Today, electronic commerce, commonly known as ecommerce, has revolutionized the way businesses operate and consumers shop. Ecommerce refers to the buying and selling of goods and services through online platforms, eliminating the need for physical storefronts. This booming industry has witnessed exponential growth over the years, driven by technological advancements, widespread internet access, and changing consumer preferences.

Behind every successful ecommerce venture lies a robust financial backbone. As ecommerce businesses flourish, managing their finances becomes increasingly intricate and demanding. This is where accountants and accounting firms play an essential role in supporting their growth and sustainability. A CPA or an accounting firm brings specialized expertise, experience, and technology to the table, helping ecommerce entrepreneurs navigate complex financial waters.

This article aims to guide ecommerce entrepreneurs and business owners in their quest to find the most suitable accounting firm. We’ll explore the unique accounting needs of ecommerce businesses, the key considerations for choosing a partner accountant, and the criteria to evaluate accounting firms effectively.

Contents:

1. What is the job of business accountants?

2. Key features of ecommerce accounting

3. The ultimate tool for automating and streamlining the work of an accountant

4. Criteria for evaluating accounting firms and accountants

5. Best ecommerce accounting firms

6. Tips for ecommerce businesses when choosing an accounting firm

What is the job of business accountants?

With the burgeoning ecommerce landscape, the demand for exceptional accounting services tailored to this industry has surged. The work of an ecommerce accountant goes beyond traditional bookkeeping; it involves handling multiple payment channels, monitoring inventory and cost of goods sold (COGS), complying with tax regulations across different jurisdictions, and safeguarding against fraudulent activities. The accuracy and efficiency of financial processes are critical in ensuring ecommerce businesses’ success, making the partnership with a reliable accountant or accounting firm invaluable.

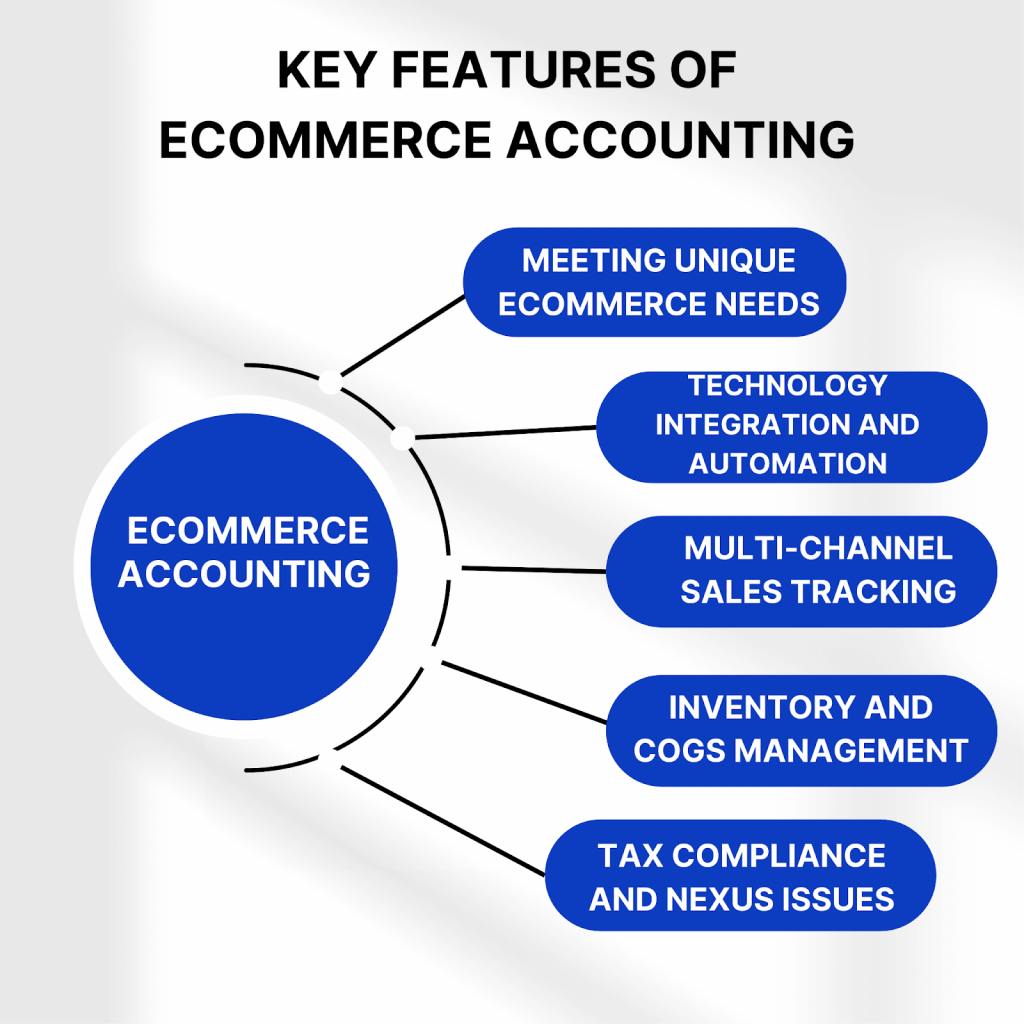

Key features of ecommerce accounting

Meeting unique accounting needs of ecommerce businesses

Ecommerce businesses have distinct accounting requirements compared to traditional brick-and-mortar establishments. They involve a high volume of online transactions, complex payment gateways, and unique inventory management challenges. Understanding and addressing these unique needs is crucial for accurate financial reporting and decision-making.

Technology integration and automation

Integrating accounting systems with ecommerce platforms is vital for seamless data synchronization. Automation plays a critical role in handling repetitive tasks, such as order processing, invoicing, and payment reconciliation. Leveraging technology streamlines accounting processes, reduces manual errors, and increases efficiency.

Multi-channel sales tracking

Ecommerce businesses often sell products through multiple online channels, such as marketplaces, social media platforms, and their websites. Effectively tracking sales across these diverse channels ensures comprehensive revenue recognition and precise financial analysis.

Management of inventory and cost of goods sold (COGS)

For businesses involved in selling physical products, efficient inventory management is essential. Monitoring stock levels, tracking COGS, and assessing inventory turnover impact profitability and financial performance.

Tax compliance and nexus issues

During tax preparation, ecommerce businesses often encounter complex tax implications, including sales tax nexus in multiple states or countries. Staying compliant with tax regulations is critical to avoid penalties and maintain a positive financial standing.

The ultimate tool for automating and streamlining the work of an accountant

Synder is a specialized accounting tool for accountants, bookkeepers and business owners that focuses on automating and streamlining financial processes for ecommerce businesses. It’s designed to integrate seamlessly with popular ecommerce platforms and payment gateways, such as Shopify, Amazon, eBay, PayPal, Stripe, and more. Synder’s main goal is to simplify accounting tasks and provide accurate financial data for an ecommerce entrepreneur, bookkeeper, and business accountant.

Key features of Synder for ecommerce businesses include:

Automatic synchronization of an accountant’s routine

Synder automatically syncs ecommerce sales, expenses, fees, and taxes directly from the connected platforms into accounting software like QuickBooks or Xero in two different modes: detailed per transaction sync or more general daily summary entries. This eliminates the need for manual data entry and reduces the risk of errors.

Multi-channel support

Synder supports multiple sales channels, allowing ecommerce businesses to manage transactions from various platforms in one place.

Sales tax management

The software handles sales tax calculations and ensures accurate tax reporting, taking into account different tax rates and jurisdictions.

Check out How Synder simplifies Amazon sales tax collection.

Inventory tracking

For ecommerce businesses having issues with inventory, Synder can track sales and inventory levels, providing a comprehensive view of stock movement and cost of goods sold (COGS).

Read more about inventory management software for small businesses.

Automated invoicing

Synder can generate and send automated invoices to customers, saving time on manual invoicing processes.

Find out about the best invoicing software 2023.

Real-time reporting

The platform offers real-time financial reporting and dashboards, giving businesses valuable insights into their financial performance, like LTV, gross sales, top and least performing customers, top and least performing products, and much more.

Synder’s automation and integration capabilities can significantly enhance accounting processes for online businesses, saving time and reducing the likelihood of errors.

Want to see how Synder will streamline your operations? Sign up for a 15-day free trial or spare a seat at webinar with Synder’s support specialist.

Criteria for evaluating accounting firms and accountants

Ecommerce business experience

When assessing an accountant or accounting firm, consider their experience and expertise in serving the ecommerce industry. Look for firms that have a proven track record of working with ecommerce businesses similar to yours. A deep understanding of the unique financial challenges and regulatory requirements faced by online retailers is essential for providing tailored solutions.

Track record and business reputation

A CPA’s or firm’s track record and reputation are indicative of its reliability and professionalism. Research the firm’s history, client base, and achievements. Seek testimonials or reviews of business accountants from other ecommerce businesses they have worked with to gauge their level of client satisfaction and success stories.

Range of services offered by a company or CPA

Evaluate the breadth of services offered by the accountant or accounting firm. Beyond standard bookkeeping and tax services, consider additional offerings that align with your ecommerce needs. Specialized services such as inventory management, sales tax compliance, financial analysis, and cash flow forecasting can provide significant value to your business.

Technology and software utilization

Efficient ecommerce accounting relies on technology integration and automation. Assess accountants’ or accounting firms’ usage of accounting software, cloud-based systems, and apps that integrate with your ecommerce platform. A CPA or firm that uses technology can streamline financial processes, improve accuracy, and enhance data accessibility.

Client reviews of the business accountant or accounting firm and testimonials

Client reviews and testimonials offer valuable insights into the accountant’s or firm’s performance and client satisfaction. Look for feedback on their communication, responsiveness, accuracy, and problem-solving abilities. Positive client experiences indicate a reliable and trustworthy accounting partner.

Cost and pricing models

Understand the firm’s pricing structure and how it aligns with your budget and business requirements. Some firms may offer fixed monthly fees, while other business accountants may charge based on transaction volumes or specific services. Ensure transparency in pricing and inquire about any additional fees that may apply.

Consider each criterion holistically when evaluating accountants and accounting firms for your ecommerce business. The right one should have a solid understanding of the ecommerce industry, a reputable track record, a diverse range of services, embrace technology, receive positive client feedback, and provide cost-effective solutions. By making an informed decision, you can forge a productive and long-lasting partnership with an accounting firm that propels your ecommerce business to success.

Best ecommerce accounting firms

Here at Synder, we’re well aware of how difficult it can be to choose the right accounting firm to entrust your finances to out of an enormous pool of companies that offer their services on the market. And Synder can also help deal with this challenging task. We’ve done tremendous work to compile a list of the best accounting firms for ecommerce businesses. Here are a few prominent examples.

Totally Booked

NYC based accounting Totally Booked offers expert bookkeeping services. They are QuickBooks Online Certified ProAdvisors and see their mission as to help you increase your bottom line. The team of Totally Booked specializes in ecommerce, working for you to streamline and create efficient accounting processes. Their range of services includes QuickBooks setup and training, as well as QuickBooks clean-up and catch-up.

Decimal

With Decimal, an accounting firm from Delaware, you can experience a more efficient approach to bookkeeping. Entrusting your financial tasks to their experts allows you to focus on managing and growing your company.

Decimal revolutionizes the Accounts Payable (AP) process and simplifies Bill Pay through automation. Leave the behind-the-scenes work to this accounting firm and free yourself up to concentrate solely on approvals and other crucial aspects of your business.

HireEffect LLC

HireEffect LLC, Texas, USA, offers a comprehensive range of outsourced advisory services, including business bookkeeping, payroll, human resources, recruiting, technology and business advisory services. Through the integration of cloud-based technology, the company enables business owners to step away from the back-office tasks and focus on engaging with their customers directly.

Tips for ecommerce businesses when choosing an accounting firm

Identifying specific needs and requirements

Begin by thoroughly assessing your ecommerce business’s specific accounting needs and requirements. Consider the volume of transactions, the complexity of your financial operations, and any unique challenges related to your industry. Understanding your needs will help you find an accountant or accounting firm that can cater to your business’s unique demands effectively.

Conducting due diligence and research

Take the time to conduct in-depth research on potential accountants or accounting firms. Look for an accountant or firm with a solid track record of serving ecommerce businesses. Take your time to study client reviews and testimonials to evaluate their reputation and client satisfaction. Verify their credentials and check if they have experience dealing with businesses similar to yours.

Evaluating the firm’s technology and security practices

In today’s world, technology plays a vital role in accounting. Ensure that the accountant or accounting firm you choose uses modern accounting software and cloud-based systems that integrate seamlessly with your ecommerce platform. Additionally, prioritize the security measures the firm employs to protect your sensitive financial data and customer information from cyber threats.

Considering long-term scalability

As your ecommerce business grows, so do your accounting needs. Choose an accounting firm that can scale its services to accommodate your business’s expansion. A firm that can adapt to changing requirements and provide guidance as your business expands will be a valuable long-term partner.

Seeking referrals and recommendations

Reach out to fellow ecommerce entrepreneurs or business owners within your network for referrals and recommendations. Personal experiences and word-of-mouth recommendations can provide valuable insights into the capabilities and strengths of different accounting firms. Referrals from trusted sources can help you make more informed decisions.

Referring to BBB

BBB stands for the Better Business Bureau, a non-profit organization promoting transparency and trust in the marketplace. Established in 1912, it serves as a mediator between consumers and businesses, offering voluntary accreditation to companies that adhere to ethical practices.

Among others, the BBB provides detailed business profiles of CPAs and accounting firms based on location. Its reputable ratings system and consumer education efforts make it a valuable resource for fostering fair and trustworthy relationships between customers and accounting firms.

Inquiring about communication and collaboration

Effective communication is essential for a successful partnership with an accountant or accounting firm. Inquire about their communication channels, response times, and how they collaborate with clients. A firm that offers clear, open lines of communication and takes the time to understand your business will ensure a more productive and efficient relationship.

Understanding pricing and contract terms

Discuss pricing and contract terms with the accounting firms you are considering. Ensure you have a clear understanding of their fee structure and what services are included in their packages. Look for transparent pricing models without hidden fees, and consider the overall value you’ll receive from their services.

By following these tips, you can make a well-informed decision when selecting an accounting firm that aligns with your ecommerce business’s needs and helps you achieve financial success and compliance.

Final words

In conclusion, accountants and accounting firms play a pivotal role in supporting the financial success of ecommerce businesses. The dynamic nature of online retail demands accurate and efficient financial management, which can be achieved through the expertise and services of dedicated accounting professionals. From handling unique ecommerce accounting needs to ensuring tax compliance and providing valuable financial insights, accounting firms offer invaluable support that empowers ecommerce entrepreneurs to make informed decisions and drive growth.

As you embark on the journey of selecting the best accounting firm for your ecommerce business, keep these final tips in mind. Prioritize firms with extensive experience in the ecommerce industry, as they understand the complexities and challenges you face. Conduct thorough research, read reviews, and seek recommendations to gain valuable insights into each firm’s reputation and client satisfaction. Pay attention to their technology integration, security measures, and long-term scalability to ensure they can meet your evolving needs as your business grows.

Overall, as an ecommerce entrepreneur, the significance of sound financial management can’t be overstated. By partnering with the right accounting firm, you can offload the burden of financial tasks and focus your energy on strategic decision-making and business expansion.

The other week, my mom told me she wants to start delegating tasks before she goes insane with all of her work. She’d really benefit from hiring an accountant because she’s made a few financial mistakes in the past months. That’s why I’m positive that she’ll be grateful for your insight on reviewing an accountant’s contract and pricing before hiring one.