In the dynamic world of business, numbers, charts, and ledgers are the unspoken language. They tell tales of profit and loss, of assets acquired and debts incurred. But, amid all these figures, how often do we stop and truly try to understand what they mean and how they interconnect?

One of the most critical yet misunderstood components of this financial story is ‘liabilities’. While many entrepreneurs diligently track their revenue and assets, it’s equally crucial to understand the nuances of liabilities.

In this article, we’re going to demystify the world of liabilities in accounting. We’ll explore what they are, how they can impact your business operations, and why keeping a close eye on them can be a game changer for your financial strategy. So, buckle up, and let’s journey through the ledger together!

Liabilities definition: What is a liability in accounting?

When it comes to accounting, there are a few major categories under which everything is grouped:

- Income (or Revenue) – how much you make

- Expenses – how much you spend

- Assets – what you own and are owed

- Liabilities – what you owe

- Equity – the difference between what you own and are owed and what you owe

It doesn’t take an accounting genius to say that you need income to be greater than expenses and that it’s preferable to own more than you owe! But, sometimes, figuring out what makes up each category can be more complicated.

Take liabilities for instance. As mentioned above, liabilities can be simply described as what you owe someone else.

That “someone else” could be your customers or clients, government agencies, or various lenders, vendors, or credit card companies. Sometimes liabilities are easy to identify, such as in the case of a bank loan or credit card balance. Sometimes, they are less obvious, such as when a client or customer purchases an annual subscription or service.

Yes, annual subscriptions are a liability.

Why? Because you owe them a year of service. The revenue from a client’s annual subscription should therefore be recorded as deferred or unearned revenue on the Balance Sheet and only recognized on the Income Statement as it is earned when the service is delivered. Since SaaS businesses frequently have annual subscription options, this is an important aspect not to overlook.

What are the main types of liabilities in financial accounting?

Generally speaking, liabilities can be grouped into two broad categories: current or short term liabilities and long-term liabilities.

Short term liabilities are obligations that must be fulfilled in one year or less. Long-term liabilities encompass everything else. It’s fairly common for a business to have a higher quantity of short term liabilities but a higher dollar value of long-term liabilities. After all, one would expect the total amount owed over the next thirty years to be higher than that owed in the current year alone!

It’s worth noting that “one year” doesn’t mean “within the calendar or fiscal year” but an actual rolling twelve-month period from the date of reporting. Thus, the balance of some short term liabilities can remain fairly static for a significant amount of time. An example is the current portion of long-term debt: the amount due over the next twelve months for a single loan is unlikely to change much until the final year of the loan’s term.

Also, since short term liabilities are obligations that must be fulfilled within one year or less, you may need to ensure that you have assets on hand to cover the liability in an emergency (i.e., having cash or equivalents on hand to pay off credit card debt or short-term loans). In some cases, a lender may stipulate that the loan is contingent upon a business maintaining above a certain Working Capital Ratio. Or the business’s leaders (CFO, Controller, etc.) may set restrictions themselves to ensure they have enough working capital available.

So let’s take a look at what kind of accounts tend to fall under each of these categories.

Short term liabilities

- Accounts payable (think bills from vendors)

- Credit card balances

- Pre-paid annual subscriptions from clients (deferred revenue)

- Deferred revenue for projects set to start or be completed within the next year

- The current portion of a long-term loan (basically what you owe in the next year on a multi-year loan)

- Lines of credit

- Payroll and sales taxes

- Warranties owed

- Accrued interest (interest that will be due this year but hasn’t yet been paid)

Long-term liabilities

- Multi-year loans or notes payable

- Employee retirement benefits

- Bonds payable

- Dividends payable

- Deferred revenue for long-term projects (if the actual project isn’t supposed to be delivered for more than a year)

What’s the difference between liabilities and assets in accounting?

In accounting, both liabilities and assets appear on the Balance Sheet as a snapshot of a moment in time. Unlike income and expenses, where you may want to look at them for a certain time period, assets and liabilities are viewed as of specific dates. Balance Sheet statements are frequently created at the end of a month, quarter, or year and thus, assets and liabilities are viewed as of those particular moments as well.

Assets are what you own and are owed – cash in the bank, accounts receivable, inventory, buildings, land, patents, prepaid subscriptions, etc. Interestingly enough, some of a business’s assets are another party’s liabilities.

Cash in the bank, or funds the bank owes you, is the bank’s liability.

Money other people owe you is their liability, your assets.

Prepaid or annual subscriptions and memberships,or a service owed to you – their liability, your asset.

When trying to decide if something is an asset or a liability, it’s worth taking the time to ask if it’s something that is owed to you – whether as a service or monetary compensation – or if it’s something that you owe someone else. This question can particularly help when considering accruals and deferrals or other less obvious items.

What’s a capital ratio and how is it related to liabilities?

The capital ratio is a measurement that compares a business’s assets to its liabilities to measure the liquidity of your business – and risk of doing business with you. By comparing assets and liabilities, anyone, internally or externally, can estimate a business’s ability to meet its obligations.

So how does one calculate a capital ratio?

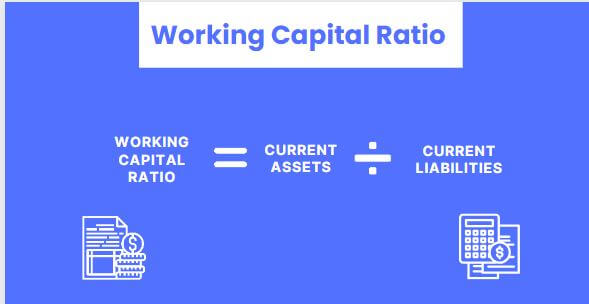

In accounting, the common capital ratio used is the Working Capital Ratio or Current Ratio which specifically measures the ability of a business to meet its obligations for the next year using only what it owns or is owed within that same time frame.

The formula:

So, if a business has $300,000 in Current Assets and $200,000 in Current Liabilities, their Working Capital Ratio would be 1.5:

$300,000 / $200,000=1.5

A Working Capital Ratio of 1.5-2.0 is generally considered a good one . A business theoretically has enough assets available in the next year to cover all of their liabilities in the same time period.

When the Working Capital Ratio drops below 1.0, the liquidity of the business is called into question and there may be doubts in their ability to continue to function (though the industry and age of the business will affect this). On the other hand, higher capital ratios may indicate that a business isn’t making good use of its assets.

How do liabilities affect a business’s current and long-term operations?

Liabilities generally cause some form of restriction on a business’s operations. Many of these are simple and may not affect cash flow much, such as the obligation to provide access to software for a year, while others can be more severe, such as lender restrictions.

Nevertheless, they shouldn’t be looked on in a purely negative light. Let’s take a look at some ways well-handled liabilities can assist a business’s operations:

- For long-term projects, purchasing supplies on credit instead of with cash may enable the cash inflow for the project to match the cash outflow.

- The interest on long-term debt is an expense that can ultimately reduce taxes owed and increase project profitability.

- Offering annual subscriptions or memberships at a discount can assist with customer retention and long-term cash flow.

- Various loans may enable larger capital projects for which normal cash flow is insufficient, yet will increase the business’s reliability and/or profitability in the long run.

Also, from the operations side, keeping good track of your business’s liabilities can help prevent shocks to your cash flow. When you keep up with things like credit card due dates, accounts payable in the next 30, 60, or 90+ days, you’re better able to know when and where you need the assets on hand to cover those liabilities.

In every case, knowing what your liabilities are is a strong step in helping you better plan for your business’s future.

Of course, if you feel unsure of your capabilities to manage liabilities in a way that’s optimal for your company finances, hiring an accounting professional who knows their way with them is always the safest option.

As an example, Tairiseach has been able to work with one of our marketing clients to identify immediate and near-term liabilities and use those to determine cash flow needs on a week-to-week and longer-term basis helping them reduce and even prevent late bill payments and cash flow crunches. Not knowing what was due had led to constant worries about ability to meet obligations. Now they can plan more easily for the future and rest assured that they know what is coming.

Wrapping up the ledger: The balanced perspective on liabilities

In the vast landscape of accounting, every component has its significance, and each carries a story of financial choices and future implications. Liabilities, as we’ve seen, are more than just numbers indicating what we owe — they’re indicators of the business strategy, adaptability, and foresight.

By understanding and managing liabilities effectively, businesses not only ensure their financial stability but also strategically leverage them to unlock new opportunities. Thus, it’s essential to remember that a successful business isn’t merely about amassing assets but in balancing them skillfully with liabilities.

The dance between what we own and owe is the rhythm of enduring business success. So, as you flip through your financial statements, approach liabilities not as burdens, but as tools — each with a potential to mold the future of your business.

Thanks for uploading such a detailed article! This was very helpful and informative for me while still being easy to understand.

Thank you so much for your kind words!