One of the things entrepreneurs care about when they get an interesting venture idea is, among others, how to raise money for a business. From startup loans to grants, private investors to crowdfunding – there is a multitude of small business funding options available to founders.

Raising money for business isn’t easy. We’ll help you understand the specifics of fundraising so that you can decide which option is the right one for you. Whether you’re interested in getting a small business loan or want to know how to raise money for a business without a loan, you’ll find everything you need to know about funding your business in this guide.

Ready to find out more?

Contents:

1. Raising money for business: how to start

2. Small business funding options

3. Best ways of getting a small business loan

4. How hard is it to get a small business loan?

5. How to raise funds for a business without a loan

Raising money for business: how to start

The first thing that comes to mind when you think of a great business idea is: How will I get the money to start?

Finding the best way to fund your company’s development can be a challenging journey. Two of the most important things you need throughout this process are motivation and focus.

While every business’s journey is unique, there are a few things the successful ones have in common.

Prepare a business plan for raising capital

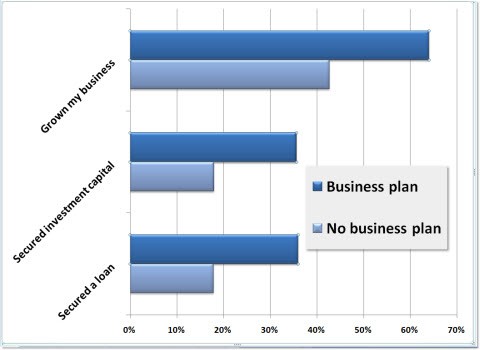

The first and most critical step every entrepreneur has to take before raising money for business is creating a detailed business plan. It must clearly show potential lenders your prospects for growth.

Having a business plan doubles your chances to succeed in fundraising. Moreover, there are many sources for assisting in writing a business plan, choose one of the best tools for business planning and write your plan professionally with a step-by-step guide.

Fix your financials

More than just being a promise for return on investment, potential investors would like to see your reliability. They may care about your credit history, monthly or yearly income and may require appropriate documents to prove you’re a reliable investment for them. This can relate to your personal and business finance, which means you’ll have to go through due diligence.

You can use accounting software such as Synder to organize your accounting data for a smooth due diligence process. How? Synder will reconcile your accounting and make up all the necessary financial reports and statements that investors will want to see. The tool will automatically gather your sales data from the ecommerce channels and payment providers and sync it to the books to prepare them for a seamless reconciliation with per transaction or daily summary records at your discretion.

Ready to simplify your accounting to spare more time for growing your business? Want to organize your accounting data so that everything is ready for due diligence? Sign up for Synder’s free trial or book a seat at our public demo and discover what smart automated accounting software is capable of.

Get ready for rejection

Prepare yourself to accept rejection as an inevitable part of the way to raise money. Not losing hope when being rejected is hard. However, staying motivated throughout the ups and downs is part of what defines the entrepreneurial spirit.

Small business funding options

venture to the next level, there are various small business funding options waiting for you.

Some of the options to how to raise capital include:

- Bank loans

- Federal government loans

- Business loans from other financial institutions

- Equity financing

- Investments

- Venture capital

- Crowdfunding

- Business grants

- Bootstrapping

- Business incubators

Such a multitude of possibilities on how to raise funds for your business can be perplexing. How should you know which method of raising funds will work best for you? The most obvious way to raise money for many business owners will be to get a loan. So let’s start with that, and get an overview of all the advantages and some possible hardships you may encounter, followed by some alternatives. Estimating your monthly payments and interest expenses with a bank loan calculator can simplify your decision on whether a loan is the best route for your business.

Best ways of getting a small business loan

When you start to look at the ways of getting a small business loan, you’ll see that there are plenty of options to choose from.

The most popular types of business loans include:

- Secured and unsecured business loans: Secured loans will require collateral from you, whereas unsecured loans won’t. Because of this unsecured loans are riskier, the interest rates are higher, therefore credit score requirements for unsecured loans are stricter.

- Flexible and structured business loans: A business line of credit (LOC) offers a lot of flexibility. With the flexible line of credit, you’ll have to repay the borrowed money as you’re able to and then borrow those funds again when you need them. Structured loans, on the other hand, offer only fixed payments.

Bank loan

Traditional bank loans are the first thing people typically choose to secure funding for small businesses. But the banks are only interested in helping you if your business, and you personally as an owner, have a strong credit record, sound financial health, and enough valuable assets to serve as collateral.

This option is the most suitable for founders with excellent credit history. For others, however, this method of raising money can be extremely hard or nearly impossible to get.

On the bright side, traditional bank loans typically have the lowest interest rates and with all the understandable rules, they’re relatively easy to apply for. You simply repay the borrowed sums over time in fixed monthly payments.

Federal funding (SBA loan)

The Government provides different federal programs to help facilitate small businesses. If getting a loan from a bank doesn’t work for you, try checking the governmental programs that may help. For example, the U.S. Small Business Administration.

An SBA loan can be an option if a traditional bank presents lending criteria that are too strict. Some of the federal loans can even be forgivable (like the stimulus program with PPP loans and EIDL). However, the application process isn’t easy and most often involves lots of paperwork and bureaucratic challenges. As a result, you can easily become swamped under the piles of documents you are required to fill in to apply. But judging based on usual SBA loan interest rates, nabbing one of these loans could be a cheaper option for most companies.

Credit Unions and Community Development Finance Institutions

These entities are a workable alternative to conventional banks for getting a loan.

Credit Unions will suit you best if you have an existing membership. They can provide more cooperative, personal relationships due to the smaller size of their organizations.

CDFIs or Community Development Finance Institutions form a country-wide net consisting of thousands of nonprofit organizations providing capital to small businesses on reasonable terms.

How hard is it to get a small business loan?

Business loans are vital to launching a new business or expanding a running company. The funds raised secure inventory, help rent working space, pay employees, and cover some other operational expenses. However, business loans can be difficult for new companies to get. Statistically speaking, only 57% of applications for a business loan are approved.

The rule of thumb for getting a business loan is this: the easier and more attractive, the more expensive the loan. If the loan is cheap, it’s definitely going to be difficult to apply for and receive.

Here’s what you should know to increase your chances of receiving the money:

1. You’re more likely to be approved for a good loan option if your personal finances are in order.

2. If your credit report shows a lack of past diligence in paying back debts, you might be rejected for a loan.

3. A good credit score, for most banks, usually lies in the range of 690 to 850.

4. Some loans require down payment, ranging from zero to 20% of the loan amount.

5. Cash flow is another important factor. For new small business loans, banks prefer a 1.35 debt-to-income ratio.

6. Some lenders request collateral in the form of property, vehicles, or any other asset of value that will be withheld if you fail to repay the loan.

7. Never underestimate a persuasive plan for your business, showing how much and for what you’re planning to spend their money on and how they’ll profit.

How to raise funds for a business without a loan

With the extensive list of requirements for a business to be acknowledged eligible for a loan, many founders struggle to raise funds from banks.

Also, not every person starting a business or launching an experimental product to the market is willing to take the risks of repaying loans and interest.

While it sounds uncomplicated in theory, the reality is that getting a loan is not an option for everyone. So for many, the real question is how to raise money for a business without a loan. Surprisingly, there are quite a few options for how you can do this.

Here’s what you can consider:

Crowdfunding

Crowdfunding is the way to raise the funds by gathering small amounts of money from many people. Entrepreneurs usually do it through crowdfunding platforms online.

For whom is crowdfunding the best choice? Well, it’s a relatively simple way to raise capital for your business at the idea phase. You actually don’t need a serious business plan, and no one cares about your credit history. All you need to have is a bright idea that will spark interest in the hearts of your fans and followers. Which presents a challenge, if you have none.

A good example of crowdfunding platform is GoFundMe that allows for creating campaigns for various purposes such as emergencies, projects, and charitable causes. Through user-friendly interfaces and social media integration, GoFundMe facilitates the rapid mobilization of support by allowing users to share their stories and gather contributions from friends, family, and strangers. The platform highlights individual stories, raises awareness, and fosters unity among diverse communities. It showcases the positive synergy of technology and human compassion, demonstrating how digital connectivity can bring about meaningful and impactful change on a global scale.

To get noticed on crowdfunding platforms and receive these necessary seed funds, you’ll have to build an online campaign and create an appealing pitch for a massive audience. That’s why crowdfunding works best for companies with creative founders and those who can easily engage with their potential customers.

Venture capitalists

Venture capitalists, or VCs, invest large sums of money, borrowed from corporations and institutions, into startup businesses with both high levels of risk and high potential. For the company to be attractive to venture capitalists, they should promise vigorous growth in value or be able to go public in the future.

To a business owner, the benefits from attracting venture capital lie not only in the financial perspective. Experienced venture capitalists assist with the mentorship and guidance of how to grow the company. They help businesses attract additional resources from the industry, including expert knowledge and connections.

The biggest disadvantage of venture capital, though, is that founders lose control of their businesses. It’s common that venture capitalists obtain the majority share, usually more than 50% of the company.

Angel investors

Another option of equity financing for businesses is attracting an angel investor to seed business funds. Private (angel) investors usually participate in helping businesses at a very early stage to enter the market. This could simply be a pre-revenue company with few to no customers at all, but with a well-developed business plan and a prototype of the product.

The banks usually ignore such cases, that’s why wealthy people with private personal capital step up as Maecenas. To win the investor’s interest, businesses need to deliver a good pitch. Turn the spotlight on your team, the competitive power of your product, and the estimated profit from your market share.

This is a great opportunity for business founders to avoid debt with the bank if the business doesn’t go as well as planned. Businesses don’t need to return the money received from angel investors. However, angels do become partners in businesses and get shares in companies. So in the incidence of your business skyrocketing, they’ll have a portion of their future revenue.

Already have an investor? Learn more about how to write a good investor update.

Business grants

There are different types of business grants you can apply for to attract more capital.

The Government or other institutions can deliver grants to assist businesses in certain areas, usually, those that benefit the wider population. For example, businesses in science and research, grants to support women entrepreneurs, businesses focused on innovation in agriculture, etc.

Each business grant will have its own application process and strict qualification criteria. But generally, to win, you have to meet the goals and requirements and have a high potential for commercialization.

You may be eligible for a small business grant to cover certain types of expenditure too. Check if any grants are available for you to cover things like rent, machinery, or software equipment.

Bootstrapping

Bootstrapping means using your personal savings to finance the growth of your business venture. If you believe in your vision and have an absolute refusal to accept failure as an option, you should feel comfortable investing your own money into the business. It can be a great way to finance your operations.

What benefits can you get from bootstrapping? First of all, investing personal finances doesn’t have to be the only option. It can be a working strategy for the start. The fact that you put your own money in your idea makes other investors and lenders more confident in it too. This may make them more willing to partner with you down the line.

Additionally, if you’re happy with how your business operates in the future, you’ll be free of any obligations to lenders and will retain full control of your company.

Business incubators

Business incubators are supportive environments designed to help startups and early-stage companies grow and succeed. They provide resources such as shared office spaces, mentorship, networking opportunities, and educational programs. Incubators cater to specific industries and encourage collaboration among entrepreneurs. They also offer access to funding sources, aiding startups in securing capital. Ultimately, business incubators serve as essential platforms that guide and nurture promising ventures through their initial stages, fostering innovation and economic development within entrepreneurial communities.

Wrapping up

In this guide to small business funding options, we discussed the different sources of funding for businesses and explored the opportunities for businesses to raise money.

You may be inclined to get a small business loan, or decide to raise money for your business without a loan. Apply for a business grant, look for an investor, or find budgeting through crowdfunding platforms.

In the end, it’s up to you to decide what approach will work best for you, and your business. Just make sure to weigh up all the pros and cons of the different funding methods and which approach suits your capacities best in order to ensure your venture will be profitable.