7. More changes in legal and regulatory compliance

The ecommerce sector has been growing and expanding but has become more complex and intertwined. With such growth and expansion comes rapid changes in legal and regulatory compliance.

Think of the cross-border transactions mentioned earlier. Ecommerce businesses or online sellers penetrating the global market should be familiar with the laws and regulations of each country. More importantly, they should strictly adhere to them, whether federal, state, or local.

Below are some legal matters to keep in mind for ecommerce payments:

- Consumer protection: It’s more than just meeting consumer needs but also protecting them. Online stores should always have the customers’ interests in mind!

- Data privacy: Ecommerce payments might compromise customers’ information, whether personal or bank details. As such, click-and-order stores should stay on top of data protection!

- Network security: Ecommerce software, systems, and networks might be vulnerable to cyberattacks like password, phishing, and denial of service (DoS) attacks. Therefore, ecommerce entrepreneurs should secure their systems and networks as well as safeguard their customer information.

Final words

The ecommerce industry is poised to grow and expand, showing no signs of stopping or slowing down. While it allows online sellers to make more money, this sector helps satisfy the needs of ecommerce consumers. However, both stakeholders must align themselves with the business changes and industry trends.

That said, expect various payment solutions to emerge and evolve in 2026—and the next few years. Whether you’re an entrepreneur or a consumer, consider the top predictions in ecommerce payments put in the spotlight in this article. That way, you can make informed decisions about selling or buying products.

The future of ecommerce is glistening and promising. Payment solutions will make the lives of sellers and buyers much more accessible, seamless, and convenient. What better way to proceed with ecommerce than to capitalize on these easy and painless solutions!