Running a Shopify store often starts with passion—great products, compelling branding, and steady sales. But as the business grows, so does the volume of transactions. What starts as a simple spreadsheet quickly becomes a tangle of orders, fees, taxes, and deposits. Manual bookkeeping that once took an hour now consumes entire days.

That’s when many ecommerce businesses turn to Shopify accounting automation. With the right setup, it’s possible to connect your store directly to accounting platforms or ERPs like QuickBooks, Xero, Sage Intacct, or NetSuite, and let software handle the heavy lifting.

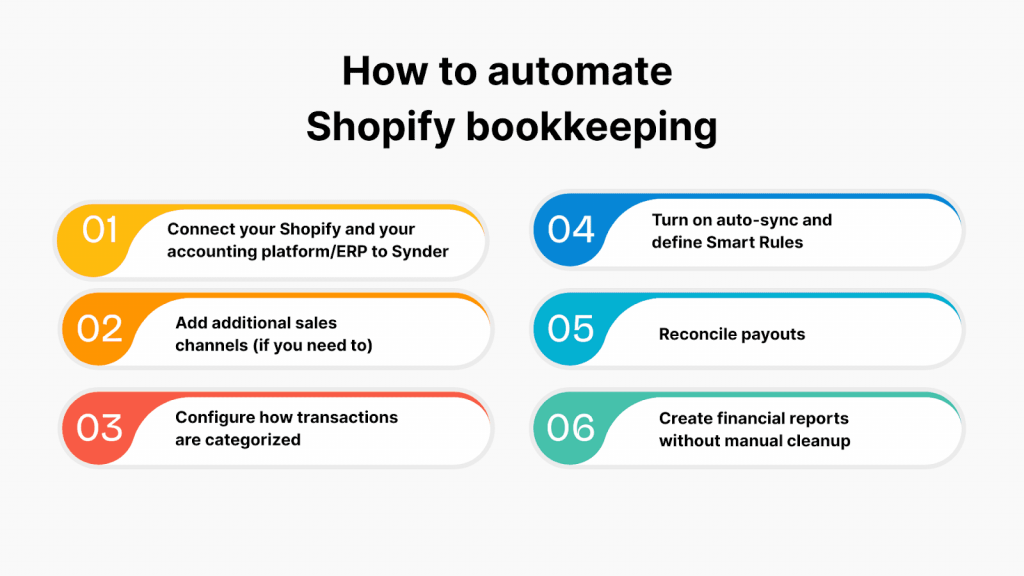

Here’s what that journey typically looks like.

What to do when you’re ready to automate Shopify bookkeeping

1. Connect your Shopify and your accounting platform/ERP to Synder

Every automation journey starts by establishing the right connection between your Shopify store and your accounting system or ERP. To do that in a few clicks, you can use Synder, allowing sales, refunds, fees, discounts, and taxes to sync automatically and accurately into your books.

Popular options that Synder supports include:

- QuickBooks Online for flexible, cloud-based bookkeeping

- QuickBooks Desktop for local control and advanced features

- Xero for its simplicity and ecommerce-friendly design

- Sage Intacct or NetSuite for complex, multi-entity operations

You can get started with Synder’s 15-day free trial to explore the platform, test the connection, and see how automation fits your workflow. If you’d like a walkthrough before diving in, join a Personal 1-1 Demo where Synder’s product experts show you the platform in action and answer live questions.

With the connection in place, you’re ready to build a streamlined, hands-free bookkeeping process.

2. Add additional sales channels (if you need to)

Many Shopify sellers don’t stop at one store. Whether it’s Amazon, Etsy, PayPal, or Stripe, Synder supports multi-channel ecommerce accounting automation, bringing over 30 platforms into one central, organized system.

3. Configure how transactions are categorized

With the systems connected, the focus shifts to setup. This involves telling the software where to put things:

- Sales go to the correct income accounts

- Shipping charges are tracked separately

- Discounts, taxes, and payment fees are clearly labeled

This mapping ensures that financial reports are not just automated, but accurate.

4. Turn on auto-sync and define Smart Rules

To make automation truly hands-off, auto-sync is enabled. As new transactions come in, they’re automatically recorded in the books. Smart Rules add another layer—automatic categorization based on triggers like payment processor, product type, or customer location.

5. Reconcile payouts

One of the biggest pain points in ecommerce accounting is matching Shopify payouts to actual bank deposits. Synder handles this by linking every transaction to its corresponding payout, making monthly reconciliation smooth and discrepancy-free.

6. Create financial reports without manual cleanup

Once everything is flowing correctly, reports become easier and more reliable. Profit & loss statements, balance sheets, and cash flow reports can be generated directly from your accounting platform, powered by clean, categorized data.

FAQ

Can I automate accounting if I sell on platforms beyond Shopify?

Yes. Synder supports 30+ ecommerce platforms like Amazon, eBay, Etsy, Walmart, and WooCommerce, and payment gateways, such as PayPal, Stripe, Square, and Afterpay, allowing you to sync all data into one accounting system.

Do I need accounting experience to set this up?

Not necessarily. Tools like Synder are designed to be user-friendly, with guided setup and support teams that help along the way. If you run into questions, Synder’s onboarding specialists and support team are available to walk you through the process and ensure everything is set up correctly for your specific business needs.

How often should I review the automation setup?

Monthly is a good rhythm. It keeps things accurate and allows quick adjustments as your business scales or changes. Regular check-ins help catch any sync issues early, ensure your product mappings and Smart Rules stay aligned with your current operations, and give you peace of mind that your financial data remains clean and audit-ready.