What Is Marketplace Facilitator Tax? Also known as Tax Withholding.

Marketplace facilitator tax, also known as tax withholding, refers to sales tax collected and remitted directly by platforms like Amazon, eBay, Etsy, PayPal, TikTok, and Walmart. These platforms are legally required to withhold sales tax on your behalf and send it to the appropriate tax authorities.

Synder now also supports taxes withheld by Shopify (more on that below).

Even though these taxes aren’t remitted by you, they’re still associated with your sales and need to be properly recorded in your accounting system.

How Does Synder Record Transactions with Tax Withheld by Amazon/eBay/Etsy/PayPal/TikTok/Walmart?

Synder gives you two options for how withheld taxes can be recorded:

- Track marketplace facilitator tax withheld as your own payable

- Record withheld tax separately (recommended)

Let’s break them down.

Option 1: Track Marketplace Facilitator Tax withheld as your own payable

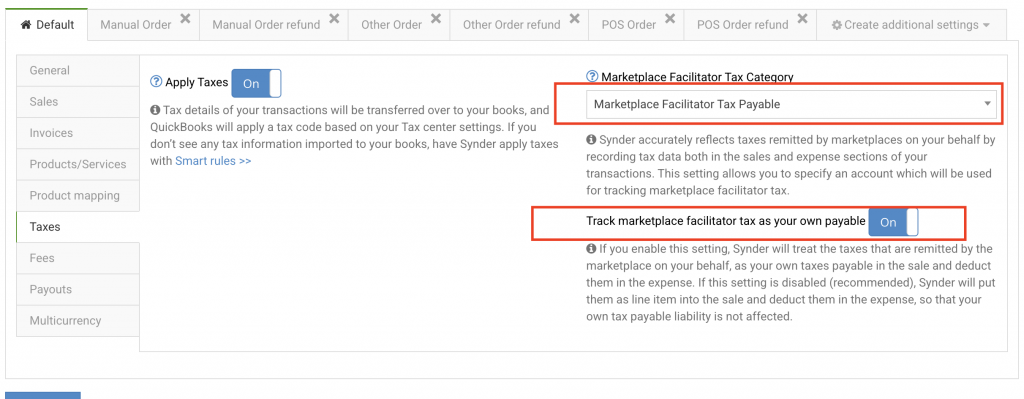

If you want Synder to treat withheld taxes as your own payable, follow these steps:

Enable the Track Marketplace Facilitator Tax as your own payable option.

- Go to Settings.

- Select the integration (e.g., Amazon).

- Go to the Taxes tab.

- Under the Marketplace Facilitator Tax Category, select the account that will be used for tracking marketplace facilitator tax withholding.

- Enable the Track Marketplace Facilitator Tax as your own payable option.

When this setting is enabled, Synder will:

- Record the withheld tax amount in the transaction’s tax field and assign a tax code to it;

- Include it in your taxable sales reports, affecting your tax liability on the balance sheet;

- Categorize the tax amount in the expense to the Marketplace Facilitator Tax Payable account you’ve selected;

Let’s take a look at the following example: a $100 sale with $10 tax (10%) and a $3 Amazon fee

Sales Receipt

– Product: $100

– Tax: $10 (recorded as the actual tax with a tax code; affects liability on the balance sheet)

– Total: $110

Expense

– Amazon Fee: $3

– Tax Withheld: $10 (categorized to your Marketplace Facilitator Tax account)

Total: $13

Note: This method increases your Sales Tax Payable account by $10 when the tax is recorded on the sale. The amount is automatically distributed across the appropriate liability accounts for each tax agency. An expense transaction then attempts to offset this by categorizing the $10 to the Marketplace Facilitator Tax Payable account. However, your tax reports will still reflect the $10 as a liability on your balance sheet, even though Amazon has already remitted the tax.

Option 2: Record withheld tax separately (recommended)

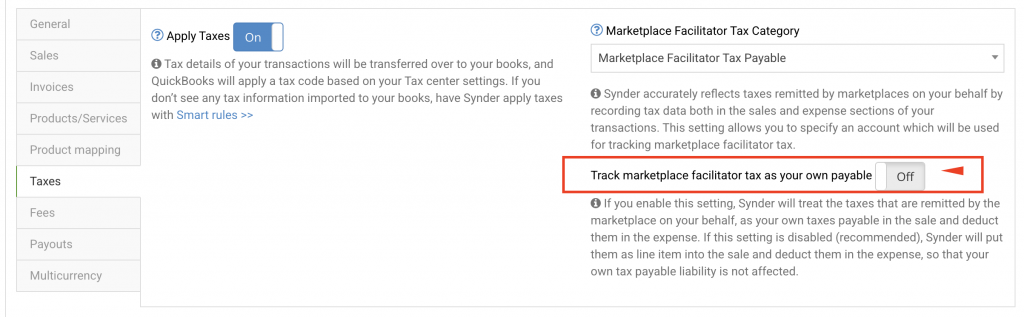

To avoid recording marketplace-collected taxes as your own payable, simply disable the Track Marketplace Facilitator Tax as your own payable option.

With this setting disabled, Synder will:

- Add a non-taxable line item called Marketplace Facilitator Tax in the sale. This item is configured to use the Marketplace Facilitator Tax category as its income account;

- Create a corresponding line in the expense, using the account from the same category;

- Ensure both amounts are posted to the Marketplace Facilitator Tax account you selected.

This method ensures all withheld taxes are clearly tracked — without affecting your Sales Tax Payable balance.

Benefits of recording withheld tax separately

This recommended approach ensures:

- Clear and transparent reporting: Withheld tax is shown as a separate, non-taxable line in both the sale and expenses.

- Accurate liability: Marketplace-collected taxes aren’t mistakenly reported as your own.

- Better reconciliation: Tax reports reflect your actual obligations, preventing overstated payables.

- Cross-platform consistency: The same logic applies regardless of which marketplace you’re selling on.

Additional notes on Shopify tax withholding

Now that Synder fully supports Marketplace Facilitator Tax withheld by Shopify, here’s how it’s handled in your books:

- If Shopify has already remitted tax on a sale, you’ll see a new item line in the sales portion of your transaction called Marketplace Facilitator Tax. If multiple taxes apply to the Shopify order, they will all be consolidated into a single line item, with the description field showing all the individual tax types.

- To ensure accurate reporting, a new transaction type called ‘Sales Tax Adjustment’ will automatically be created to offset this amount.

To make sure everything is set up correctly:

- Go to Settings.

- Select your Shopify integration.

- Navigate to the Taxes tab.

- Confirm two things:

A. That a Marketplace Facilitator Tax Category account is assigned based on how you prefer to record withheld tax

B. That the Track Marketplace Tax as your own payable setting is disabled.

By default, this setting is disabled for Shopify integrations, meaning tax withholdings are recorded as line items and won’t affect your Sales Tax Payable.

However, you can choose to enable it if you prefer to treat those taxes as your own liability.

Once set, Shopify’s withheld taxes will be handled just like those from other platforms — accurately and seamlessly.

That’s it! You’re now ready to manage taxes withheld by marketplaces with full clarity and confidence.

Reach out to the Synder Team via online support chat, phone, or email with any questions you have – we’re always happy to help you!