Net working capital plays a crucial role in the financial health and operational efficiency of businesses. Understanding net working capital is essential for effective financial management and decision-making. In this guide, we will delve into the concept of net working capital, its components, significance, and strategies for effective management.

Understanding net working capital

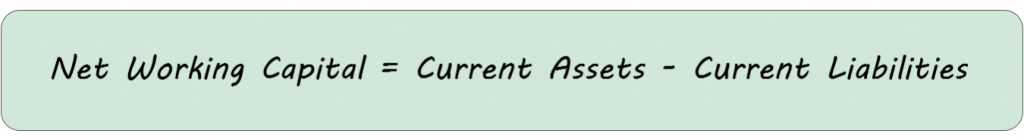

Net working capital is the difference between a company’s current assets and its current liabilities. It represents the funds available to cover day-to-day operations and short-term obligations.

Current assets include cash, accounts receivable, inventory, and short-term investments. These assets are expected to be converted into cash within one year.

On the other hand, current liabilities encompass accounts payable, short-term loans, and other obligations that are due within one year.

How to calculate net working capital

Calculating net working capital is a straightforward process that provides valuable insights into a company’s financial health.

By subtracting current liabilities from current assets, businesses can determine their net working capital position. A positive net working capital indicates that a business has enough current assets to cover its short-term obligations and is typically viewed as a healthy sign. It signifies that the business has a cushion of liquid assets that can be utilized to fund day-to-day operations, meet upcoming payments, and seize opportunities.

Where to find the necessary components to calculate net working capital

To find the necessary components to calculate net working capital, you need to refer to a company’s financial statements. The key components required for calculating net working capital are:

Current Assets

Current assets include cash, accounts receivable, inventory, and short-term investments. These are assets that are expected to be converted into cash within one year.

- Cash. This information can be found in the company’s balance sheet under the “Cash and Cash Equivalents” section.

- Accounts Receivable. The value of accounts receivable, which represents the amount owed to the company by its customers, can be found in the balance sheet under the “Accounts Receivable” or “Trade Receivables” section.

- Inventory. The value of inventory, which includes raw materials, work-in-progress, and finished goods, is typically mentioned in the balance sheet under the “Inventory” or “Inventories” section.

- Short-term Investments. If the company has short-term investments, such as marketable securities or treasury bills, you can find their value in the balance sheet under the respective section.

Current Liabilities

Current liabilities encompass accounts payable, short-term loans, and other obligations that are due within one year.

- Accounts Payable. The amount owed by the company to its suppliers and vendors can be found in the balance sheet under the “Accounts Payable” or “Trade Payables” section.

- Short-term Loans. If the company has any short-term loans or borrowings, the outstanding amount can be found in the balance sheet or in the notes to the financial statements.

It’s important to note that financial statements are typically available in a company’s annual reports, quarterly reports, or other financial filings.

Interpreting net working capital

A positive net working capital allows businesses to navigate unexpected expenses or fluctuations in cash flow without resorting to short-term borrowing or compromising their financial stability. It provides a sense of security, as the company has readily available resources to handle unforeseen circumstances or take advantage of favorable business conditions.

On the other hand, a negative net working capital raises concerns about a potential liquidity issue. It suggests that a business may not have enough current assets to cover its current liabilities. This situation can arise due to various factors such as aggressive expansion, poor cash flow management, or high levels of debt. A negative net working capital indicates that the company may struggle to meet its short-term obligations and may need to rely on external financing or negotiate payment extensions with suppliers.

Having a negative net working capital does not necessarily mean a business is doomed. In some cases, it may be a temporary situation resulting from specific business cycles or seasonal fluctuations. However, consistently operating with negative net working capital can strain a company’s financial resources, hinder growth opportunities, and potentially lead to insolvency if not addressed promptly.

Monitoring net working capital regularly is essential for businesses to maintain a healthy financial position. By assessing net working capital trends over time, businesses can identify potential issues early on and take proactive measures to address them. This may involve implementing cost-saving measures, optimizing cash flow, negotiating better credit terms with suppliers, or exploring alternative financing options.

It’s important to note that the ideal net working capital position varies across industries and businesses. Factors such as business models, seasonality, and growth strategies influence the appropriate level of net working capital required. Therefore, benchmarking net working capital against industry peers and analyzing the company’s historical performance can provide valuable insights and help set realistic targets for net working capital management.

The role of net working capital in business operations

Net working capital is vital for managing day-to-day operations and ensuring financial stability. It helps businesses maintain liquidity by having enough current assets to cover immediate expenses, such as salaries, utility bills, and raw material costs.

Adequate net working capital is also crucial for meeting short-term obligations promptly, such as paying suppliers and employees, which enhances the company’s reputation and fosters healthy business relationships.

Ultimately, evaluating net working capital is essential for assessing a company’s financial health and making informed decisions about expansion, investments, and financial strategies. By understanding the net working capital position, businesses can assess their ability to weather financial challenges, seize growth opportunities, and plan for long-term success.

Strategies for effective net working capital management

To effectively manage net working capital, businesses can implement several strategies:

Best inventory management practices

Efficient inventory management is crucial for maintaining an optimal level of stock. Excess inventory ties up valuable funds, increases carrying costs, and may lead to obsolescence, while insufficient inventory can result in stockouts and lost sales. Adopting inventory management techniques like just-in-time (JIT) systems and conducting ABC analysis can help optimize inventory levels and reduce carrying costs.

Improving accounts receivable and payable processes

Effective accounts receivable and payable processes also impact net working capital. By managing accounts receivable efficiently, businesses can minimize outstanding customer payments, reducing the cash conversion cycle. Offering incentives for early payments and implementing robust credit control measures can improve cash inflows. Similarly, optimizing accounts payable by negotiating favorable credit terms with suppliers and strategically managing payment schedules can help enhance cash flow.

Cash flow forecasting and management

Cash flow management is another critical factor in net working capital. By accurately forecasting cash inflows and outflows, businesses can identify potential shortfalls and plan accordingly. Regular budgeting and expense control practices allow companies to maintain a healthy cash flow position and allocate resources effectively.

Analyzing net working capital performance

To evaluate net working capital performance, businesses can utilize various financial ratios:

Current ratio

This ratio compares current assets to current liabilities and provides insights into a company’s short-term liquidity position. A current ratio greater than 1 indicates a healthy net working capital position, with sufficient assets to cover liabilities.

Quick ratio (acid-test ratio)

The quick ratio provides a more conservative measure of liquidity by excluding inventory from current assets. It reflects a company’s ability to meet short-term obligations using its most liquid assets. A higher quick ratio indicates a stronger net working capital position.

Cash conversion cycle

This ratio measures the time it takes for a business to convert inventory and accounts receivable into cash. By reducing the cash conversion cycle, companies can accelerate cash inflows and improve net working capital.

Benchmarking net working capital ratios against industry standards and comparing performance over time can help identify areas for improvement and potential risks.

Common working capital challenges and pitfalls

Businesses may face various challenges related to net working capital. The most typical are as follows:

- Insufficient working capital

Inadequate net working capital can lead to cash flow problems, hinder growth opportunities, and make it challenging to meet short-term obligations. It’s important to regularly monitor and manage net working capital to avoid liquidity issues.

- Inaccurate forecasting

Lack of accurate cash flow forecasting can result in unexpected shortfalls or excess cash. Implementing robust forecasting techniques and continuously reviewing actual performance against projections is crucial for effective net working capital management.

- Inefficient inventory management

Poor inventory management can tie up funds, increase carrying costs, and lead to stockouts or excess inventory. Adopting efficient inventory management practices, leveraging technology solutions, and closely monitoring demand patterns can optimize inventory levels and enhance net working capital.

Conclusion

Net working capital is a vital aspect of financial management for businesses. Understanding and effectively managing net working capital enable companies to maintain liquidity, meet short-term obligations, and make informed financial decisions. By implementing strategies such as efficient inventory management, optimizing accounts receivable and payable, and maintaining robust cash flow management practices, businesses can ensure a healthy net working capital position. Regularly assessing net working capital performance and comparing it to industry standards will lead to improved financial health and long-term success. With a sound net working capital foundation, businesses can navigate challenges, seize growth opportunities, and thrive in today’s dynamic business landscape.