Tax filing season can be daunting, especially when it comes to understanding the various forms required. One important form that businesses and individuals need to be familiar with is Form 1099-NEC. This article serves as a comprehensive guide to help you navigate the process of filing Form 1099-NEC accurately and efficiently, ensuring compliance and avoiding penalties.

This article has been prepared for informational purposes only and gives general instructions and an overview of Form 1099-NEC. It is not intended to provide any tax advice. Keep in mind that it’s better to consult with a tax professional to ensure that the form is properly filled.

Understanding Form 1099-NEC

Form 1099-NEC, which stands for Nonemployee Compensation, is used to report income paid to non-employees, such as independent contractors, freelancers, and self-employed individuals. It replaced the use of Box 7 on Form 1099-MISC for reporting nonemployee compensation starting in the tax year 2020.

Read our article to learn more details about Form 1099-NEC.

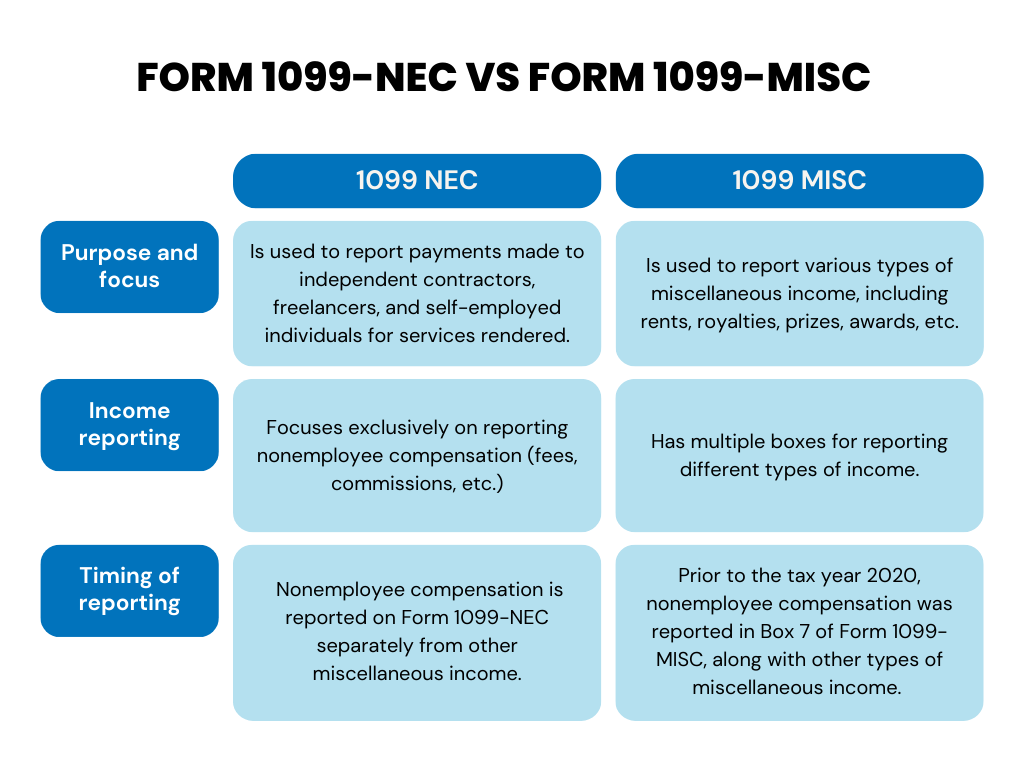

The main difference between Form 1099-NEC and Form 1099-MISC lies in the types of income they report and the specific boxes used for reporting. Here are the key distinctions between 1099 NEC and 1099 MISC:

1. NEC vs MISC:

- Form 1099-NEC: As was said above, this form is specifically used to report nonemployee compensation paid to independent contractors, freelancers, and self-employed individuals. It is used for reporting payments made for services rendered, such as fees, commissions, or other forms of compensation.

- Form 1099-MISC (Miscellaneous Income): This form, on the other hand, is used to report various types of miscellaneous income that do not fall under nonemployee compensation. It includes reporting rent, royalties, prizes, awards, and other forms of miscellaneous income.

2. Reporting Box:

- Form 1099-NEC: Compensation is reported in Box 1 on Form 1099-NEC. This box is dedicated solely to reporting the total amount of nonemployee paid to the recipient.

- Form 1099-MISC: Prior to the tax year 2020, nonemployee was reported in Box 7 on Form 1099-MISC. However, starting from the tax year 2020, it is no longer reported on Form 1099-MISC. Instead, it is reported on Form 1099-NEC.

3. Other Types of Income:

- Form 1099-NEC: This form is solely focused on reporting nonemployee and does not include any other types of income.

- Form 1099-MISC: Form 1099-MISC is used to report other types of miscellaneous income, including rent, royalties, prizes, awards, and other forms of miscellaneous income. Depending on the specific category, these types are reported in various boxes on the form.

It’s important to note that Form 1099-NEC and Form 1099-MISC serve distinct purposes in reporting income. Understanding the specific requirements and using the appropriate form based on the reported income type is essential for accurate tax filing and compliance with IRS regulations.

Gathering required information before filing 1099 NEC

Before completing Form 1099-NEC, it’s crucial to gather all the necessary information. This includes:

Payee information

Obtain the payee’s legal name, address, and Taxpayer Identification Number (TIN), which can be either a Social Security Number (SSN) or an Employer Identification Number (EIN). It’s essential to verify the TIN provided by the payee to avoid potential issues.

Payment information

Gather the total amount of nonemployee compensation paid to each individual throughout the tax year. This includes any fees, commissions, or other forms of compensation provided for services rendered.

Steps to file Form 1099-NEC

It is important to accurately report the financial information in Form 1099-NEC and properly calculate your self-employment taxes to ensure that you are meeting your tax obligations. It is recommended to consult a tax expert or use tax software to help you accurately report your income, determine your tax liability, and maximize any eligible deductions or credits.

Filling out Form 1099-NEC involves several steps. Follow the instructions below to complete the form accurately:

Obtain the form

Download Form 1099-NEC from the official IRS website or obtain a physical copy.

Enter your information

In the top-left corner of the form, enter your name, address, and Employer Identification Number (EIN).

Provide recipient information in the form

In the first section, enter the recipient’s name, address, and Taxpayer Identification Number (TIN), which can be either a Social Security Number (SSN) or an Employer Identification Number (EIN).

Report nonemployee compensation

In Box 1, enter the total amount of reportable payments (nonemployee compensation paid to the recipient throughout the tax year). This financial information includes any fees, commissions, or other forms of compensation provided for services rendered.

State income tax withholding (if applicable)

If state income tax was withheld from the payments made to the recipient, enter the amount in Box 5.

Double-check the information

Review all the information entered on the form to ensure accuracy. Check for any misspellings, incorrect numbers, or missing details.

Retain copies and provide to recipients

Make a copy of Form 1099-NEC for your records. Retain these copies for at least four years after the filing due date. Provide the recipient with their copy of Form 1099-NEC by January 31st.

File the form

There are two ways to submit Form 1099-NEC to the IRS: electronically or by mail. If filing electronically, you can use the IRS FIRE system or approved tax software. Ensure that you follow the specific guidelines for electronic filing. If filing by mail, send the completed Form 1099-NEC along with Form 1096 (Annual Summary and Transmittal of U.S. Information Returns) to the designated IRS address. The deadline for filing by mail is generally February 28th.

Correcting errors in the form (if necessary)

If you discover errors on a previously filed Form 1099-NEC, promptly file corrected forms using Form 1096. Provide corrected copies to the recipient as well.

Potential penalties and common errors

Failure to file or filing incorrect information on Form 1099-NEC may result in penalties. Penalties can range from $50 to $550 per form, depending on the delay in filing or the severity of the error.

Common errors to avoid include incorrect TINs, missing or inaccurate information, and late filing. It’s essential to double-check all information and ensure accuracy to prevent penalties.

Remember, if errors do occur, promptly file corrected forms using Form 1096 and provide corrected copies to the payees.

The IRS provides a variety of resources to assist with filing Form 1099-NEC. Visit the official IRS website to access the instructions and publications related to Form 1099-NEC. Additionally, consider consulting a tax professional or utilizing tax software to simplify the process, especially if you have complex tax situations.

For personalized advice, it is advisable to seek the guidance of a qualified tax professional to ensure accurate reporting and maximize tax benefits.

Conclusion

Filing Form 1099-NEC accurately is crucial for complying with tax regulations and avoiding penalties. By understanding the purpose of Form 1099-NEC, gathering the necessary information, completing the form correctly, and submitting it on time, you can streamline the tax filing process and ensure compliance.

Remember to stay updated with the latest tax regulations and consult the official IRS resources or seek professional assistance when needed. By taking proactive steps in understanding and filing Form 1099-NEC accurately, you can navigate the tax filing season with confidence.

Want to know more? Read Does an LLC get a 1099 and the article about Calculating cash flow.