In this guide, you’ll learn what a smart reconciliation is and what possible challenges it helps to overcome.

Overview:

What smart reconciliation is and how it works

If you’re an e-commerce store owner or manager, you sell using various payment gateways. Synder can benefit you immensely: it allows you to do seamless reconciliation of your transactions, bringing a lot of your data to your books. In fact, we’re trying to pick up as much information as possible for each integration.

Let’s say you have an e-commerce store and sell orders using various payment gateways (e.g., Shopify as an e-commerce platform, and Stripe as a payment processor). Here is when the smart reconciliation comes into action, bringing a lot of data to your books – both from an e-commerce store (product names, order numbers, etc.) and from a payment provider (payment and fee details).

Note: you are to connect both your sales channel and payment processor to Synder.

Possible issues and how to solve them

Sometimes you set up the sync and find out that some information you have in your e-commerce orders is missing (e.g. you have default product names, like Stripe item, PayPal item; wrong document numbers recorded, etc.) Read further to learn about possible reasons and solutions.

Reason 1: an e-commerce platform has been disconnected/lost the connection from your Synder company.

Solution:

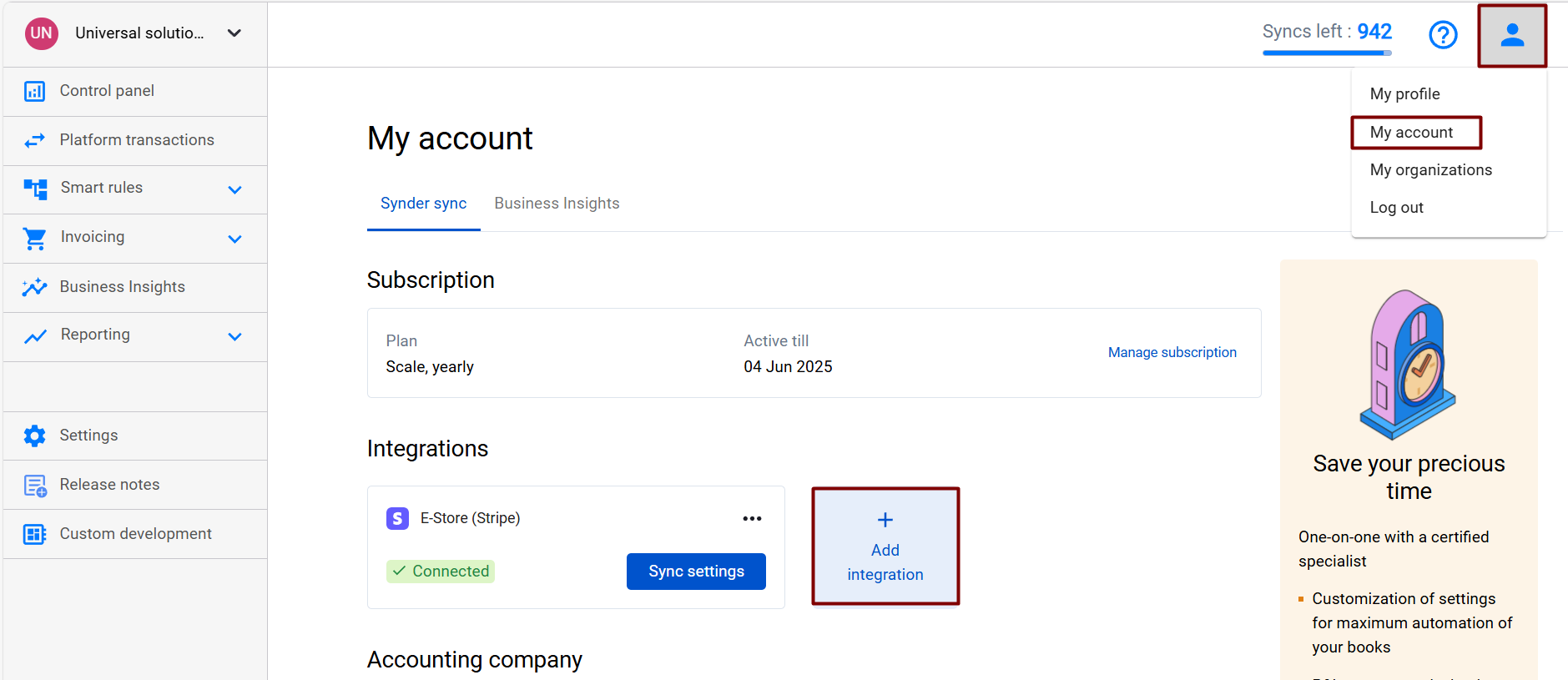

- Click on the Person icon in the upper-right corner and choose My Account.

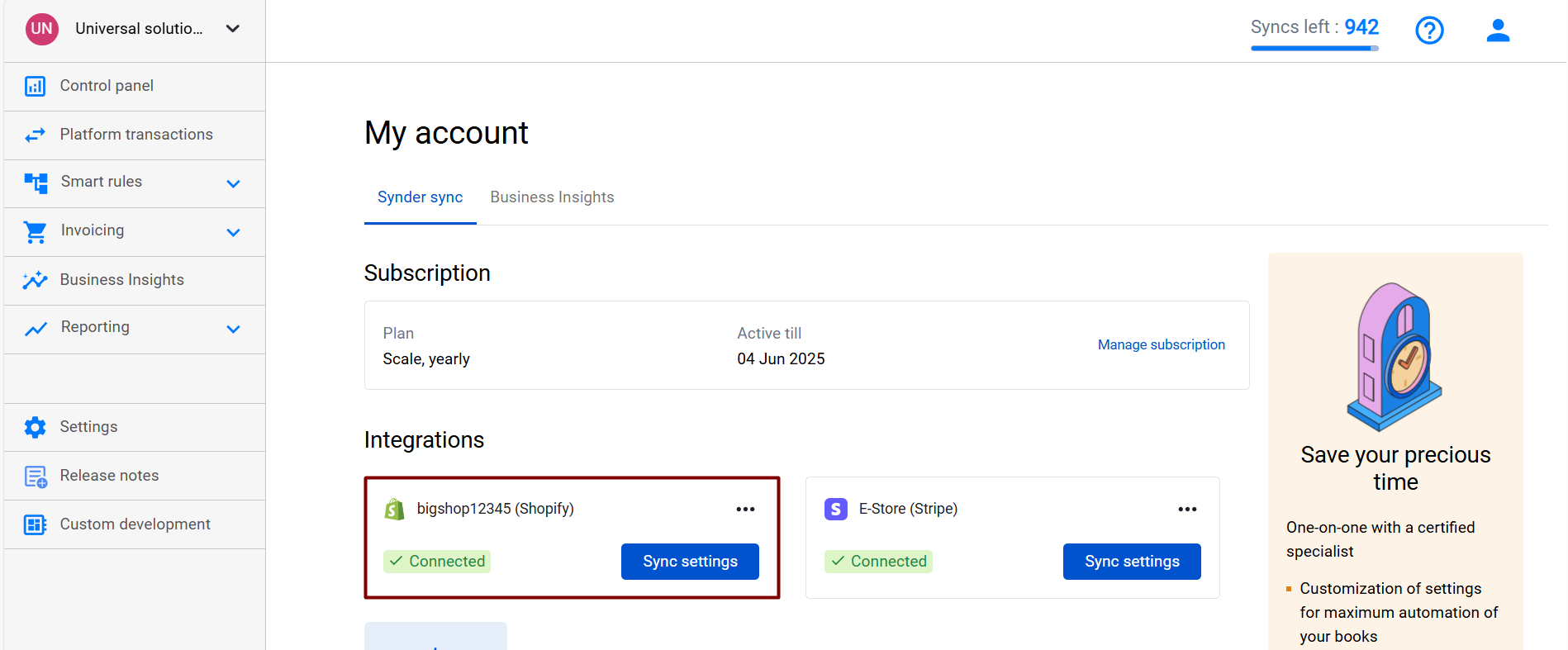

- Under the Integrations menu, click on Add integration and select your sales channel (for cases when an e-commerce store is disconnected) or click on Reconnect under your sales channel.

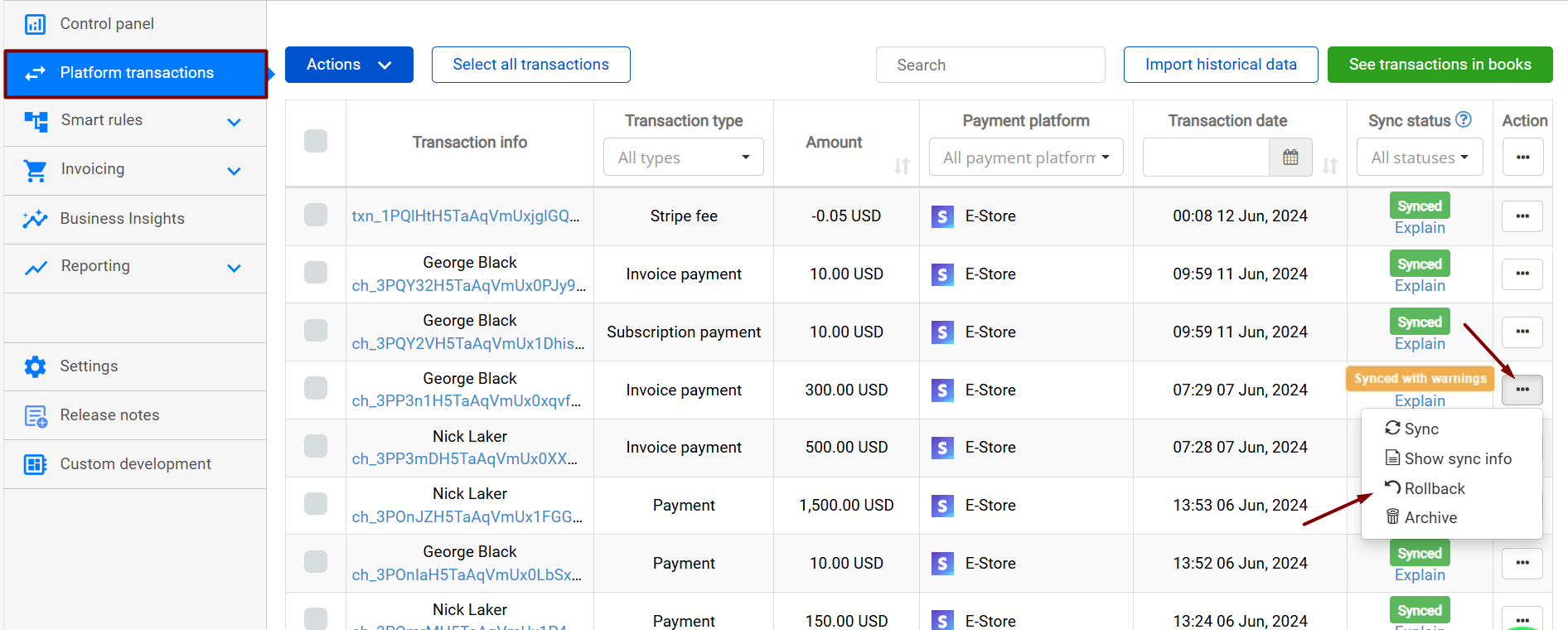

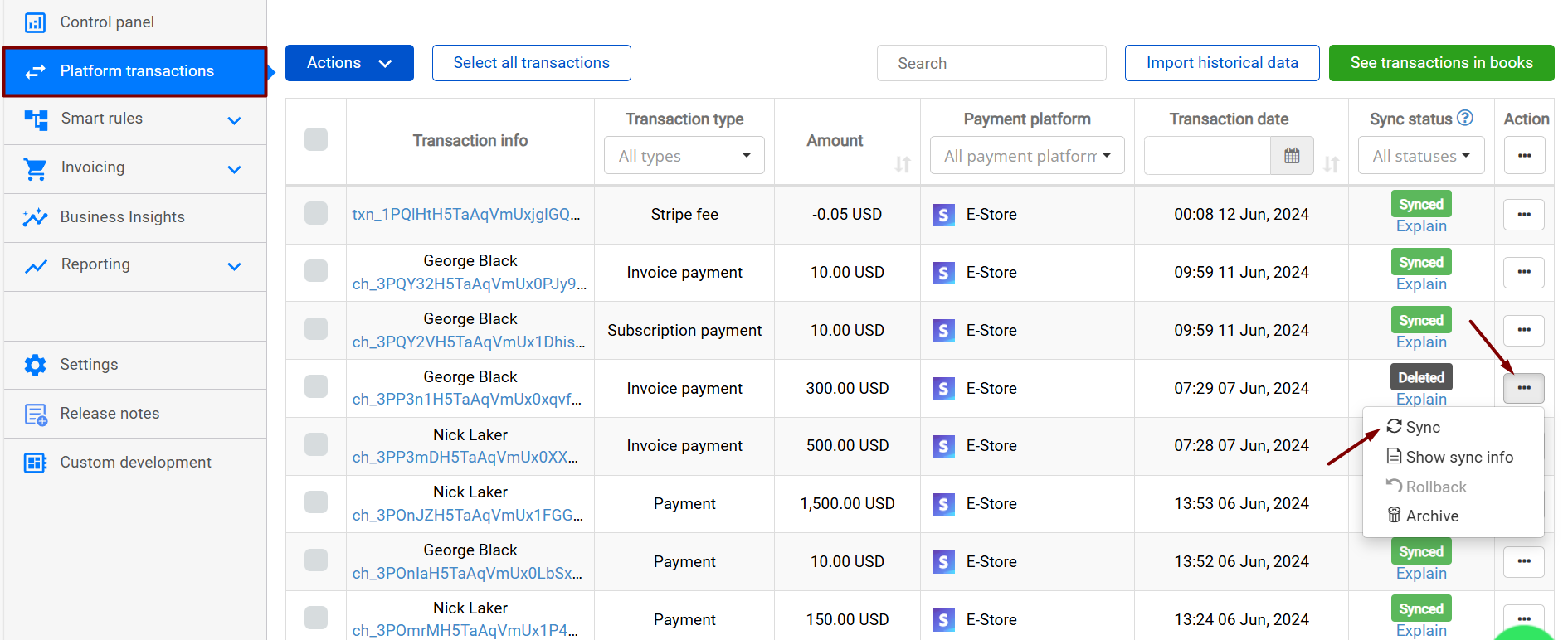

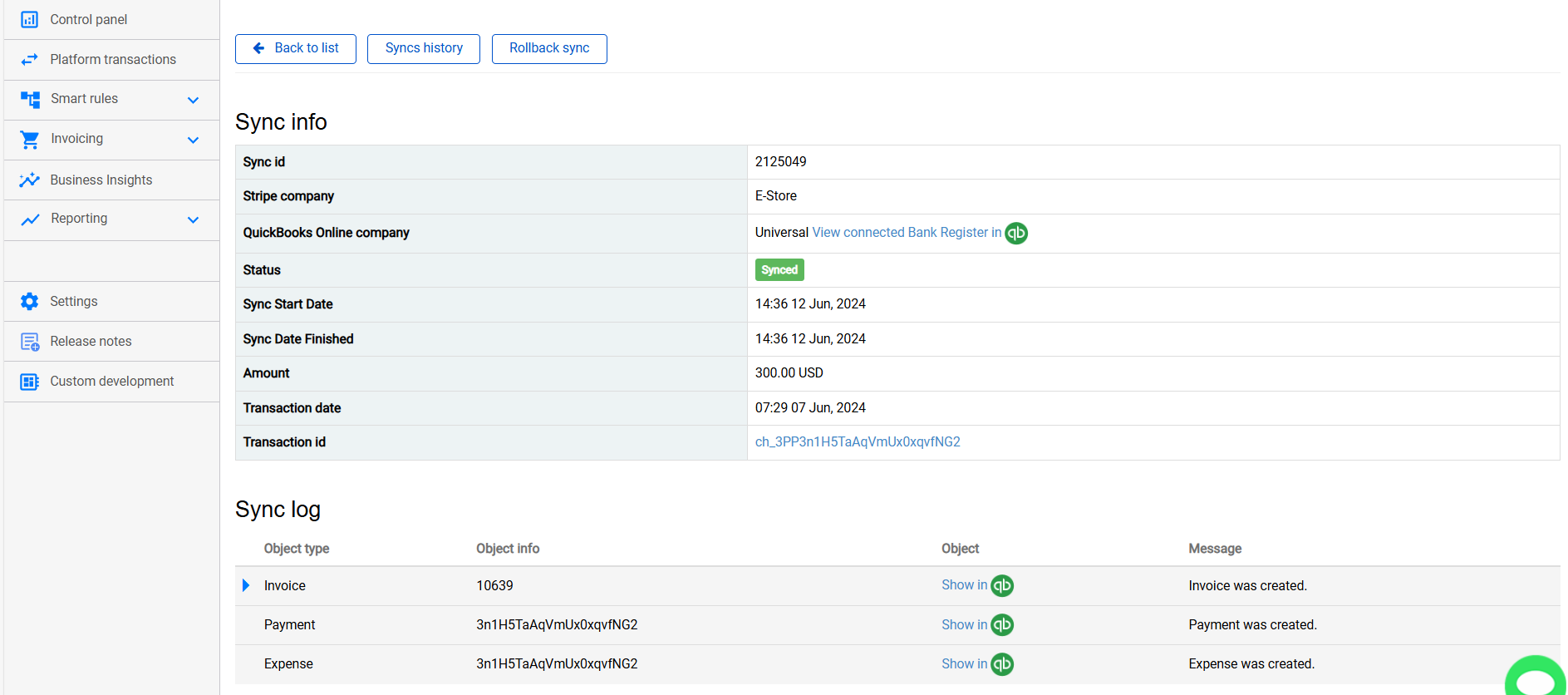

- Rollback and sync the transactions missing e-commerce order details again.

Screenshots are for Shopify and Stripe integrations, but the logic will be the same for other platforms.

Reason 2: your plan does not include the smart reconciliation feature, which allows fetching e-commerce order details to synced transactions.

Solution:

Upgrade to a plan that includes smart reconciliation. See current plan details here.

Reason 3: There are no internal details referring to an e-commerce store order in your payment platform transactions (e.g., checkout IDs, etc.)

Solution:

Contact your Payment Provider Support to figure out why these internal details are not fetched to the payment processor.

Reason 4: Restrictions on the e-commerce side (plugins, protecting systems, blocking addresses) that don’t allow fetching order details (mostly concerns WooCommerce users).

Solution: Check this guide on how to fix it.

Reach out to the Synder Team via online support chat, phone, or email with any questions you have – we’re always happy to help you!