In the sprawling urban expanse of Los Angeles, where dreams are forged in the crucible of ambition, the role of financial accountancy takes center stage. The city’s diverse and dynamic business landscape demands the guidance of skilled professionals who understand the intricacies of financial accounting.

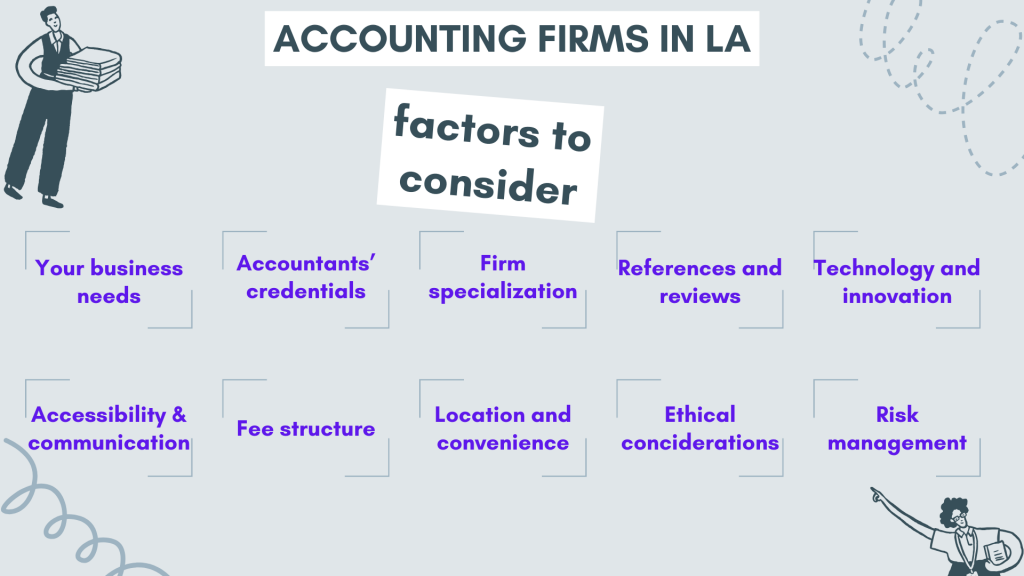

This article looks at what you need to look at to evaluate Los Angeles accountants and accounting companies, guiding you through the process of selecting the ideal partner for your small business’s financial needs.

Understanding your needs as a small business owner in Los Angeles

Each small business is as unique as a fingerprint. Therefore, before diving into the selection process, it’s paramount to comprehend your specific financial accounting needs. The accountancy requirements of a tech startup in Silicon Beach may drastically differ from those of a family-owned restaurant in Downtown LA.

Start by conducting a comprehensive assessment of your financial situation.

- What are your short-term and long-term goals?

- Do you require assistance with financial accounting, tax planning, bookkeeping, or financial forecasting?

- Are you looking for a CPA firm that can provide strategic financial accounting advice or one that primarily handles compliance?

Knowing your needs inside and out will serve as the compass guiding you toward the right accounting partner.

Additionally, consider the scale and complexity of your financial operations.

Does your business handle multiple revenue streams, international transactions, or intricate financial instruments?

Identifying these intricacies will help you narrow down your search to accounting firms with relevant expertise. Remember, the better you understand your financial accounting needs, the more effectively you can communicate them to potential CPA firms.

With the outlined requirements at hand, you can start exploring accounting firms to choose the best fit into your needs framework.

Evaluating accountancy credentials of Los Angeles accountants

In the realm of financial accounting, credentials matter, and evaluating credentials of accountants you’re potentially going to partner might be a good nest step for you. Here’s what you might want to consider.

CPA status

The most fundamental credential to look for when choosing an accounting firm is the Certified Public Accountant (CPA) designation. Los Angeles accountants who are CPAs have undergone rigorous training and examination, demonstrating their commitment to excellence in the field of accountancy.

Experience and track record

However, it’s not enough to merely confirm a firm’s CPA status. Delve deeper into their credentials by scrutinizing their experience and track record. How long has the accounting firm been in business? Have they worked with businesses similar to yours in terms of size and industry? A Los Angeles accounting firm with a history of successfully navigating the intricate financial landscape of the city is a valuable asset.

Professional development

Beyond this, inquire about the professional development of the firm’s accountants. Are they up-to-date with the latest changes in tax laws and financial regulations? The ever-evolving financial climate of Los Angeles requires accountants to stay ahead of the curve to provide accurate and insightful financial advice.

Remember, when assessing credentials, it’s not just about the firm’s reputation but also the qualifications and expertise of the professionals who will be handling your financial matters.

Accounting firm specialization

As previously mentioned, various industries have their unique financial intricacies. As such, it’s crucial to seek out an accounting firm with specialization that aligns with your business.

For example, if you’re running a production company in the entertainment industry, you may want to partner with an accounting firm well-versed in dealing with the complex financial structures of film and television projects. Conversely, if you’re managing an e-commerce venture, you’ll benefit from a firm experienced in online retail accounting and e-commerce tax compliance.

The advantage of working with a specialized accounting firm in Los Angeles is that they are more likely to have a deep understanding of your industry’s challenges and opportunities. They can offer tailored financial solutions that take into account the unique aspects of your business, helping you navigate the Los Angeles business landscape with precision.

Client references and reviews for an accounting company

In the digital age, the power of word-of-mouth has been amplified, making client references and online reviews essential resources in your quest to find the ideal Los Angeles accounting firm. Start by asking the firms you’re considering for a list of client references. Contact these businesses to gain insights into their experiences with the accounting company.

Simultaneously, explore online review platforms and industry-specific forums. Websites like Yelp and Google Reviews can provide valuable feedback on the reputation and reliability of Los Angeles accountants and accounting companies. Pay attention to both positive and negative reviews, and consider the context in which they were posted.

While client references and online reviews are valuable tools, it’s important to remember that experiences can vary widely, and one person’s perspective may not reflect the overall quality of a firm. Therefore, use these resources as a part of your decision-making process but not as the sole determining factor.

Embracing technology and innovation in financial accounting

The world of accounting is evolving rapidly, thanks to the integration of fintech solutions. In Los Angeles, where technology is king, it’s essential to assess a prospective accounting firm’s embrace of innovation. The use of advanced accounting software, cloud-based platforms, and automation tools can significantly enhance the efficiency and accuracy of financial accounting.

When evaluating a Los Angeles accounting firm’s tech-savviness, consider the following questions:

- Is the firm utilizing modern accounting software to streamline processes?

- Do they offer digital solutions for secure document sharing and collaboration?

- Are they well-versed in data analytics and reporting tools that can provide valuable insights into your business’s financial performance? A firm that keeps pace with technological advancements not only ensures smoother financial operations but also demonstrates a commitment to delivering the best possible service to their clients in the dynamic landscape of Los Angeles.

Furthermore, inquire about the firm’s approach to data security and privacy, especially if your business handles sensitive financial information. Ensuring that the firm has robust cybersecurity measures in place is crucial to safeguarding your financial data.

Effective communication with a CPA firm and accessibility

Effective communication is the cornerstone of a successful partnership with an accounting firm. Before making a decision, assess the firm’s communication practices and accessibility.

Below are some factors you might want to pay attention to.

- Responsiveness

First, evaluate the responsiveness of the firm during your initial interactions. Did they promptly reply to your inquiries, and were they attentive to your concerns? Responsiveness at this stage can be indicative of their communication practices throughout your partnership. - Communication models

Consider the modes of communication the firm offers. In the digital age, many Los Angeles accounting firms provide options for virtual meetings and collaboration through video conferencing platforms, which can be especially convenient for businesses with hectic schedules. However, if face-to-face interactions are essential to you, ensure that the firm can accommodate in-person meetings. - Accessibility

Another aspect of communication to consider is the accessibility of your dedicated accountant or team. Will you have a single point of contact, or will you be working with a team of professionals? Clarifying this upfront can help manage your expectations regarding communication and support.

It’s also worth noting that effective communication with your accounting firm is not only about addressing issues but also about proactive discussions on financial strategies and opportunities. It’s a partnership built on trust and transparency, ensuring that you’re always in the financial know .

Fee structure and budgeting

Understanding the fee structure of potential accounting firms is a critical aspect of your decision-making process. Accounting firms employ various billing methods, and it’s essential to comprehend how these will impact your budget.

Common fee structures include hourly rates, flat fees, and retainer agreements.

- Hourly rates are straightforward but can be unpredictable if your accounting needs fluctuate.

- Flat fees provide more predictability, while retainer agreements involve paying a set fee for ongoing services, which can be advantageous for businesses with continuous accounting needs.

Discuss the fee structure in detail with prospective firms. Inquire about any additional costs that may arise, such as charges for special services or unexpected issues. Additionally, seek clarity on how the firm handles billing disputes and whether they offer flexible payment options.

Consider your budgetary constraints and the value that each accounting firm brings to the table. While cost is an important factor, remember that quality and expertise should not be compromised for the sake of saving a few dollars.

Location and convenience

Proximity to your business can play a role in your decision-making process. A firm located closer to your office may offer convenience in terms of in-person meetings and quick access to financial documents.

However, in the digital age, the importance of physical proximity has diminished. Many Los Angeles accounting firms are adept at serving clients remotely, using secure online platforms to collaborate and share documents. This allows you to cast a wider net when searching for the right firm and potentially access a broader range of expertise.

Consider your preferences and the nature of your business when deciding on the importance of location. The convenience of a nearby accounting firm may be valuable for some, while others may prioritize the specialized skills of a more distant CPA firm.

Ethical considerations

Ethical considerations are paramount when choosing an accounting firm in Los Angeles or anywhere else. Maintaining financial integrity and adhering to ethical practices is not only a legal requirement but also essential for your business’s reputation.

Begin by researching the firm’s track record for ethical conduct. Have they been involved in any legal or ethical controversies? Look for any disciplinary actions taken against them by professional organizations or regulatory bodies. A clean ethical record is a strong indicator of a firm’s commitment to ethical standards.

Additionally, inquire about the firm’s approach to confidentiality and data security. How do they protect your sensitive financial information? Understanding their safeguards can give you peace of mind, knowing that your financial data is in trustworthy hands.

When in doubt, don’t hesitate to seek legal counsel or advice from industry associations to ensure that the accounting firm you’re considering meets the highest ethical standards. Maintaining ethical integrity is not just a legal requirement but also a fundamental pillar of trust .

Risk management and compliance

Accounting comes with its fair share of risks, from complex tax laws to regulatory changes. Choosing an accounting firm that can help you manage and mitigate these risks is crucial for the financial health of your business.

You might want to consider an accounting firm that emphasizes compliance with all relevant tax codes and financial regulations. A firm’s commitment to staying up-to-date with changing laws and regulations can protect your business from costly penalties and legal issues.

Besides, assess the firm’s approach to risk management. Do they offer strategic financial advice to help you make informed decisions that minimize financial risks? Are they proactive in identifying potential issues and proposing solutions before they become major problems?

An accounting partner that excels in risk management and compliance can be invaluable in your business’s success, helping you navigate the turbulent waters of the city’s financial landscape with confidence.

Conclusion

To wrap it up, selecting the right accounting firm is akin to choosing a compass for your business journey. The landscape of accounting companies is vast and varied, but armed with the knowledge of what to look at in a potential partner, you can confidently navigate the maze.

Remember, understanding your specific financial accounting needs, evaluating credentials, and considering factors such as specialization, client references, and technology are crucial steps in the selection process. Communication, accessibility, fee structure, and location also play significant roles in finding the ideal company to outsource your business accounting to. And, of course, ethics and risk management should always be at the forefront of your decision-making process.

Learn more about Amazon FBA vs Dropshipping.