Medicare is a vital healthcare program in the United States that provides coverage to millions of individuals, particularly those who are 65 years and older, as well as certain younger individuals with disabilities. To sustain the funding for this program, the government levies a specific tax known as the Medicare tax.

In this article, we’ll delve into the details of Medicare, explore the purpose and mechanics of the Medicare tax, discuss its impact on individuals, and shed light on the allocation of tax revenues.

Contents:

2. Understanding tax for Medicare

- Who needs to pay Medicare, and how to do it?

- Tax withholding rates and income thresholds

- Additional Medicare tax

- Exemptions and exceptions to the Medicare tax

3. Calculation and impact of the Medicare tax

- Calculation of the Medicare tax

- Examples to illustrate the impact of the Medicare tax

- Comparison with other payroll taxes

4. Funding Medicare: Where does the money go?

5. Recent changes and future outlook

- Recent developments in Medicare tax legislation

- Potential changes to the Medicare tax system

- Future challenges and implications for the Medicare tax

What is Medicare?

Before getting to Medicare tax withholding, let’s recall what Medicare is and how it impacts the US society.

Medicare is a government-sponsored health insurance program in the United States, established in 1965 under the Social Security Act. Its primary aim is to provide essential healthcare coverage for individuals meeting specific eligibility criteria. Centers for Medicare & Medicaid Services (CMS), a federal agency, stands behind and sponsors this program.

Medicare serves as a vital safety net, primarily for senior citizens – 65 years and older. However, it also covers individuals under the age of 65 with particular disabilities or those who have end-stage renal disease (ESRD) and need dialysis or a kidney transplant.

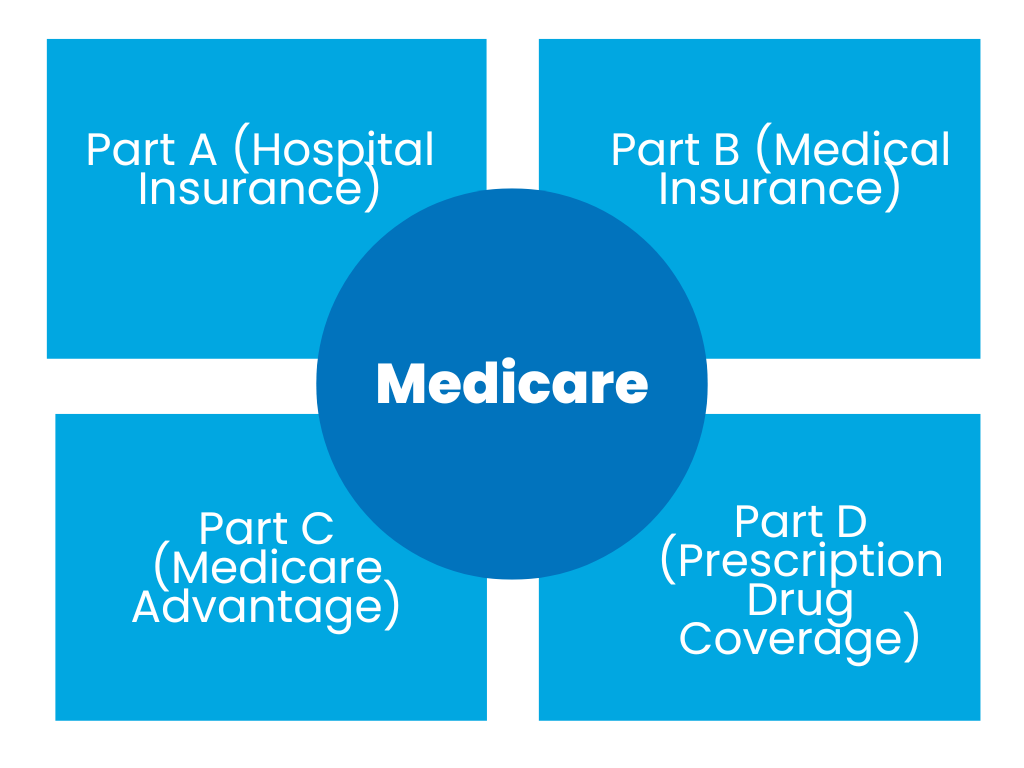

Medicare consists of several distinct parts, each catering to different aspects of healthcare needs:

- Medicare Part A – Hospital Insurance

Part A primarily covers inpatient hospital care, skilled nursing facility care, hospice care, and certain home health care services. Most beneficiaries don’t pay a premium for Part A, as they’ve contributed to it through payroll taxes during their working years. - Medicare Part B – Medical Insurance

Part B focuses on outpatient medical services, such as doctor’s visits, preventive services, durable medical equipment, and some home health care. Beneficiaries typically pay a monthly premium for Part B. - Medicare Part C – Medicare Advantage

Part C offers an alternative to the traditional Medicare program. Private insurance companies approved by Medicare provide these plans, which often include additional benefits like prescription drug coverage and may have different cost structures. - Medicare Part D – Prescription Drug Coverage

Part D provides prescription drug coverage through private insurance plans. Beneficiaries pay a monthly premium for Part D coverage, and the program helps cover the cost of prescription medications.

Access to essential healthcare services is crucial for seniors and individuals with disabilities, and Medicare provides this support by reducing the financial burden of medical expenses. As you can see, it covers various areas such as hospital care, doctor visits, preventive care, prescription drugs, and more.

Without Medicare, many seniors and individuals with disabilities would struggle to afford the healthcare they need. At this point, the program enhances their quality of life and promotes public health by ensuring necessary medical services are readily available.

Still, it’s worth noting that while Medicare provides coverage for a broad range of healthcare services, it may not cover all costs. Some expenses, such as deductibles, co-payments, or co-insurance, may need to be paid by the individual out of their own pockets and can’t be requested to be covered under Medicare. To help with these costs, individuals with Original Medicare (Parts A and B) can opt for supplemental insurance, known as Medigap.

To be eligible for Medicare, a person needs to meet particular criteria based on age, disability status, or ESRD. Typically, those who have been receiving Social Security or Railroad Retirement Board disability benefits for 24 months are considered eligible for Medicare. However, eligibility requirements may vary, and it’s essential to understand the specific criteria and enrollment periods to ensure timely access to Medicare coverage.

Understanding tax for Medicare

The Medicare program at large gets funding through general revenues and payroll taxes. Medicare tax, also known as the Hospital Insurance (HI) tax, at this point, is a payroll tax that applies to all earned income in the United States and supports the Medicare Part A component of the program. Part A, as you remember, primarily covers hospital stays, skilled nursing facilities, and some home health services. This tax is levied on employees and employers and is an integral part of the broader Medicare financing system.

Who needs to pay Medicare, and how to do it?

In most cases, if you’re earning a wage or salary, you deal with Medicare tax withholding. The Federal Insurance Contributions Act (FICA) tax system collects this tax and Social Security taxes. Thus, Medicare is one of FICA taxes. Both employees and employers, as mentioned above, are responsible for contributing to the Medicare tax, with each party paying an equal share. Self-employed individuals, however, are liable for the entire Medicare tax amount.

Tax withholding rates and income thresholds

Tax withholding is a standard procedure where a portion of an individual’s income is automatically deducted by their employer and sent directly to the government to cover various taxes. This method ensures that individuals meet their tax obligations incrementally rather than in one lump sum when they file their tax returns. The taxes withheld from paychecks typically include income tax, Social Security tax, and Medicare tax (relevant to this discussion).

Medicare tax withholding is relatively straightforward. It’s deducted at a flat rate from an employee’s wages. As of the current tax year, the Medicare tax withholding rates and income thresholds are as follows:

Tax rates

- The standard Medicare tax rate is 1.45% of the earned income for both employees and employers.

- For self-employed individuals, they are responsible for paying the entire 2.9% (1.45% as the employee and 1.45% as the employer) as self-employment tax.

For example, if you earn $50,000 annually, your employer will withhold 1.45% of each paycheck. They’ll also contribute an equivalent amount. These withheld funds are then directed towards the Medicare program to ensure it remains adequately funded to provide healthcare services to eligible individuals.

Additional Medicare tax

While the standard Medicare tax applies to most wage earners, there exists an additional Medicare tax that applies to higher-income individuals. The rate for the additional Medicare tax is 0.9%.

This tax, introduced as part of the Affordable Care Act, is an extra tax on earned income designed to help finance Medicare. The additional Medicare tax is earmarked for the Medicare Part A trust fund and aims at bolstering Medicare’s financial sustainability as healthcare costs rise.

It’s worth mentioning that not everyone is subject to the additional Medicare tax. To determine your liability, you might want to consider your filing status and total earned income.

Income thresholds for Additional Medicare tax

- For individuals filing as single or head of household, the additional Medicare tax applies to wages and self-employment income exceeding $200,000.

- For married couples filing jointly, the threshold is $250,000.

- For married individuals filing separately, the threshold remains at $125,000.

It’s important to note that these income thresholds are subject to change, and it’s advisable to refer to the most up-to-date information and a respective instructions form from the Internal Revenue Service (IRS) or consult a tax advisor for accurate and current Medicare tax rates and income thresholds.

Exemptions and exceptions to the Medicare tax

While most individuals are subject to the Medicare tax, there are certain exemptions and exceptions to consider. Here are some common exemptions and exceptions to the Medicare tax:

1) Nonresident aliens

Nonresident aliens, as defined by the IRS, who aren’t American citizens, residents, or nationals, are generally exempt from paying Medicare taxes.

2) Students

Full-time students working at the same institution they attend, such as colleges or universities, are often exempt from Medicare taxes on wages earned from their on-campus jobs. This exemption typically applies to students who are enrolled and regularly attending classes, so they won’t see Medicare on their paycheck.

3) Government employees

Certain government employees, such as state or local government workers, may be exempt from Medicare taxes under specific circumstances. For example, employees covered by the Civil Service Retirement System (CSRS) or the Federal Employees Retirement System (FERS) may be exempt from Medicare tax.

4) Religious organizations and members of religious orders

Wages received by employees of qualified religious organizations or members of recognized religious orders may be exempt from Medicare tax.

It’s important to note that while these exemptions may apply to Medicare tax, individuals may still be subject to other payroll taxes, such as Social Security taxes or income taxes, depending on their specific circumstances.

Check out our helpful guides on payroll taxes and income taxes for additional information.

Calculation and impact of the Medicare tax

In this block, we’ll review how this FICA tax is calculated and what impact it has.

Calculation of the Medicare tax

To calculate the Medicare tax, individuals multiply their earned income by the applicable tax rate. For example, if a small business owner earns $50,000 in a given year, their Medicare tax liability would be $725 (1.45% of $50,000). For those subject to the additional 0.9% tax rate, the calculation is slightly more complex due to the income thresholds.

Examples to illustrate the impact of the Medicare tax

Let’s consider two examples to understand the impact of the Medicare tax:

1) A single individual earning $100,000 would owe and file $1,450 in Medicare taxes ($100,000 * 1.45%).

2) A married couple filing jointly with a combined income of $300,000 would owe and file $4,350 in Medicare taxes ($300,000 – $250,000 * 0.9%).

Comparison with other payroll taxes

It’s important to note that the Medicare tax is just one component of the overall payroll tax. Let’s see how they compare. While the Medicare tax is set at the rate of 1.45% (or 2.35% for higher earners), the Social Security tax rate is currently 6.2%. Understanding these distinctions is essential for employees and employers to accurately calculate their tax liabilities.

Funding Medicare: Where does the money go?

Now that you know how the Medicare tax is calculated, let’s answer this popular question and find out why you see Medicare on your paycheck and where the money goes.

Overview of Medicare funding

The revenue generated through the Medicare tax is used to finance the Medicare program and cover various healthcare services for eligible beneficiaries. It forms a basis for ensuring the financial stability and sustainability of the program.

Explanation of the Medicare trust funds

The Medicare program operates through two trust funds: the Hospital Insurance (HI) Trust Fund, also known as Medicare Part A, and the Supplementary Medical Insurance (SMI) Trust Fund, encompassing Medicare Parts B and D. These trust funds play a crucial role in financing and sustaining the Medicare program. Here’s an explanation of each trust fund:

Hospital Insurance (HI) Trust Fund (Medicare Part A)

- The HI Trust Fund is primarily responsible for funding hospital insurance benefits under Medicare Part A.

- It helps cover inpatient hospital care, skilled nursing facility care, hospice care, and some home health services.

- The HI Trust Fund is financed mainly through payroll taxes paid by employees, employers, and self-employed individuals throughout their working years.

- The funds collected are deposited into the trust fund and used to pay for eligible beneficiaries’ hospital-related healthcare services.

- The financial health of the HI Trust Fund is periodically evaluated to ensure its solvency and ability to cover future hospital insurance costs.

Supplementary Medical Insurance (SMI) Trust Fund (Medicare Parts B and D)

- The SMI Trust Fund covers medical insurance benefits under Medicare Parts B and D, which include physician services, outpatient care, medical supplies, and prescription drug coverage.

- Medicare Part B provides coverage for medically necessary services and supplies not covered by Part A. It’s voluntary and requires payment of a monthly premium by beneficiaries.

- Medicare Part D offers prescription drug coverage and is provided through private insurance plans approved by Medicare. Beneficiaries pay premiums and may have copayments or coinsurance for medications.

- Financing for the SMI Trust Fund comes from various sources, including premiums paid by Part B and Part D beneficiaries, general revenue from the federal government, and state contributions for certain low-income beneficiaries.

- The SMI Trust Fund ensures that medical and prescription drug benefits are available to eligible Medicare beneficiaries by pooling the funds and administering payments to healthcare providers and prescription drug plans.

It’s important to note that the HI Trust Fund and the SMI Trust Fund are separate entities within the Medicare program, each with its own sources of revenue and expenses. The funds are managed by the Department of the Treasury and overseen by the Centers for Medicare & Medicaid Services (CMS) and the Medicare Board of Trustees.

Regular assessments of the financial status of these trust funds are conducted, and adjustments may be made to funding sources or program parameters to ensure their sustainability and the ability to meet future healthcare needs of Medicare beneficiaries.

Recent changes and future outlook

Recent developments in Medicare tax legislation

Over the years, there have been discussions and debates surrounding the Medicare tax system. Recent developments in legislation may impact the tax rates, income thresholds, or exemptions. It’s crucial to stay updated on any changes to ensure compliance and proper tax planning.

Potential changes to the Medicare tax system

In view of the evolving healthcare landscape and financial considerations, policymakers may propose modifications to the Medicare tax system. These changes could aim to address funding challenges, enhance the sustainability of the program, or make adjustments to tax rates and income thresholds.

Future challenges and implications for the Medicare tax

As the population ages and healthcare costs continue to rise, Medicare faces significant challenges in maintaining its financial stability. The Medicare tax will play a pivotal role in meeting these challenges. Understanding the potential implications and ensuring the long-term viability of the program will require ongoing evaluation and possible adjustments.

Conclusion

In conclusion, the Medicare tax serves as a critical source of funding for the Medicare program, which provides essential healthcare coverage to millions of Americans. By understanding the mechanics, rates, and impact of the Medicare tax, individuals and employers can better navigate their tax obligations while contributing to the sustainability of the program. Staying informed about recent developments and future changes to the Medicare tax system is crucial for effective tax planning and compliance. Ultimately, a comprehensive understanding of Medicare and its respective tax empowers individuals to make informed decisions and secure reliable healthcare coverage for themselves and their loved ones.

Want to read more? Check out our other articles on debit vs credit accounting and how long it takes to get tax refund.