Profit and loss statements are something that all firms, regardless of how long they have been in business, should be familiar with. Understanding what they are, how they work, and how they can positively benefit your business is key to ensuring long-term success. While it may not seem entirely intuitive at first, I, Benjamin Popwell, a financial statement analysis expert, am here to provide you with straightforward guidance to help you fully harness its potential.

With this guide, we’ll examine what a profit and loss statement is, and how to break down all the key components for one to be able to properly analyze them. We’ll even throw in some real-life examples of how they can improve revenue for your business and the common mistakes to avoid when dealing with them. At the end of it all, we’ll discuss how to develop the correct strategies for your company that can be built around these statements, like my team and I do to maximize profits. The aim of the game here is to help you fully grasp the concept of profit and loss statements, so what are we waiting for? Let’s get right into it!

Contents:

- What is a profit and loss statement, and why is it crucial for your business?

- How can a company use the profit and loss statement to improve profitability?

- What key components of a profit and loss statement should every business analyze?

- What common mistakes do companies make when interpreting a profit and loss statement?

- How do businesses develop strategies based on profit and loss statement insights?

- Profit and loss statements: Key takeaways

What is a profit and loss statement, and why is it crucial for your business?

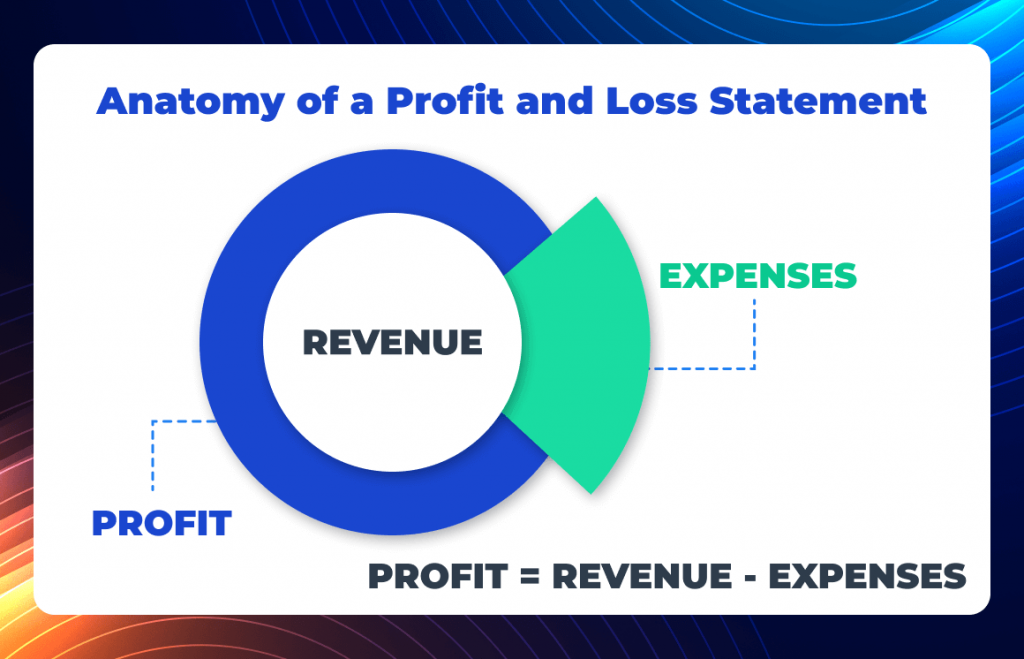

The profit and loss statement is essential to understanding the health of a business. At its core, the profit and loss provides a summary of a company’s revenues and expenses for a given period. Stacking up the revenue of the company against that period’s expenses allows the user to determine if a company is profitable, and if so, to what extent.

This is helpful for many reasons, depending on who’s using the report. For investors, understanding the profitability of a business is key to determining the value of a company and whether it would be a worthy place to invest its capital to help fuel growth. Management may use the profit and loss to hold their teams accountable to sales growth and expense management goals, further driving revenue growth and efficiencies within the organization and thereby increasing profitability. Owners can use the profit and loss in conjunction with a forecast to budget for upcoming tax liabilities and proactively work with their tax advisors to minimize their impact.

While the value of the profit and loss statement is largely determined by the end user, the structure of the report remains the same for all parties and is largely consistent across businesses, particularly those within the same industry. This is important as it allows for comparability between companies and a set of standard ratios that enable the reader to easily compare the performance of one company against another.

How can a company use the profit and loss statement to improve profitability?

A company can use a profit and loss statement to not only understand its profitability but also to significantly improve it. As the adage goes “What gets measured gets managed,” and this is particularly true for profit margins. A key component of using the profit and loss statement effectively is understanding your drivers:

- What are the levers you can pull that will cause your revenue and expenses to increase or decrease?

- Who has access to those levers?

- Are incentives aligned to encourage decision-makers to use them in the right way?

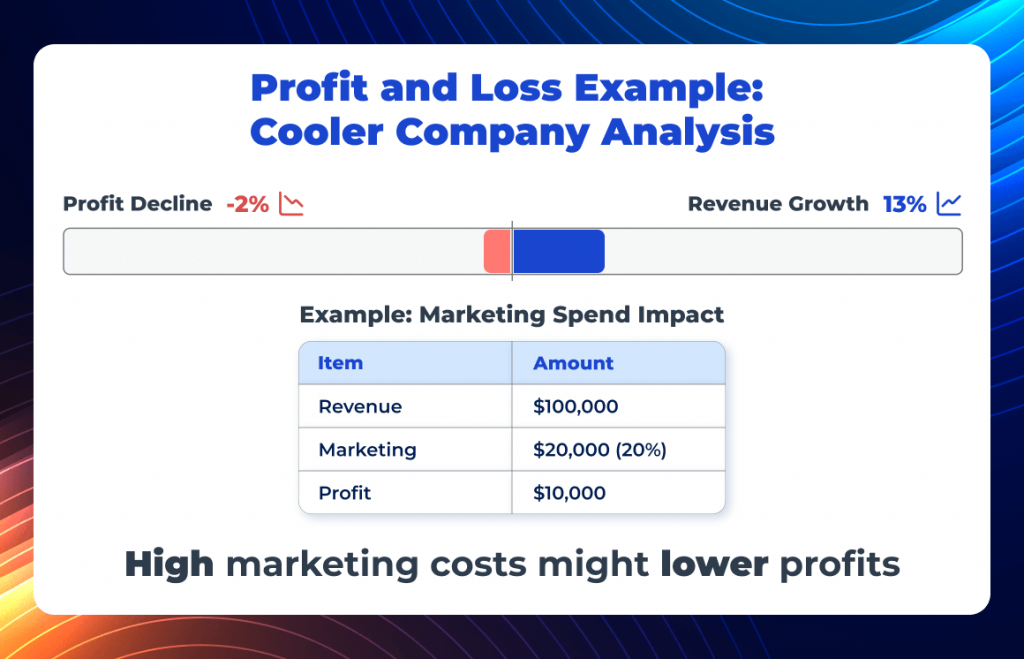

For example, suppose you own a cooler company and set a goal for your sales team to increase revenue by 12% year over year一a worthy goal! At the end of the year, you review your profit and loss to see that revenue has increased by 13%. Success, right? On closer examination, however, you discover that the overall profitability declined during the same period.

What happened? One area to look at would be your return on ad spend (ROAS), as marketing is often a key driver of revenue. Did marketing costs stay constant, or did they rise disproportionately with the increase in revenue? Perhaps they ballooned out of proportion, negating the gains from the revenue increase.

The profit and loss helps you understand the whole story of what occurred in your company, rather than just focusing on a single metric in isolation. Aligning incentives within the organization and tracking all aspects of the profit and loss一including revenue, cost of goods sold, expenses, and the various profit margins (gross profit, operating profit, net income)一 ensures that decision-makers are held accountable and incentivized to act in the best interest of the entire organization.

What key components of a profit and loss statement should every business analyze?

There are several key components of a profit and loss statement a business should analyze.

Among the most important are the gross profit margin, fixed and variable costs, and the breakeven point.

Gross profit is defined as revenue minus cost of goods sold (COGS). This represents the amount left to cover operating costs after you acquire and deliver your product to the customer. Using the earlier example of a cooler company, gross profit would be the selling price of your cooler minus the expenses incurred to source the coolers, store them in your warehouse, and fulfill customer orders.

Gross profit margin is gross profit relative to revenue, i.e. stated as a percentage rather than a dollar amount. This is a key metric for e-commerce companies. Understanding your gross profit margin is key to making pricing decisions and choosing which products are going to drive growth in your business. An integral part of maintaining profitability is analyzing gross profit margin over time and ensuring there is no margin erosion一when the gross profit margin decreases over time. This could be due to:

- Lower prices,

- Increased returns,

- Excess discounts, or

- Increased product costs.

All of those could be potential obstacles to sustainable growth. Fixed and variable costs don’t display directly on a profit and loss but are categories of costs within the profit and loss. The test for knowing if a cost is fixed or variable is whether it varies concerning revenue. For instance, rent is typically a fixed cost as a company’s monthly lease expense won’t directly fluctuate with a change in monthly revenue (up to a point). Advertising or certain types of labor, however, very often do directly fluctuate in proportion to shifts in sales.

Understanding this distinction is important as it is necessary to determine the breakeven point, which is the revenue threshold at which a company will be profitable. This is critical for a company when making investment decisions and planning for potential cash flow concerns.

What common mistakes do companies make when interpreting a profit and loss statement?

Perhaps the most common mistake companies make is not properly analyzing their profit and loss. Business owners often become accustomed early in the business life cycle to heavily relying on bank statements to gauge the health of their business.

While this may seem logical一since cash is critical for any business, especially in its infancy一only analyzing cash fluctuations won’t provide the insights necessary for informed decision making. Maintaining an accurate accounting system and producing insightful, timely management reports (including profit and loss) is key to the success of any business.

Similarly, financial analysis is only valuable if it drives actionable change within the organization. Good reporting is the first step, but it must be paired with using the insights from those reports to hold teams accountable and create measurable goals.

One effective way to ensure that the profit and loss are used to drive accountability and growth is to pair it with a budget. By strategically setting an annual budget and tracking actual results against the budget, potential financial weaknesses can be identified, analyzed, and acted upon before they escalate.

How do businesses develop strategies based on profit and loss statement insights?

Companies can use the insights from the profit and loss to help shape their long-term direction. These decisions often focus on maximizing revenue growth, improving operational efficiency, and enhancing profitability. For example, identifying consistent revenue growth in a particular region or customer segment might prompt a business to expand its presence in that market or develop tailored marketing campaigns. Similarly, insights into successful products or services could encourage further investment in innovation or the creation of complementary offerings.

Cost optimization is another crucial area where profit and loss insights drive strategy. High operating expenses may lead management to streamline workflows, adopt cost-saving technologies, or renegotiate supplier contracts. Businesses can also reallocate budgets toward departments or activities that deliver the highest return on investment.

Enhancing profitability often involves revisiting pricing strategies, bundling offerings to add value, or discontinuing unprofitable products or services. Maintaining accurate financials, producing timely monthly reports, and consistently analyzing those reports to identify weaknesses and opportunities are essential for any business.

As a trusted advisor to businesses, the most fulfilling aspect of my work is witnessing owners leverage the insights from the reports we’ve crafted to drive meaningful change and unlock growth within their organizations—achieving results they once considered unattainable.

Profit and loss statements: Key takeaways

As we conclude our exploration of profit and loss statements, I hope you’ve gained valuable insights and a deeper understanding of how to interpret these financial documents. By understanding their structure and purpose, businesses can clearly identify opportunities for growth, improve operational efficiency, and make informed decisions. Through conducting regular analysis of key metrics like your profit margin and breakeven points, and pairing them with actionable strategies, you’ll be able to transform your statements into powerful tools for driving success.