In the dynamic landscape of SaaS businesses, an astute understanding of key metrics and their implications is paramount for achieving sustained growth and attaining competitive advantage. One such metric is the Annual Contract Value (ACV).

Let’s find out what it means, why ACV matters for SaaS businesses, and what correlation it holds with sales efficacy and revenue generation.

Understanding ACV

Before delving into the significance of ACV, it is essential to first establish a clear definition of what it entails and explore its various components.

ACV definition

ACV, or Annual Contract Value, refers to the monetary value of a customer’s annual subscription contract with a SaaS business. It represents the revenue that a SaaS company expects to generate from a customer throughout the duration of their contract. ACV is a metric that plays a pivotal role in the business world, particularly in the realm of SaaS companies. It serves as a valuable indicator of a customer’s financial worth based on their contractual agreement with the SaaS provider.

ACV Components

ACV comprises several key components that contribute to its calculation and provide deeper insights into a customer’s value. Knowing these components can give a business a comprehensive understanding of ACV and its implications for their operations and empower businesses to make informed decisions when it comes to sales strategies, resource allocation, and revenue forecasting.

Let’s look at them in more detail.

- Subscription pricing models are a fundamental component of ACV. SaaS businesses often offer different pricing plans to cater to the diverse needs and budgets of their customers. These pricing models can include tiered plans, where customers have the option to choose from different levels of service and features based on their requirements. They can also include usage-based pricing, where the cost is determined by the customer’s usage of the software or service. Additionally, businesses may offer discounts or incentives for longer-term contracts, which can impact the overall ACV. According to the Younium guide, it is crucial to correctly forecast subscription revenue to be able to effectively leverage your sales pipeline.

- Contract duration is another significant factor that influences the ACV. SaaS businesses typically offer contracts that span a specific period, such as monthly, annually, or even longer-term commitments. The length of the contract affects the ACV calculation, as longer contracts usually result in a higher ACV due to the extended revenue stream from the customer.

- The ACV calculation may also take into account additional services or features provided to customers. SaaS businesses often offer value-added services or premium features that customers can opt for, either as part of their subscription or as add-ons. These additional offerings can contribute to increasing the ACV by providing more value to the customer and generating additional revenue for the business.

How to calculate SaaS ACV?

To calculate the Average Contract Value (ACV) for a SaaS business, you can follow these steps:

Step #1 – Identify the relevant time period

Determine the specific time period for which you want to calculate the ACV. It could be monthly, quarterly, or annually, depending on your business requirements.

Step#2 – Sum the contract values

Add up the total value of all contracts signed within the chosen time period. This includes the revenue generated from new customers, renewals, and upgrades.

Step #3 – Exclude one-time charges

Exclude any one-time charges or fees that are not recurring. ACV focuses on the recurring revenue generated from contracts.

Step#4 – Adjust for contract length

If you have contracts of varying lengths, adjust the values to reflect the chosen time period. For example, if you are calculating ACV on an annual basis and have a 3-year contract, divide the contract value by 3 to reflect the value over one year.

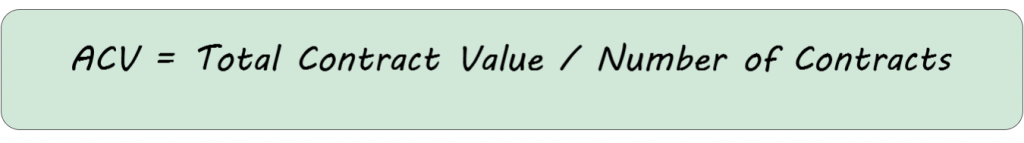

Step #5 – Calculate the average

Divide the total contract value by the number of contracts considered in the calculation. This will give you the average contract value for the chosen time period.

Remember, ACV is a metric that provides an average value and can be used for forecasting and financial analysis. It is important to consider other metrics, such as Customer Lifetime Value (CLTV) and Monthly Recurring Revenue (MRR), to gain a comprehensive understanding of your business’s financial health and performance.

Why ACV Matters for SaaS Businesses?

ACV is an important metric for SaaS businesses as it helps gain insights into their average deal size, identify high-value customers, and track changes in customer spending patterns over time. ACV is instrumental in measuring the financial health of a business, and thus, it helps make informed decisions regarding pricing strategies, resource allocation, and sales forecasting. It’s critical for SaaS businesses to understand the metric, track and optimize it to maximize revenue and drive sustainable growth in a highly competitive market.

Let’s look at how it applies to various aspects of SaaS business.

Revenue forecasting and predictability

ACV plays a pivotal role in revenue forecasting and provides a foundation for predicting future revenue streams. By analyzing historical ACV data and extrapolating it for future periods, SaaS businesses can make informed financial projections and develop comprehensive revenue models. This enables effective resource planning, allows for strategic investment decisions, and provides a basis for investor confidence and stakeholder alignment.

Understanding Customer Lifetime Value (CLTV)

ACV is intrinsically linked to Customer Lifetime Value (CLTV), which represents the total revenue that a SaaS business expects to generate from a customer throughout their entire relationship. ACV serves as a critical component in calculating CLTV, as it provides insights into the revenue potential of individual customers over time. Understanding the relationship between ACV and CLTV enables businesses to identify high-value customers, tailor retention strategies, and nurture long-term relationships that drive sustainable growth and maximize revenue.

Improving SaaS sales

ACV serves as a valuable metric for SaaS sales teams, empowering them to drive revenue growth, optimize customer relationships, and make strategic business decisions. ACV helps identify high-value customers, allowing sales teams to focus their efforts on nurturing and expanding those relationships. It also enables sales reps to forecast and project revenue accurately, aiding in goal setting and performance tracking. ACV data helps in pricing strategies, ensuring that pricing aligns with the value delivered to customers and optimizing revenue generation.

Growth and scalability

SaaS ACV acts as a key growth indicator for businesses. Higher ACV directly impacts revenue growth, as it allows companies to allocate more resources towards customer acquisition, product development, and customer success initiatives. By focusing on increasing ACV, SaaS businesses can enhance scalability, expand their market reach, and accelerate their growth trajectory.

Factors Influencing ACV

Several critical factors can influence Average Contract Value, so you might want to consider them. Let’s look at the major factors in more detail.

- Product pricing and packaging

Effective pricing strategies that align with customer needs and market demand are fundamental in optimizing ACV. SaaS companies must carefully evaluate their pricing models, considering factors such as perceived value, market competition, and potential for upselling. Properly packaging features and services to meet customer requirements while maximizing revenue potential is essential.

- Target market segmentation

Different market segments often exhibit diverse purchasing power and specific needs. By identifying and targeting high-value market segments, SaaS businesses can tailor pricing and offerings to optimize ACV. This segmentation approach allows for a more precise understanding of customer requirements and facilitates the creation of compelling value propositions.

- Upselling and cross-selling opportunities

Upselling and cross-selling strategies are effective means of increasing ACV. By identifying opportunities to offer additional services, features, or higher-tier plans, SaaS businesses can enhance customer value perception and drive incremental revenue. Leveraging existing customer relationships to upsell and cross-sell is a cost-effective approach that can significantly impact ACV and overall revenue growth.

- Customer success and retention efforts

Retaining customers and nurturing long-term relationships are pivotal to maximizing ACV. SaaS businesses should invest in robust customer success programs, implement CSP software, proactive account management, and personalized support to ensure customer satisfaction, minimize churn, and extend customer lifecycles. Building strong customer relationships contributes directly to ACV by fostering loyalty and recurring revenue streams.

How to increase ACV?

As mentioned above, various factors can influence ACV, however, businesses can increase Average Contract Value if they approach it wisely. Though maximizing ACV can be challenging, there are various strategies you can consider to power the increase in ACV.

Challenges in maximizing ACV

While ACV presents significant opportunities for SaaS businesses, challenges may arise due to various reasons, including:

- Competitive pricing pressure

The SaaS market is highly competitive, and pricing strategies must strike a balance between maximizing ACV and remaining competitive. Overpricing can deter potential customers, while underpricing may result in leaving revenue on the table. Businesses must continuously evaluate pricing strategies in the context of market dynamics and competitive landscapes.

- Balancing ACV with Customer Acquisition Cost (CAC)

Maximizing ACV should be aligned with an understanding of the associated Customer Acquisition Cost (CAC). It is crucial to strike a balance between the two to ensure long-term profitability. Businesses must analyze the cost-effectiveness of customer acquisition strategies and optimize them to ensure that ACV outweighs CAC.

- Pricing transparency and customer perception

Complex pricing structures and lack of transparency can negatively impact customer perception. Customers need clear communication regarding pricing models, contract terms, and the value they will receive. Transparency fosters trust and positive customer perception, ultimately contributing to higher ACV and customer retention.

Strategies to increase ACV

Now let’s take a quick look at the strategies that allow businesses to increase their ACV.

Tiered pricing models

Implementing tiered pricing models allows businesses to cater to different customer segments and capture varying levels of value. By offering multiple pricing tiers with distinct features and capabilities, SaaS companies can attract customers with diverse needs and budgets, ultimately increasing ACV.

Offering enterprise plans

Developing tailored enterprise plans for larger organizations can significantly impact ACV. These plans typically include advanced features, increased support, and customization options that address the unique requirements of enterprise clients. Targeting the enterprise market unlocks higher revenue potential and expands the scope for increased ACV.

Bundling additional services or features

Packaging complementary services or features together provides customers with added value and incentivizes them to opt for higher-priced plans. Bundling offerings effectively communicates the benefits of comprehensive solutions, enabling businesses to boost ACV by upselling additional services and increasing customer satisfaction.

Conclusion

As you can see, ACV holds immense significance for SaaS businesses as a fundamental revenue metric. Understanding the comprehensive ACV definition and its implications is vital for revenue forecasting, customer lifetime value analysis, and driving growth and scalability. By considering the factors that influence ACV, implementing effective strategies, and addressing associated challenges, SaaS businesses can harness the power of ACV to optimize sales, increase revenue, and foster long-term customer relationships. As the SaaS landscape continues to evolve, it is crucial for businesses to stay attuned to emerging trends and market dynamics, continually refining their ACV measurement and strategies to remain competitive and drive sustainable growth.

.png)