- Main Reconciliation Flow

- If your clearing account does not reconcile

- Limitations

- When to contact support

- Best practices for ongoing reconciliation

Walmart is a sales-only integration in Synder. Synder syncs sales, refunds, and processing fees from Walmart. Payouts are not synced automatically and must be recorded manually.

This guide explains how to:

- Record Walmart payouts manually

- Walmart clearing account reconciliation

- Investigate unreconciled data

QuickBooks Online is used as an example. The same reconciliation approach applies to other supported accounting integrations and to other platforms that do not support payout syncing.

Use this guide if:

- You use Walmart with Synder

- Your clearing account does not reconcile or zero out automatically

- You need to record payouts manually

- You need to verify that Walmart transactions and accounting records match

After completing the steps, your Walmart clearing account will reconcile with sales, payouts, and fees reflected accurately in your books.

Walmart clearing account reconciliation flow

Complete the steps below in order.

Record payouts manually

Manual payout entries are required to clear the Walmart clearing account balance.

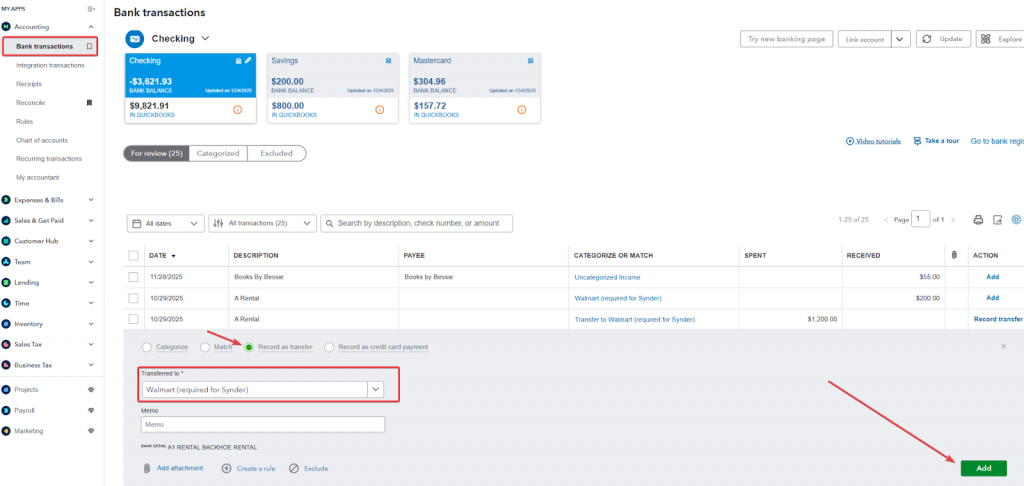

- Log in to QuickBooks Online and go to Accounting.

- Select Bank transactions, then select the bank statements account that receives Walmart payouts.

- On the For review tab, select the deposit to categorize.

- Select Record as transfer.

- In Transferred to, select the Walmart clearing account (required for Synder).

- Select Add.

Some accounting platforms support rules or other automation for posting payouts. Use the guide for integrations without payout support to configure automation.

When payouts are recorded and Synder data is synced, the clearing account balance should match the expected ending balance.

Some accounting platforms support rules or other automation for posting payouts. Use the guide for integrations without payout support to configure automation.

When payouts are recorded and Synder data is synced, the clearing account balance should match the expected ending balance.

Finish the Reconciliation

After a cycle closes, the Walmart and the QuickBooks Online clearing account balance will be zero.

Congratulations on reconciling your clearing!

Note: In Walmart, the entire amount is converted into a scheduled payout. When a balance remains, it indicates adjustments that Walmart applied to a later cycle and should be reviewed in subsequent settlements.

If your clearing account does not reconcile

If Walmart and QuickBooks Online balances do not match, the cause is commonly missing or unsynced transactions. Complete the checks below before moving to advanced comparison.

- In Synder, filter transactions by status.

- On the Platform transactions page, confirm all transactions in the reconciliation period are in Synced or Skipped status. Any other status indicates the transaction is not in the books or requires review and will prevent reconciliation.

- Confirm you are comparing the correct totals (for example, sales totals may differ from cash totals).

- If the platform was disconnected during the reconciliation period, run Historical Import on the Platform transactions page to retrieve missing transactions.

If balances still do not match, use Advanced comparison (Excel method) to identify specific discrepancies.

Step 1: Download required reports

- Download the Walmart detailed report for the same reconciliation period used when recording payouts and fees.

- Generate a Walmart clearing account report from QuickBooks Online for the same reconciliation period.

Follow this link to find the exact steps on how to generate a clearing account report in QuickBooks Online and how to find this sum.

Step 2: Prepare your Excel data for comparison

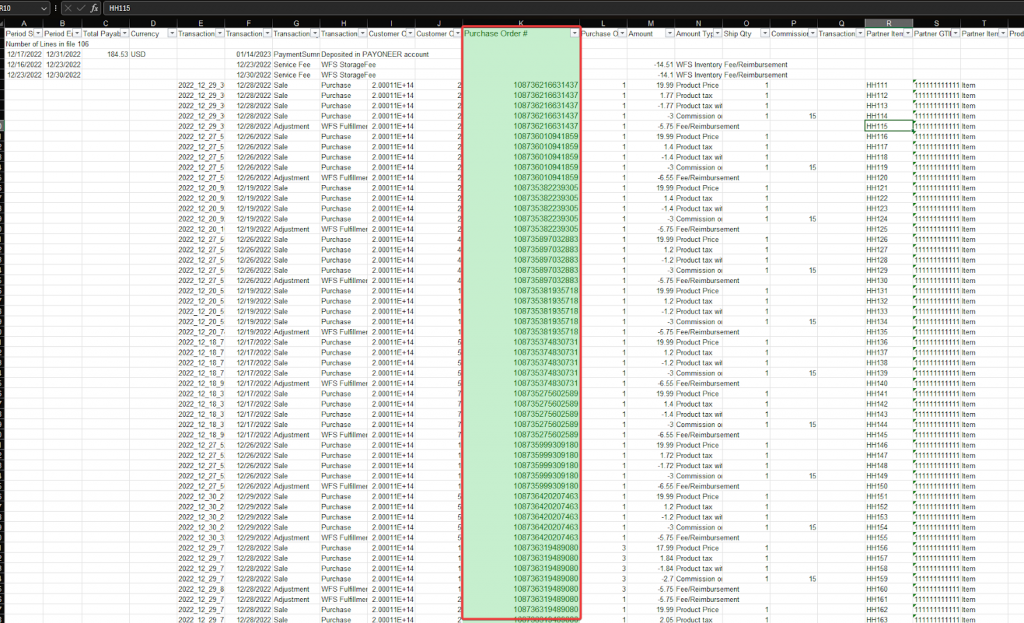

Walmart report includes a lot of transaction details that you don’t need for comparison.

Copy values of Purchase Order # and Amount columns into a new sheet. This will be our Walmart clean report.

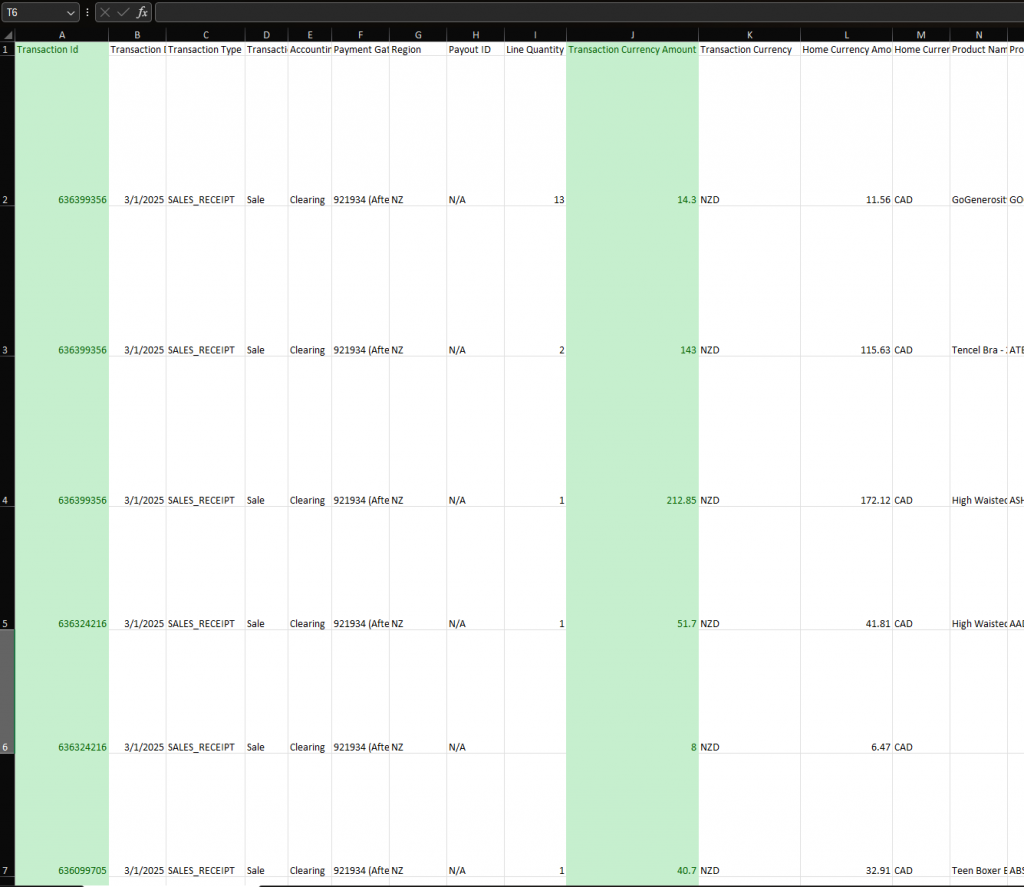

QuickBooks Online register report also has a lot of information that we don’t need. Lines we should focus on are:

- Transaction ID

- Transaction Currency Amount

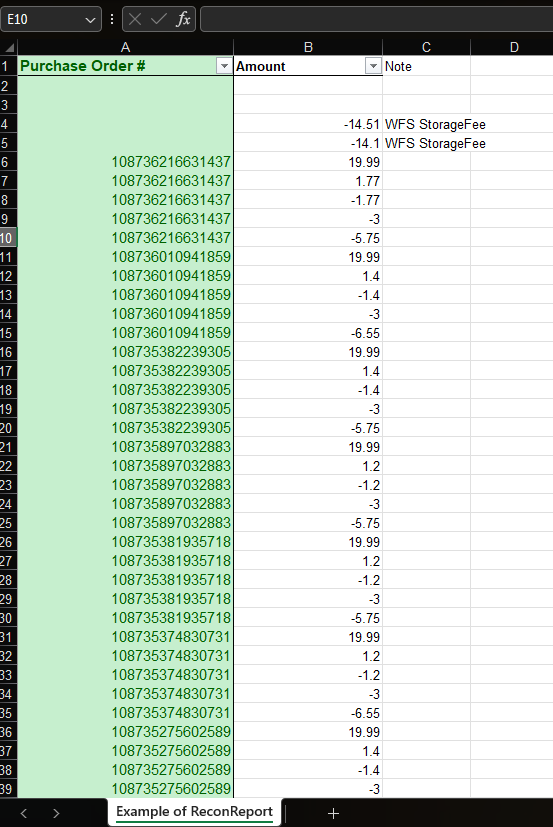

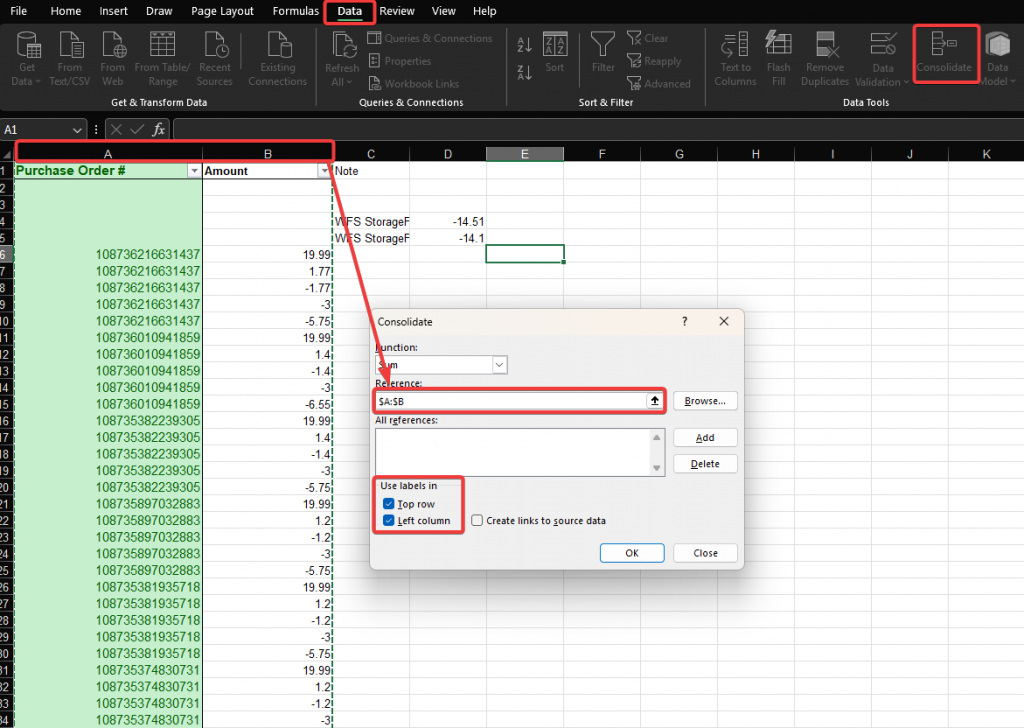

Step 3: Consolidate multiple lines into one entry per transaction

Walmart transactions may appear as multiple line items in QuickBooks Online (for example, one line per product or fee). Consolidate to a single row per transaction with the total amount.

- Select an empty cell in an empty row.

- Go to Data → Consolidate.

- In Reference, select both columns A and B (ID and amount columns).

- Select + to add the reference.

- In Use labels in, select both:

- Top row

- Left column

- Top row

- Select OK.

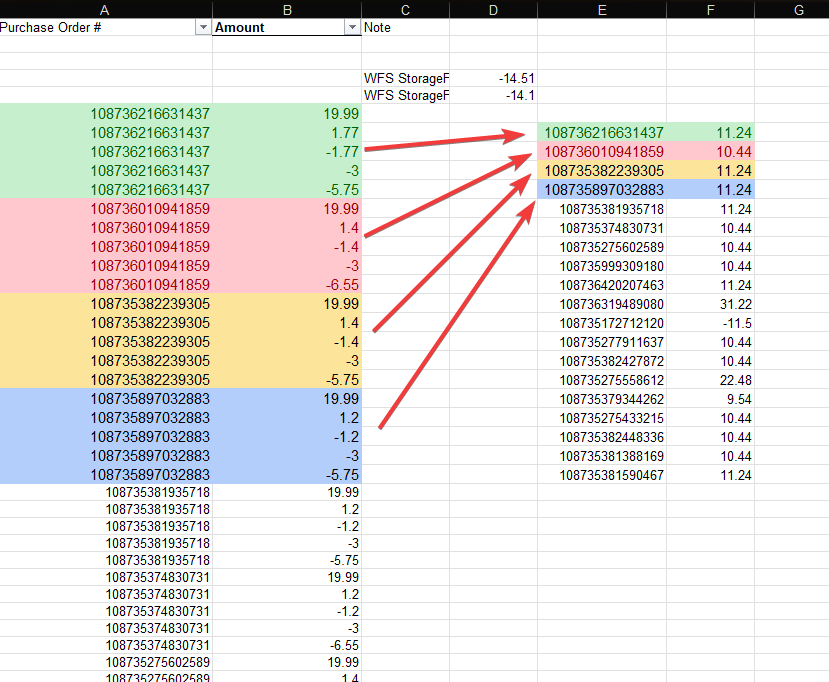

As a result, Excel will group multiple transactions with the same ID into one and sum their amounts. Here’s how it should look:

Repeat the same consolidation steps for the Walmart report if the Walmart data also contains multiple lines per transaction.

Step 4: Organize your data

1. Create a new sheet for your Comparison Analysis.

2. In your Comparison Analysis sheet, create columns for:

- Walmart Transaction ID.

- Walmart Amount

Copy and paste columns from your Clean Walmart report. - QuickBooks Online Transaction ID

- QuickBooks Online Transaction Amount

Copy and paste columns from your Clean QuickBooks Online report. - Lookup

- Difference

Here’s how the end result should look:

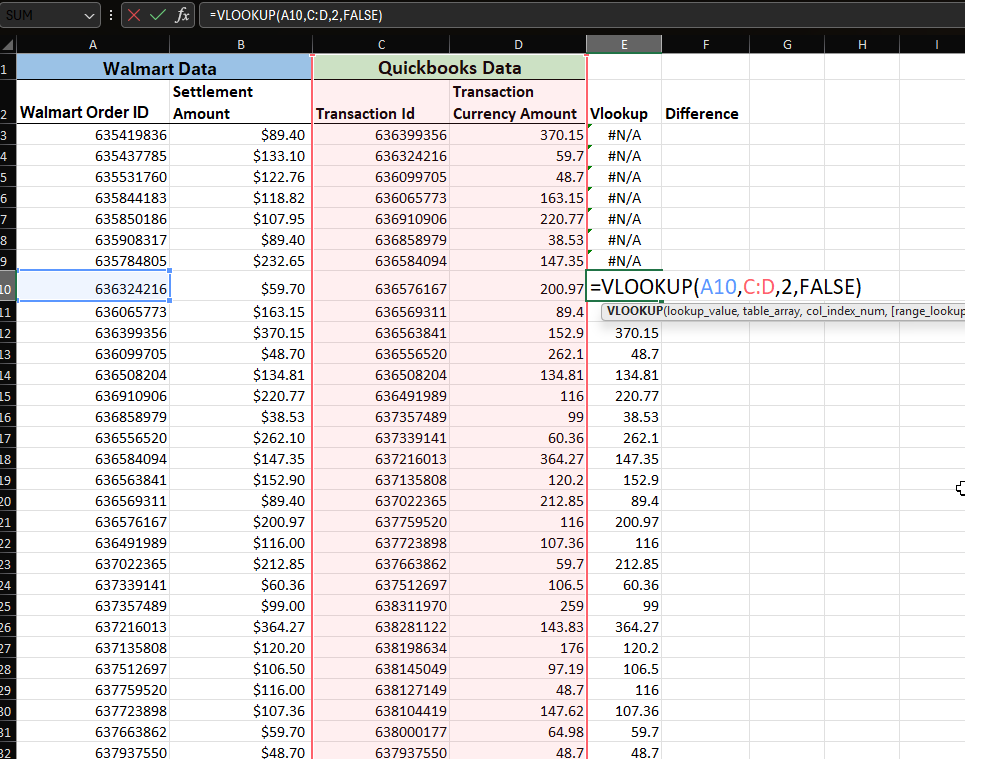

Step 5: Compare data using VLOOKUP

Our objective is to match transaction amounts from Walmart and QuickBooks Online that have shared IDs. This process helps us identify any discrepancies in amounts or missing transactions within QuickBooks Online.

- In the Lookup column, use:

- =VLOOKUP(A3,C:D,2,FALSE)

- =VLOOKUP(A3,C:D,2,FALSE)

- Breaking down the formula:

- A3 = Walmart transaction ID

- C:D = QuickBooks Online data range (ID in column C, amount in column D)

- 2 = returns the amount from the second column in the range

- FALSE = exact match

- A3 = Walmart transaction ID

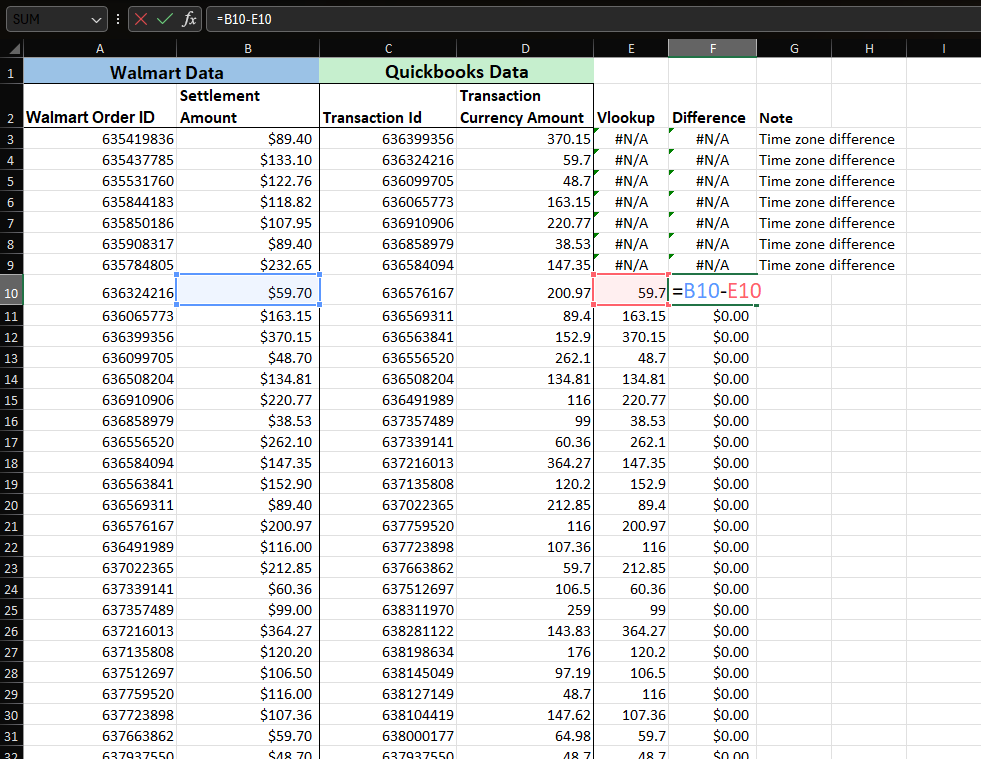

In the Difference column, subtract the looked-up QuickBooks Online amount from the Walmart amount.

2. Identify discrepancies. Perfect matches should show 0 in the difference column.

Discrepancy indicators:

- Negative value: QuickBooks Online amount is higher than the Walmart amount

- Positive value: Walmart amount is higher than the QuickBooks Online amount

- #N/A: Transaction ID exists in Walmart but not in QuickBooks Online

Step 6: Address common discrepancies

1. Missing transactions in QuickBooks Online

Possible causes:

- Transaction failed to sync due to network issues

- Transaction filtered out by Synder settings

- Unsupported transaction type

Actions to take:

- Check Synder’s sync logs for failed transactions.

- Force a manual sync in Synder for the missing period.

- Confirm timezone settings match between Walmart reports (PST/UTC) and Synder.

2. Amount differences

Possible causes:

- Currency conversion differences between marketplaces

- Partial refunds not properly matched to original orders

- Difference in fee calculations between Walmart reports and Synder processing

Actions to take:

- Check for currency conversions if selling in multiple countries.

- Look for reserve balance movements in the same period.

- Check for related adjustment entries in subsequent periods.

3. Extra transactions in QuickBooks Online

Possible causes:

- Manual entries created by your accounting team

- Duplicate syncing from multiple sync attempts

- Journal entries or adjustments made outside of Synder

- Starting balance entries when first setting up clearing accounts

Actions to take:

- Check if descriptions indicate manual entry.

- Verify transaction source in QuickBooks Online (look for “Synder” in descriptions).

- Check for duplicate Walmart connections in Synder.

- Review any manual clearing account adjustments.

Limitations

- Walmart integration does not support payout syncing. Payouts must be recorded manually.

- Synder does not fetch fees and refunds for Walmart Canada. Import this information manually.

When to contact support

Contact support when you identify specific transactions causing reconciliation issues and cannot resolve them.

Include the following in your request:

- Reconciliation period (start and end dates)

- Specific transaction IDs

- Screenshots of the transactions in Walmart and QuickBooks Online

- Summary of findings (for example, “5 missing fulfillment fees totaling $47.50”)

- Currency and marketplace details, if applicable

- Steps already completed

Best practices for ongoing reconciliation

- Reconcile monthly.

- Monitor multiple currency clearing accounts when selling internationally.

- Review Synder alerts for failed sync transactions.

- Keep timezone settings consistent across Walmart, Synder, and reconciliation periods.

- Document manual entries made to clearing accounts.

- Review unsupported transaction types periodically.

A consistent reconciliation routine saves time, reduces errors, and keeps your finances audit-ready. By following these best practices, you’ll avoid surprises down the line and ensure your clearing accounts stay clean and reliable month after month.

Reach out to Synder Team via online support chat or email with any questions you have – we are always happy to help you!