The bank reconciliation process is a key step in financial accounting and bank reconciliation problems can be a real headache for businesses. When figures don’t align, it raises serious concerns. But what exactly happens if a bank reconciliation doesn’t balance? Let’s dive into the consequences and the impact it can have on a business.

Key takeaways:

- Bank reconciliation is about making sure your financial records and the bank statement line up.

- It’s best to perform regular bank reconciliations at the end of each month, though you might need to check more often if you have lots of transactions.

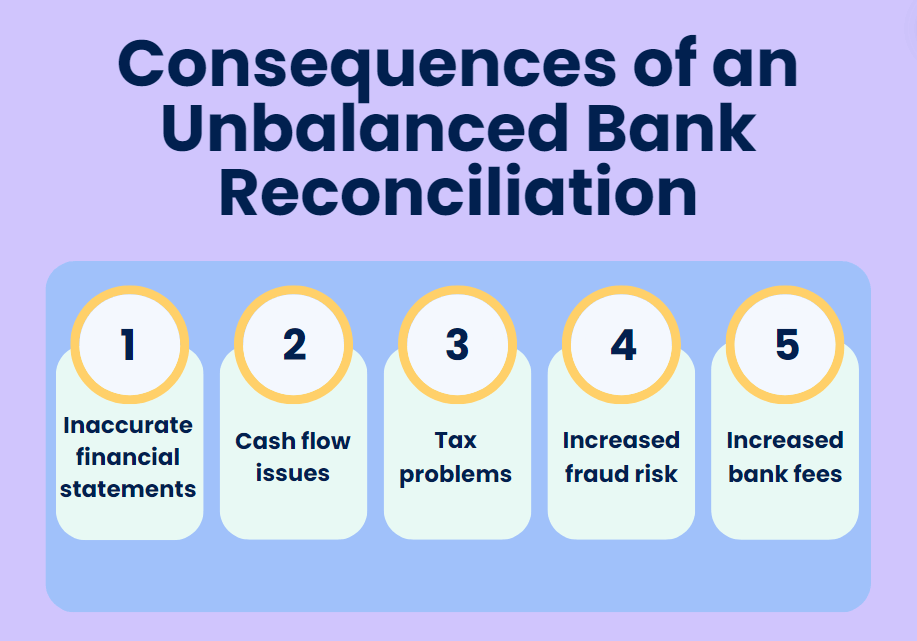

- When your bank reconciliation statement doesn’t balance, it messes up your financial statements, creates cash flow headaches, leads to tax issues, and opens the door to fraud detection issues.

- Unbalanced bank reconciliation statements can erode stakeholders’ trust, cause audit troubles, and disrupt your day-to-day operations.

Contents:

1. What is bank reconciliation?

2. Consequences of an unbalanced bank reconciliation

3. Reasons for bank reconciliation discrepancies

4. Why you should try automation

What is bank reconciliation?

Before diving deep into the problems, it’s important to understand the bank reconciliation process. Put simply, bank reconciliation is a way of making sure everything lines up between your bank statement balance and your own accounting records.

A quick rundown of the bank reconciliation process

First off, a bank reconciliation is simply making sure your company’s cash account matches the bank’s records. Imagine you have two lists – one from your bank (the bank statement) and one from your own financial accounting system. Your job is to go through each list and make sure every transaction on one list matches up with a transaction on the other. In other words, you need to find out if a payment, deposit, or withdrawal in one place shows up in the other.

If you find any differences, you need to dig deeper. Maybe there are bank fees you forgot to record, or there might have been a recording error.

After finding the discrepancies, your next step is to adjust your financial records accordingly. This means adding in missing transactions or correcting any errors.

Want to know what happens if your reconciliation doesn’t balance?

Consequences of an unbalanced bank reconciliation

When your bank reconciliation statement doesn’t balance, it’s a red flag waving in your face. It means there’s a mismatch between your bank statement balance and your internal records, and ignoring it is like sticking your head in the sand. Failing to balance your bank reconciliation can set off a chain reaction of problems that can affect various aspects of your financial health.

#1. Inaccurate financial statements

One of the most immediate consequences of poor bank reconciliation, especially payout reconciliation, is inaccurate financial statements. This is bad news for any business. Accurate financial reporting depends on having correct figures, and if your bank reconciliation is off, so is your entire financial picture.

#2. Cash flow issues

When it comes to cash, discrepancies can lead to either a false sense of security or unwarranted panic. Imagine thinking you have more cash on hand than you actually do – you might spend money you don’t have, leading to overdraft fees and bounced checks. On the flip side, underestimating your cash balance might result in unnecessary cuts or missed investment opportunities.

#3. Tax problems

Unbalanced reconciliation statements can also cause tax headaches. Inaccurate financial records can lead to errors in your tax filings, which can result in penalties and fines from the tax authorities. Moreover, if your business is ever audited, unbalanced reconciliation, or when no journal entry for reconciliation discrepancy has been made, can raise red flags, making the tax audit process more complicated and stressful.

#4. Increased fraud risk

Poor bank reconciliation can open the door to fraud detection issues. When accounting records aren’t accurate, it’s easier for fraudulent transactions to slip through the cracks. Regular bank reconciliations can help detect unauthorized transactions and reduce the risk of fraud.

#5. Increased bank fees

Unbalanced bank reconciliations can lead to unintended bank fees. If you miss payments or bounce checks due to discrepancies, banks can charge hefty fees. Over time, these fees add up, eating into your profit margins and impacting your overall financial stability.

Reasons for bank reconciliation discrepancies

Now we’ll take a look at the most common issues that pop up during reconciliation and how you can handle them to keep your financial records in perfect shape.

#1. Unmatched payouts

One such problem is unmatched payouts in bank feeds. This happens if a payout was recorded in the wrong account or the transaction might already be matched or reconciled with another one. Also, transactions older than 180 days might need a manual process to fix because automated systems often archive older data, making it harder to match these transactions automatically.

#2. Clearing account discrepancies

Clearing accounts can be a real headache. If your checking account balances but the clearing account shows a big negative balance, it means not all sales transactions were synced. Check if all sales were imported and synced for that period. On the other hand, a big positive balance suggests that you might have been adding transactions in bank feeds without syncing payouts, causing income to pile up in the clearing account. To fix this, you can create a big balancing expense to zero out the clearing account balance instead of manually rematching everything and ensure future payouts are synced properly.

#3. Duplicate transactions

Duplicate transactions can cause significant problems. This often happens when you click “Add” in the bank feeds, creating a deposit in your accounting company, and then syncing the same transaction through a data sync app. To sort this out, delete the extra deposits in your accounting company, match them with the tool’s expenses, and stop clicking “Add”. If you have multiple automation apps doing the same job, turn off the extras and clean up the duplicates. If your bank rules and the automation tool both add deposits, disable the rules and clear out the duplicates.

#4. False discrepancies

Sometimes, the problem isn’t with the transactions but with the reports being used. You might accidentally compare net income reports taken from your accounting platform with gross income reports from the payment processor, leading to false discrepancies. Make sure you’re looking at the right report to avoid these issues.

If you want to steer clear of these issues, you should try an automation tool. Let’s break down why it’s worth doing for your bank reconciliation needs.

Why you should try automation

Using an automation app can transform how you handle your account reconciliation. Instead of manually syncing data from various channels, these apps bring everything together in one place. Imagine pulling data from your bank statements, payment processors, and accounting records into a single dashboard.

Automation apps not only sync your data but also categorize it into the correct income accounts. This means you don’t have to sift through piles of receipts or dig through old bank statements to figure out where the money’s coming from or going.

One such powerful automation tool is Synder. It logs your sales, fees, expenses, and refunds into a clearing account and then transfers the right amounts to your checking account. When you get a bank statement, your accounting company suggests matches based on these transfers, and all you need to do is click “Match.” This way, your books are always in sync without you breaking a sweat.

What else can Synder do for you?

- Synder is syncing your bank statement balance with your financial records in real time.

- It takes care of assigning transactions to the right income accounts and expense categories.

- Synder keeps track of your tax deductions and ensures that everything is recorded accurately.

- The app can generate detailed financial statements in just a few clicks. Whether you need a balance sheet, income statement, or cash flow report, they’re all available.

- Synder also helps you catch errors before they become big problems. If there are discrepancies between your bank statement balance and your internal records, the app will flag them.

Wrapping up

To wrap things up, an unbalanced bank reconciliation statement isn’t just a minor hiccup—it’s a serious issue that needs addressing asap. If you let these discrepancies slide, you’re opening the door to a slew of problems, from cash flow complications to tax troubles and even fraud detection risks. In the long haul, it can erode stakeholder trust and stir up trouble during audits. If you want to maintain your business’s financials healthy, stay on top of your bank reconciliations, keep a sharp eye out for discrepancies and tackle them head-on.

Share your thoughts

What’s your experience with bank reconciliation? Have you faced any reconciliation issues balancing your accounts? Let us know how you tackled the issues or any tips you might have for others dealing with reconciliation problems.

Thanks for the article! It was eye opening to learn about unbalanced reconciliation and will help in better management of my professional UK accountants business.

You’re most welcome, David!