- What is Colorado Retail Delivery Fee?

- How to reflect this fee properly in my books?

- How does Synder handle Colorado Retail Delivery Fee?

- How to change income account for an item in QuickBooks Online

- How to change income account for an item in Xero

What is Colorado Retail Delivery Fee?

On July 1, 2022, Colorado imposed a retail delivery fee of $0.27 on all deliveries by motor vehicle to a location in Colorado with at least one item of tangible personal property subject to state sales or use tax.

The retailer or marketplace facilitator that collects the sales or use tax on the tangible personal property sold and delivered, including delivery by a third party, is liable to collect and remit the retail delivery fee. Deliveries include when any taxable goods are mailed, shipped, or otherwise delivered by motor vehicle to a purchaser in Colorado.

So basically, the Colorado Retail Delivery Fee is a tax, but unlike most sales taxes, it is not percent-based but rather is a fixed amount you’re charged on every order that you ship to Colorado.

How to reflect this fee properly in my books?

Given that it is a ‘kind of’ tax, it should be reflected as a liability in your books. However, it is a flat fee so if you just put it into the sales tax field, the tax amount will be off by $0.27 compared to what it should be judging by the tax rate.

Is there a solution? Enter Synder.

How does Synder handle Colorado Retail Delivery Fee?

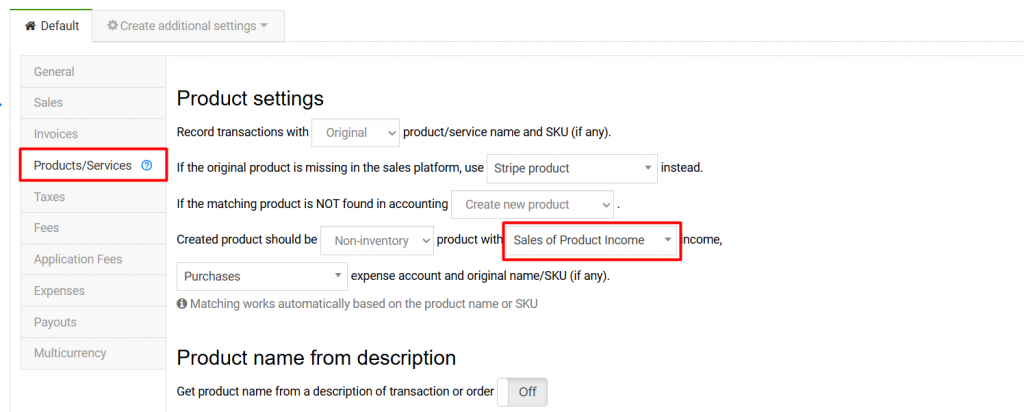

When Synder detects a Colorado Retail Delivery Fee in your transactions, it is synced as a non-taxable line item called ‘Colorado Retail Delivery Fee’. Upon creation, it is assigned the default income account in accordance with your Settings → Products/Services.

However, since it is liability, not income, you’d like to change the account for it. Below are the instructions how to do it for QuickBooks Online and Xero.

How to change income account for an item in QuickBooks Online

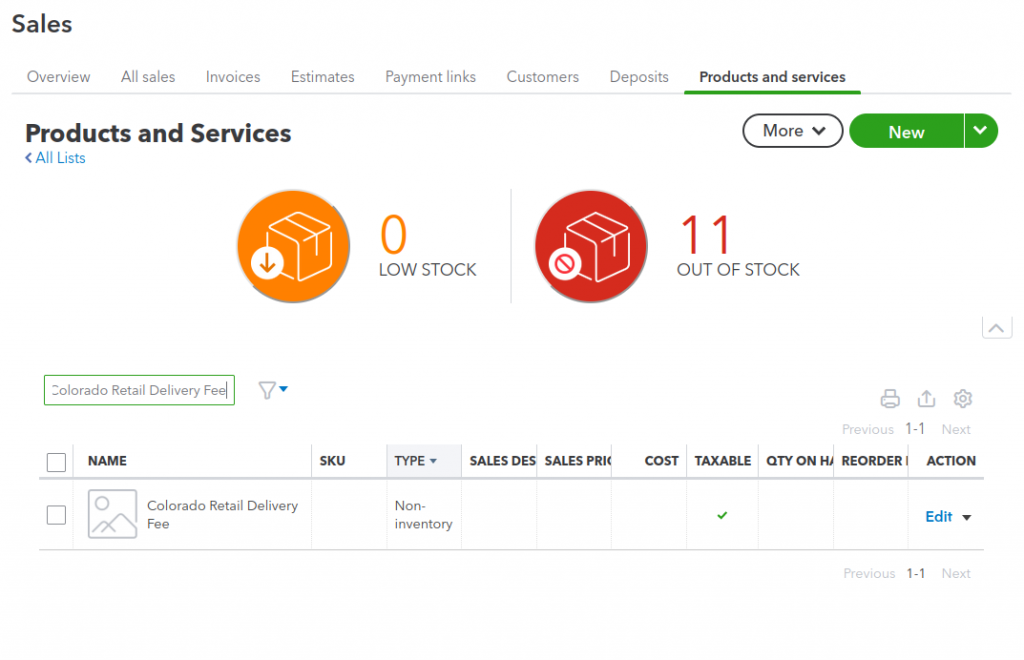

- In QuickBooks, navigate to Sales → Products and Services and find the item called ‘Colorado Retail Delivery Fee’ there.

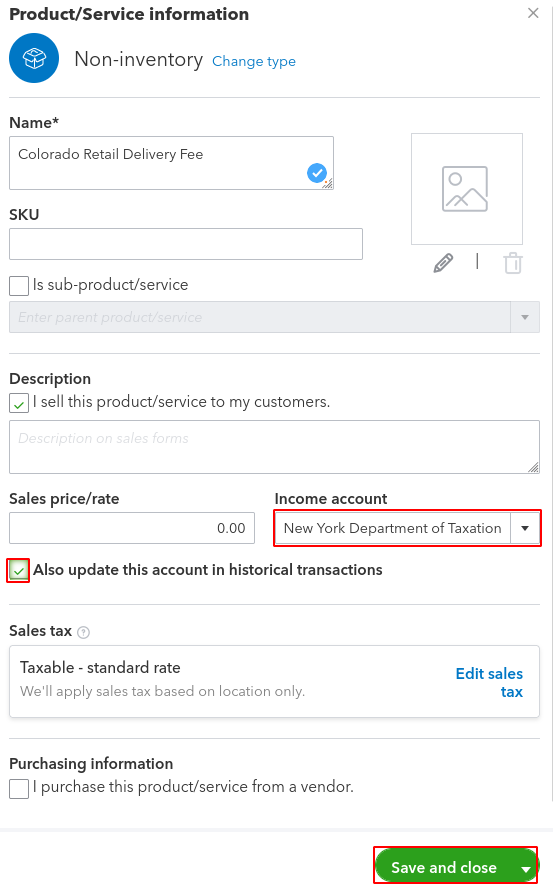

- Click

Editand look for the Income account setting there. - Select a liability account there. Note: you will not be able to select a system Sales Tax Payable account for it – this is a QuickBooks restriction. The solution is to create a subaccount under the Sales Tax Payable account for Colorado, and select it for this item. The balance of the subaccount will then be reflected in the total balance of the Colorado tax payable account.

- After you change the account, there will appear a checkbox ‘Also update this account in historical transactions’. Tick it if you’d like all instances where this fee appears in your transactions to appear on the newly-selected liability account.

Voilà, you’re amazing!

How to change income account for an item in Xero

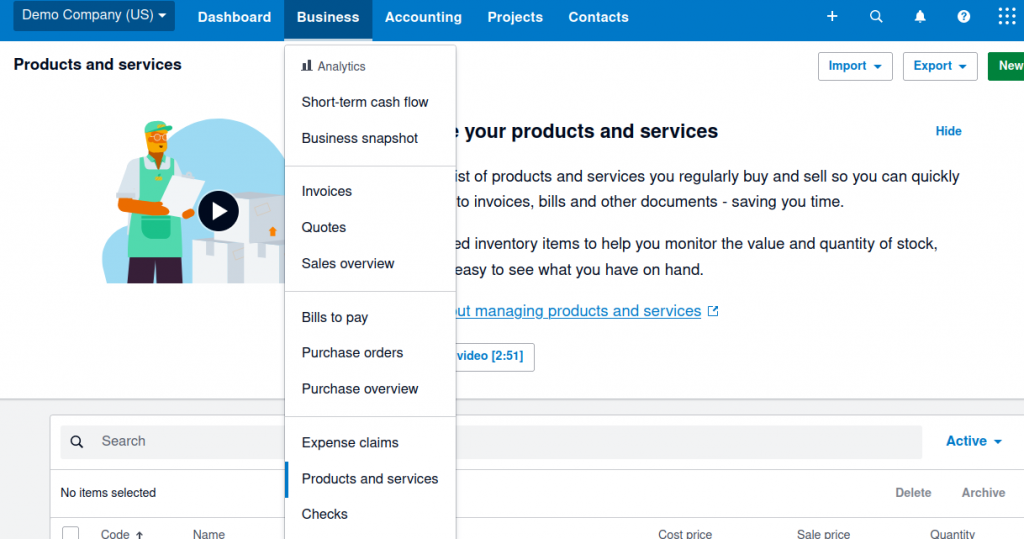

- In Xero, navigate to Business → Products and services.

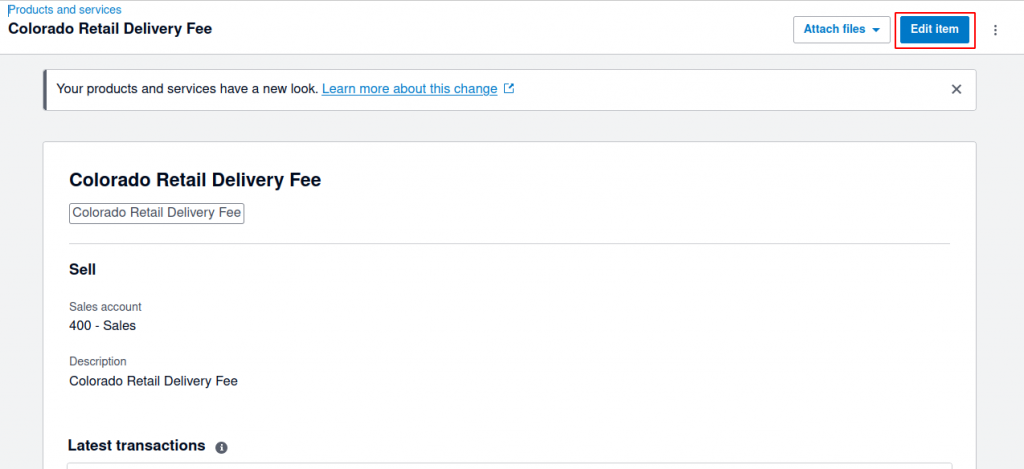

- Find the Colorado Retail Delivery Fee.

- Click Edit and change the account from the default one to the correct liability account.

- Rollback and re-sync transactions with this flat fee to apply the changes to all of them, if necessary.

Reach out to the Synder Team via online support chat, phone, or email with any questions you have – we’re always happy to help you!