In today’s digital age, ecommerce has emerged as a dominant force in the world of business, enabling seamless transactions between businesses and consumers worldwide. At the heart of this digital revolution lies the payment gateway, a crucial element that facilitates secure and efficient online transactions.

In this article, we will look at payment gateways, exploring their functions, working principles, significance in ecommerce business management, and the critical factors to consider when selecting the most suitable payment gateway for your business.

Understanding payment gateways

Payment gateways serve as virtual bridges between customers, merchants, and financial institutions, ensuring the secure transmission of payment information. These sophisticated systems enable online businesses to accept various forms of electronic payments, such as credit cards, debit cards, digital wallets, and more.

Payment gateways act as intermediaries, facilitating communication between the customer’s device, the merchant’s website, and the payment processor or acquiring bank. They securely transmit payment data, encrypting it to protect sensitive information, and authorize or decline transactions based on the verification process.

Working principles of payment gateways

When a customer initiates a transaction on an ecommerce website, the payment gateway comes into play. The process typically involves the following steps

Encryption and secure data transmission

Payment gateways utilize encryption technology to safeguard sensitive customer information during transmission. Encryption transforms data into a format that is unreadable to unauthorized parties, ensuring that payment details remain confidential and protected from potential threats.

Authorization

The payment gateway communicates with the customer’s issuing bank to verify the transaction’s validity. This step includes checking factors such as funds availability, cardholder authentication, and fraud detection. The payment gateway acts as a mediator between the merchant and the customer’s bank, ensuring that the transaction meets the necessary criteria.

Transaction settlement

Once the authorization is received, the payment gateway facilitates the transfer of funds from the customer’s bank to the merchant’s account. Settlement typically occurs within a specified timeframe, depending on the payment gateway provider and the agreement between the merchant and the acquiring bank.

Confirmation

The payment gateway communicates the transaction status to both the customer and the merchant, completing the payment process. The customer receives a confirmation message indicating the success or failure of the transaction, while the merchant receives the necessary information to process the order and fulfill the customer’s requirements.

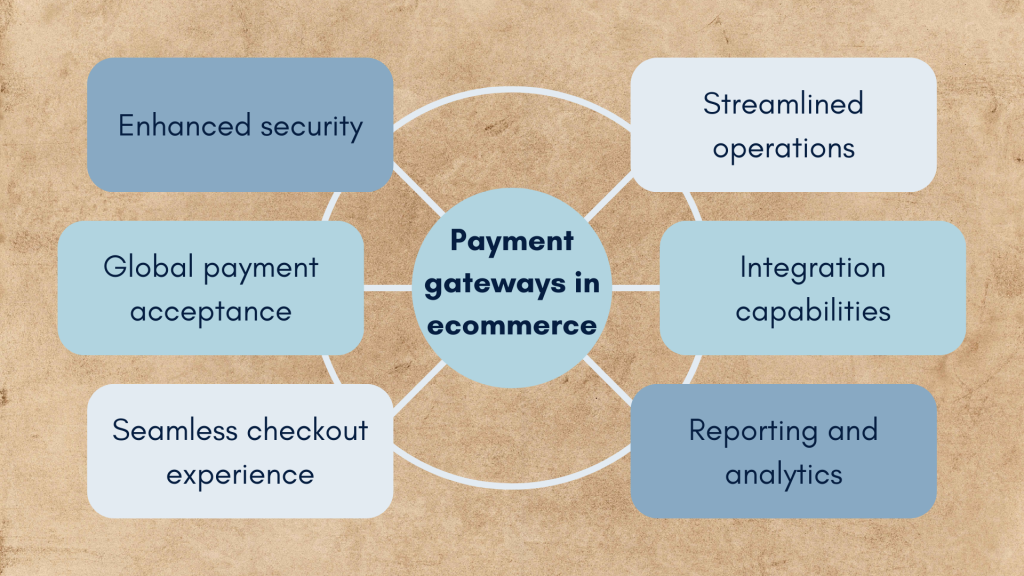

Role of payment gateways in ecommerce business management

Payment gateways in the US and othe regions play a pivotal role in the seamless operation of an ecommerce business, providing numerous benefits.

Enhanced security

Payment gateways employ advanced security measures to protect customer data during transmission and storage. Encryption and tokenization technologies ensure that sensitive information, such as credit card details, remains secure. Additionally, payment gateways often incorporate fraud detection systems to identify and mitigate potential risks.

Global payment acceptance

With the growth of cross-border ecommerce, payment gateways enable businesses to accept payments in multiple currencies, expanding their customer base internationally. This flexibility empowers businesses to cater to diverse markets and capitalize on global opportunities.

Seamless checkout experience

Customers expect a smooth and hassle-free checkout experience. Payment gateways offer a wide range of payment options, including credit cards, debit cards, digital wallets, and alternative payment methods. By providing these choices, payment gateways ensure convenience and flexibility for customers, reducing cart abandonment rates and improving conversion rates.

Streamlined operations

Efficient payment gateways automate transaction processing, reconciliation, and reporting, saving time and reducing administrative burdens. These systems integrate seamlessly with ecommerce platforms, allowing for real-time updates and synchronization of payment data. Automated processes enhance operational efficiency, enabling businesses to focus on core activities while minimizing manual intervention.

Integration capabilities

Payment gateways offer integration capabilities with various ecommerce platforms and shopping carts, allowing seamless connection between the online store and the payment processing system. This integration simplifies the implementation process and ensures that payment information flows seamlessly between different systems, minimizing errors and streamlining operations.

Comprehensive reporting and analytics

Payment gateways often provide merchants with detailed reporting and analytics features. These insights enable businesses to track sales, monitor transaction trends, and gain a deeper understanding of customer behavior. By leveraging these data-driven insights, merchants can make informed decisions to optimize their ecommerce strategies and enhance profitability.

Importance of choosing the most suitable payment gateway

Selecting the right payment gateway is crucial for the success of an ecommerce business. Consider the following factors when evaluating and choosing a payment gateway.

Security features

Prioritize payment gateways with robust security measures, such as PCI-DSS compliance, tokenization, and advanced fraud prevention systems. The chosen payment gateway should employ encrypted connection technology to protect customer data during transmission and storage, ensuring the highest level of security.

Payment methods

Choose a payment gateway that supports popular payment methods aligned with your target audience’s preferences. Consider the geographical location of your customers and their preferred payment options. Ensure that the payment gateway can accept major credit cards, debit cards, and emerging digital wallet solutions to cater to a wide range of customer preferences.

Integration options

Assess the compatibility of the payment gateway with your ecommerce platform, such as Shopify payment gateways or WooCommerce payment gateways. Ensure that the payment gateway seamlessly integrates with your chosen platform or shopping cart system. This integration simplifies setup and ensures smooth data flow between systems, minimizing technical issues and potential disruptions.

Pricing structure

Evaluate the cost structure of different payment gateways. Consider transaction fees, setup fees, monthly subscription costs, and any additional charges. Carefully analyze your projected transaction volume to understand the overall cost implications. Compare different payment gateway providers to find a balance between pricing and the services and features offered.

Customer support

Opt for a payment gateway provider that offers responsive customer support. Technical issues or inquiries may arise during the setup and operation of the payment gateway. Ensure that the provider offers timely assistance, reliable support channels, and resources to address any concerns that may arise.

Reputation and reliability

Research the reputation and reliability of payment gateway providers. Look for reviews and testimonials from other merchants to gauge their experiences. Choose a reputable provider with a proven track record in the industry to ensure a stable and trustworthy payment processing solution for your business.

Conclusion

Payment gateways are the backbone of secure and efficient online transactions in the ecommerce industry. By understanding their workings and significance, businesses can harness the power of payment gateways to streamline operations, provide a seamless customer experience, and facilitate growth. Choosing the most suitable payment gateway requires careful consideration of security features, payment methods, integration capabilities, pricing, and customer support. Embracing the right payment gateway empowers businesses to thrive in the digital landscape, ensuring success and customer satisfaction in the ecommerce realm.