Smart Reconciliation is an automated feature designed to accurately match payments received from various processors with the correct orders from your online store, ensuring precise accounting of your complex financial data without manual effort or double entry.

This guide covers:

- The core function of Smart Reconciliation

- The technical steps of the matching process

- Available user settings and controls

- Answers to common user inquiries

What Smart Reconciliation does

Smart Reconciliation allows automated management of financial and order data from two distinct integrations. It can be boiled down to two main functions:

1. Automated payment-to-order matching

It eliminates the need for manual reconciliation by linking incoming financial data from processors like:

- Stripe, PayPal, Square, Amazon Pay

with the corresponding orders from e-commerce platforms such as:

- Shopify, WooCommerce, BigCommerce, eBay

2. Enriching transaction records with full order details

Once a match is made, Synder enhances the payment record with comprehensive order information, moving beyond just a date and amount and making your online financial systems scalable. This enriched detail includes:

- Products and services: line-item specifics

- Customer information: name and contact details

- Financial details: shipping charges, taxes, discounts, and coupon codes

- Reference: the original order number and any associated notes

The benefits are clear and accurate bookkeeping. This detailed matching process makes reconciliation significantly easier since each payment clearly reflects the order sale it represents.

- Totals automatically align with your store data.

- Reduces the need for error correction and manual cleanup.

How Smart Reconciliation works

The data reconciliation process of two distinct integrations is executed in three steps:

Step 1: Identifying potential matches

When a new payment is received, Synder instantly searches your connected ecommerce store(s) for the corresponding order by cross-referencing email, name, payment amount, date/time, charge IDs, etc.

Step 2: Selecting the highest confidence match

If multiple similar orders are found, Synder employs a confidence-based prioritization system to select the most accurate match based on the date/time, payment gateway, and payment amount.

Step 3: Data enrichment

The payment record is updated with all available order information from the e-commerce platform, with operational efficiency.

Refund handling

When a refund occurs, Synder:

- Locates the original sale order.

- Links the refund to the correct original transaction.

- Accurately maps partial refunds if line-item details are provided by the platform.

What you can control

You can manage which payment processors are permitted to match transactions with specific stores.

Controlling system combinations

This control is crucial for users with complex setups, such as:

- Using multiple payment processors for a single store.

- Using a single payment processor across multiple stores.

Example control:

- Enable Stripe payments to match Your Store orders.

- Disable PayPal payments from matching with Your Store orders.

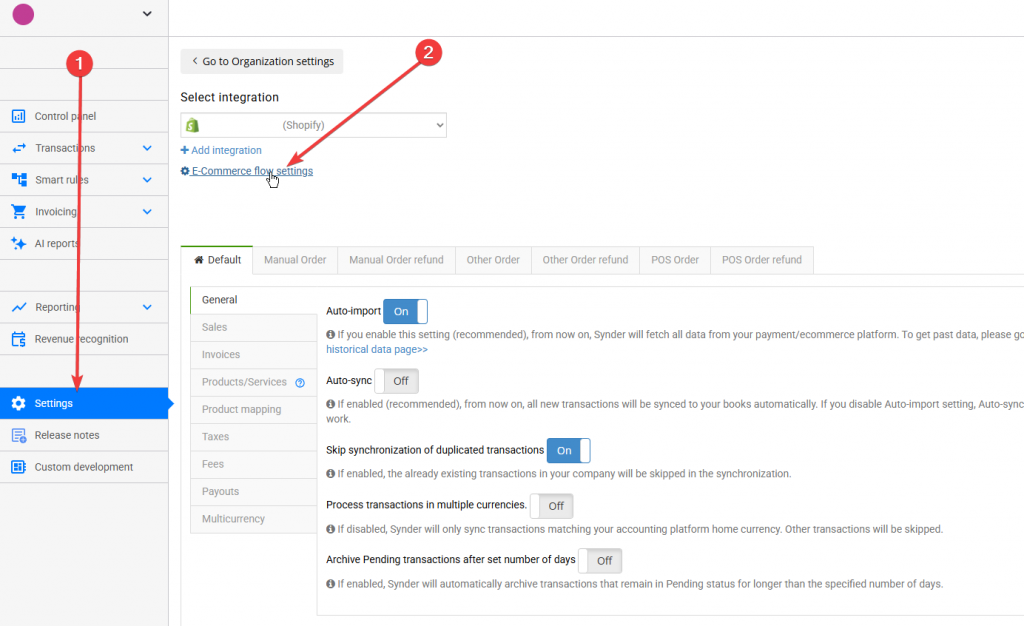

Accessing the settings

The Smart Reconciliation settings can be found by following these steps:

- Go to your main settings.

- Click E-commerce flow settings

Please note that the settings link appears only when:

- The ecommerce platform supports Smart Reconciliation (Shopify, WooCommerce, BigCommerce, eBay, Ecwid, Wix, Squarespace).

- At least one compatible payment processor is connected.

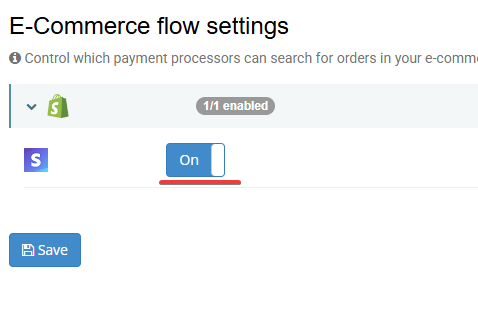

How the settings page works

- The page is organized by connected store.

- You will see an ON/OFF toggle for every connected payment processor.

- A counter shows the enabled combinations (e.g., “3/5 enabled”).

Crucial: Remember to click Save after making changes.

Default behaviour and impact of changes

Upon initial setup, all valid system combinations are enabled by default. If you turn a combination OFF, Synder will no longer attempt to match orders for that specific pair. In this case, payments will sync with processor-level details, separately from each integration, and will not be enriched with order information.

Please note that any changes you make will apply only to future syncs, while previously synced transactions will not be updated retroactively.

Common customer questions

Why isn’t my order being matched?

Check the following:

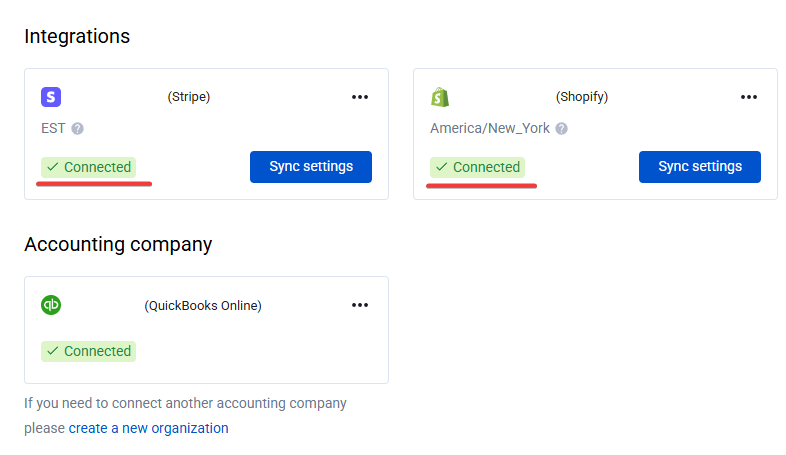

1. Is the e-commerce platform connected?

Navigate to Organization settings and make sure that your e-commerce platform (Shopify / WooCommerce / BigCommerce) connection is active.

2. Is the payment processor’s smart reconciliation enabled for this store?

Navigate to Ecommerce flow settings and check that the toggle is ON for the specific payment processor + ecommerce platform. If disabled, enable it and re-sync the transaction.

3. Is the order too old?

Make sure that the transaction age is within the search age period. It varies from integration to integration. For example:

- Shopify: up to 3 months back

- WooCommerce: up to 10 days back

4. Is the order cancelled?

Please check whether the order is cancelled. Such orders will not be considered for Smart Reconciliation.

5. Is the customer information different?

Ensure that the customer name or email between the payment and the order is the same. Otherwise, the order won’t be matched.

6. The wrong order was matched.

If an incorrect order has been matched, it’s usually because multiple transactions share the same amount and occurred on the same day, such as when a customer makes several purchases in quick succession. To resolve or prevent this, you can:

- Resync the incorrectly matched payment processor transactions individually.

- Contact Synder Team if resyncing did not help.

Order details are missing but the order ID is shown.

Synder found a reference to the order but could not retrieve the full order details. Possible causes include:

- The order was deleted from the e-commerce platform.

- API access has issues.

- There are temporary connectivity problems.

The sync log will show a warning such as “order details missed.” To resolve this matter, re-sync the transaction after confirming the connection is stable.

How do I stop a specific payment processor from matching with a store?

Navigate to E-commerce flow settings and find the e-commerce platform (for example, Shopify). Toggle OFF the payment processor you want to disable. Click Save Settings.

This affects future transactions only. Already synced transactions are not changed unless rolled back and resynced

Reach out to the Synder Team via online support chat, phone, or email with any questions you have – we’re always happy to help you!