You’ll probably agree that when running a business, efficiency is key. Managing accounts receivable (AR) can be time-consuming and error-prone, but what if there was a way to streamline the process and save valuable time? The answer is accounts receivable automation software, a game-changer for businesses of all sizes.

Imagine a system that handles data entry, resolves discrepancies, updates records, and generates reports, all without the need for manual intervention. Sounds too good to be true? It isn’t. Let’s find out everything you need to know about AR automation.

Key takeaways:

- AR automation uses technologies to manage data entry, reconciliation, record updates, and report generation, reducing the hours of manual work.

- The software integrates with other business platforms to automate tasks like invoicing, tracking outstanding invoices, and sending payment reminders.

- AR automation transforms the receivable process, making it faster, more accurate, and efficient. It benefits businesses of all sizes, from small enterprises to large corporations.

Contents:

1. What is accounts receivable automation?

3. What are the benefits of AR automation?

4. The ultimate AR automation solution

5. How do AR automation, AI, and robotic process automation interact?

What is accounts receivable automation?

First off, let’s start with the definition of AR, or accounts receivable. It refers to the tracking, following through, and recording of money that your customers owe to your company for goods or services they’ve already received from you. And now that we refreshed it, let’s break down AR automation.

Automation uses digital processes to speed up the workflow, for example, by eliminating manual accounts receivable and building huge Excel spreadsheets. Such software can perform:

- Data entry;

- Reconciliation;

- Updating records;

- Generating reports.

In this way, the entire process is optimized, leading to quicker accounting procedures and improved efficiency.

How does it work?

AR includes several tasks such as credit management, invoicing, cash flow and late payments tracking, reconciliation, and more. How can they be automated?

Let’s take invoices as an example. AR pulls information from other platforms your business uses and then creates and sends invoices digitally. It can also track outstanding invoices and remind customers of what they owe.

Accounts receivable software automatically reconciles all transactions, significantly speeding up and simplifying the process by eliminating the need for manual work.

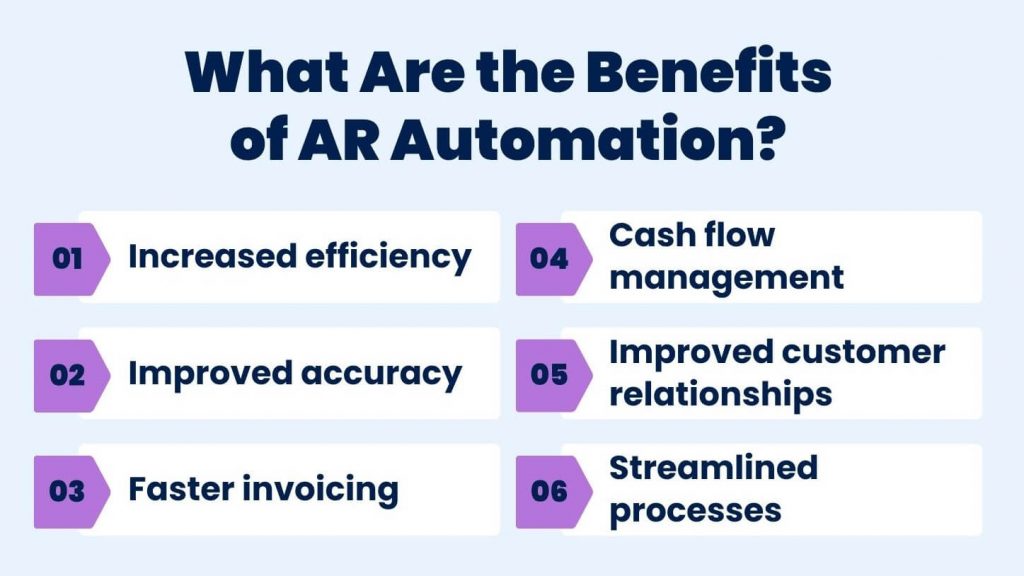

What are the benefits of AR automation?

Automating accounts receivable comes with a lot of benefits to your business. It might not be immediately clear, but remember when the phone replaced paper letters? It’s a similar transformation. So, what are these AR automation benefits? Let’s see:

- Increased efficiency: Automating repetitive tasks like invoicing and reconciliation saves time and reduces manual effort.

- Improved accuracy: You might find a human error in data entry or calculations. Automation minimizes such issues and provides more accurate financial records.

- Faster invoicing: Digital invoicing speeds up the billing process, leading to quicker payment cycles.

- Cash flow management: Real-time tracking and monitoring of outstanding invoices help maintain better control over cash flow.

- Improved customer relationships: Automated reminders and follow-ups improve communication with customers, reducing late payments.

- Streamlined processes: Integration with other platforms and systems ensures a smooth and cohesive workflow.

The ultimate AR automation solution

As you can see, automation is a must for a fast and efficient workflow. But what accounting automation solution is better? If you’re not a fan of manual work and sleepless nights, then Synder is your software of choice.

With a huge pool of tasks, such an option can be your magic wand. But what exactly will you get from Synder and how can it help you? Here’s just a sneak peak into the features that this accounting software can offer to automate your bookkeeping processes:

- Customize and organize this data;

- Record ongoing and historical transactions with all the details, including fees, taxes, customers’ information, and more;

- Synchronize data from 30+ ecommerce platforms, payment gateways, and POS systems;

- Reconcile multi-channel sales for hassle-free month-end bookkeeping.

By implementing Synder in your finance teams, you’ll not only eliminate manual processes but also change the game with new opportunities.

How do AR automation, AI, and robotic process automation interact?

Many accounting automation programs use artificial intelligence (AI), also called machine learning. AI can handle tasks like entering and matching data from receipts and invoices to purchase entries.

AI is different from robotic process automation (RPA) because it learns and improves from the data it processes, making the system more efficient and accurate over time. In accounts receivable (AR) automation, AI can be used for predictive analytics, helping to forecast cash flow and identify potential payment issues before they occur. AI can also analyze customer payment behaviors and suggest optimized credit terms.

AR automation also uses RPA, which takes care of repetitive tasks like sorting, data entry, filling out forms, and interpreting text and data. RPA can be used to automatically generate and send invoices, track outstanding payments, and issue reminders to customers. It can also match incoming payments to the correct invoices and update the ledger accordingly. RPA reduces processing time and frees up staff for other work, such as sending late payment notices to customers.

Conclusion

Imagine never having to worry about invoice delivery or online payments again. With customizable workflows and an automated receivable process, your company can achieve this. Sounds good, right? It’s not a dream if you use an accounts receivable automation solution. By automating repetitive tasks, minimizing errors, and delivering valuable insights through data analytics, AR automation will help your company grow much faster. From small business to large enterprise, automation of AR will be useful to each. So, what’s stopping you?

Share your thoughts

We’d love to hear your experiences and insights on accounts receivable automation. Have you implemented AR automation in your business? What benefits have you noticed? Are there any challenges you’ve faced? Share your thoughts below!

FAQs

What is accounts receivable automation software?

Accounts receivable automation software handles key tasks like capturing and entering data into the AR ledger, reconciling discrepancies, updating records, and generating reports and financial statements. It saves time and cuts costs in the AR process.

What is the difference between an account receivable and an account payable?

Accounts receivable represent money that customers owe to a business for goods or services provided on credit. Accounts payable, on the other hand, represent money that a business owes to suppliers or vendors for goods or services received.

How do you record accounts receivable collections?

For the journal entry, record the total amount due from the invoice as a debit in the accounts receivable account. Then, record the same amount as a credit in the sales account. This method is useful for maintaining accuracy in a double-entry accounting system.

Can accounts payable be automated?

Yes, it can be automated. Accounts payable automation lets companies handle supplier invoices without manual work. It creates a digital workflow to manage tasks that usually require an AP staff member.

Can accounts receivable be outsourced?

Yes. Outsourcing accounts receivable is helpful for businesses of all sizes. Growing businesses might not need a full-time AR clerk or analyst yet, while large organizations may need to quickly expand their accounting teams during busy periods.