This guide explains how to configure sales tax tracking in Synder Summary Sync when posting summaries to QuickBooks Online (US and non-US versions).

Use this guide if:

- You use Summary Sync in Synder.

- Sales tax must appear correctly in QuickBooks.

- You use QuickBooks Online (US, Canada, UK, AU, NZ, etc.)

The configuration depends on your QuickBooks region.

For US QuickBooks

QuickBooks Online (US) does not allow tax codes in journal entries. Synder posts sales tax amounts directly to Sales Tax Payable liability accounts.

If you collect tax in multiple states, configure one of the following:

- Manual Groups

- Group by region

Option 1: Manual Groups

Use Manual Groups for granular mapping based on custom conditions.

You can filter transactions by:

- ZIP code

- City

- Customer

Set up mapping groups according to your required conditions. Refer to this guide for step-by-step instructions on creating mapping groups.

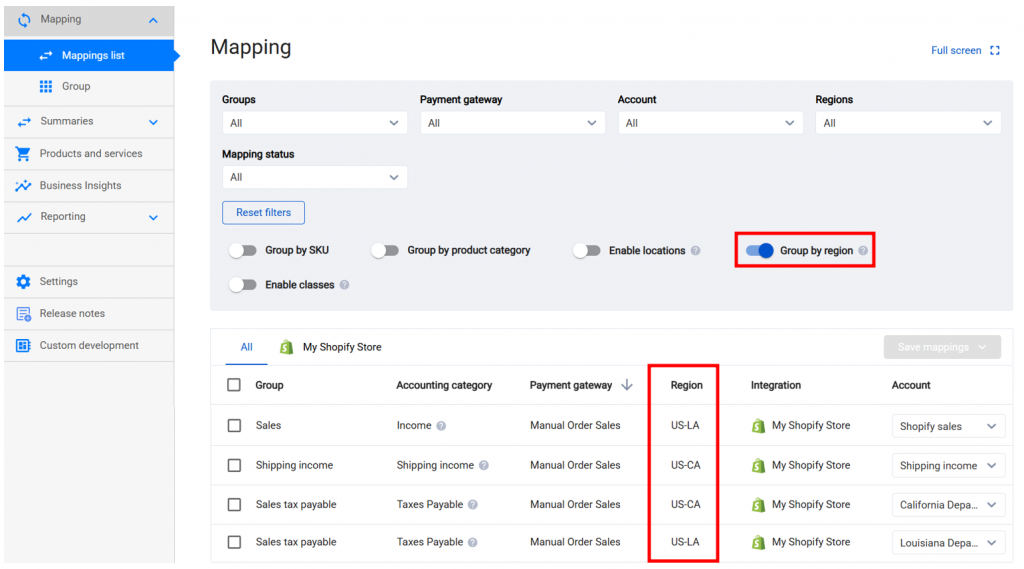

Option 2: Enable Group by region

Use this option to split tax by state automatically.

- Click on the Mapping dropdown in the left-side menu.

- Click the Mappings list.

- Enable Group by region.

- Assign a dedicated Sales Tax Payable liability account for each state.

- Save changes.

With this configuration, Synder will:

- Use the shipping address to determine the region.

- Post tax amounts directly to state-specific liability accounts.

- Split tax correctly if multiple states appear in one summary.

All newly generated summaries will reflect the updated mapping. Rebuild the existing summaries to reflect the updated mapping. Refer to this guide on how to rebuild.

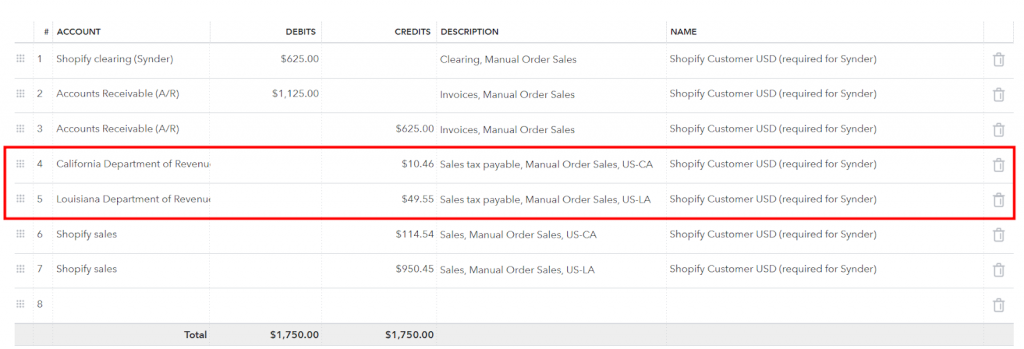

Example Journal Entry with regional mapping

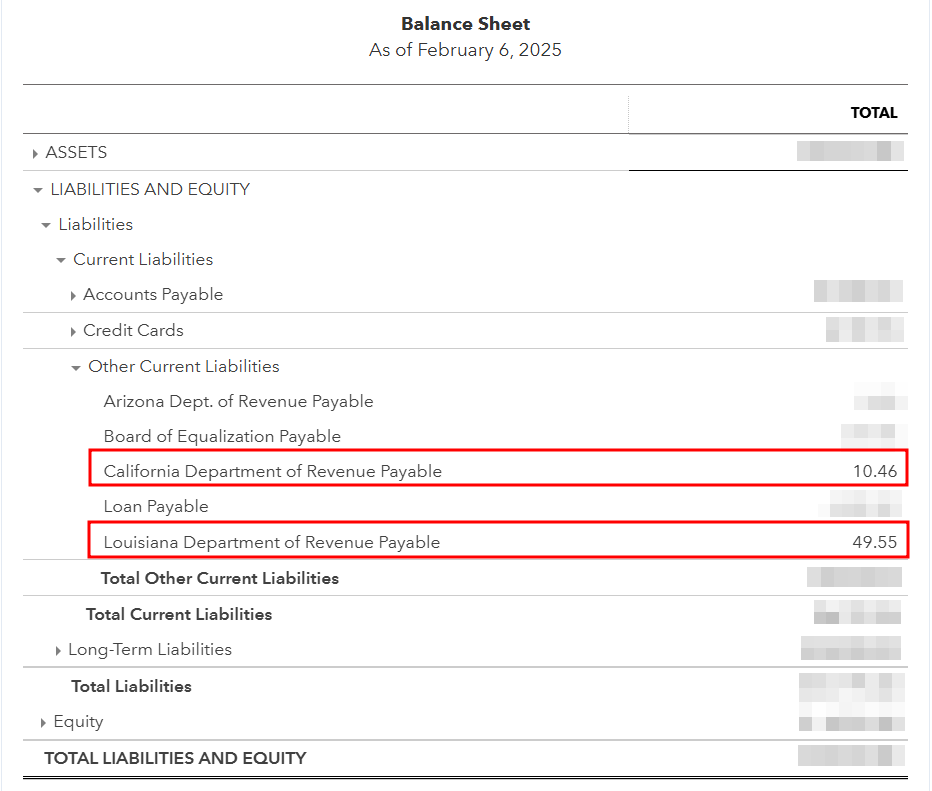

Balance Sheet view

Tax amounts appear under Other Current Liabilities.

Note: Enabling Group by region also groups Sales, Refunds, Shipping income, and other mapping lines by region.

For Non-US QuickBooks (Canada, UK, AU, NZ, etc.)

Non-US QuickBooks allows tax codes in journal entries. Choose one of the following configurations:

- Option 1 — Tax tracking enabled

- Option 2 — Tax tracking disabled

Option 1: Tax Tracking Enabled

Use this setup if you want tax to appear in QuickBooks Tax Reports.

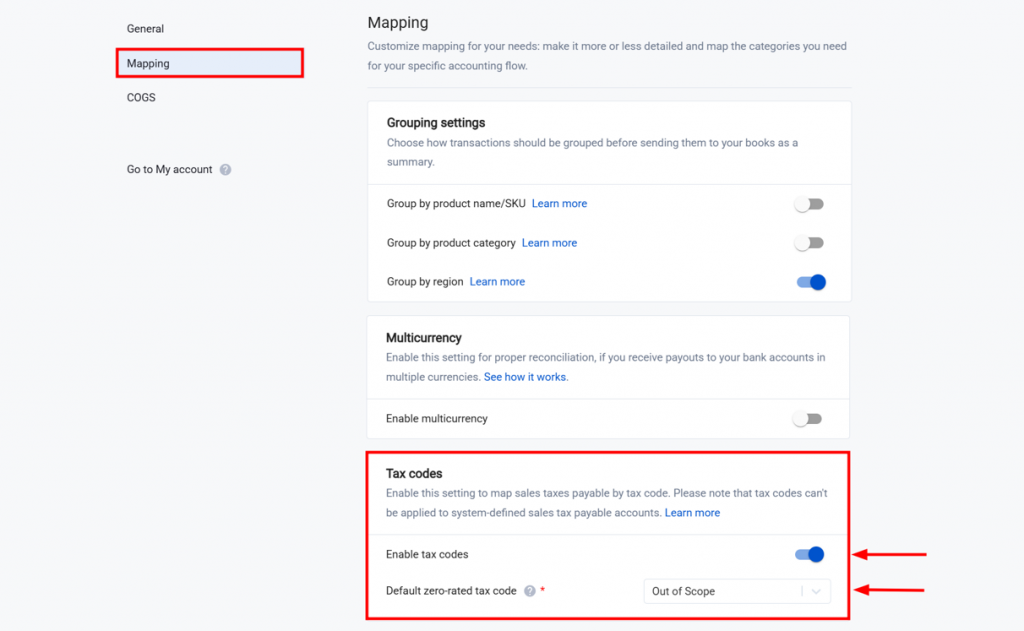

Step 1: Enable Tax Codes

- Go to Settings.

- Move to the Mapping tab.

- Scroll down to Tax codes.

- Enable tax codes.

- Assign a default zero-rated tax code.

Step 2: Assign Tax Codes to Mapping Lines

- Open the Mappings list from the left-side menu.

- Assign tax codes to Sales Tax Payable lines.

- Map Sales Tax Payable lines to preferred accounts.

- Recommended: Income → Other income (e.g., “Sales Tax Clearing”).

- Assign zero-rated tax codes to the rest non-tax lines.

- Save changes.

If no zero-rated code is assigned to non-tax lines, Synder uses the default zero-rated tax code from Settings.

New summaries will reflect the tax codes. Rebuild the existing summaries to reflect the updated mapping. Refer to this guide on how to rebuild Summaries.

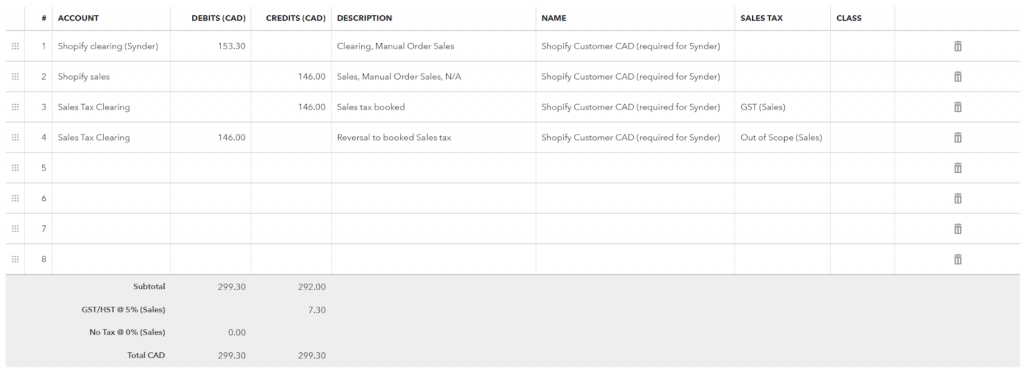

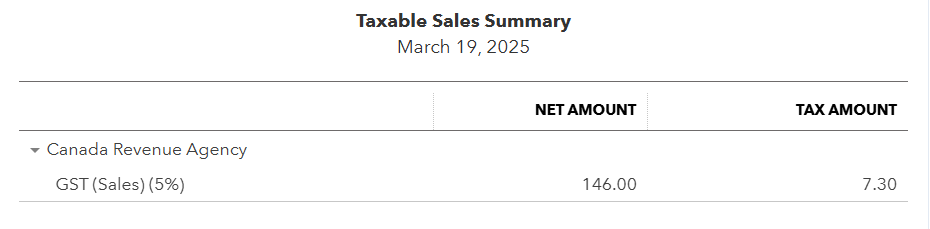

What You’ll See in the Journal Entry

Example:

- Item total: 146 CAD

- Tax (5% GST): 7.30 CAD

- Total: 153.30 CAD

Synder:

- Creates lines for account mapped to the Sales Tax Payable line.

- Applies tax codes.

- Keeps income unchanged.

- Ensures tax appears in Tax Reports.

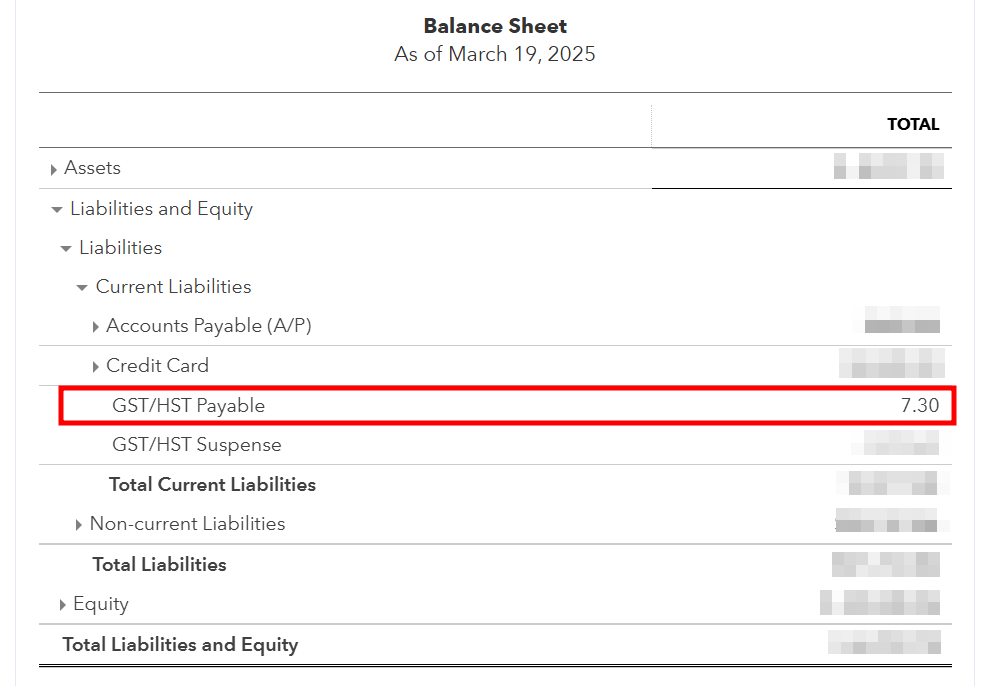

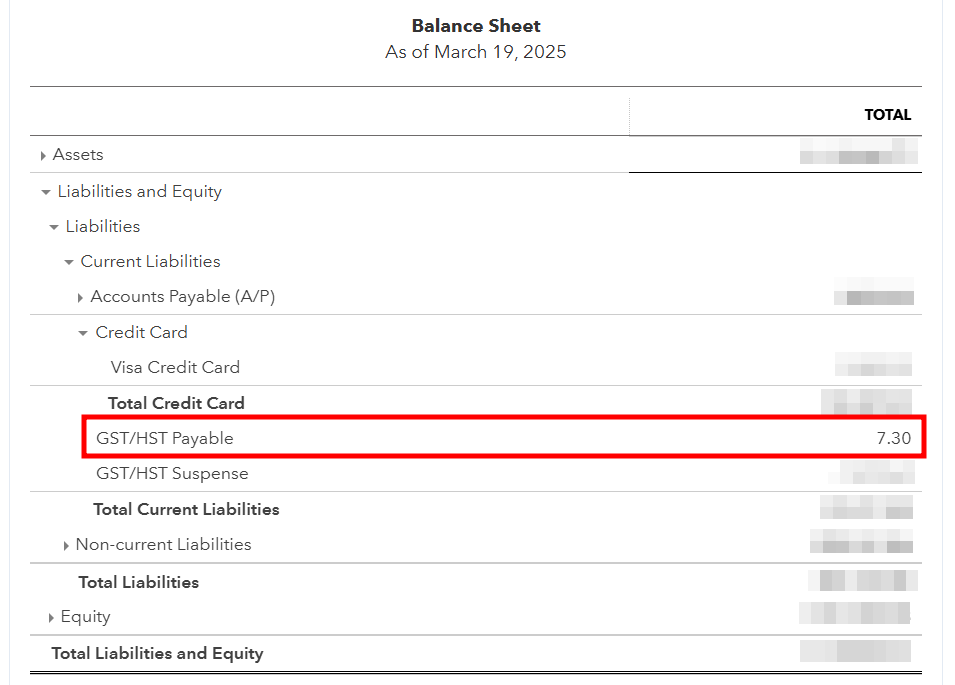

Balance Sheet view:

- Tax appears under the selected liability or clearing account.

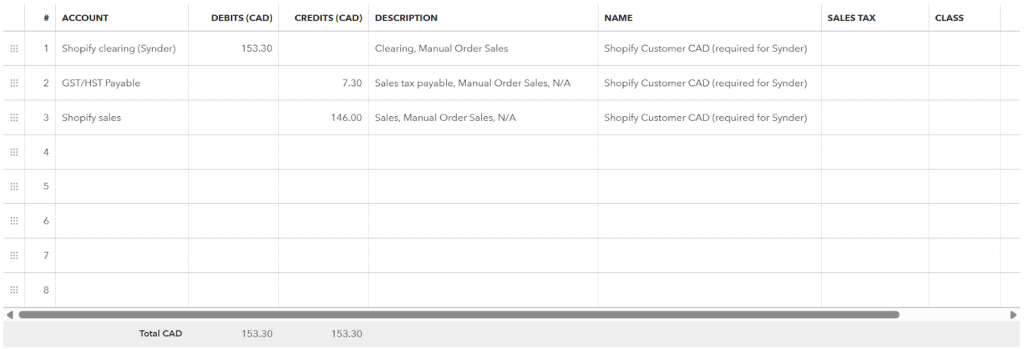

Option 2: Tax Tracking Disabled

Use this setup if tax reporting in QuickBooks is not required and only liability balances must be recorded.

Tax tracking is disabled by default. With this feature disabled:

- Synder posts total tax directly to Sales Tax Payable (liability) account.

- Recommended account type: Current Liabilities.

- No tax codes are applied.

- Tax will NOT appear in QuickBooks Tax Reports.

- Balance Sheet still reflects tax owed correctly.

Example Journal Entry (Tax Tracking Disabled)

Balance Sheet reflecting the correct tax owed

Important notes

- For Multi-State Mapping, enable Group by region or use the Groups feature for more granular mapping. Refer to this guide for step-by-step instructions on how to set up mapping groups.

- After enabling Group by region, you may encounter following regions:

- “Unknown” – Missing or unrecognized state/country information.

- “N/A” – No shipping address is available(e.g., for adjustments).

- Do NOT select system-generated tax liability accounts when you have Tracking Taxes enabled (like GST/HST Payable). QuickBooks does not allow tax codes on them and sync will fail.

- Tax codes on expenses are not supported on Summary sync. Consider using the per-transaction synchronization mode to apply taxes to expenses/fees. Refer to this guide to understand how Synder handles taxes on fees in per-transaction sync mode.

FAQ

- I don’t see the desired tax code in the dropdown to choose. Why?

This can happen if the tax code is not set up in QuickBooks. Create the tax code in QuickBooks first. Then select it in Synder mapping. - Why do my summaries fail with the error message “Cannot assign tax code on the Sales Tax account”?

Synder attempted to apply a tax code to a system-generated tax liability account (for example, GST/HST Payable).

QuickBooks does not allow tax codes on these. Map taxable sales amounts to a non‑payable clearing account (recommended: an Income: Other income account, such as “Sales Tax Clearing”) to avoid failure.

Reach out to Synder Team via online support chat or email with any questions you have – we are always happy to help you!