Afterpay is an increasingly popular payment method, allowing shoppers to purchase items online and pay them off in installments. For those looking to budget their spending and not break the bank, Afterpay offers an attractive solution. Whether you’re shopping for clothes, electronics, or furniture, Afterpay offers a convenient way to spread the cost of your purchases. But does Afterpay offer monthly payments? The answer is yes, but there are a few things to consider before you commit to using Afterpay.

In this article, we’ll dive into all the details you need to know about Afterpay, including the advantages and disadvantages of using it to pay for your purchases in monthly installments.

What is Afterpay?

Afterpay is an alternative payment method that allows shoppers to pay for their purchases in monthly installments rather than all at once. The idea is that people may want the item but not pay its full cost at once. At this point, Afterpay allows you to pay a small amount upfront and then make the rest of the payments over the next three months. Afterpay is close to a layaway plan, as both have a set time frame to make the payments.

Afterpay was launched in Australia in 2016, and the company has expanded to several other countries, including the U.S., the UK, and New Zealand. Afterpay can be used online at more than 300 retailers, including Myer, David Jones, The Iconic, Nautica, Bloom, and more.

Does Afterpay Offer Monthly Payments?

Afterpay offers monthly payments, but there are a few things to consider.

- First, the minimum payment is $10. You can pay off the item as quickly as you want but must make at least $10 monthly payments.

- You can also pay off the full amount at any time, which is always recommended when it comes to high-interest credit. The longer you take to pay off your purchase, the higher the interest will be. After the three-month repayment period ends, Afterpay will charge a standard late fee of $10.

- Afterpay also offers a “three strikes” policy, which means that if you miss a payment, you won’t be able to use the service again. It’s a protective measure the company takes against people who fail to pay the installments.

Advantages of Using Afterpay

The advantages of using Afterpay are that it is easy to use, flexible, and convenient. You can shop online and use the Afterpay checkout option to spread out your payments.

The other nice thing is that Afterpay doesn’t require a credit check, so even those who can’t currently get a credit card can use it. While some payment methods also offer this option, Afterpay requires less initial capital than other payment methods like layaway.

You don’t have to make a large upfront payment for your purchase. You can also put the item on hold for free and use Afterpay on a few different items.

Afterpay also allows you to treat a larger purchase as a series of smaller purchases. You can split a large purchase into three monthly installments. This can be helpful if you want to buy furniture, a new computer, or another big item but don’t have enough cash saved up.

Disadvantages of Using Afterpay

While Afterpay has a lot of advantages, it also comes with some disadvantages.

First, you will pay more in interest using this payment method than if you paid the item off in one payment. The more you pay off in installments, the more interest you will pay on the money. Therefore, it’s important to make sure you can pay off the item in full by the end of the three months.

You also need to be careful not to miss or get behind in payments.

Afterpay offers a lot of flexibility, which can also be a disadvantage. If you have the money to pay off your item in one payment, then you are paying interest. With most credit cards, you can transfer a balance and pay no interest, which is why using a credit card is often a better option.

How to Set Up Afterpay

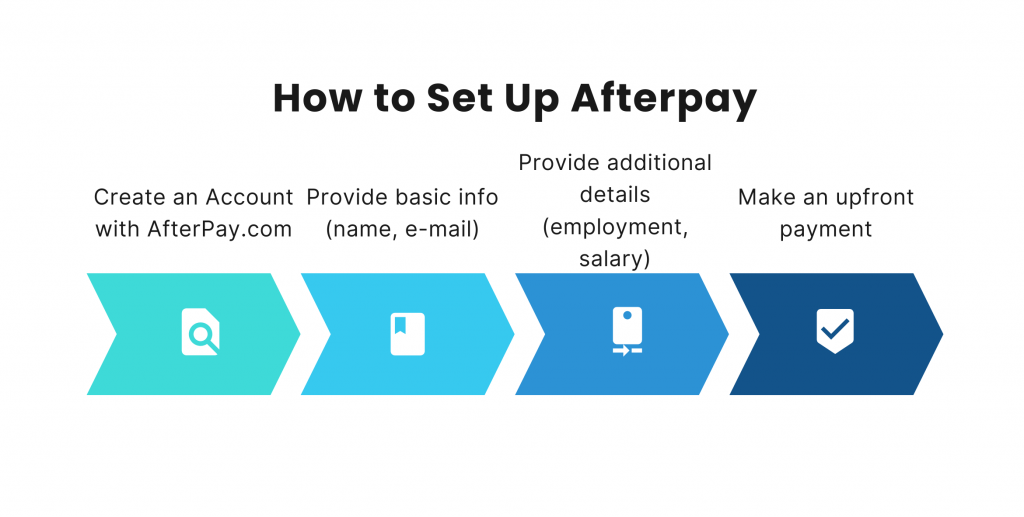

Before you can make any purchases using Afterpay, you need to set up an account. You can do so online by following these steps:

Go to Afterpay.com and select Create Account to begin the signup process.

You will be asked to provide some basic information like your name, email address, and password, and some additional details, like your annual salary and employment details.

Afterpay will also ask you to make an upfront payment, which is similar to a credit card deposit. You can choose to make an upfront payment of $50 or 10% of the total cost of your purchase. You can also choose to pay $10 per month to build your Afterpay credit.

Tips for Using Afterpay Responsibly

When using this payment method, you might want to use it responsibly.

It means making sure you can pay off the total amount of your purchase before the end of the three-month repayment period. If you don’t have the ability to pay off the purchase in full, you probably shouldn’t be using Afterpay at all. After all, it is an interest-bearing payment method, unlike a credit card, which charges interest but has the option to pay off sooner.

One thing to keep in mind is that you will have your name and credit information on file. This is what makes it easier for retailers to accept Afterpay as a payment method. But, it also means that these companies can see your credit history.

Afterpay can help you make a purchase that you otherwise couldn’t afford. Make sure that you only use it on a purchase that you can afford to pay off before the end of the payment period. After all, if you don’t make payments, it can damage your credit.

Conclusion

Afterpay is a payment method that allows you to make purchases and pay them off in monthly installments. More and more e-commerce businesses implement it as a payment method, making purchasing easier for customers and benefiting from the simple management of Afterpay transactions.

Afterpay is an effective way to pay for larger purchases you may not be able to afford in one lump sum payment. It can help you buy the things you need and want without breaking the bank. To benefit from Afterpay to the fullest, customers might want to use it responsibly by making sure they can pay off their purchases in full before the end of the three months.