Whether you run an ecommerce or a brick-and-mortar store, a chain or an independent business, you need to understand the financial transactions taking place. That’s why you need a system for payment analytics. Without this data, you’ll struggle to make informed decisions and grow your business.

These analytics, in fact, provide valuable context to the flow of transactions keeping you afloat. You can observe trends in your customer base, like their geographical distribution, or slow points in the year. You can even identify the flaws holding your sales back, like an overly complicated checkout process causing cart abandonment.

So, here’s our guide on getting the most out of payment analytics for your business.

Contents:

1. What are payment analytics and why do they matter?

2. Different types of payment data

3. How your business can use payment analytics

4. 3 tips for analyzing payment data effectively

What are payment analytics and why do they matter?

Payment analytics are systems you use to gather and analyze data from payments to your business. You might assume that such information might be limited to, say, what was purchased and how much was paid, but that’s not the full picture.

Let’s say, for example, that you’re collecting analytics on subscription payments for an internet phone service. Even that fairly predictable transaction generates a vast number of data points, such as the most popular subscription packages, the preferred payment methods, and the renewal frequencies.

All these can tell you an awful lot about the state of your business. For an ecommerce business, payment analytics would highlight their most popular items, geographical customer distribution, rates of purchase, and so on. So, you should be starting to see how payment analytics offer valuable context.

Different types of payment data

With so many potential data points for even a simple transaction, it helps to categorize the broad types of information. So, here are the different types of data you’ll be looking at with payment analytics:

- Customer data, like identity, demographics and purchase history.

- Product data, including specs, quantity and review performance.

- Transaction data, such as time, location, and payment methods.

- Payment processing, like fees, declines, and authorization times.

- Financial data, meaning the cash flow of your business, like revenue and overhead.

- Fraud data, concerning any potentially illegal transaction.

Collecting and leveraging all this data effectively can pose significant accounting challenges. But with the right systems in place, you can clear those obstacles and reap the business benefits of payment analytics.

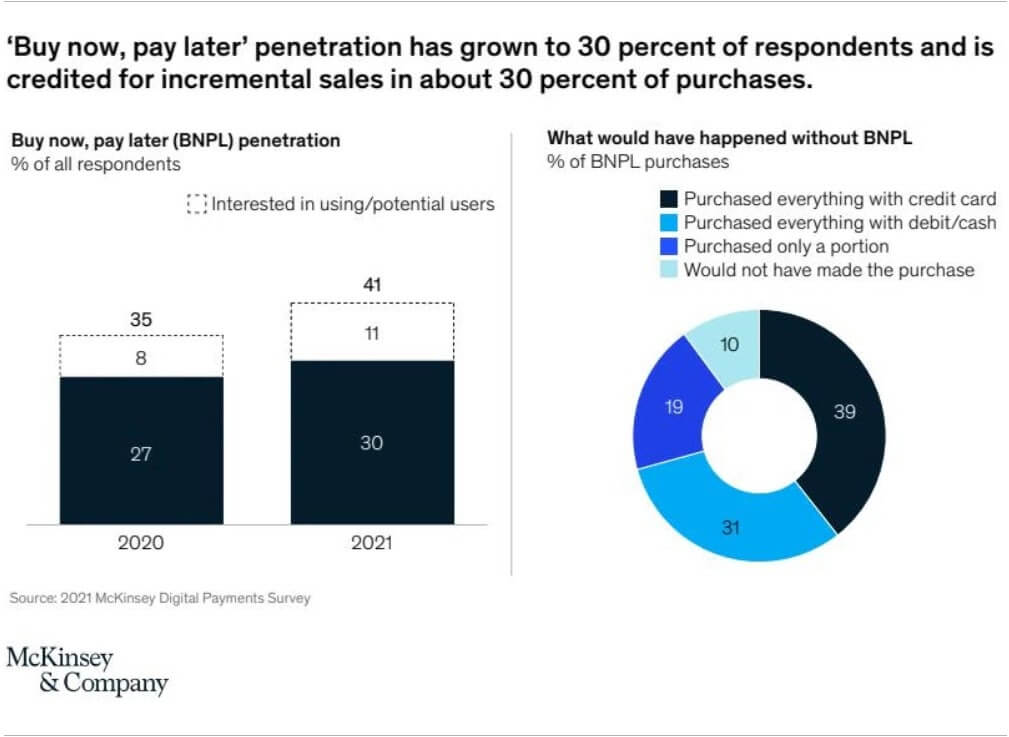

Image sourced from mckinsey.com

How your business can use payment analytics

Now that we’ve established what payment analytics are, let’s go over the various benefits and applications they have for businesses. Knowing how you can apply information from your analysis, in fact, helps establish which data points are essential for your business.

Reducing churn and cart abandonment

If you’ve ever shopped online, the term “cart abandonment” should be pretty self-explanatory. Sometimes, you add things to your cart, then either change your mind or forget about them. It’s important not to overwhelm people with information during the checkout process, as this adds to stress by increasing cognitive load.

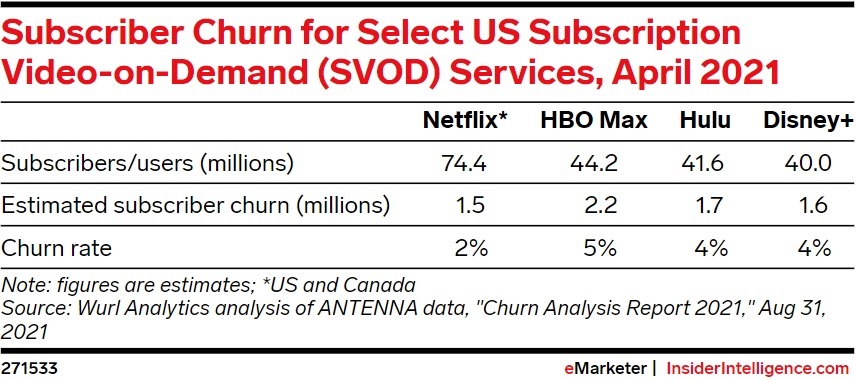

Churn, simply put, is the loss of subscribers for a subscription-based service. People cancel their payment plans for all kinds of reasons, so some degree of churn is inevitable. However, if you notice an unusual spike, it can indicate problems with your retention strategy.

With payment analytics, you can pinpoint whether high rates of churn and cart abandonment happen at particular times of the year or are associated with specific products. In these cases, you might need to do something to incentivize people to stick around, such as special purchase offers for ecommerce, or exclusive content for subscription holders.

Improving infrastructure efficiency

It may seem like a minor point, but understanding payment data can even benefit facility management for your business. For instance, assessing product popularity can help you organize and stock your warehouses more effectively.

Let’s say, there’s a decline in people buying computer monitors, whereas the rates of TV purchases remain consistent. By uncovering this insight through payment analytics, you can adjust stock levels accordingly in pursuit of greater profit. And if some products frequently get matched in the same orders, you can streamline shipping logistics by storing them in the same section.

There are even benefits for office infrastructure. For instance, you might notice your remote marketing team is working equally or more profitably than office-based colleagues. As a result, you could scale back office costs and invest in your remote and hybrid infrastructure.

Image sourced from insiderintelligence.com

Using conversion rates as a health check

Conversion rates show how many of your website’s visitors are actually purchasing products or setting up subscriptions. As such, they don’t tell you a lot about why things are happening but, despite their simplicity, they’re still very useful to your organization.

That’s because a sudden dip in conversion rates is a clear sign something’s wrong. So, keeping track of conversions over time through payment analytics can help you react quickly. Long-term conversion analysis also means you can establish your busiest and quietest points in the year, and refocus your marketing efforts accordingly.

Understanding customers to increase loyalty

Whether you’re running an ecommerce store independently or through ecommerce hubs like Shopify, customer loyalty is everything. So, when your conversions take a hit, what can you do to bring people in and make them want to stick around?

The answer to that depends largely on your customers. Which is why you need to run their data through your payment analytics process. And it’s not just about the items or the subscription features they like. Those things are only the beginning.

Payment analytics can tell you a surprising amount about people. For example, you might notice products with sustainably sourced packaging are selling better than equivalent competitors. This suggests you should have your own sustainable packaging and other green initiatives in place, which boosts customer retention by appealing to their ethical concerns as consumers.

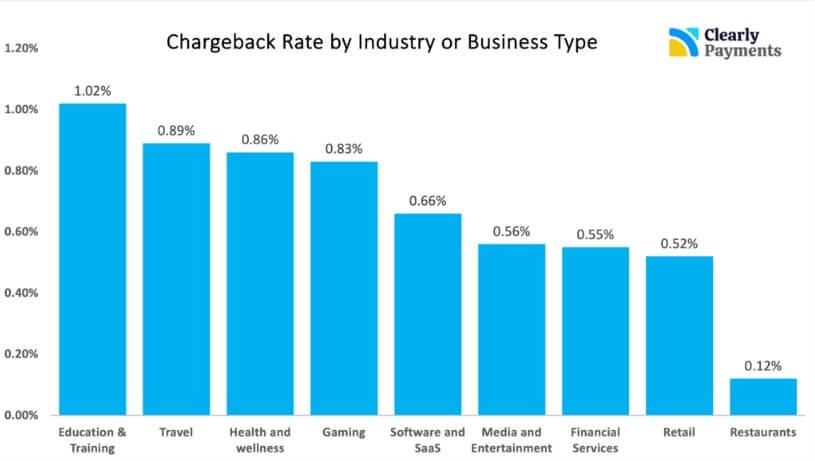

Chargeback rates and fraud detection

As the old adage goes, you can please some of the people some of the time, but not everyone all the time. So, you’ll inevitably encounter customers who aren’t satisfied with their purchase or experience.

Image sourced from clearlypayments.com

Analyzing chargeback rates through payment analytics can expose a number of issues for your business, especially if you request more information from customers seeking refunds. You might uncover, for instance, issues with products or service reliability, or faults with your delivery process, meaning goods arrive damaged or compromised.

Unfortunately, though, not all refund requests are in good faith. Chargeback payment analytics are a key part of fraud detection for your business. Cross-referencing chargeback data with customer purchase histories can help identify suspicious trends. With an established system of rules, you can also flag and block problematic transactions.

3 tips for analyzing payment data effectively

Knowing what information to process and why is great, but you also need to analyze it efficiently, especially if you have large volumes of payment data to process. So, here are three tips for making your payment analytics more effective.

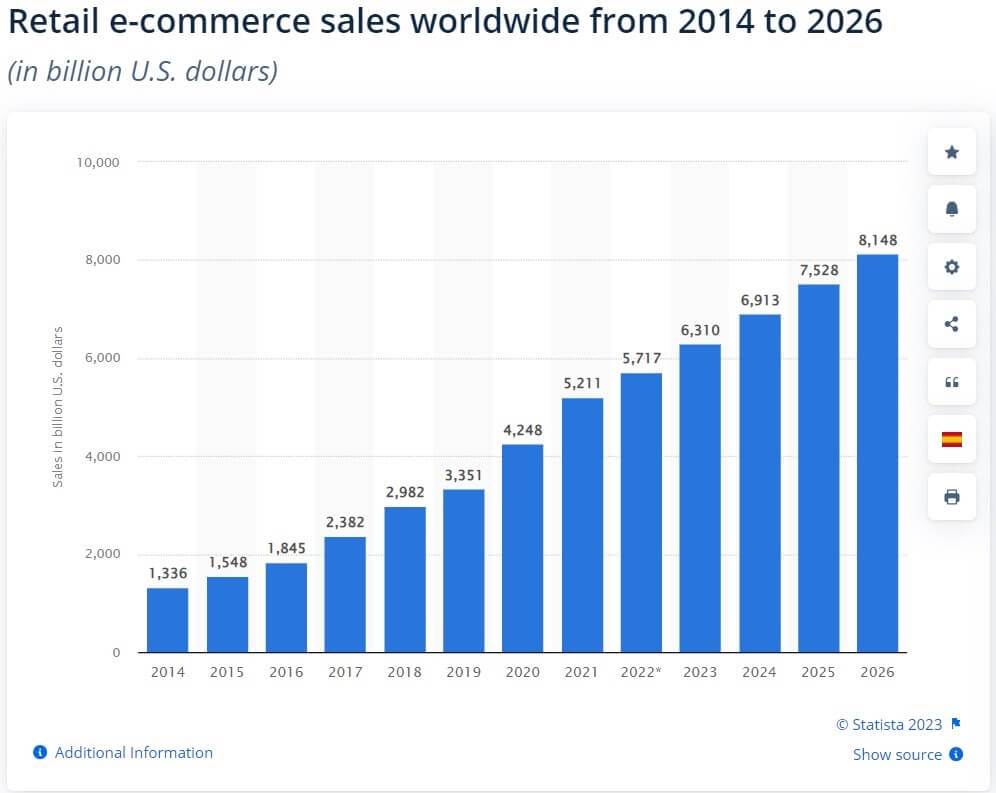

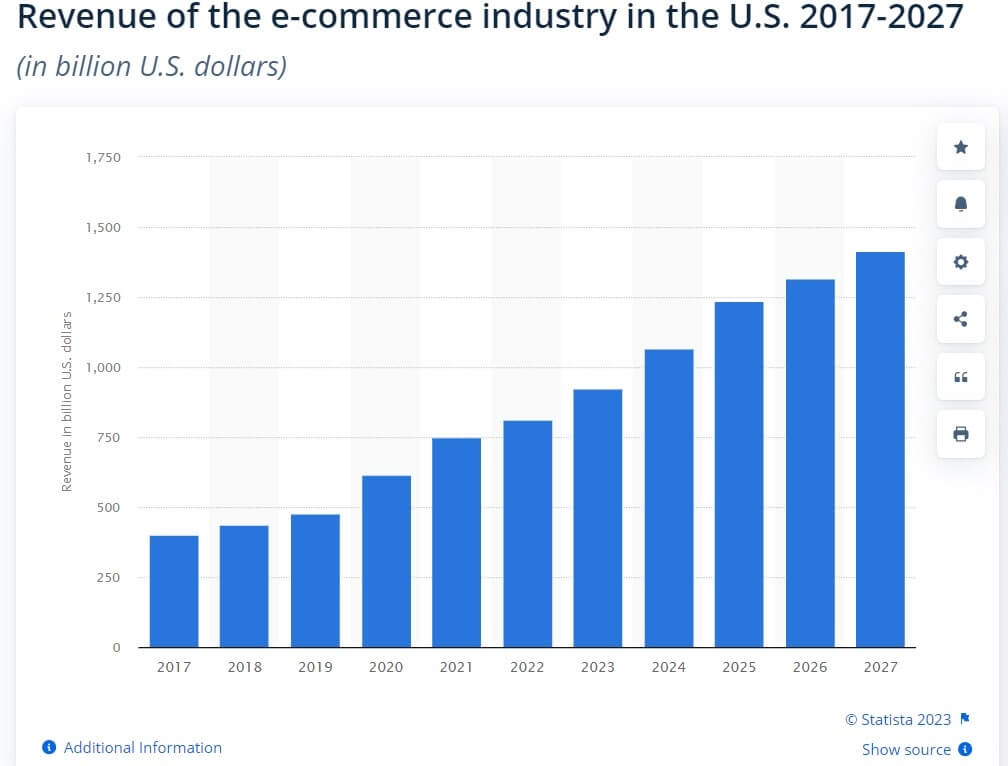

Image sourced from statista.com

1. Centralize your payment data

Payment analytics produce massive quantities of raw data because you’re collecting information from all over your business: invoices, website data, banking interactions, and so on.

Therefore, it’s important to get everything organized and in one place. Of course, you could outsource it to an external data handler, but if you want to be fully in control, you should use a self-service portal in combination with your accounting software.

2. Prioritize the right data for your business

There are almost countless data points stemming from payment analytics. Overall, that’s a good thing, but with a sea of information at your disposal, you need to sift for the most relevant insights.

What these are depend on your goals and the type of business you’re running. For example, if you’re a B2B tech company offering virtual PBX VoIP subscriptions, chances are that you have very different priorities than a consumer-focused subscription model or an ecommerce store.

Let’s compare this B2B company to a meal kit delivery service. Both would prioritize the number of subscribers, but a B2B service would also care about the sizes and sectors of client businesses. By comparison, the meal kit company would be more concerned with things like subscriber churn or the popularity of specific meals.

All payment analytics are potentially useful, but it’s important to find your key data points and move secondary or tertiary points into the background.

3. Set an ongoing report frequency

In theory, you can compile these reports as often as you like. However, the longer you leave it, the more time you’ll waste playing catch-up in the end. Regular payment analysis reports are an important part of long-term strategic financial planning. So, you need to find the cadence that works for your organization.

We recommend implementing monthly payment data reports as an ongoing measure, but it’s also worth engaging in deeper analysis as a quarterly measure. This makes sure you have a moving picture of seasonal trends and changes over time.

Image sourced from statista.com

Bottom line: Payment analytics offer a better view of business success

Payment analytics may have a lot of moving parts. Between the different data points and categories, there’s so much to keep track of. But getting a handle on these things is absolutely worth it.

These analytics don’t just tell you how well you’re doing – you could get that information from conversions, chargebacks, and churn alone. Instead, payment analysis as a whole sheds light on why you’re successful. Or, equally, why you’re struggling.

As a result, you’ll have a deeper, three-dimensional understanding of your organization’s financial performance and your relationship with your customers. In turn, these will allow you to move forward and grow your business with confidence.