In business, the accounting process happens behind the scenes and requires a lot of responsibility. But what exactly is so special about it? It’s a long story, but every journey begins somewhere. So, let’s start by mastering the accounting process — the basis of all accounting.

What is the accounting process? How does it work and why is it so important? Let’s find out.

Key takeaways:

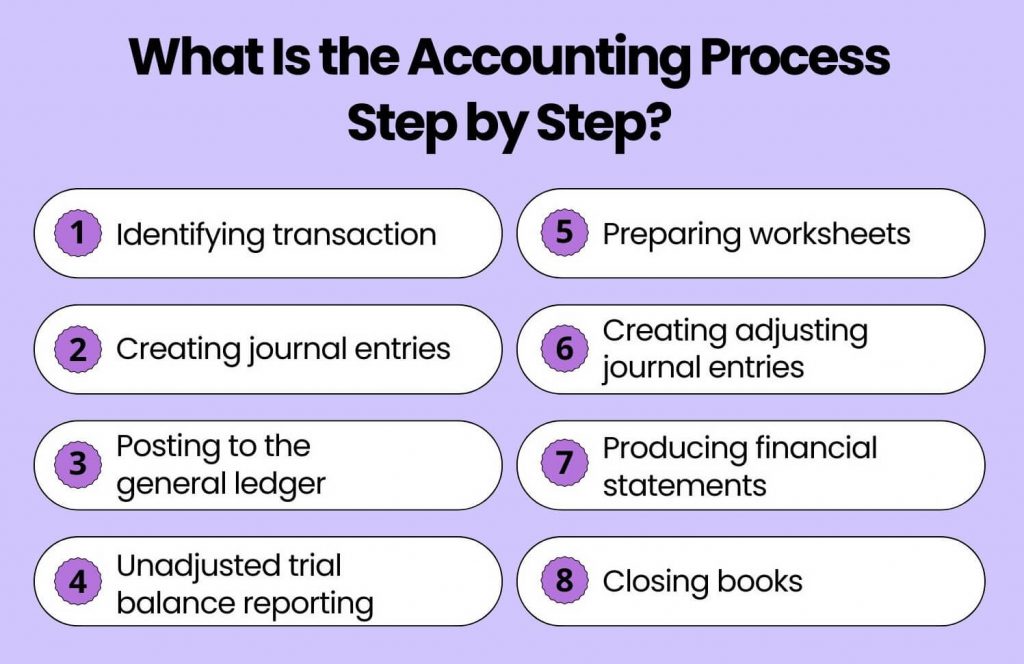

- The accounting process consists of eight steps, from identifying transactions to closing the books.

- The accounting process ensures that businesses can manage their transactions efficiently and comply with regulations.

- The accounting cycle is continuous, with closing one period leading to the start of a new one, allowing for ongoing financial management and planning.

Contents:

1. What is an accounting process?

2. What is the accounting process step by step?

3. Why is the accounting process important?

4. Optimize your accounting cycle with Synder

5. Conclusion

What is an accounting process?

We all know what a process is — a sequence of actions. The accounting process is a series of steps taken to track transactions. It begins when a transaction occurs and finishes when financial statements are prepared and the books are made ready for the next reporting period.

What steps does this process include? Here’s the answer:

- Identifying transaction;

- Creating journal entries;

- Recording to the books;

- Trial balance reporting;

- Preparing worksheets;

- Modifying journal entries;

- Producing financial statements;

- Closing books.

Let’s take a closer look at each of them!

What is the accounting process step by step?

Step 1. Identifying transaction

The first thing you’ll need to do in the accounting cycle is to identify transactions. Each company has many transactions, such as sales, purchases, receipts, and payments, during the accounting period, whether monthly or annually. If those transactions are recorded in the books correctly, there won’t be any issues at this step.

Step 2. Creating journal entries

The next step is to create a journal entry for each transaction in your accounting system. The timing of when you record these transactions depends on the accounting method used. In accrual accounting, you record transactions when they happen, matching revenues with expenses. And in cash accounting, you record transactions only when money is received or paid.

Step 3. Posting to the general ledger

When all transactions are recorded in a journal, you’ll need to post them into the general ledger. Posting to the general ledger helps business owners have a comprehensive view of all accounting processes and activities and allows them to track financial performance and cash flow of the company.

Step 4. Unadjusted trial balance reporting

A trial balance is prepared to ensure that the debits equal the credits. Its main purpose is to identify any errors made in the accounting process. A trial balance shows the balances of all accounts at a specific time.

After preparing a trial balance, accountants check that the total credits match the total debits. If they don’t, there’s an error that must be found and corrected. If everything is alright, you’ll receive an adjusted trial balance and move to the next step.

Step 5. Preparing worksheets

At this point you have to analyze the worksheet and determine the adjusting entries. In addition to finding errors, adjusting entries are also necessary to match revenues and expenses in accrual accounting.

Step 6.Creating adjusting journal entries

This is the error correction stage. The specialist makes necessary edits to the journal entries to record changes. This allows for another check to find and fix any mistakes and make any adjustments if needed.

Step 7. Producing financial statements

After making all corrections, the company generates its financial statements for the accounting period, whether monthly or at year-end. Using accounting systems can be helpful, as they can also show quarterly totals.

Financial statements include:

- Balance sheet;

- Statement of owner’s equity;

- Income statement;

- Cash flow statement.

Step 8. Closing the books

Finally, the company completes the accounting cycle in step eight by closing its books on the specified date. Closing statements provide a report to analyze the performance for the period.

After closing, the accounting cycle begins again with a new accounting period. Closing is a good time to file paperwork, plan for the next period, and review upcoming events and tasks.

Why is the accounting process important?

The answer is simple: it’s a fundamental part of financial reporting. Without these steps, achieving clear and balanced books is impossible.

Imagine trying to bake a cake without flour. Sounds strange, right? The same logic applies here. You can’t skip any part of the process, not even one step. It’s like trying to add eggs after the cake is baked.

The accounting process helps business owners and established companies to close their books efficiently for each accounting period. And, of course, balanced books lead to optimized financial processes.

Optimize your accounting cycle with Synder

When working with accounting records manually, errors can sneak in. It’s easy to get confused with numbers and mess everything up. To avoid such situations, a good rule of thumb is to use automation.

One of such accounting automation solutions is Synder, which provides a unique opportunity to enhance your workflow without any additional effort of entering an endless stream of numbers. When working with numerous transactions, such a tool is indispensable.

So which accounting features will you get? Synder is able to:

- Record ongoing transactions;

- Customize and organize data;

- Synchronize data from 30+ ecommerce platforms;

- Reconcile multi-channel sales;

- Automatically categorize P&L and record taxes;

- Automate the syncing process in settings.

Conclusion

Well, accounting can be scary, right? No worries. To understand everything, you need to know the rules. In the accounting process, there are eight steps that must be followed. When you get raw financial data, you need to convert it into something useful.

By following a series of steps, from identifying transactions to closing the books, businesses can keep clear and balanced financial records. And if you add automation to this mix, everything will be in its place, like accounts receivble automation software does.

Share your thoughts

What’s your experience with the accounting process? Have these steps helped you maintain clear financial records? Share your tips to help others manage their accounting more effectively!

Disclaimer

This article is for informational purposes only. It’s best to consult a professional accountant for advice tailored to your specific situation.