Are you tired of your clients looking at you as purely a “number cruncher”? Accounting is more than balancing spreadsheets – you’re making a real impact on the success of your client’s businesses. To do that, however, you must leave the confines of numbers to take on the role of the trusted advisor.

During our recent Beyond Numbers: Engaging and Retaining Clients in Accounting webinar, we shared some mind-blowing insights on how to raise your accounting practice to a whole new level. So if you’re ready to strengthen your relationships, seriously add value, and stand out, here are the key takeaways and actionable strategies to get you across the divide.

Featured guest:

Geni Whitehouse, CPA, is an author and founder of The Impactful Advisor, a mission-driven organization to transform accountants into trusted advisors. With over 20 years of experience, she’s known for making accounting engaging and empowering professionals to communicate better, connect deeper and create real impact.

Why the numbers aren’t enough

Here comes the main accounting illusion: if the figures balance, then the job is done.

Quite often, accounting professionals believe that their job is over when financial statements are prepared, bank accounts reconciled, and books closed. For the clients, though, these numbers are only a tip of an iceberg that stands for results of everyday operations.

Too often, clients get lost in the ocean of numbers where they can’t connect the figures back to their actual business goals. This tends to be the reason why accountants are being viewed as a commodity, thus, leading clients to shop based on price alone.

In fact, offering services that are in tune with the long-term objectives of the clients will truly help accountants retain clients, charge full value for the delivered service, by merely connecting the dots between financials and strategic goals.

Advisory services: Helping clients make their dream a reality

It seems that advisory is a buzzword in accounting nowadays, but what does that mean, really?

According to Geni, advisory is “whatever you’re doing to help your clients move the needle forward in the direction of their dreams.” It’s about understanding the client’s “why“—the deeper motivation that gets them into business—and then offering actionable strategies toward those ends.

Making this shift requires the accountant to move from being reactive to being proactive. Generally, an accountant is focused on what’s happened, like the net income or sales figures. However, to be of value is engaging closely with the client, attempting to understand what drives their business, and helping shape their path to success.

“It’s about what we can do to improve the future, not just account for the historical results they’ve achieved,” says Geni.

Shifting from compliance to consulting

What this means is that accountants must redirect conversations with clients in a different way—to be perceived as a little more than just a compliance service. They should ask business goal questions, questions on operations, and long-term vision—things that make them come out as strategic partners.

Geni’s advice:

“Ask a series of questions to understand what your client is trying to do in their business. That’s how you start advisory.”

Today’s clients seek more than mere compliance; they seek partners with knowledge of their businesses to help them grow and sail through challenges. And this need is on the rise now.

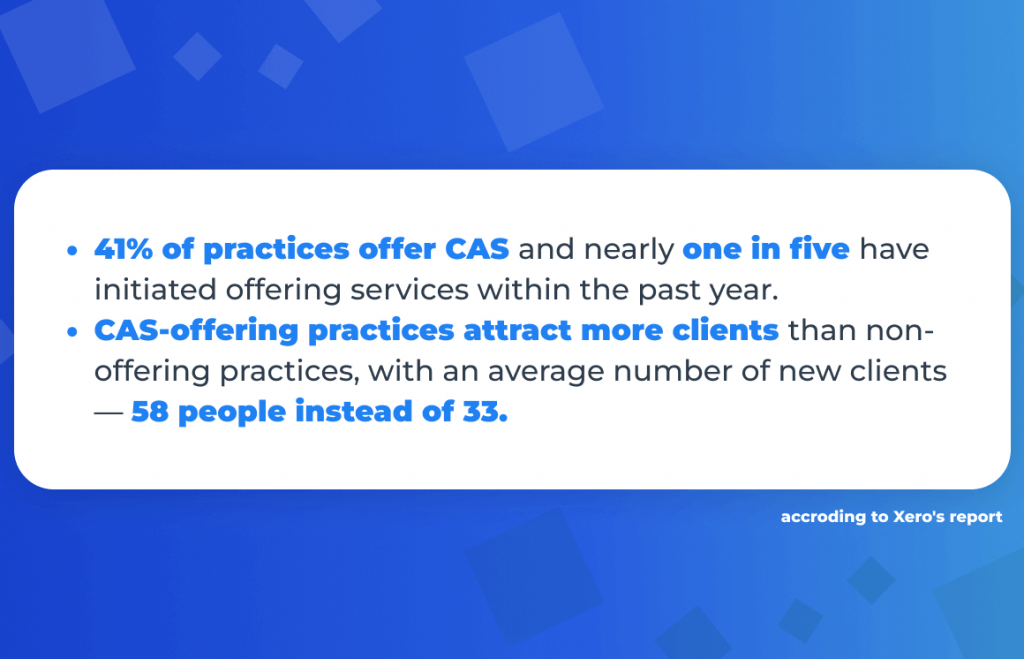

Did you know?

Xero’s report reflects the growing trend in accounting practices that are investing more into CAS—client advisory services.

Eliminating random acts of consulting

In fact, most accountants and bookkeepers already provide what Geni calls “random acts of consulting.” These are ad hoc solutions to client issues, usually made when the client asks for something specific. Although these efforts may be helpful, they’re often scattered and don’t create a consistent approach to offering advisory services.

“Instead of random acts of consulting,” Geni suggests, “we want to give you tools that allow you to do it over and over again across clients, so you really gain confidence and get smarter about the patterns you’re gonna see.”

Engaging the front line: Metrics that drive customer behavior

Another critical component of advisory services is advising on the right metrics that drive the business effectively. While lagging indicators—profits and revenues—show the performance of a business in the past, most of them come too late to enable speedy adjustments or improvements. That’s why tracking leading indicators is important, insists Geni. These metrics provide insight into real-time activities that shape future outcomes and thus enable more proactive decisions.

Key leading indicators include:

- the daily number of customer visits;

- the conversion rate;

- average transaction size.

Tracking how many visitors are coming into the store each day or monitoring how often visitors are converted into paying customers shows the business how well it performs daily. Emphasizing average transaction size points out opportunities to upsell or improve the sales technique.

“If you measure things, it changes behavior. The act of measuring makes people aware and drives change. That’s where you can make a difference.”

Geni Whitehouse, CPA, The Impactful Advisor

Through the use of current activity measures, accountants and owners can identify proper timing for change by modifying marketing strategies, enhancing the customer experience, streamlining operations, and thus driving the growth of the business.

Take wineries for example. They monitor how many bottles each visitor purchases as a leading indicator. Instead of tracking overall revenue, they focus on trying to increase the average bottles sold per visitor by just one more. It’s an easy way to bring the profits up. Train staff to upsell, suggest bundles, or recommend premium bottles, and presto: in one easy, actionable step, the big goal of boosting sales is realized.

Not only does this increase daily sales, but it also demonstrates to the employees how much difference they’re making and helps motivate them to become part of the winery’s success in the long run.

Did you know?

Recent McKinsey research on performance management and leading indicators showcases:

The power of process mapping & tools like Synder

In fact, understanding a business system is very important in determining what should not be done to provide value-added advice. Process mapping, as Geni stressed, captures every step within a business process that could open up areas ripe for automation and improvement. This would enable accountants to smooth out not only the business operation but also allow their clients to have better insights and recommendations.

Using Synder to track KPIs and deliver advisory services

Beyond simplifying reconciliation, Synder empowers accountants to track business KPIs with ease. With seamless integration to more than 30 sales channels and payment gateways such as Shopify, Amazon, Stripe, PayPal, Square, and many others, Synder automatically syncs every transaction into accounting systems: QuickBooks Online, QuickBooks Desktop, Xero, and Sage Intacct. Having this data in real time gives accountants and business owners accurate and up-to-date metrics of sales, expenses, and cash flow all in one place.

“Synder takes all that pain away. I connected my account, and it all flows in the right place. The bank deposit hits, it’s got the fees accounted for, and it sets up a new customer if I want it. It can also just summarize and put in the totals. Everything is done—I don’t have to reconcile anything.”

Geni Whitehouse, CPA, The Impactful Advisor

Financial insights at this level provide accountants with an opportunity to generate more advisory value over and above compliance work. It allows them to find trends in sales, cash flow, and customer buying behavior that will enable clients to make key decisions in identifying opportunities to grow the top line of their business, enhance profitability, and make better decisions based on data. When comparing your offering to the larger firms and chains, clients need to know that you have the tools to keep their data safe. Always use a secure and user friendly service to receive files.

Learn more about how you can boost your accounting practice with Synder during our 15-day free trial or join one of our Weekly Public Demos for a guided tour of the app.

Geni emphasizes Synder’s benefits for accountants and clients alike:

“This is the kind of stuff you can bring to your clients. Synder connects to all the main payment solutions and simplifies the accounting on the backend so that QuickBooks is right every day.”

Wrapping up: Uncovering the gold within

In fact, such a consultative approach helps accountants unlock value hidden within the client’s businesses and assists clients in achieving their goals, positioning themselves as a strategic partner.

What’s the result? Happier clients that are more loyal and willing to pay for the services you provide. If you want to elevate your practice, become an advisor and start adding proactive value to your client’s business. This shift alone will help you free yourself from underbilling and create a massive impact on the success of your clients while building stronger, more meaningful relationships along the way.

So, why not take it to the next level?

Share your thoughts

We’d love to hear from you! What resonated with you most in this article? Share your own insights or experiences in the comments below. Let’s keep the conversation going!

Thanks for the article! These client retention tips will be extremely helpful for my own tax planning UK business.

Thank you, David!