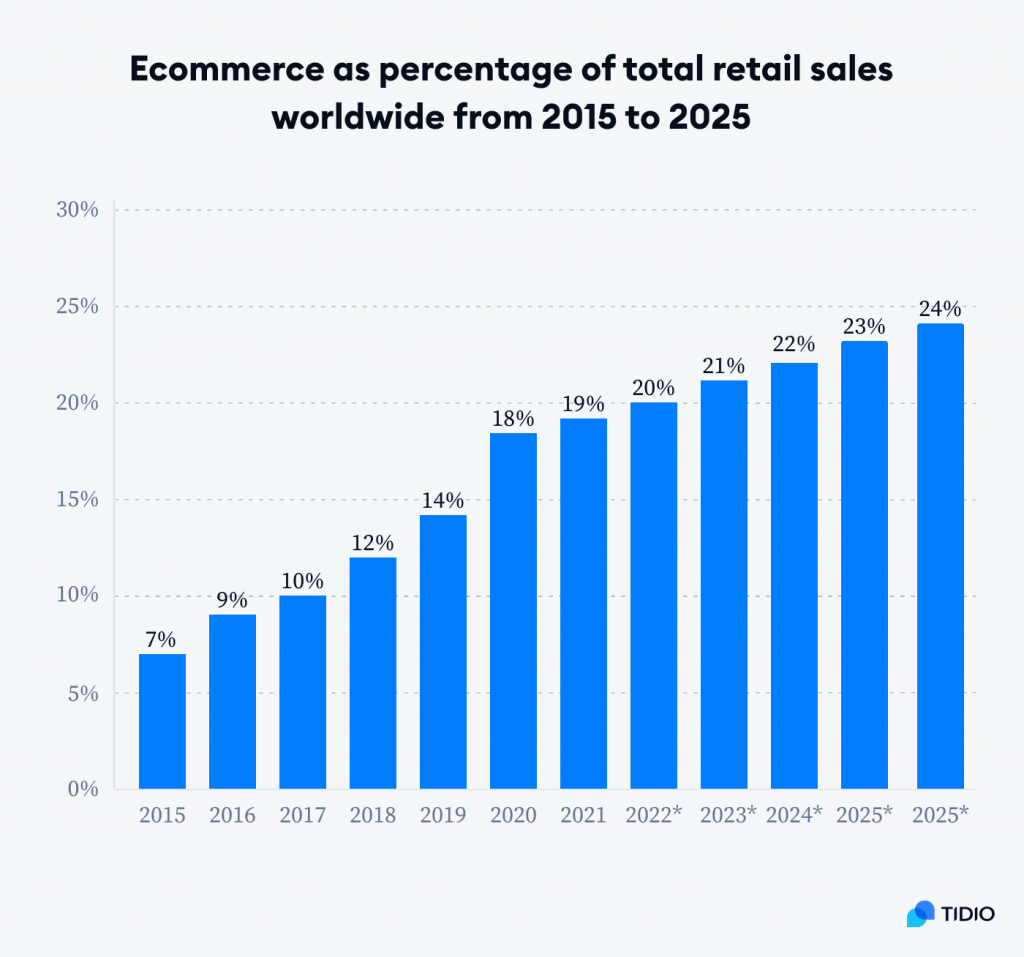

Ecommerce accounts for around 20% of global retail sales. With ecommerce projected to grow, ecommerce fraud is set to become a bigger problem for businesses. Luckily, this problem has solutions.

In this guide, we’ll discuss the various forms of ecommerce fraud, how to recognize it, and what you can do to prevent it.

Image sourced from tidio.com

What is ecommerce fraud?

Ecommerce fraud is when cybercriminals or fraudsters utilize illegal or immoral methods to negatively impact your ecommerce business.

Ecommerce fraud can result in financial loss, data breaches, loss of customer trust, or even legal repercussions.

Types of ecommerce fraud and how to prevent them

There are various ways ecommerce fraudsters operate. This ranges from cyber criminal enterprises to unscrupulous customers looking for a freebie.

So let’s get into it.

Payment fraud

Free to use image from Pixabay

What is it?

Payment fraud is when a purchase is made on your website using stolen banking information.

Payment fraud happens when criminals gain access to people’s credit or debit cards and commit card fraud. This could be a result of hacks, data breaches, or purchasing stolen information from the web.

This causes problems for your ecommerce store. The genuine account holder can file the fraudulent activity with their bank and get their money back. This means your store has lost products and money.

How can you prevent it?

Learn to recognize the signs of payment fraud:

- Card testing–fraudsters make multiple small purchases over a short time period to assess if a card still works and what its limits are.

- Customers using multiple cards–while most people use a few different bank accounts, scammers will often use a lot of different accounts over a short time period.

- High-ticket item purchases–not suspicious in theory, but it’s a good idea to have extra protections on expensive purchases.

- IP address discrepancies–this can be one buyer using multiple IP addresses in different areas, IP addresses not matching billing or shipping addresses, or IP addresses that are flagged as high risk on IP quality assessment sites.

- Repeated declined purchases–the criminal might lack access to certain sensitive information that proves the account holder’s identity. For example, card verification numbers.

It’s important to have systems in place that can detect suspicious activity. Many ecommerce platforms have built-in detection tools, bank verification, and multi-factor authentication, which also play a critical role in account takeover prevention by stopping unauthorized access before fraud escalates.

Also, protect your business transactions and communications. Utilize tools like antiviruses, firewalls, and end-to-end encryption and verified payment portals to bolster security. Your methods for contacting customers should be equally secure so that no sensitive information is leaked. For example, you might switch from landline phones to VoIP telephony to boost security.

If you suspect ecommerce fraud, block the IP address, billing/shipping address, or bank account associated with the fraudulent purchase. Be sure to report suspicious activity to the relevant authorities.

Refund fraud

What is it?

Refund fraud is when customers ask for frivolous or dishonest refunds. They might falsely claim that an item:

- hasn’t been delivered.

- isn’t as described.

- doesn’t work/arrived broken.

These customers bank on ecommerce stores not having the resources to deal with every claim. Investigations take time, and returns hike up your business’ shipping costs. Scammy customers might even return a different, cheaper item and keep their purchase.

Many ecommerce stores will simply approve a refund to resolve it quickly.

How can you prevent it?

Define your refund policy up-front so that customers are entering an informed agreement when they make a purchase.

Policies ensure that everyone knows and agrees to the rules of your ecommerce store. They’re also a helpful backup should a dispute arise.

Further prevention methods include:

- Asking for photo or video proof of broken items.

- Contacting couriers to investigate claims of customers not receiving purchases.

- Blocking customers with frequent, repeated refund requests.

- Asking the customer to return the item to check it yourself.

Always investigate refund requests to the extent your resources allow you.

Triangulation fraud

What is it?

Triangulation fraud involves multiple steps and parties.

Step 1: A scammer opens an ecommerce store selling hot items for low prices.

Step 2: A buyer purchases an item, inputting their bank details.

Step 3: The scammer purchases the item from a legitimate seller with a stolen card and ships the item to the buyer.

Step 4: The buyer receives the item and suspects nothing.

Step 5: The victim of the stolen card loses money and files the fraud with their bank or credit card company.

Result:

- The buyer’s bank account details are in the hands of a scammer.

- The victim of the stolen card either loses money or has to get a refund from the legitimate seller.

- The legitimate seller might lose money through the refund.

How can you prevent it?

As an ecommerce seller, you can do little to prevent this kind of fraud. You can, however, learn to recognize the signs of a fraudulent seller and report them.

By staying in contact with customers, you can educate them about triangulation fraud. You might use social media, email newsletters, or on your website. For example, when designing your Shopify storefront, you could add a ‘stopping fraud’ page.

Triangulation fraud often presents offers that are “too good to be true”, like high-ticket items for absurdly low prices. The websites these fraudsters use are often newly built with odd URLs and no HTTPS certification.

Chargeback fraud

Free to use image from Unsplash

What is it?

Also known as “friendly fraud”, chargeback fraud is when customers purchase an item and then file a chargeback with their credit card company.

The customer falsely claims that they didn’t receive the item, the item wasn’t as described, or that they didn’t make the purchase at all. Their credit card company refunds the money from your business to the customer’s account, charging you a fee in the process.

A lot of chargebacks can get your ecommerce business flagged by credit card providers as high risk.

How can you prevent it?

Friendly fraud is difficult to prevent–you have little control over someone’s relationship with their credit card company.

You can, however, prepare yourself. Keep a paper trail as proof for disputes with credit card companies. Have records of transactions, secure communications, pictures, proof of delivery, and any other evidence you can find to argue your case.

Preventing ecommerce fraud: Conclusion

Ecommerce fraud can cost your business time, money, and customer trust.

When trying to build a successful ecommerce business, it’s important to have strong return policies, fraud detection methods, and an action plan should fraud occur.

Knowledge is power. Use this guide to help you recognize the signs of ecommerce fraud and take steps to prevent it in the future.

Hello, Volha! I want to thank you for this article. I haven’t read something so useful for a long time. I think it is very important to cover such topics and, in principle, talk about it. In the business world, it is very important to have everything under control. And I am very sorry that scammers exist – it’s so terrible and low.. I don’t know what such people are guided by, but certainly not by adequate moral principles and views of the world. It’s frustrating. But that’s the way our world is. Thank you again, I think this is very useful for many businessmen.

Hi Tony! Appreciate your comment. As an author, I’m super content you find the article useful. And I absolutely share your opinion about scammers – they are disgusting. But they are a part of any business’s reality. And I believe business people have to be aware of scammer tactics to recognize if any are being used against them and act accordingly. I see it as the only possible way to prevent being scammed (or at least minimize the risk).