The easiest way to sync Shopify refunds to QuickBooks Online with all details like tax, shipping, and discounts is to use Synder’s Shopify–QuickBooks integration. Synder records refunds automatically, links them to original sales, and posts them to the right accounts in QuickBooks, making reconciliation quick and accurate.

According to the 2025 Emerging Trends in Accounting AI report, finance teams that automate reconciliation save an average of one full workday per employee each month and over 50% cut 3–5 days from their month-end close. With Synder, Shopify store owners can achieve the same by removing manual uploads from their workflow while gaining real-time, audit-ready financial records.

Shopify refund syncing in QuickBooks with Synder

Setting up Shopify refund syncing in QuickBooks Online with Synder is quick and straightforward. Just follow these steps to ensure every refund is captured accurately and reconciled automatically.

Step 1: Connect Shopify and QuickBooks Online to Synder

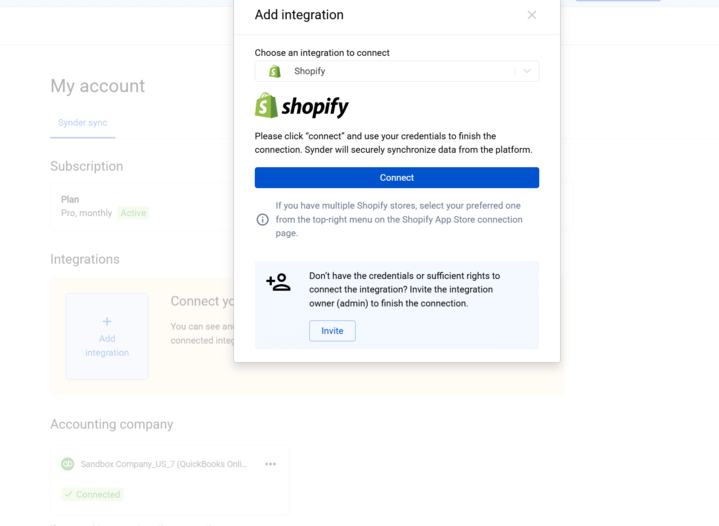

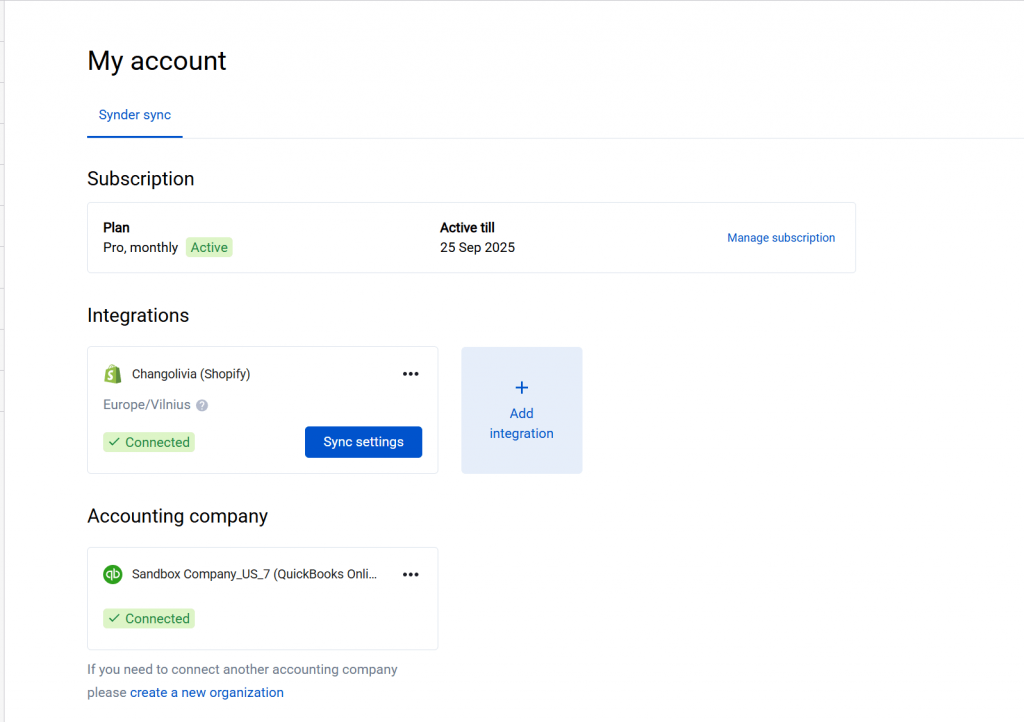

- In Synder, go to Organization settings → Add integration and select Shopify.Add QuickBooks Online as your second integration and authorize Synder to access your company file.

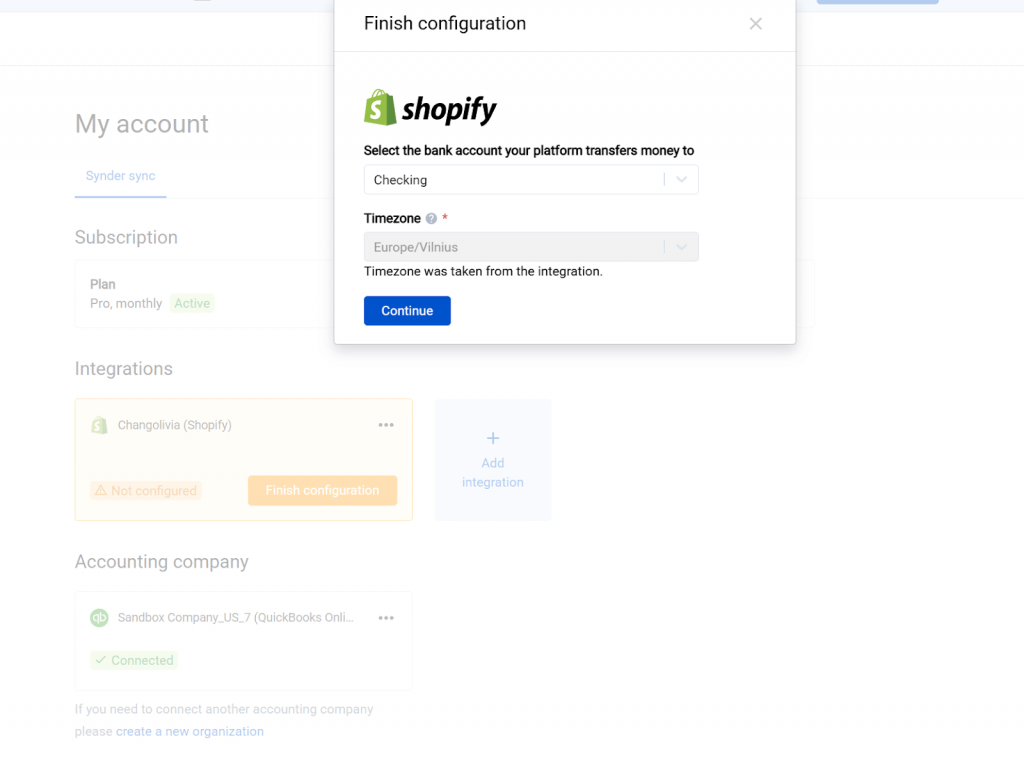

- Choose the account in QuickBooks where your Shopify payouts will be deposited (usually your checking account). This ensures smooth reconciliation.

- Log in to Shopify, approve the connection, and click Install App when prompted.

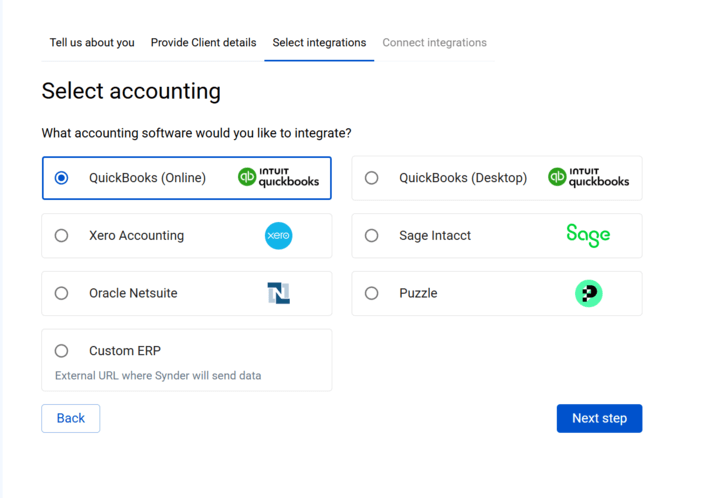

- Add QuickBooks Online as your second integration and authorize Synder to access your company file.

Tip: If you use additional payment processors (e.g., PayPal, Stripe, Amazon Pay), connect them in Synder so all related sales, fees, and refunds are captured in one workflow.

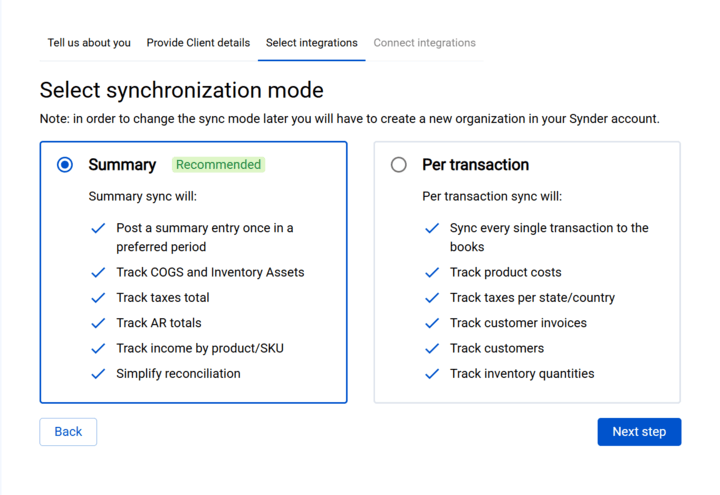

Step 2: Choose your sync mode

- Per Transaction Sync – Posts each refund individually for detailed tracking and precise reconciliation.

- Summary Sync – Combines all refunds from a single day into one summarized entry for a cleaner QuickBooks ledger.

Tip: Per Transaction is ideal for businesses that require detailed reporting or frequent audits. Summary Sync is better for high-volume stores that prioritize speed.

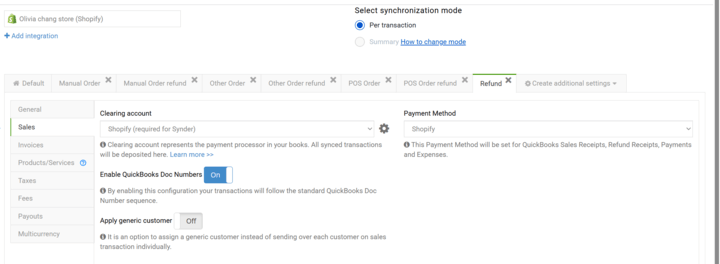

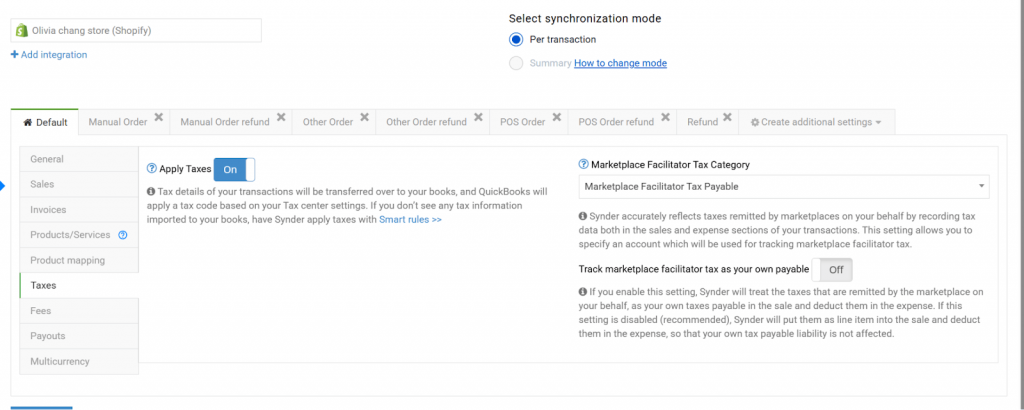

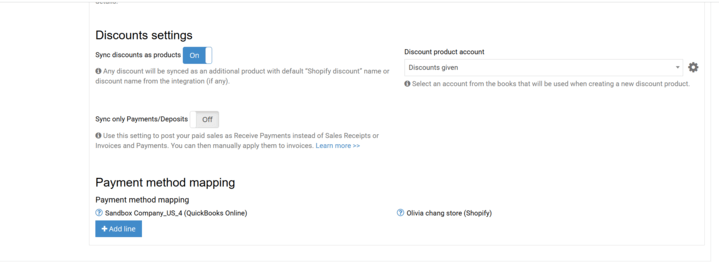

Step 3: Map refund components to QuickBooks

In Settings → Shopify → Chart of Accounts Mapping:

- Map shipping refunds and discount reversals to their respective accounts.

- Map refund amounts to your income adjustment account.

- Map tax refunds to your sales tax payable account.

This ensures every part of the refund is categorized correctly in QuickBooks.

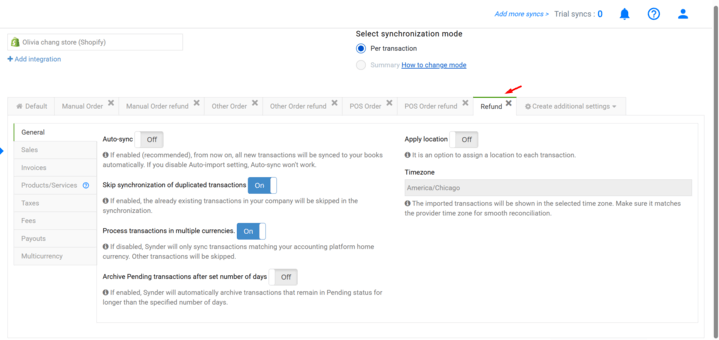

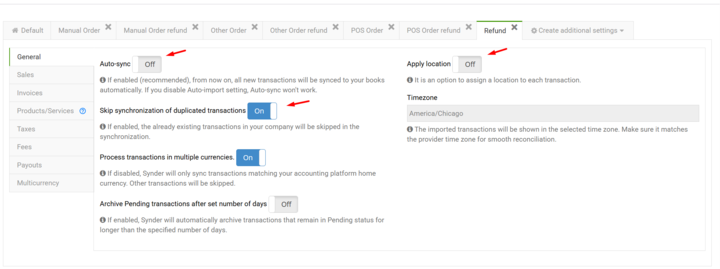

Step 4: Adjust settings for automation

Enable:

- Auto-sync – Sends refunds to QuickBooks as soon as they happen in Shopify.

- Skip duplicates – Prevents duplicate entries if a refund has already been recorded.

Location tracking – Adds location details to refunds if you need to segment data by store or sales channel.

After setup

- Once everything is configured, you can choose between running a manual sync for specific refunds or letting Auto-sync update QuickBooks automatically in the background.

- Refunds will appear in QuickBooks as refund receipts or credit memos, always linked to the original sale so you have a clear audit trail.

- When reconciling, open QuickBooks’ Bank Reconciliation screen and match the synced refund entries to the actual bank transactions, ensuring accuracy without manual adjustments.

Types of Shopify refunds Synder can sync

1. Partial refunds: Synder supports partial refunds, recording only the refunded portion while keeping the original sale intact. This ensures your sales and refund reports stay accurate.

2. Refunds with tax and shipping adjustments: If a refund includes tax or shipping, Synder will split these amounts into the correct accounts based on your mapping, so tax liabilities and shipping income are adjusted automatically.

3. Overpayments and Shopify payments deposits: When overpayments occur, Synder records the extra amount in the correct liability account and adjusts it when the refund is issued. If you’re using Shopify Payments, these will appear in QuickBooks as part of your payout transactions, ready for reconciliation.

4. Multicurrency refunds: For international sales, Synder records refunds in both the transaction currency and your home currency, applying the correct exchange rate for accurate reporting.

5. Historical refund imports: If you need to bring in past refunds, Synder can sync historical transactions from Shopify to QuickBooks so your records are complete from day one. Available on the Premium plan, included with 3 months free on the Pro plan, and offered as a paid add-on for the Basic and Essential plans.

See how easy refund syncing can be:

Book a free demo to learn how Synder automatically syncs Shopify refunds to QuickBooks capturing tax, shipping, and discounts, linking them to original sales, and preparing them for one-click reconciliation. Save hours, eliminate errors, and keep your books audit-ready.

FAQ

Can I push historical Shopify refunds to QuickBooks Online?

Yes. Synder can import and sync historical Shopify refunds into QuickBooks Online, ensuring your records are accurate from day one. This feature is available on Premium, 3 months free on Pro, and as a paid option for Basic/Essential.

How are Shopify refund components recorded in QuickBooks Online?

Synder breaks each refund into components: tax, shipping, and discounts, and maps them to the correct QuickBooks accounts based on your setup. This ensures accurate financial reporting, compliant tax adjustments, and clean reconciliation without manual categorization or data entry.

What QuickBooks entry does Synder create?

Depending on your configuration, Synder creates either a refund receipt or a credit memo in QuickBooks, always linked to the original sale. This provides a clear audit trail and makes matching refunds during bank reconciliation simple and accurate.