When starting any business, there are some choices to consider to help this business grow and prosper. One of the most important choices is related to accounting. Are you planning to hire an accounting professional, do it all on your own, install accounting software? The decision is yours. Different types of business models have their peculiarities in accounting and it’s best to know it all at the very start.

There’s no doubt that accounting for a dropshipping business can be done with a spreadsheet or a pen and paper. What has to be considered here is whether this choice is beneficial. There are many high-quality accounting software options that will cater to the needs of all types of businesses and save their users from wasting time, money and effort trying to streamline their financial processes and manage their businesses. Relying on accounting professionals who have the expertise and skills seems wise too if you are going to concentrate on scaling your business. Good accounting software, aside from its main function, may provide you with valuable business insights that are vital to keep it going successfully.

In this article, we’re going to take a look at the following points:

2. Benefits of accounting software for a dropshipping business

3. How to choose the best accounting software for your dropshipping business?

- Types of accounting software

- Features provided by accounting software

- The price of accounting software for small businesses

4. Best accounting software for dropshipping: top 5

5. Synder as a bridge to your e-commerce accounting software

What is dropshipping?

All starting e-commerce entrepreneurs face a very hard choice that generally comes down to three questions:

1) What to sell?

2) Where to sell?

3) How to sell?

Despite the fact that the “what to sell” question takes the first place, the answer to it actually comes out of questions 2 and 3. The issue of choosing an e-commerce platform is closely connected to defining a business model you are going to use. This choice may set some limitations on the products you decide to sell. It’s hard to compare selling your handmade items on Etsy and dropshipping a number of different items that are produced inside or outside the country on Amazon, eBay, Shopify and other platforms. As we are talking about the best accounting software for dropshipping, let’s quickly recap how it functions.

Dropshipping is a popular business model also defined as a form of retail business, in which the seller transfers customers’ orders directly to the dropshipper who fulfills the order and ships it to the customer. This essentially means that you are running an online store without stock. Your responsibilities as the seller are marketing and selling the product at your online store, while the dropshipper (whether a manufacturer or wholesaler) takes the responsibility for creating, procuring and shipping the product to the customer.

The dropshipping model can be represented as a sequence of steps, which may vary a bit from platform to platform:

1. The Seller signs an agreement with the dropshipper and sets up their online store.

2. The Customer orders online.

3. The Seller receives the order.

4. The Customer receives an order confirmation.

5. The Seller forwards the order to the dropshipper who charges the seller a price for the product sold, normally wholesale plus a dropshipping fee.

6.The dropshipper packages the goods and ships them directly to the customer.

7. The Customer receives their product.

When you choose the dropshipping model for your e-commerce store, the second step would be determining which e-commerce platforms support dropshipping and whether you’re going to have more than one store on different platforms. Starting a dropshipping business may seem super simple, but there are some things to think over.

Benefits of accounting software for a dropshipping business

According to Forbes Advisor, the most obvious benefits of using accounting software are the following:

- Saving time. Automation of accounting software allows saving time on repeated and time-consuming tasks like creating journal entries and reconciling statements.

- Compliance. Many accounting software programs have features that will make your business compliant in terms of tax preparation and reporting.

- Integration. Good accounting software programs provide multiple integrations with other business applications, such as marketplaces, payment platforms, CRMs.

- Mistake reduction. Accounting software helps to reduce mistakes by automating repetitive tasks and providing real-time insights.

- Round-the-clock access. Cloud-based accounting software provides the necessary freedom in terms of time and place of access, which is absolutely necessary when you travel for example.

- Affordability: Prices for accounting software vary and there are some free options too, so it can fit any budget.

There are some more important benefits to add, according to business.com:

- Accurate control of your finances. Accounting software allows you to keep all your financial data in one place, which enables you to see the performance of your business in real time.

- Tracking expenses. Automation of expense tracking helps prevent cash flow shortage and make the necessary adjustments timely.

- Reporting and analysis. A lot of accounting software offers some analytical functions or reporting, which gives you valuable insights into your business processes.

How to choose the best accounting software for your dropshipping business?

If the benefits of accounting software for a dropshipping business are quite tangible and clear, choosing this very software is quite a task. The things you have to consider to make the right choice for your business actually boil down to the following points:

- Type of accounting software;

- Features provided by accounting software;

- The price of accounting software.

Type of accounting software

The first consideration is about the type of accounting software that will better cater to your business. According to Forbes Advisor, there are at least 8 different types of accounting software, but it seems wise to narrow it down to those that might meet the needs of a dropshipping business.

Two types are identified based on how you can access the software:

- Cloud-based accounting software: This software is hosted on the vendor’s servers and can be accessed via the internet. It’s more affordable than on-premises software and offers anytime, anywhere access.

- On-premises accounting software: On-premises software is installed on your company’s own servers. Hence, it’s more expensive than cloud-based software and can be more difficult to set up and maintain.

Two more types are identified based on the audience they are designed for:

- Commercial accounting software: It’s designed for businesses of all sizes.

- Small business accounting software: This type of software is designed to meet simple accounting needs of a small business. It might as well be less expensive than other types of software and offer fewer features.

One more type of accounting software is designed with a specific aim:

- ERP accounting software: This type of software is made to integrate with other business applications, such as CRM and e-commerce platforms. This software might be more expensive and difficult to set up and use.

These types overlap and an accounting solution might be ERP commercial and cloud-based.

Features provided by accounting software

Modern accounting software has a lot of features and the main thing here is to pick the ones necessary for your dropshipping business.

You may not need payroll, project management or inventory management in their general understanding, so there’s no need to pay extra for these functions. It is quite obvious that accounting software should be secure and user-friendly for any type of business, so we are not talking about that in detail.

These are the basic features of accounting software you are looking for when dropshipping:

- Accounting.

Basic accounting features like creating and managing invoices, tracking expenses and revenues, and preparing financial statements are the core of accounting for a dropshipping business.

- Billing and invoicing.

This feature helps to streamline the process of issuing invoices, keeping tabs on payments and organizing customer information. Dropshipping business is known for the higher volume of invoices. As you don’t keep your own inventory, you’re invoiced by your supplier for every sales order that’s made.

- Reporting.

Generating financial reports, tracking business performance and creating custom reports are necessary for any business model.

- Customer relationship management (CRM).

CRM provides features like tracking customer contact information, managing customer interactions and tracking sales opportunities. Working with clients is one of the pillars for a dropshipping business. Customer service is super important and hard due to the lack of control over inventory and order fulfillment.

- Sales Tax Calculation.

One of the key moments for any e-commerce business accounting is sales tax compliance. A dropshipping business selling around the globe has to take it seriously. Lots of accounting programs calculate sales tax, but often you have to enter the data and file the taxes manually.

- Ability to integrate

Accounting software requires manual data entry, which is time- consuming and might be prone to error. Accounting integration with payment processors, e-commerce platforms and other business applications is a viable solution to this problem.

The price of accounting software for small businesses

According to investopedia.com, prices of accounting software for small businesses range from $0 to $150 or more per month. Basic plan prices range from $0 to $40 per month.

The main idea here is that your accounting software should be affordable for you now, but also give you room to grow in the future. In other words, it should be scalable, which means you won’t have to worry about switching to a different provider as you grow.

Best accounting software for dropshipping: top 5

Having studied the ratings for the best accounting software for small business on such reliable sources as forbes.com, ecommerceceo.com, nerdwallet.com, we chose the ones that are mentioned in all or at least three of these sources. So the top 5 looks this way:

Quickbooks Online

Quickbooks has a long-standing reputation of a reliable accounting solution and the standard in accounting, used by the majority of small business accounting professionals. A huge benefit here is that there are also endless online training resources and forums to get support when needed. Quickbooks has integrated with all kinds of tools to better cater to your e-commerce store.

The prices for the plans are: Simple Start ($30 per month), Essentials ($55), Plus ($85), Advanced ($200). There’s a free 30-day trial and 50% off for the first three months.

Xero

Xero is considered the best for micro-business owners and for the option of unlimited users. This accounting software has a simple interface and supports integration with third-party services. Xero users can collect payment online from customers through Xero’s integration with Stripe and GoCardless. Xero has three plans that can help you scale from small business to midsize or even a larger company. Higher paying plans also provide support for different currencies.

Xero offers three plans: Starter ($25 per month), Standard ($40 per month), Premium ($54 per month). There’s a free 30-day trial.

Freshbooks

Freshbooks started as an invoicing software and is known for providing more customizations for invoicing compared to other accounting software. While its main function is to send, receive, print, and pay invoices, it can be used for handling basic bookkeeping needs. FreshBooks’ unique feature is that customized invoices look really professional.

Freshbooks has three plans: Lite ($ 17 per month), Plus ($ 30 per month) Premium ($ 55 per month) with 90% discount for the first three months and a free 30-day trial.

Wave

Wave is considered the best for providing a free option. The basic accounting features like financial reporting, invoicing, income and expense tracking, and scanning receipts are free and can be accessed online or via the mobile app, which might be ideal for a dropshipping business. Unlike the basic accounting features, customer payment processing and payroll cost extra.

Wave charges money for credit card transactions (2.9% + $ 0.60), bank payments (1%, or minimum $1), payroll ($ 40 per month), bookkeeping support ($ 149 per month) and some other options.

Sage Accounting

This software can be a good choice for micro-businesses and startups that are looking for accounting software with basic features at an affordable price. Sage allows its users to manage invoices, track their inventory, income and expenses in multiple currencies.

Sage offers two plans to small businesses: Sage Accounting Start ($10 per month), Sage Accounting ($ 25 per month with 70% discount for the first 6 months). There’s a free 30-day trial.

Synder as a bridge to your ecommerce accounting software

As accounting software normally requires manual input of data, selling through multiple channels with different payment processors and keeping it all under control can be quite a challenge. Accounting integration is the solution for this issue. Synder Sync can help you out by fostering a smooth reconciliation process and providing constant support for your dropshipping business. Synder Sync was designed for e-commerce businesses and it has the highest number of integrations, adding more on a regular basis. Platforms available on Synder include all the big e-commerce platforms like Shopify, Amazon, eBay and more, plus lots of payment platforms like Stripe, Paypal, Square and many others. This all makes Synder Sync a perfect solution for a dropshipping business.

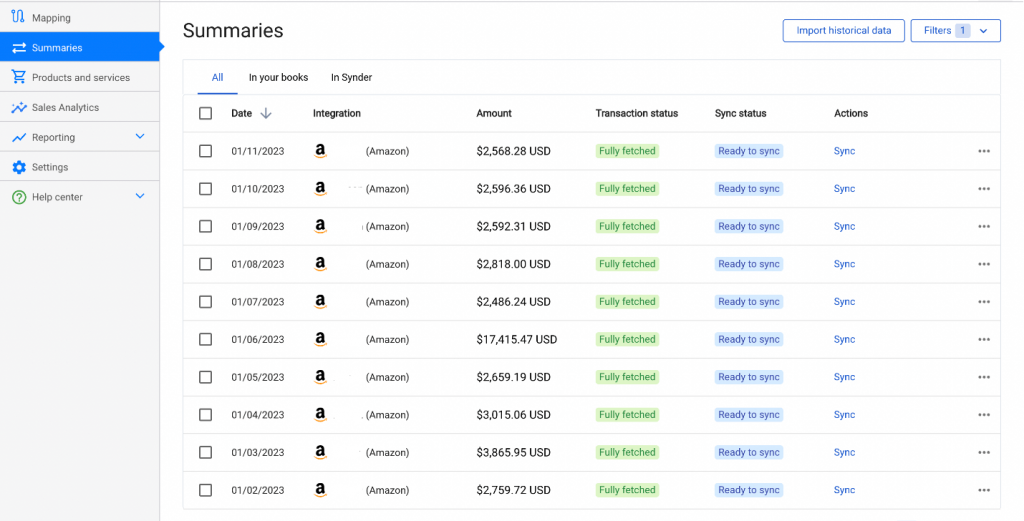

Here’s the experience of one of our clients, Eve, using Synder’s Daily Summary Sync mode to integrate with Quickbooks.

“I, as an accountant serving an online dropshipper, want to have their books done. The business sells through Amazon, Ebay, Shopify platforms and uses PayPal as their payment provider. Some free integrations were breaking up and randomly missed transactions and weren’t picking up the fees. I wanted a system that would be able to do that and to help with COGS tracking. Synder was able to do the whole thing!

It connects to all the payment processors, namely Stripe, Square, PayPal, Amazon Pay and Shopify Payments and the sales channels (Amazon, eBay, Shopify in this case) and imports each and every detail including fees, taxes, discounts, etc. It summarizes everything into a daily batch and posts to QuickBooks. Everything is stored on clearing accounts separately and when money transfer happens to the bank it transfers the same amount to the checking account. So my bank feed actually matches every time. Moreover, it was important for the owner to track their COGS. They didn’t care about the individual product sales, so the setup was really easy. But as Synder is tracking costs and calculates COGS automatically for daily summaries, I only have to import costs files for Amazon, for Shopify costs update automatically!”

Check out the article “Daily Summary vs Per Transaction Sync: Which Pill Do You Need?” to learn about this feature.

One solution for many problems looks like a great choice. If you want to try out Synder’s Daily Summary, there’s a 7-day free trial and an opportunity to book a demo, to see how Synder can automate a great chunk of manual accounting tasks for your dropshipping business.

Bottom line:

When choosing accounting software for your dropshipping business, it’s crucial to consider the needs and requirements of your business and match them to the features accounting software provides for the price that fits your budget. Considering a package of an accounting solution and accounting integration might be a very rational decision, because there’s nothing better than saving time and being sure of your good accounting practices.

Interested in accounting? Find out Best Small Business Accounting Software!