Filing taxes might close one financial chapter, but for forward-thinking companies, it initiates another. The weeks and months after you file are sometimes worth much more than you think. It’s a time when the data is most recent, trends can be observed, and strategic changes can be initiated.

TL;DR

- Financial automation platforms like Synder help centralize multi-source data, streamline reconciliation, and maintain accuracy for audits and long-term tax planning.

- Post-filing is a strategic opportunity to analyze fresh financial data, reconcile accounts, lock books, and document learnings for future improvement.

- Refunds should be categorized and analyzed as operational signals to reduce leakage, improve margins, and inform pricing, fulfillment, and forecasting decisions.

- Audit readiness is year-round and requires reconciled data, digital documentation, monthly reviews, and quarterly internal audit checks.

- Filed results should guide future tax strategy by shaping revenue timing, capital planning, refund trend analysis, and tax calendar planning.

Throughout this period, Ledger Labs has assisted numerous ecommerce and SaaS firms to move beyond compliance mode into growth mode. That change is easier, faster, and more precise than ever with accounting automation tools such as Synder.

This is how you can use your after-filing clarity to conduct a smarter, more determined long-term strategy.

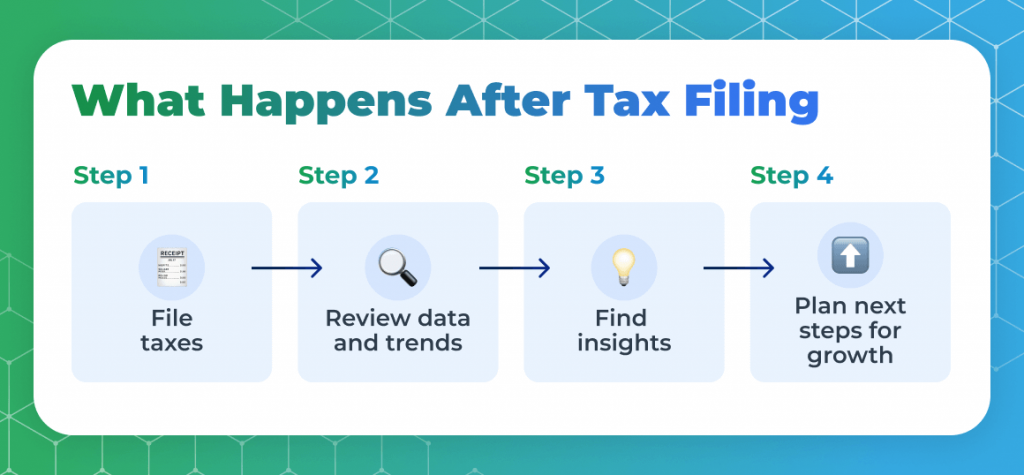

What key steps should organizations take immediately after filing?

As soon as the filing period is over, good accounting should be considered as a component of a powerful overall strategy. The initial measure will be a complete variance review, which involves comparing results that are filed against projections to detect an imbalance in refunds, margins, or deferred revenue. Ledger Labs has assisted numerous customers in employing this process to examine the data regarding operations and reveal the unnoticed inefficiency.

Then close and reconcile all accounts immediately. Lock the books of the year that are being filed to avoid any changes. This is near-instant with automation tools such as Synder, as all transactions on any platform, whether Shopify, Stripe, or PayPal, will be kept up to date within your accounting software.

Finally, document everything, including what worked, what didn’t, and which data caused friction. Design a brief internal post-mortem with the next season improvement objectives. To take one example, we’ve just helped a SaaS firm that found inconsistent refund classification after filing. Long-term efficiency through post-filing clarity transforms compliance into a base through which financial control is sharper, which is one of the most significant services that Ledger Labs offers.

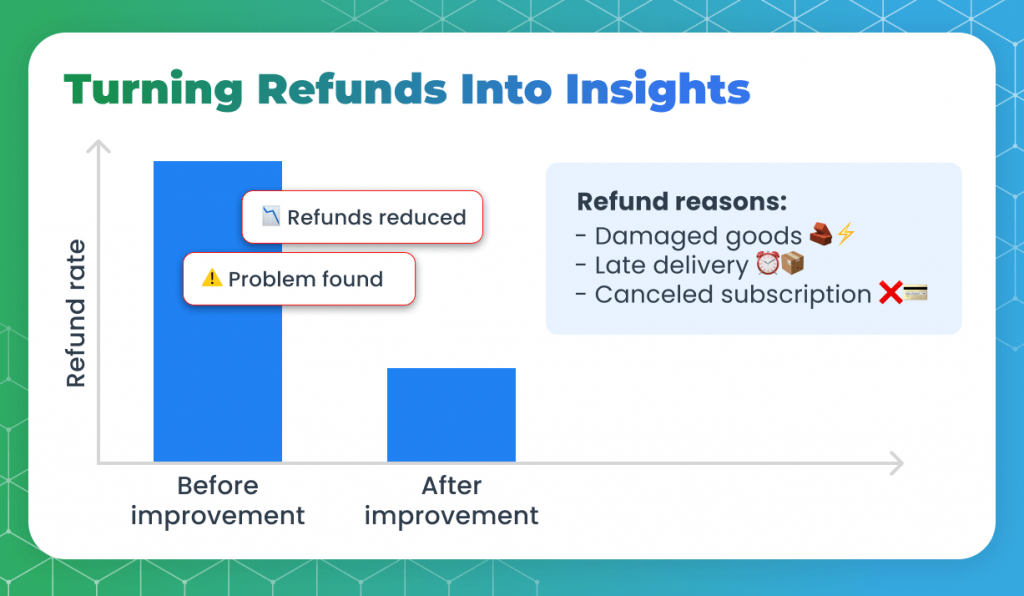

How can refund management be optimized to support broader financial goals?

Refunds can seem like a loss. However, when handled the right way, they can show where the leaks of value are in your business.

It’s all about visibility and classification. A lot of companies monitor refunds as a sum, which conceals the actual problems. Using the automated refund sync with Synder, each return or chargeback may be divided into categories, like damaged goods, shipping delays, or subscription cancellations.

In the case of one ecommerce client, 30 percent of the refunds were on a single SKU. After the problem was put in the limelight, they worked on packaging, and the refund percentage fell by 40 percent in a quarter.

In addition to accounting, strategic planning might be informed by refund data. It influences pricing schemes, fulfillment choices, and channel distribution. When combined with your overall P&L, it indicates that operational changes are increasing true margin, not just revenue.

Lastly, automated methods of recognizing refunds are a big help. Refunds are recorded immediately to the appropriate ledger through Synders’ multi-channel integrations, which ensures no overstating of revenues and gives leaders real-time and accurate views. Refund optimization isn’t the act of avoiding refunds. It is the act of transforming them into actionable intelligence that promotes more predictable and stronger profits.

What best practices help maintain audit readiness year-round?

When accuracy is continuous, audits become less stressful. Audit readiness must be initiated way before an auditor shows up and should be sustained throughout. The basis is validated data. Bank, payment processor, and sales platform reconciliations every month. We assisted a SaaS company in transitioning to a monthly reconciliation cycle based on auto-sync reports provided by Synder, which reduced their annual review period by two-thirds.

Documentation is next. All the adjustments, such as journal entries, refunds, or changes in deferred revenue, should be supported with evidence stored in digital form. Standardize the folder structure and add a summary sheet with variances.

Our other recommendations include doing internal mini-audits every quarter. Look out for irregularities such as spikes in refunds, abnormal fee growth, or gaps in revenue recognition. Fortunately, these red flags can be seen immediately with the Synder RevRec dashboard.

How can post-filing insights inform next year’s tax strategy?

The numbers you file are more than compliance. They’re a blueprint for next year’s strategy. Start by identifying what drove your tax position, including refund volumes, deferred revenue, or expense timing. For example, we worked with a SaaS client who realized subscription downgrades skewed their revenue recognition. Through schedule refinement, they matched the timing of revenues and actual delivery schedules, which minimized taxable differences considerably.

Next, analyze refund and margin trends. Increasing refund rates are rarely just a customer issue. Often, they indicate cash-flow or tax-timing challenges. Use this data to refine capital planning by deciding when to expense, defer, or invest based on projected profitability. Build a tax planning calendar with quarterly reviews to adjust estimates and deductions dynamically. Post-filing insights should never sit idle. They’re your most precise guide for the next twelve months of smarter, data-driven tax decisions.

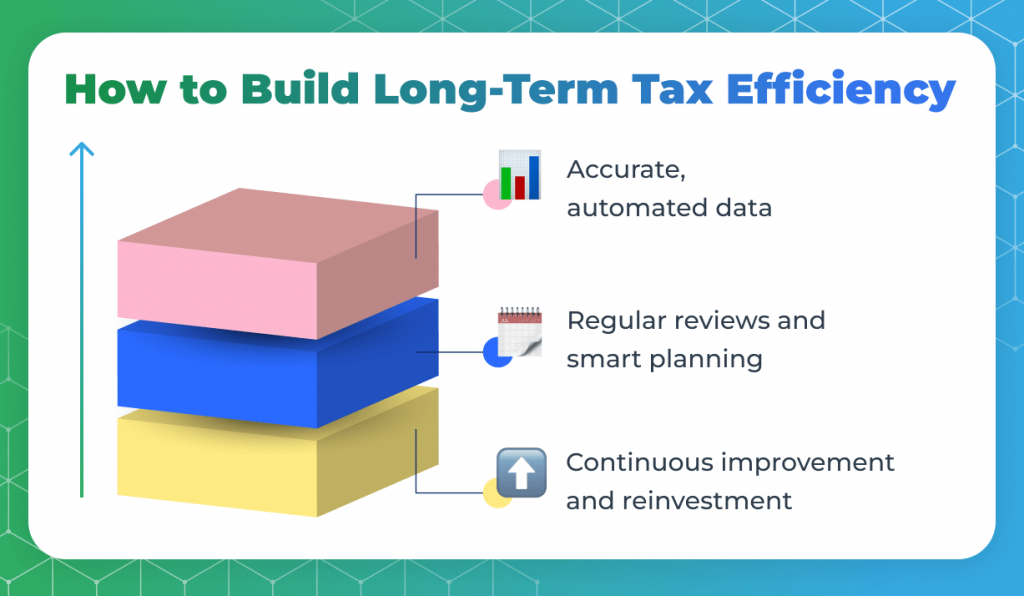

How do long-term planning approaches improve overall tax efficiency?

Long-term tax efficiency results from structure, discipline, and data. Start with automation, ensuring clean, categorized data informs every strategic decision. Next, embed tax strategy into your growth model. For example, we helped an ecommerce brand simulate how reducing refund rates from five percent to three percent would shift taxable income and working capital. The insight led to operational adjustments that freed funds for reinvestment without increasing tax pressure.

Regularly review your entity type, compensation model, and deduction timing. As businesses scale, structures that once worked can become inefficient. We also recommend scheduling semi-annual tax efficiency reviews, not just to find savings but to validate whether operational improvements are producing sustainable advantages. When data and tax planning operate in sync, efficiency becomes a permanent outcome rather than a seasonal win.

Closing thoughts

Post-filing is the point at which clarity peaks. By treating each filing as a feedback loop, organizations can refine systems, enhance visibility, and forecast with confidence. Ledger Labs works with automation-first platforms like Synder because clean data is the backbone of long-term tax efficiency. When accuracy, automation, and insights align, compliance stops being a deadline and becomes a competitive advantage.

To understand more about how Synder can improve your accounting and automate your business, book a call with us.