Once you sync a cash transaction from the payment processor into your accounting company with the help of Square QuickBooks integration, the Sales Receipt for the total amount of the sale will be created on the accounting company side.

The Sales Receipt is deposited into a clearing account called Square (required for Synder) and is categorized according to your already existing in QuickBooks product’s income account categorization or according to your Synder settings (Products/Services tab) in case you have a new product in the transaction.

Cash payments and cash refunds can be synced into a separate bank account (as opposed to the default clearing one) and settings for them can be prepared according to your specific needs. Additional settings and a separate clearing account called Square Cash (required for Synder) are automatically created for them.

You may check them by following the steps below:

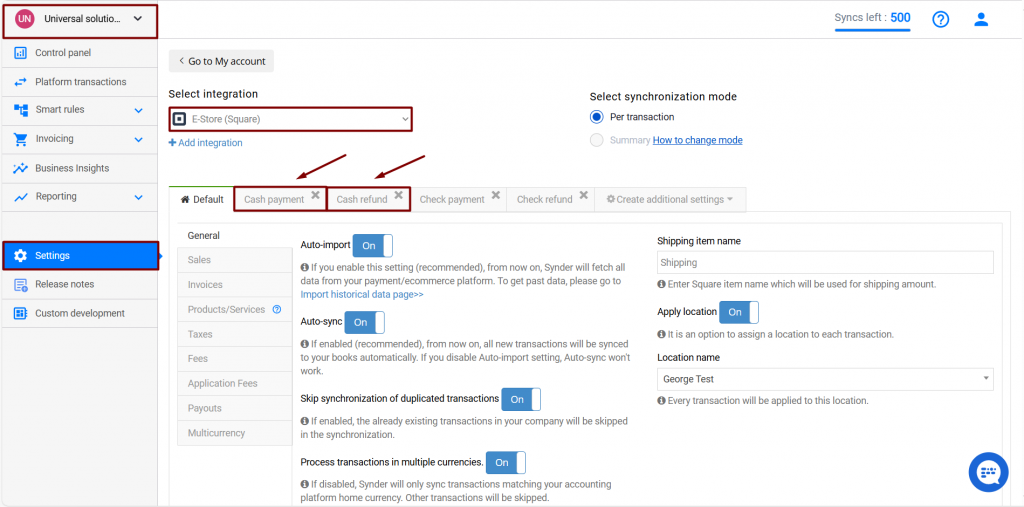

- Go to the Organization needed (if you have several) at the top right of the page → Settings → select Square in the Integration dropdown → you will see automatically created Cash payment and Cash refund additional settings.

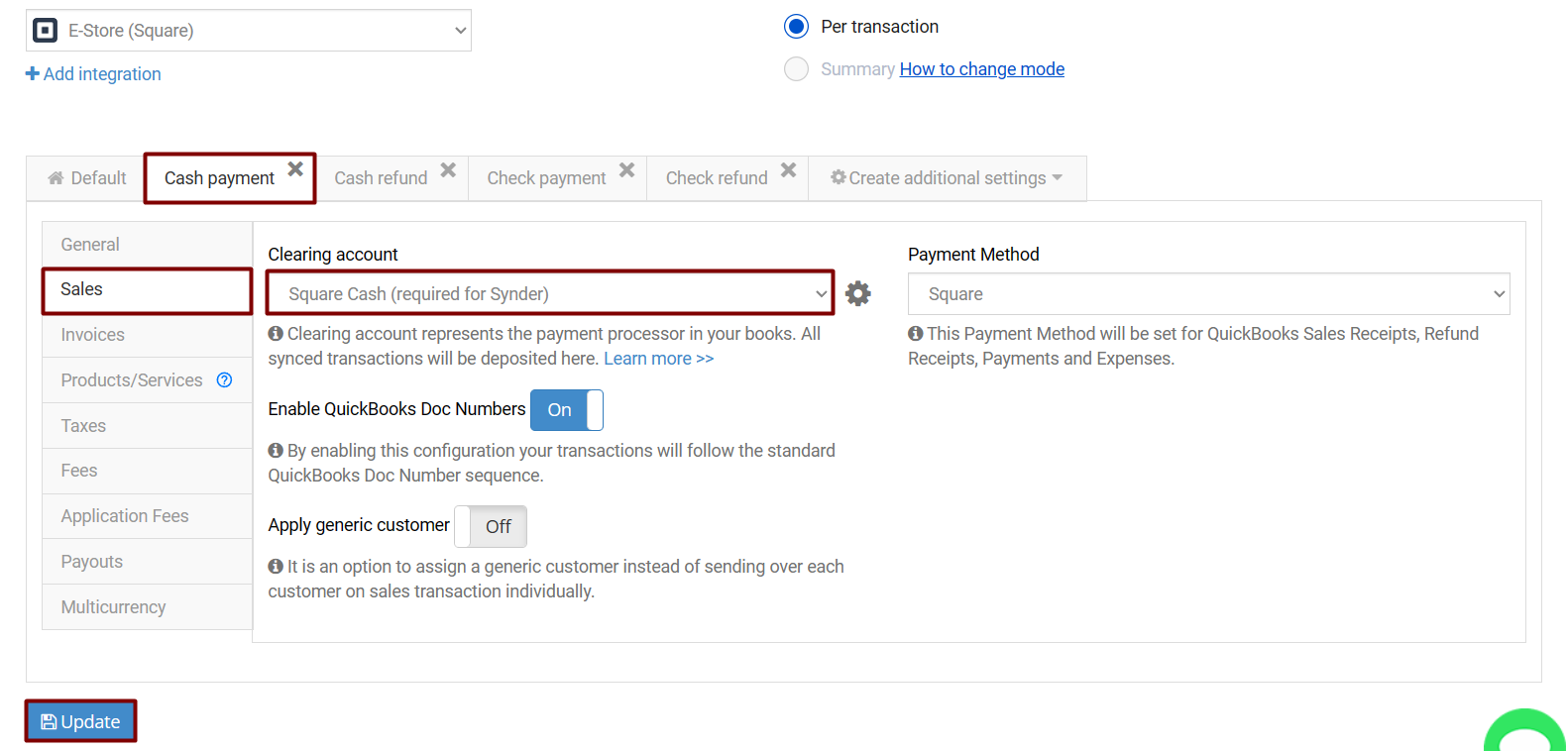

2. Click on the Cash payment additional setting → go to the Sales tab → select the account cash payments will be deposited to or just leave the default Square Cash (required for Synder) one → click on Update.

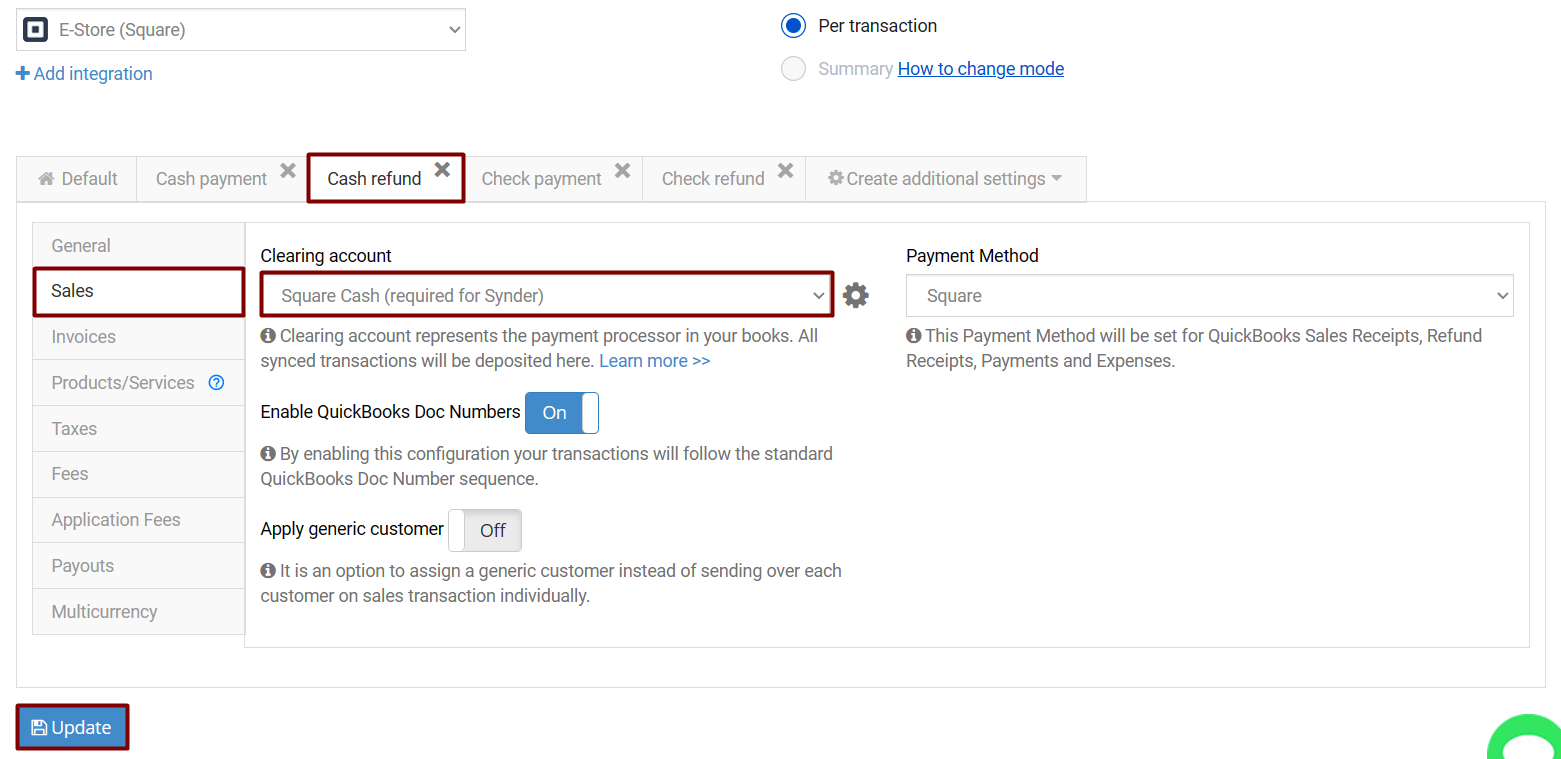

3. Follow the same steps for Cash refunds.

Congratulations! That is it.

Reach out to the Synder Team via online support chat, phone, or email with any questions you have – we’re always happy to help you!