Cases it may cover: a shipping tax amount is recorded as a line item rather than into the shipping field in QuickBooks Online (for US users).

How it works: Synder records a shipping tax as a line item:

- If the Shipping setting is disabled into QuickBooks Online;

- If the Shipping setting is enabled into QuickBooks Online, but was disabled during the first sync with Synder.

Solution: Go on syncing transactions containing a shipping tax the same way because:

- The shipping tax amount is recorded into a separate income account linked to the Shipping product;

- The transaction amount will not change, and your reports will still be accurate and up-to-date.

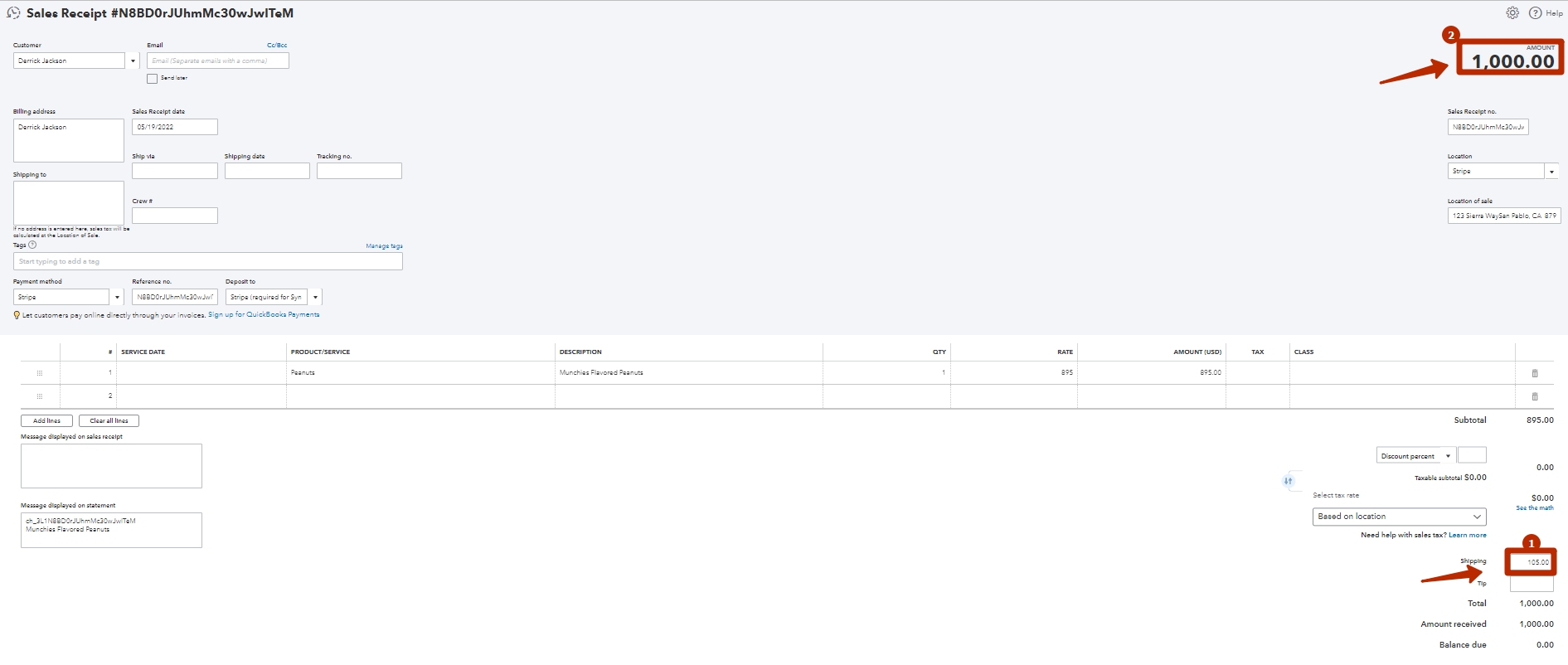

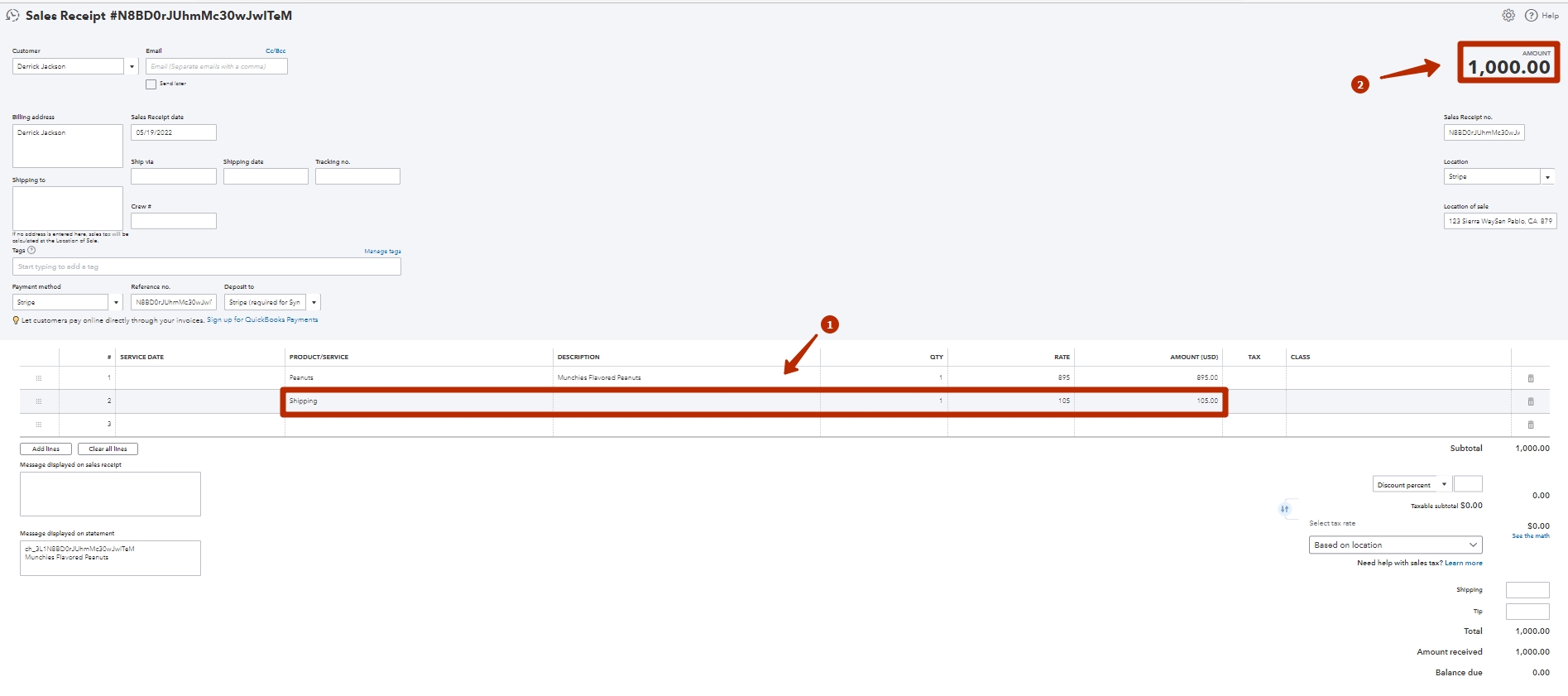

Here’s an example of a transaction with shipping as a tax (1) and as a line item (2).

As you can see, the total amount equals $1000 in both cases.

Important note: If QuickBooks Online has automated sales tax enabled (for U.S. companies), the taxability of shipping is determined by your accounting company itself. This means that even if shipping is taxable according to your e-commerce or payment gateways, QuickBooks Online will not mark shipping as taxable if it determines otherwise.

Reach out to the Synder Team via online support chat, phone, or email with any questions you have – we’re always happy to help you!

Learn How to Sync Daily Summaries From Shopify and Stripe Into QuickBooks Online With Synder.