Afterpay is a sales-only integration in Synder. Synder syncs sales and refunds from Afterpay, but payouts and processing fees are not synced automatically and must be recorded manually.

This guide explains how to:

- Manually account for Afterpay payouts

- Manually record Afterpay processing fees

- Reconcile your Afterpay clearing account

- Troubleshoot discrepancies if they arise

QuickBooks Online is used as an example, but the same reconciliation approach applies to other supported accounting integrations and to other payment platforms that do not support payout and fee syncing.

Use this guide if:

- You use Afterpay with Synder

- Your clearing account does not reconcile or zero out automatically

- You need to account for payouts and fees manually

- You want to verify that Afterpay and accounting records match

After completing this guide, your Afterpay clearing account will reconcile correctly, with all sales, payouts, and fees accurately reflected in your books.

Main Reconciliation Flow

To reconcile your Afterpay clearing account, complete the steps below in the order given.

For most cases, reconciliation is complete after recording payouts and fees.

Step 1: Add Payouts Manually:

Regular manual entries are crucial for proper reconciliation of integrations without fee and payout support. Without it, the clearing account balance won’t be cleared. We’ll highlight a few efficient ways of processing these manual entries.

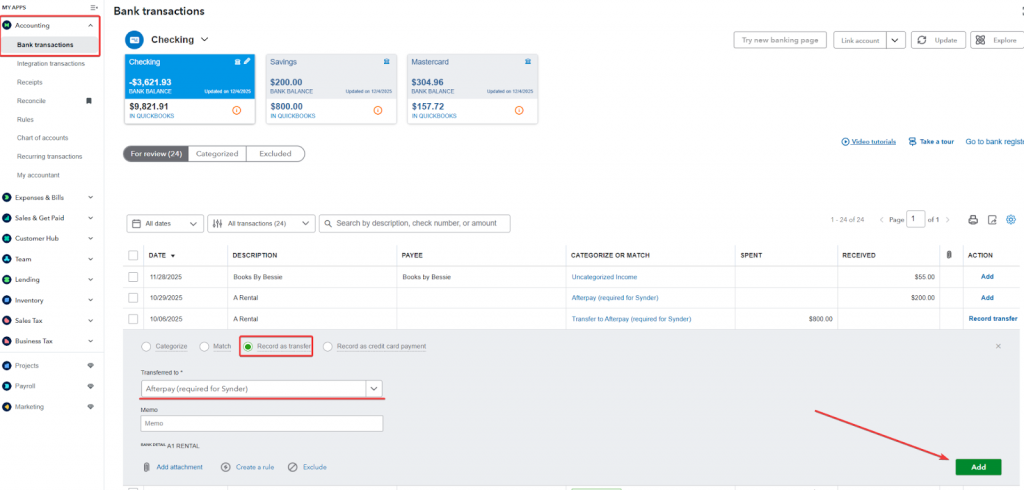

- Log in to QuickBooks Online and navigate to the Accounting tab.

- Click on Bank Transactions and select the bank account to which your integration transfers funds.

- Under the For review tab, click on a Deposit you’d like to categorize.

- Go to Record as transfer and select Transferred to Afterpay (required for Synder) account.

- Click on Add.

QuickBooks Online and some other accounting software have tools that can help you automate posting Payouts. We suggest reviewing this guide about integrations without payout support.

Step 2: Add expenses manually

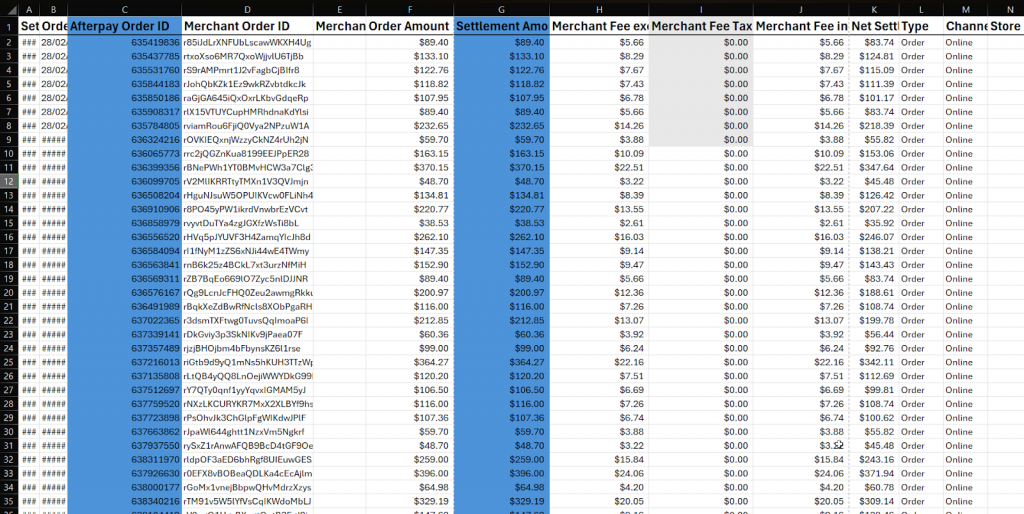

Tax and expense information can be found in the Afterpay reports. Here’s how:

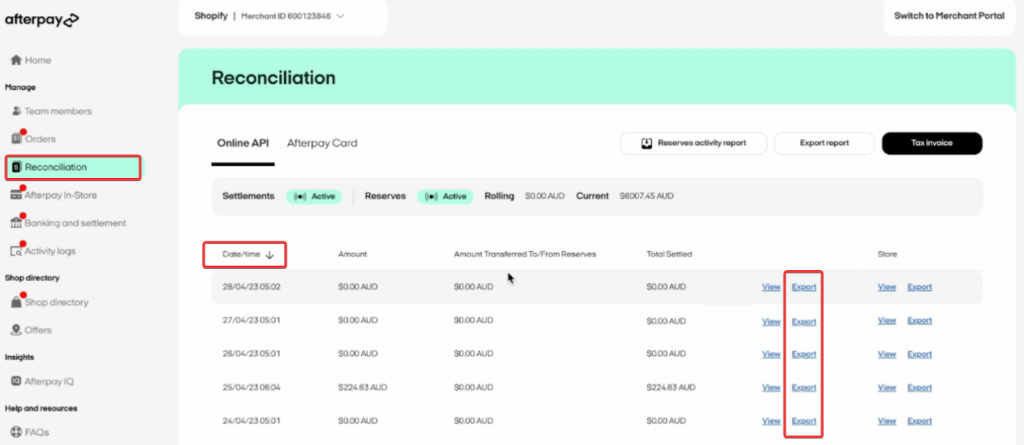

- Log in to your Afterpay Merchant Portal (https://merchant.afterpay.com).

- Go to the Reports or Settlements section (usually in the left-hand menu).

- Use the date filter to select your desired settlement period.

- Click Export.

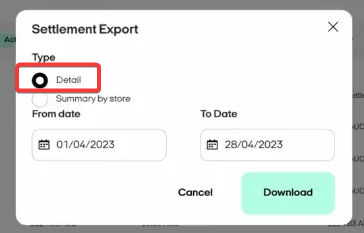

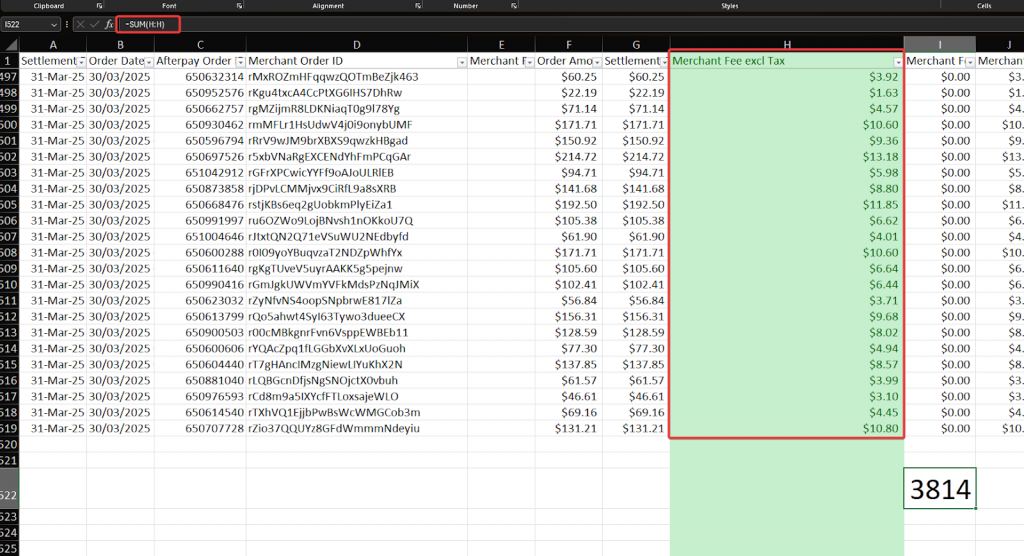

- Select a Detailed type and click Download (often as a CSV or Excel file).

- Save the file to your device.

- Open downloaded report in Excel.

- Find Merchant Fee excl Tax column.

- Sum all the values within that column with a formula:

=SUM(H:H), where H is the column where Merchant Fee excl Tax is located.

The number you received is your total Afterpay fee for the selected month. Record it in your books by creating a journal entry: debit the Afterpay fees expense account and credit the Afterpay (required for Synder) Clearing account for that amount.

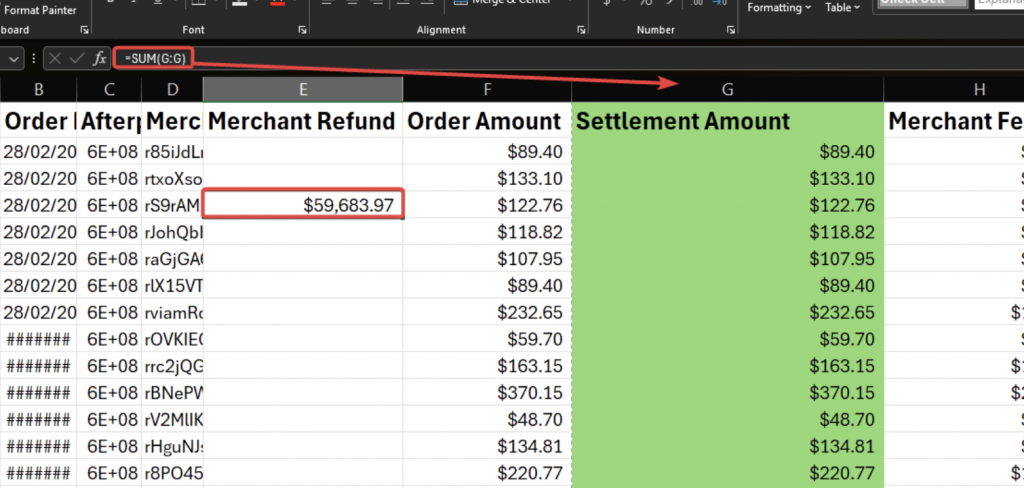

Step 3: Sum total Afterpay sales

From the same report, sum the Settlement Amount column using =SUM(G:G) function.

Step 4: Compare Afterpay Settlement Amount sum to QuickBooks report

By following this guide, find out the clearing account amounts from your QuicBooks.

https://docs.google.com/document/d/1sO0HsIj4Fox0U3V56Ni-wwmLYwBcd8dtghiUipDQNhQ/edit?tab=t.0

The amounts you will see in the QBO clearing report will match your Afterpay Settlement amount, meaning the reconciliation was successful. Congratulations!

If Your Clearing Account Does Not Reconcile

If the balances between your Afterpay and Quickbooks report don’t match, it’s often caused by unsynchronized transactions. Follow the steps below to make sure that Synder has successfully synced your Afterpay data:

- Go to Synder and filter transactions by status. Make sure that all the transactions within your reconciliation period are in statuses: Synced or Skipped on the Platform transactions page. All the other statuses indicate that the transaction is not in your books or needs additional checking. As long as such transactions are present, your books won’t reconcile.

- Make sure you are comparing the right numbers (sales might not equal cash, for example). It’s important to use the right numbers for reconciliation and comparison.

- If your platform was disconnected within the reconciliation period, make sure you run a Historical Import on the Platform transactions page to retrieve any missing transactions.

If you’ve checked all the basics but the discrepancy still persists, follow the steps below to download the report from Afterpay and compare it with the report from QuickBooks. This will help identify the transactions causing differences.

Step 1: Download required reports

You should already have a report from Afterpay if you’ve followed the main reconciliation flow. If not, please download it by following the steps above.

We will also need a report of the AfterPay clearing account from your accounting software.

Follow this link to find the exact steps on how to generate a clearing account report in QuickBooks Online

Note: If your QuickBooks clearing account has tens of thousands of transactions, it might not download the full dataset. After downloading one of the reports above, check for data completeness. If the report is missing data, try the alternative download method.

Step 2: Prepare your Excel data for comparison

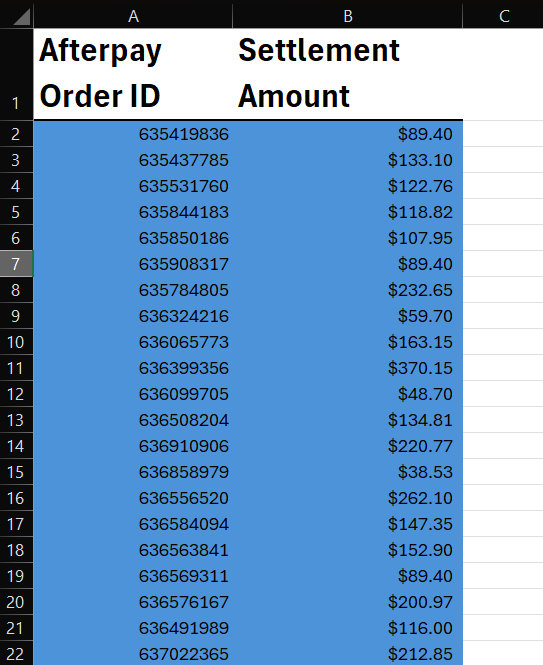

Afterpay report includes a lot of transaction details that you dont need for comparison.

Create a new clean Afterpay report by copying the values of Afterpay Order ID and Settlement Amount columns into a new sheet..

Here’s how your clean report should look after a cleanup.

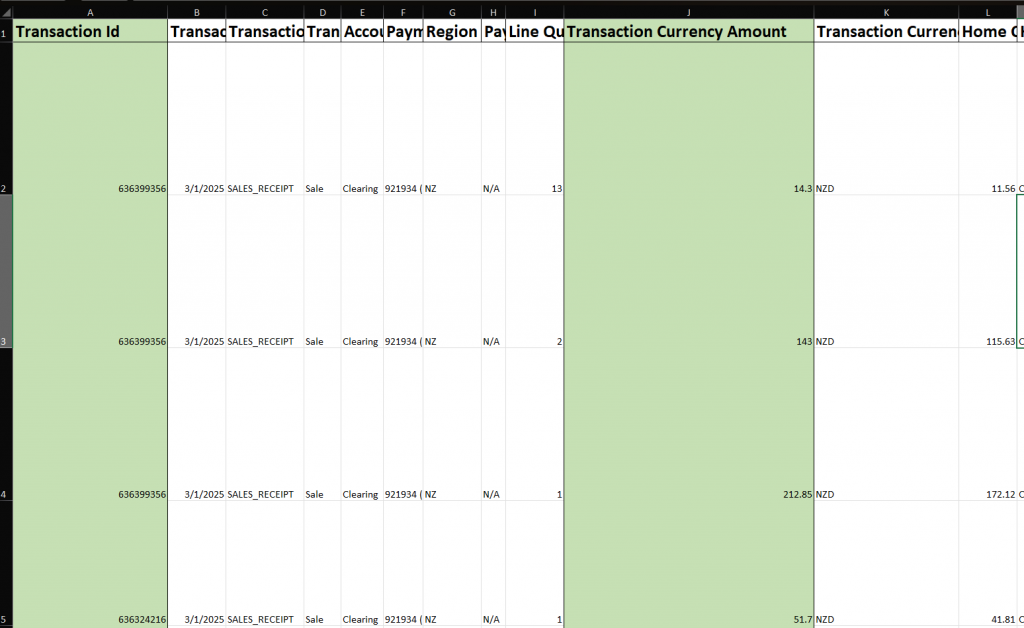

QuickBooks register report also has a lot of information that we don’t need. Perform the same steps, but with Transaction ID and Transaction Currency amount lines.

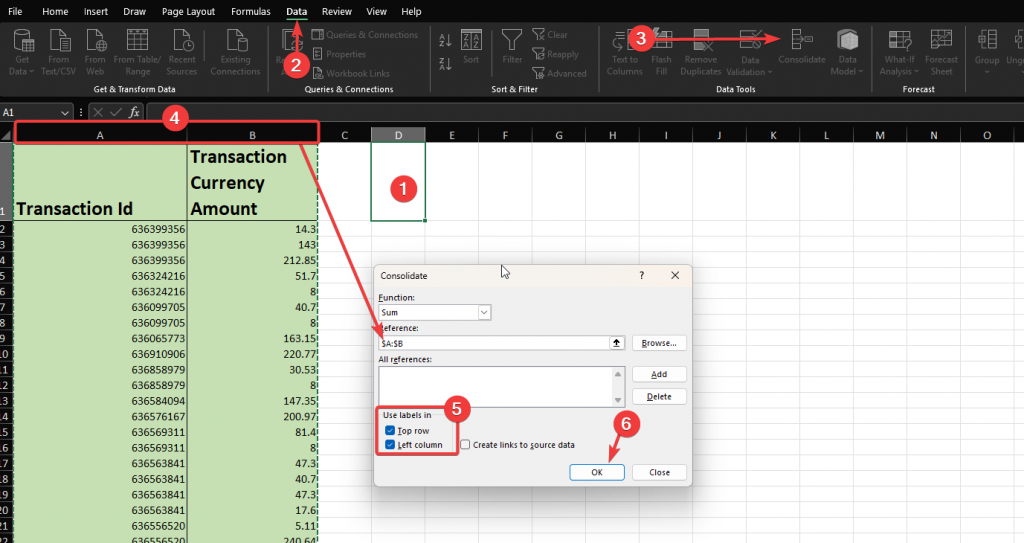

Step 3: Consolidate multiple lines into one entry per transaction

Afterpay transactions may appear as multiple line items in QuickBooks Online (e.g., one per product or fee). For accurate reconciliation, you need to consolidate these into a single row per transaction, showing the total amount. Use Excel’s Consolidate function:

- Click on a empty cell in an empty row.

- Go to Data → Consolidate

- In the reference box, select both columns A and B (your ID and amount columns).

- Click the + (plus sign) to add this reference.

- In the Use labels in section, check BOTH boxes:

- ☑️ Top row (uses column headers);

- ☑️ Left column (uses IDs as grouping criteria)

- Click OK.

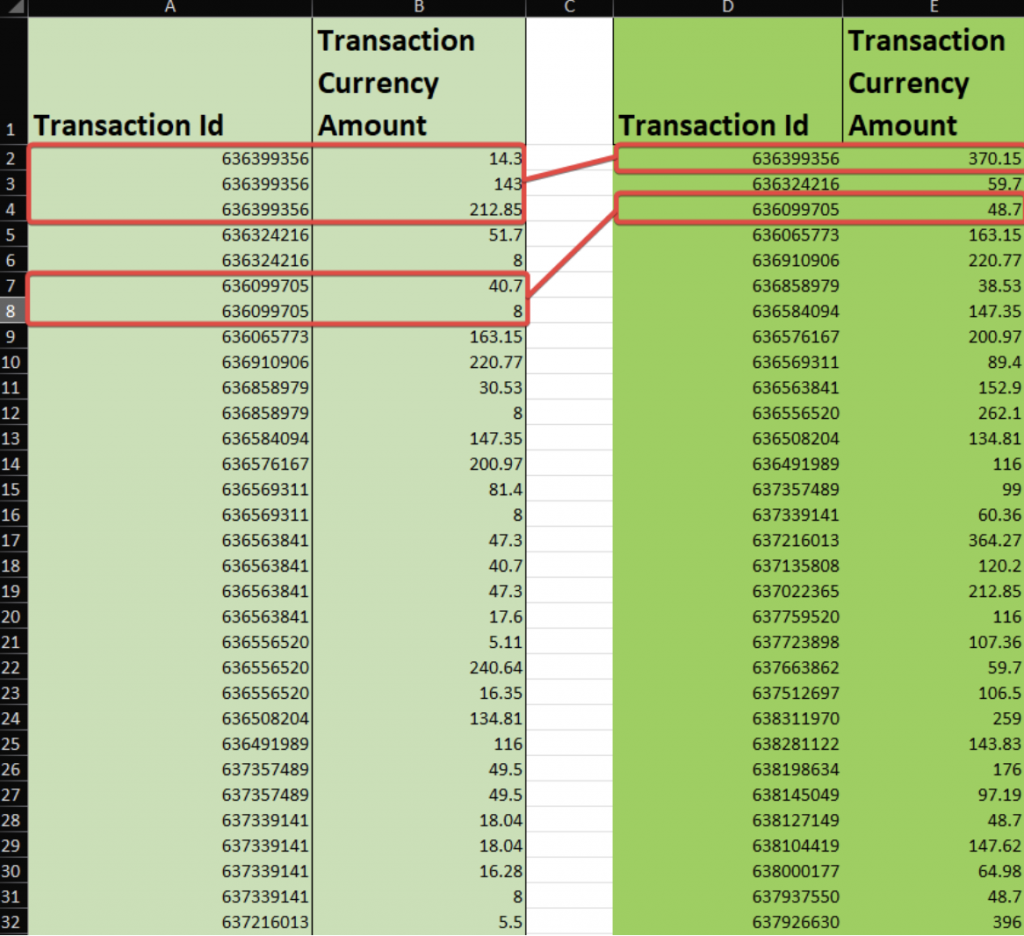

As a result, Excel will group multiple transactions with the same ID into one and sum their amounts. Here’s how the end result should look like.

- Compare consolidated totals:

- Use your newly consolidated QuickBooks Online data to compare against the Afterpay report.

- Each Afterpay transaction should now align with a single consolidated total from QuickBooks Online.

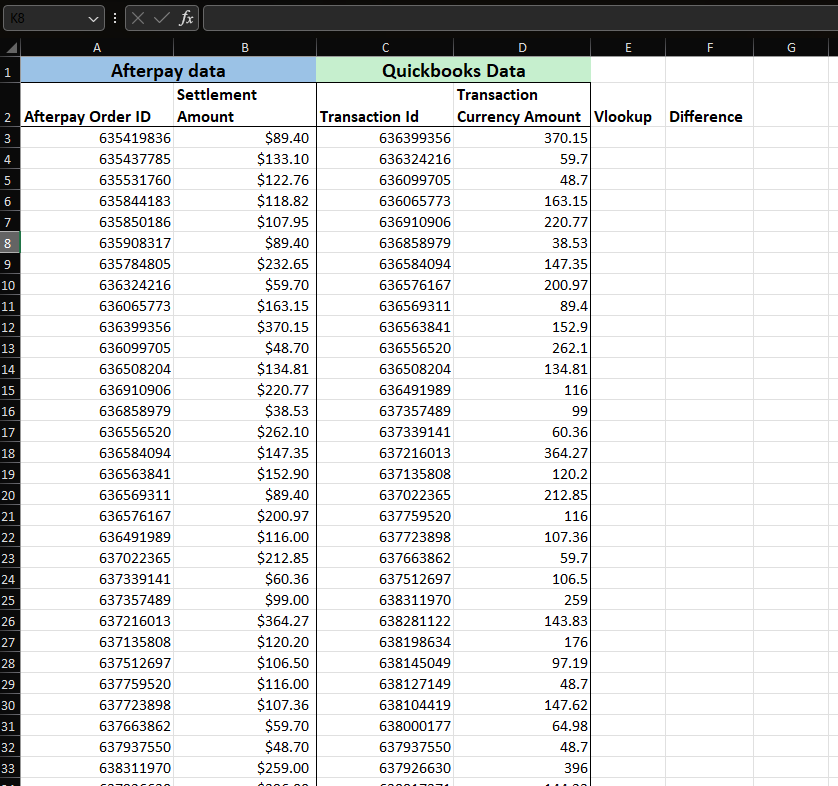

Step 4: Organize your data

1.Create a new sheet for your Comparison Analysis.

2. In your Comparison Analysis sheet, create columns for:

- Afterpay Order ID.

- Afterpay Amount

Copy and paste columns from your Clean Shopify report. - QuickBooks Transaction ID

- QuickBooks Transaction Amount

Copy and paste columns from your Clean QuickBooks report. - Lookup

- Difference

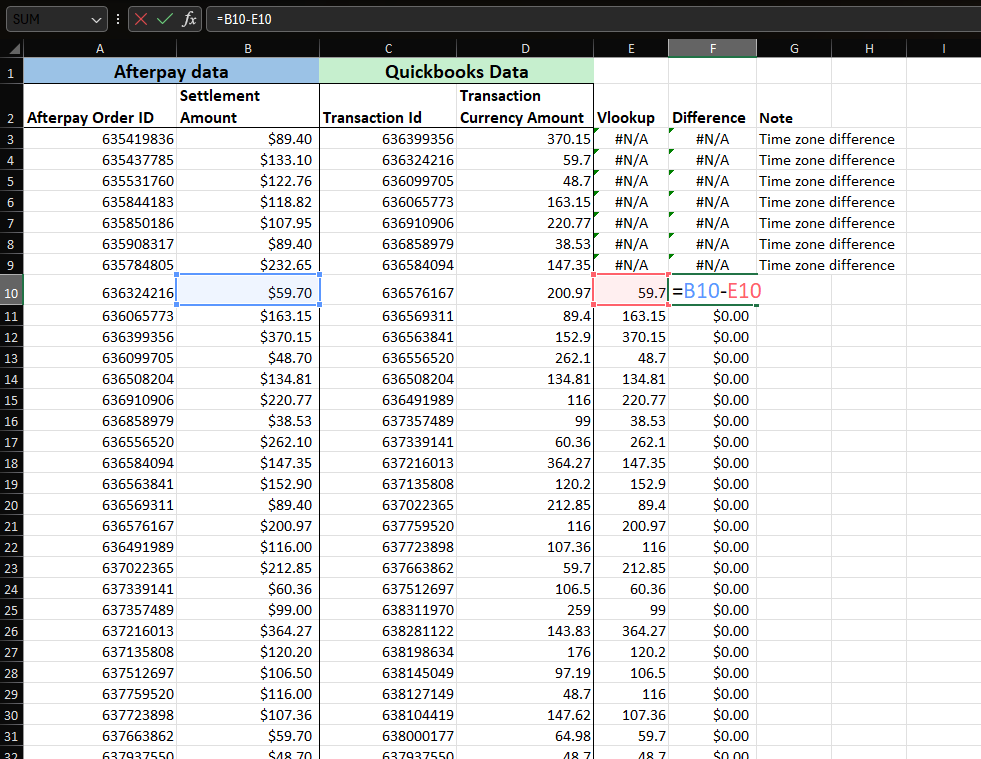

Here’s how the end result should look:

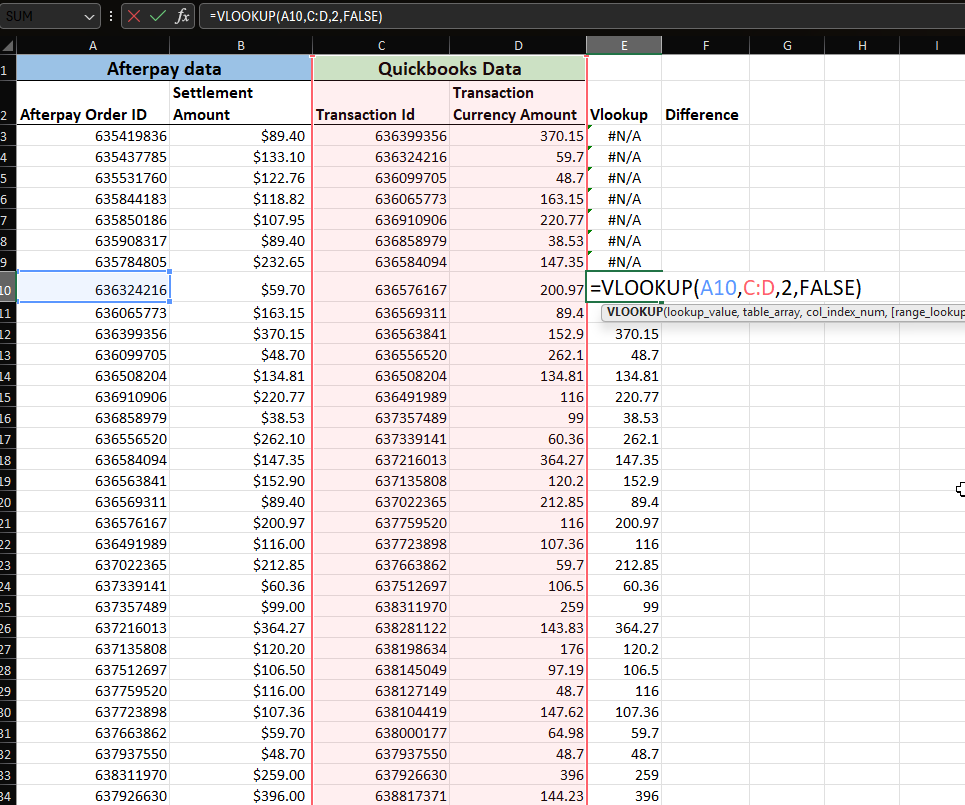

Step 5: Compare data using VLOOKUP

Our objective is to match transaction amounts from Afterpay and QuickBooks Online that have shared IDs. This process helps us identify any discrepancies in amounts or missing transactions within QuickBooks Online.

1. Set up your comparison formula

- Copy your cleaned Afterpay IDs and amounts to columns A and B.

- In the Lookup column, use VLOOKUP to find matching QuickBooks Online amounts:

=VLOOKUP(A3,C:D,2,FALSE)

Where:

- A3 = Afterpay ID you’re looking up

- C:D = Your QuickBooks Online data range (ID in column C, amount in column D)

- 2 = Returns the amount from the 2nd column (QuickBooks Online amount)

- FALSE = Exact match only

In the Difference column, calculate the difference by subtracting the looked-up amount from the Afterpay amount.

2. Identify discrepancies

Perfect matches should show 0 in the difference column.

Common discrepancy indicators include:

- Negative number = QuickBooks Online amount is higher than the Afterpay amount.

- Positive number = Afterpay amount is higher than the QuickBooks Online amount.

- N/A = Transaction ID exists in Afterpay but not in QuickBooks Online.

Step 6: Address common discrepancies

1. Missing transactions in QuickBooks Online

Possible causes:

- Transaction failed to sync due to network issues

- Transaction filtered out by Synder settings

- Unsupported transaction type

Actions to take:

- Check Synder’s sync logs for failed transactions.

- Force a manual sync in Synder for the missing period.

- Confirm timezone settings match between Afterpay reports (PST/UTC) and Synder.

2. Amount differences

Possible causes:

- Currency conversion differences between marketplaces

- Partial refunds not properly matched to original orders

- Difference in fee calculations between Afterpay reports and Synder processing

Actions to take:

- Check for currency conversions if selling in multiple countries.

- Look for reserve balance movements in the same period.

- Check for related adjustment entries in subsequent periods.

3. Extra transactions in QuickBooks Online

Possible causes:

- Manual entries created by your accounting team

- Duplicate syncing from multiple sync attempts

- Journal entries or adjustments made outside of Synder

- Starting balance entries when first setting up clearing accounts

Actions to take:

- Check if descriptions indicate manual entry.

- Verify transaction source in QuickBooks Online (look for “Synder” in descriptions).

- Check for duplicate Afterpay connections in Synder.

- Review any manual clearing account adjustments.

When to reach out to support

Get in touch with support when you’ve identified specific transactions causing issues but can’t resolve them.

What to include in your support request:

- Reconciliation period (start and end dates)

- Specific transaction IDs

- Screenshots of problematic transactions in both Afterpay and QuickBooks Online

- Summary of your findings (e.g., “Found 5 missing fulfillment fees totaling $47.50”)

- Currency/marketplace information if applicable

- Steps already taken to resolve the issue

Best practices for ongoing reconciliation

Staying on top of your clearing accounts requires consistency. Here are key practices to help you keep your books accurate and your reconciliation process smooth over time:

- Reconcile monthly rather than waiting for quarter-end.

- Monitor multiple currency clearing accounts if selling internationally.

- Keep an eye on alerts in Synder for failed sync transactions.

- Maintain timezone consistency across Afterpay, Synder, and reconciliation periods.

- Document any manual entries made to clearing accounts.

- Review unsupported transaction types periodically as Synder adds support.

A consistent reconciliation routine saves time, reduces errors, and keeps your financials audit-ready. By following these best practices, you’ll avoid surprises down the line and ensure your clearing accounts stay clean and reliable month after month.

Reach out to Synder Team via online support chat or email with any questions you have – we are always happy to help you!