International Financial Reporting Standard (IFRS) 15, titled “Revenue from Contracts with Customers,” ensures accurate and consistent revenue reporting, a fundamental aspect of financial statements that investors and stakeholders heavily rely on. By aligning revenue recognition practices across different industries and regions, IFRS 15 plays a crucial role in global finance.

This comprehensive guide offers an in-depth analysis of IFRS 15, its application, and its impact on businesses worldwide.

Understanding IFRS 15

IFRS 15 provides a standardized approach to revenue recognition, applicable to all contracts with customers except for leases, insurance contracts, and financial instruments. Its goal is to establish principles for reporting useful information about the nature, amount, timing, and uncertainty of revenue and cash flows from contracts with customers.

The key principles of IFRS 15 revolve around the recognition of revenue to depict the transfer of promised goods or services to customers in an amount that reflects the consideration to which the company expects to be entitled. It introduces a more disciplined and systematic approach to revenue recognition, focusing on contractual obligations and customer expectations.

→ Learn how to maximize revenue recognition efficiency with Synder.

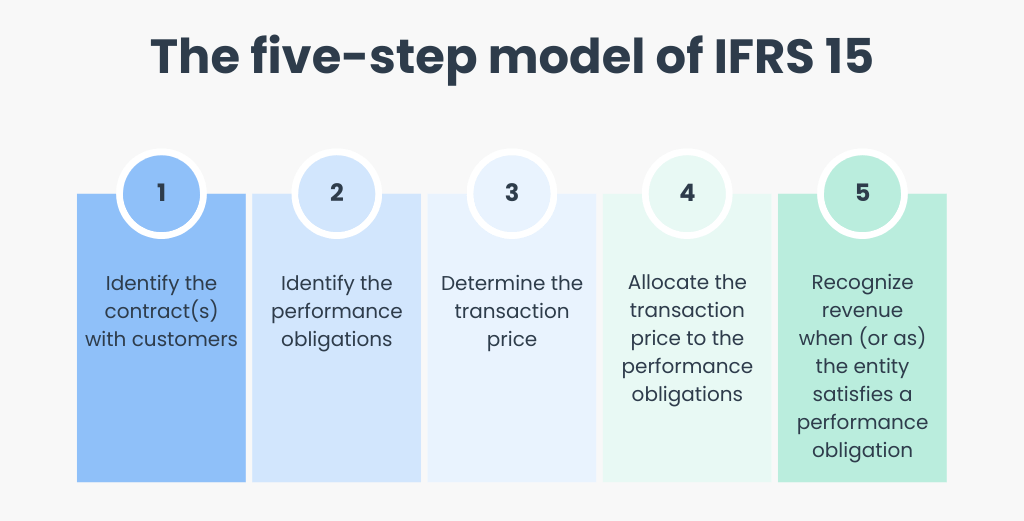

The five-step model of IFRS 15

IFRS 15, “Revenue from Contracts with Customers,” introduces a five-step model for revenue recognition that provides a structured approach for companies to determine when and how revenue should be recognized.

Step #1. Identify the contract(s) with customers

This step involves identifying an agreement between two or more parties that creates enforceable rights and obligations. All parties must approve the contract, have clear payment terms, and have commercial substance. The parties involved must be committed to fulfilling their obligations, and it must be probable that the entity will collect the consideration to which it’s entitled in exchange for the goods or services.

Step #2. Identify the performance obligations

A performance obligation is a promise to deliver a distinct good or service (or a series of distinct goods or services) to the customer. In this step, the entity must assess the goods or services promised in the contract and identify as performance obligations each promise to transfer to the customer either:

- A good or service (or bundle of goods or services) that is distinct;

- A series of distinct goods or services that are substantially the same and have the same transfer pattern.

Step #3. Determine the transaction price

The transaction price is the amount of consideration to which an entity expects to be entitled in exchange for transferring the promised goods or services to the customer, excluding amounts collected on behalf of third parties (like sales taxes). This step involves determining the transaction price, which can include fixed amounts variable consideration, and may also consider the time value of money if there is a significant financing component.

Step #4. Allocate the transaction price to the performance obligations

After determining the transaction price, the entity must allocate this amount to each performance obligation identified in the contract. This allocation is based on the relative standalone selling prices of each distinct good or service promised in the contract. If a standalone selling price is not directly observable, the entity must estimate it.

Step #5. Recognize revenue when (or as) the entity satisfies a performance obligation

Revenue is recognized when a performance obligation is satisfied by transferring the promised good or service to the customer. A good or service is transferred when the customer obtains control of that good or service. For each performance obligation, an entity must determine whether it satisfies the obligation over time or at a point in time and recognize revenue accordingly.

The impact of IFRS 15 on revenue recognition

The implementation of IFRS 15 has a significant impact on the revenue recognition practices of many companies.

#1. More judgement and greater complexity

IFRS 15 requires more management judgment and estimation, particularly in identifying performance obligations and determining transaction prices, including variable consideration. This increased complexity can impact the amount and timing of revenue recognized.

#2. Changes in revenue timing

For some businesses, IFRS 15 has changed the timing of revenue recognition. Under the new rules, revenue may be recognized either over time or at a point in time, depending on when control of the goods or services is transferred to the customer. This shift can significantly affect the reported revenue in each accounting period.

Learn more about the accounting cycle and how it differs from the budget cycle.

#3. Enhanced disclosure requirements

IFRS 15 has brought in more comprehensive disclosure requirements, demanding detailed information about revenue recognition policies, contract balances, performance obligations, and significant judgments. This aims to provide stakeholders with a more thorough understanding of a company’s revenue operations.

#4. Sector-specific impacts

The effects of IFRS 15 vary significantly across different industries. For example, in the telecommunications industry, the bundling of goods and services (like a mobile phone and a service contract) requires careful assessment to allocate the transaction price to each performance obligation. In the construction industry, the approach to recognizing revenue for long-term contracts may change, particularly for contracts with multiple elements.

#5. Reassessment of internal processes and systems

Companies have had to update their accounting systems, internal controls, and financial reporting processes to comply with the new standard. This includes the need for more detailed data collection and analysis to support the recognition and disclosure of revenue.

#6. Performance-based revenue recognition

IFRS 15 emphasizes the recognition of revenue based on the satisfaction of performance obligations. Companies with contracts with multiple elements or deliverables must allocate the transaction price to each performance obligation and recognize revenue as each obligation is satisfied.

#7. Variable considerations and constraints

The standard requires companies to estimate the amount of variable consideration to which they will be entitled and to apply a constraint to prevent overstatement of revenue. This can affect companies with significant amounts of discounts, rebates, refunds, credits, or other forms of variable consideration.

Challenges in implementing IFRS 15

Challenge #1. Complexity and judgment requirement

IFRS 15’s principles-based approach requires significant judgment, particularly in complex contracts with multiple elements. Companies must carefully assess each contract to identify performance obligations, determine transaction prices, and recognize revenue appropriately. This involves nuanced decision-making, especially in industries with complex bundling or service arrangements.

Challenge #2. Changes to existing systems and processes

Adapting to IFRS 15 often necessitates substantial modifications to accounting software and financial reporting processes. Companies must ensure that their systems can capture the detailed information required by the new standard, including data for variable considerations and performance obligations. This can be particularly challenging for firms with legacy systems or those lacking integrated IT infrastructure.

Challenge #3. Training and education

The successful implementation of IFRS 15 requires staff across multiple departments to understand its implications. This extends beyond the finance team to include sales, IT, and operations. Comprehensive training programs are needed to ensure consistent understanding and application of the standard, a task that can be resource-intensive and time-consuming.

Challenge #4. Increased disclosure requirements

IFRS 15 demands more detailed disclosure about revenue recognition practices and contract details. This includes qualitative and quantitative information about contracts, performance obligations, and significant judgments. Gathering and reporting this level of detail can be challenging, especially for companies that previously did not maintain such comprehensive records.

Challenge #5. Estimation and allocation

Estimating variable consideration and allocating the transaction price to multiple performance obligations requires careful judgment. This can be particularly complex in contracts with multiple deliverables, discounts, rebates, and other forms of variable consideration. It requires sophisticated methodologies and models to estimate and allocate prices accurately.

Challenge #6. Impact on financial metrics and ratios

The timing of revenue recognition under IFRS 15 can significantly impact financial metrics and ratios. This can affect a company’s valuation, loan covenants, executive compensation plans, and even tax obligations. Companies must carefully analyze and communicate these impacts to stakeholders.

Impact of IFRS 15 on income statements

The adoption of IFRS 15 has several significant impacts on companies’ income statements. This standard changes how and when revenue and, in some cases, expenses are recognized, thus affecting the presentation of the income statement.

#1. Timing of revenue recognition

IFRS 15 introduces a new model for revenue recognition based on the transfer of control rather than the transfer of risks and rewards. This can shift the revenue recognition timing, directly impacting the income statement. For some companies, this may lead to earlier revenue recognition, while for others, it could delay revenue recognition.

#2. Revenue amount

The total amount of revenue recognized might change under IFRS 15. This is because the standard requires an allocation of the transaction price to each performance obligation based on its standalone selling price. The change in allocation methodology can result in different revenue amounts being recognized compared to previous practices.

#3. Gross vs. net presentation

IFRS 15 requires entities to determine whether they are acting as a principal or an agent in a transaction, which affects whether revenue is reported on a gross or net basis. This assessment can change how revenue and related costs are presented in the income statement, impacting both the top line (revenue) and the associated expenses.

#4. Disaggregation of revenue

The standard requires entities to disaggregate revenue into categories that depict how the nature, amount, timing, and uncertainty of revenue and cash flows are affected by economic factors. This requirement may lead to more detailed revenue line items in the income statement, enhancing the granularity and usefulness of the information.

#5. Changes in estimates and judgments

The application of IFRS 15 involves significant judgments and estimates (like the estimation of standalone selling prices or the period over which to recognize revenue for performance obligations satisfied over time). Changes in these estimates can lead to adjustments in revenue recognition, which would impact the income statement in the period of the change.

#6. Performance obligations over time

For contracts where performance obligations are satisfied over time, revenue is recognized as the service is performed. This can lead to a smoother recognition of revenue over the period of the contract, as opposed to recognizing revenue at a single point in time under previous standards.

Recommendations for efficient implementation

Here are some recommendations for a smooth and effective implementation process.

1. Early planning and assessment

Begin with a thorough assessment of how IFRS 15 will impact your business. This should include a review of existing contracts, revenue streams, and current accounting practices. Early planning allows for the identification of areas that will require significant changes and ample time for those changes to be implemented.

2. Cross-functional project team

Form a cross-functional team involving key departments such as finance, sales, IT, legal, and operations. This collaborative approach ensures that all aspects of the business that might be affected by the new standard are considered and that the solutions developed are comprehensive.

3. Training and education

Provide extensive training for staff across all levels and departments that will be impacted by the new standard. This should include accounting and finance personnel and those in sales, contract management, and IT who will need to understand the new requirements.

4. Establish clear policies and procedures

Develop clear policies and procedures for revenue recognition under IFRS 15. This should include guidelines for identifying performance obligations, determining transaction prices, and allocating these prices to performance obligations.

5. Engage with external advisors

Consider engaging with external advisors or consultants who specialize in IFRS 15. They can provide expert advice, share best practices, and assist with complex aspects of the implementation.

6. Pilot testing

Before full-scale implementation, conduct pilot testing on a select number of contracts or business lines. This can help identify potential issues and allow for adjustments before the standard is implemented across the entire organization.

7. Ongoing monitoring and adaptation

After implementation, continuously monitor the new system and processes to ensure they are working as intended. Be prepared to make adjustments as necessary, especially in response to changes in business practices or feedback from auditors.

8. Documentation and compliance

Ensure thorough documentation of the implementation process, including the basis for decisions made regarding revenue recognition. This is crucial for audit purposes and for maintaining compliance with the standard.

9. Leverage technology solutions

Utilize technology solutions, such as advanced ERP systems or dedicated revenue management software, to automate and manage the complexities of tracking performance obligations, pricing, and revenue recognition.

10. Risk assessment and management

Conduct regular risk assessments to identify and manage any risks associated with the implementation of IFRS 15, including financial, operational, and compliance risks.

Conclusion

In conclusion, IFRS 15 is a transformative standard that modernizes revenue recognition. Its comprehensive approach ensures consistency and transparency, significantly impacting financial reporting and business practices globally. Companies must approach their implementation strategically, investing in training, systems upgrades, and thorough planning to ensure compliance and leverage the benefits of improved financial reporting standards.

IFRS 15 FAQ section

How does IFRS 15 change revenue recognition practices?

IFRS 15 revolutionizes revenue recognition by introducing a five-step model that focuses on the transfer of control rather than the transfer of risks and rewards. This model requires companies to identify contract terms, performance obligations, transaction prices, and allocate these prices to specific performance obligations before recognizing revenue. This approach provides a more detailed and structured process, ensuring that revenue is recorded accurately and consistently across all industries.

What are the challenges businesses face in implementing IFRS 15?

Businesses encounter several challenges when implementing IFRS 15. These include understanding the complex requirements of the standard, re-evaluating existing contracts, and making significant changes to accounting systems and processes. Staff training and maintaining compliance also pose challenges, as IFRS 15 requires a deep understanding of the nuances of revenue recognition and the ability to apply these principles to a wide range of contracting scenarios.

How does IFRS 15 affect financial statements?

IFRS 15 impacts financial statements significantly, particularly the income statement and balance sheet. It changes the timing and amount of revenue recognition, which can alter profit reporting periods. On the balance sheet, IFRS 15 affects how companies report assets and liabilities related to contracts with customers. The standard also requires extensive disclosures, providing more transparency into a company’s revenue management and future cash flows.

Are there any specific industries significantly impacted by IFRS 15?

Yes, several industries are significantly impacted by IFRS 15, including technology, telecommunications, construction, and service industries. Technology and telecommunication companies face changes in recognizing revenue from software and service bundles. Construction companies must adapt to new ways of recognizing revenue over contract periods. Service industries need to reassess their revenue recognition patterns, especially those with long-term contracts or multiple deliverables.

What resources are available for learning more about IFRS 15?

A variety of resources are available for learning about IFRS 15. These include educational courses and certifications offered by professional accounting bodies, online tutorials, webinars, and seminars. Many accounting firms and consultancies provide training and resources. Additionally, the International Accounting Standards Board (IASB) website and publications offer valuable guidance, including the standard’s full text, illustrative examples, and educational material.

How does IFRS 15 align with US GAAP?

IFRS 15 and the US GAAP standard ASC 606 (“Revenue from Contracts with Customers”) are aligned in many ways, as both were part of a joint project to harmonize revenue recognition globally. However, there are some differences in scope, disclosures, and implementation guidance. Both standards follow a similar five-step model for revenue recognition, aiming to increase comparability and transparency in revenue reporting across international borders.

Excellent article!

This fantastic blog has lots of helpful ideas for ! Loved the vision and context outline example for IFRS Course