In the context of personal finances, net pay holds significant influence, impacting both individual earners and businesses alike. Net pay represents the genuine income an employee pockets after factoring in deductions, taxes, and contributions deducted from their gross earnings. For employees, understanding net pay is pivotal for effective budgeting and informed decision-making, while for businesses, it fosters transparency, compliance, and stronger relationships with their workforce.

Let’s explore net pay, from its definition to the web of deductions, empowering individuals and organizations alike to navigate this financial landscape with clarity and confidence.

What is net pay?

By definition, net pay refers to the amount of money an individual receives from their employer after all deductions, taxes, and other withholdings have been subtracted from their gross earnings. It represents the actual income an individual has available for personal expenses and savings after accounting for various financial obligations and contributions. In other words, net pay – also known as take-home pay – is the final amount of money an employee receives in their paycheck.

Understanding your net pay is like having a compass for your personal finances. It tells you the actual amount of money you have at your disposal – the money you can use for your rent, groceries, savings, and that occasional treat. Knowing your net pay lets you budget better, plan for the future, and make decisions that align with your financial goals. It’s about having a clear picture of your earnings, so you can take control of your financial journey.

For employers, explaining net pay to employees isn’t just about numbers; it’s about building trust. It’s about ensuring that your team comprehends how their compensation is calculated and what they can expect in their pockets. Transparent communication about net pay enhances job satisfaction and nurtures a positive working environment. It also helps employers adhere to legal requirements, ensuring that deductions and contributions are accurately made. In essence, a clear understanding of net pay on both sides strengthens the bond between employees and the company, fostering a healthy and productive workforce.

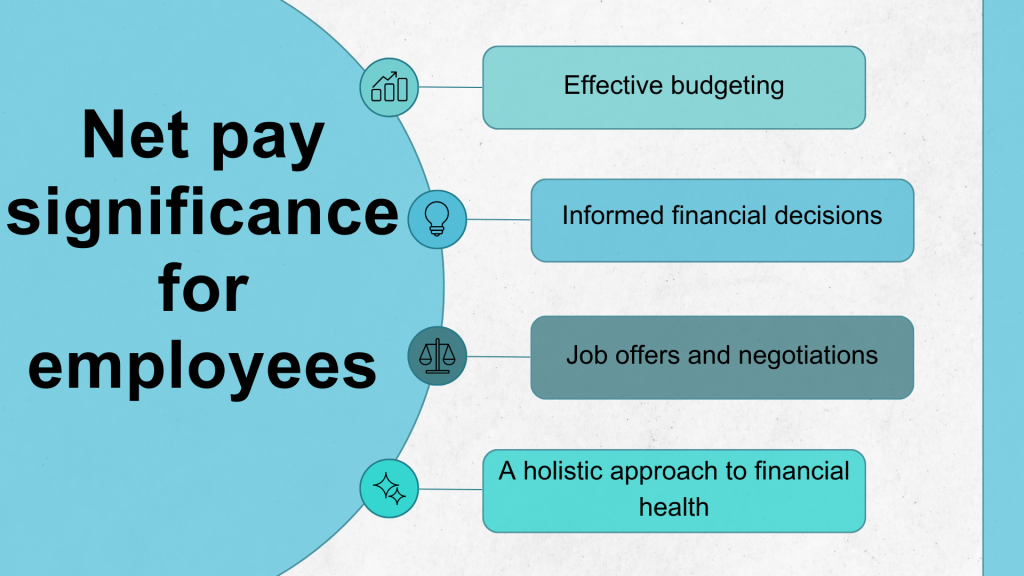

Significance of net pay for employees

We already mentioned how critical it is for an employer to know their net pay. Let’s just look at it in more detail.

Net pay isn’t just about numbers on a piece of paper; it’s a foundational pillar of financial empowerment. Here’s how it impacte your financial well-being:

When employees have a clear understanding of their net pay, they are better equipped to make informed financial decisions. For instance, when considering various payment options, including those related to taxes and deductions, exploring the benefits of different payment gateways in the US can empower employees to manage their earnings efficiently.

Effective budgeting

Imagine managing your household without knowing how much money you truly have. That’s where net pay steps in. By knowing your net pay, you can create a realistic budget that aligns with your earnings. You gain clarity on how much you can allocate to essentials like rent or mortgage payments, utilities, groceries, and transportation. This insight prevents overspending and empowers you to live within your means, making your financial life more stable and secure.

Informed financial decisions

Understanding your net pay gives you the power to make informed financial decisions. When you know exactly how much you’re bringing home, you can set meaningful financial goals. Whether it’s building an emergency fund, saving for a vacation, or investing for the future, having a clear picture of your net pay ensures that your goals are attainable and aligned with your earning capacity. Moreover, it helps you strategize to manage debts effectively and avoid getting trapped in a cycle of financial stress.

Job offers and negotiations

When it comes to career moves, knowing your net pay can be a game-changer. It equips you with the insights needed to evaluate job offers and compensation packages accurately. A higher gross salary might seem enticing, but understanding your net pay ensures that you assess the true financial impact. You can compare offers more effectively and make decisions that consider both your financial needs and aspirations. Additionally, during negotiations, knowing your net pay helps you advocate for a package that reflects your true take-home income, ensuring a fair and equitable agreement.

A holistic approach to financial health

In essence, understanding your net pay isn’t just about dollars and cents; it’s about taking control of your financial narrative. It empowers you to live responsibly within your means, make thoughtful financial choices, and work toward your aspirations with confidence. Your net pay is the foundation upon which you can build a comprehensive strategy for financial success, ultimately leading to a more secure and fulfilling life.

Significance of net pay for businesses

In the realm of business operations, nurturing a culture of transparency and trust is paramount. Educating employees about net pay plays a pivotal role in achieving this, offering benefits that extend far beyond the balance sheet. Here’s why businesses should prioritize illuminating the concept of net pay for their workforce:

Enhanced employee satisfaction

A paycheck isn’t just a transaction; it’s the tangible result of an employee’s hard work and dedication. By providing employees with a clear understanding of their net pay, businesses empower their workforce to comprehend the value of their contributions. When employees can see exactly how their gross earnings translate into take-home pay, it fosters a sense of appreciation and fairness. This appreciation, in turn, leads to heightened job satisfaction and a stronger sense of commitment to the organization’s goals.

Offering transparent and convenient payment options can significantly contribute to enhanced employee satisfaction within an organization. This applies not only to traditional payroll but also to businesses utilizing platforms like Shopify. For insights into providing seamless payment experiences, consider exploring the advantages of various payment gateways for Shopify.

Reduced confusion and frustration

Misunderstandings about pay can quickly sour the employer-employee relationship. By educating employees about net pay, businesses preempt confusion and frustration that may arise from discrepancies between gross earnings and actual take-home pay. Clear communication about deductions, taxes, and contributions creates an environment where employees feel confident that their compensation is fairly calculated and transparently communicated.

Promotion of transparent communication

Open and honest communication between employers and employees is the bedrock of a harmonious workplace. Explaining net pay encourages a dialogue about compensation, allowing employees to seek clarification and share concerns. This transparency builds trust and a sense of mutual respect. As employees gain insight into the factors that impact their net pay, they perceive the organization as invested in their financial well-being, fostering a positive and collaborative work atmosphere.

Adherence to legal regulations

In the complex landscape of labor laws and regulations, clarity is paramount. Educating employees about net pay helps businesses fulfill their legal obligations regarding wage disclosures. This proactive approach showcases a commitment to compliance and demonstrates due diligence in adhering to labor laws. When businesses are forthright about how net pay is calculated, they mitigate the risk of legal disputes and foster an environment of integrity.

A conducive work environment

In essence, explaining net pay isn’t just a matter of financial literacy; it’s about cultivating a workplace culture that values honesty, collaboration, and employee well-being. It transforms the employer-employee relationship from a mere transactional interaction into a partnership where both parties are invested in each other’s success. Businesses that prioritize educating their employees about net pay are sowing the seeds for a more engaged, motivated, and loyal workforce.

How do you get the net pay?

Understanding how your gross earnings transform into net pay involves traversing a landscape of deductions, contributions, and obligations. Let’s demystify this process step by step:

- Gross pay

Gross pay sets the stage for the net pay calculation. It’s the total amount you earn before any deductions take place. This includes your base salary or hourly wage and any supplementary earnings like bonuses, commissions, and overtime pay. Gross pay showcases the full value of your work before financial obligations come into play. - Deductions and withholdings

Once you grasp your gross pay, it’s time to navigate the terrain of deductions and withholdings. Deductions are the amounts subtracted from your gross pay, contributing to various financial commitments. These can encompass federal and state income taxes, Social Security, Medicare contributions, retirement fund contributions, health insurance premiums, and more. Each deduction serves a specific purpose and plays a role in shaping your net pay. It’s crucial to recognize that these deductions impact your overall compensation, forming the bridge between your gross earnings and take-home income. - Understanding taxes

Taxes are a significant slice of the deduction pie. Federal and state income taxes are vital contributors to government revenue. Federal tax brackets determine the percentage of your income subject to taxation, impacting your net pay. State income tax rates vary by location, further influencing the final figure you’ll take home. Delving into examples can shed light on how these deductions shape your net pay, offering a clearer understanding of the deductions process. Calculating net pay involves considering multiple factors, including taxes and deductions. One such aspect is the need for a Federal Employer Identification Number (FEIN) for businesses. This identification is crucial for tax purposes and maintaining legal compliance - Social Security and Medicare contributions

Social Security and Medicare contributions are akin to investments in your future well-being. These deductions fund programs that offer retirement benefits and medical coverage to eligible individuals. While you contribute a portion of your earnings, your employer also plays a role. These contributions ensure a safety net during your retirement years and assist in managing medical expenses as you age. - Retirement contributions

Employer-sponsored retirement savings plans, like 401(k)s, offer a path to financial security post-retirement. Contributions made to these plans are deducted from your gross pay before taxes, effectively reducing your taxable income. This maneuver doesn’t just bolster your future finances; it also influences your net pay today. Some employers sweeten the deal with matching contributions, providing an extra incentive to plan for the future. - Health insurance and other benefits

Health insurance is an invaluable shield against unexpected medical costs. Health insurance premiums are deducted from your gross pay, ensuring consistent coverage. Beyond health insurance, other benefits like dental, vision, and flexible spending accounts can also impact your net pay. Understanding how these benefits interact with your earnings helps you make informed decisions about your overall compensation package. - Voluntary deductions

Your financial journey might include additional commitments beyond mandatory deductions. Voluntary deductions, such as contributions to charitable organizations, savings accounts, or loan repayments, give you control over how your earnings are allocated. These deductions can align with your personal goals, amplifying your financial well-being. - Garnishments and legal obligations

In some cases, court-ordered obligations like child support, alimony, or debt repayments result in garnishments. These mandatory deductions are subtracted from your gross pay and can impact your net pay. While these may seem like complex equations, they serve to fulfill legal responsibilities. - Net pay – the amount in your pocket

After navigating the labyrinth of deductions, contributions, and obligations, you arrive at your net pay. This is the genuine income you receive – the amount available for your daily expenses, savings aspirations, and life’s pleasures. Your net pay encapsulates the real value of your work, serving as a reflection of your financial reality.

In essence, understanding the journey from gross pay to net pay involves unraveling a tapestry of financial intricacies. As you traverse this landscape, you’re equipped with the tools to make informed financial choices, cultivate responsible spending habits, and shape a future that aligns with your aspirations. Your net pay isn’t just a number; it’s a gateway to a world of financial possibilities.

Conclusion

Mastering net pay empowers you to take control of your finances and make informed decisions about your financial future. By understanding the distinction between gross pay and net pay, familiarizing yourself with the components that contribute to net pay calculations, and implementing strategies to optimize your income, you can effectively manage your financial resources. Remember, financial literacy and planning are the keys to unlocking a brighter financial future. Start today by exploring ways to make the most of your hard-earned income and build a solid foundation for financial success.

%20(1).png)