It’s not an overstatement to say that banking plays a considerable role in our financial life today. Looking 100 years or even 50 years back, the picture would be quite the opposite. Of course, banking existed during those times, but had a much different level of accessibility.

Not to dive too deep into banking history, it would suffice to say that banking appeared with the first currency minted. Temples in India, China, Egypt, Babylon, Greece, and the Roman Empire (to mention just a few) kept and loaned money. Banking has come a long way from temples. Online banking is now the norm, and seems to be one of the greatest developments in the financial world. With the number of smartphone users growing, digital banking may well replace traditional brick-and-mortar banking institutions in the near future. The number of digital banking users in the US is expected to reach a staggering 217 million people by 2025 or about 80% of the targeted population.

Taking all these facts into consideration, it would seem relevant to cover the basics of financial literacy. In this article we’ll cover the topic of checking accounts that serve as a fundamental tool providing individuals with financial protection, convenient online access, and opportunities for wealth management.

We’ll delve into the world of checking accounts, exploring their significance and the benefits they offer. Specifically, we will focus on two key aspects: account protection and the integration of online services for enhanced wealth management. Whether you’re a novice in the realm of personal finance or seeking to optimize your banking experience, this guide will equip you with the knowledge to make informed decisions and leverage the potential of your checking account.

Contents:

1. What is a checking account?

2. What do checking accounts provide?

3. Types of checking accounts and fees

- Traditional checking accounts

- Premium checking accounts

- Student checking accounts

- Senior checking accounts

- Interest-bearing accounts

- Rewards checking accounts

- Advantage banking

- Advantage SafeBalance

- Business checking accounts

- Checkless checking accounts

- Second-chance checking accounts

4. Where and how can you open a checking account?

- Opening checking accounts at a brick-and-mortar bank

- Opening a checking bank account at a credit union

- Opening a checking account at an online bank

5. Popular examples of financial institutions offering such accounts

6. Checking account vs savings account

What is a checking account?

A checking account or a demand/transactional account is a deposit account that serves to cover every day expenses and transactions. Checking accounts help to keep your money safe until you need to access it for making purchases or paying bills. This type of account is preferable for frequent deposits and withdrawals. Banks issue a debit card paired with your checking account, which allows you to access money using an ATM, and make payments in brick-and-mortar shops. Online, digital banking apps or mobile banking apps allow you to make online purchases and manage your account through your mobile device.

When you open a checking account, you should remember about the minimum balance – the minimum amount of money required to be maintained in a checking account to avoid fees or penalties. Banks may have different minimum balance requirements based on the type of account or specific account features, which you need to be aware of to ensure you meet it to avoid any additional charges.

What do checking accounts provide?

This type of account ensures liquidity

The main feature that a checking account has is liquidity, which means the ease of getting cash through numerous withdrawals as well as countless deposits. Liquidity describes the essence of checking accounts and comes at a price of low interest rates, if any at all. The money can be accessed through an ATM, financial institutions, by writing checks, and using electronic transfers, to mention a few. The details are to be checked with your bank.

Such bank accounts guarantee safety

Money is much safer at the bank than it is in your purse, especially if you travel. Losing your debit card doesn’t mean losing your money. It just means that you need to contact your bank, block the card and then request the issue of a new debit card. Online banking boasts a lot of security features nowadays.

This bank service enables you to cover everyday purchases and control spending

Whether you make online or offline purchases, your debit card is the easiest way to cover them. You will only need to remember the PIN and enter it when asked. If you open a checking account, it makes it much easier to control your spending by checking the balance online or with the help of an ATM. In fact, many online banking apps provide statistics based on how you spend the money. This feature comes in handy if you want to analyze your expenses.

Mobile banking of such an account generates automatic bill payment

Using mobile banking can help pay your bills from the comfort of your home or office. Once you enter the details and accounts of all your payees and see them in one place, it’s easy to manage all your periodic payments with just a click of a button or even without it – you can adjust the settings to have them paid automatically. Some applications will even send you alert messages to remind you about the payment to be covered.

Using such an account enables you to receive a direct deposit or paychecks from your job

Opening a checking account makes it possible to get paychecks from your employer through direct deposit, which eliminates the necessity of going to the bank every time you get paid.

Types of checking accounts and fees

Knowing what types of checking accounts exist and assessing your financial situation can help you choose and open the right checking account. But before going through the existing types of checking accounts, you should define your priorities. In other words, it’s wise to ask yourself a question: what should a checking account do for me?

Traditional checking accounts

This type of account allows you to write checks and use a debit card for offline and online purchases as well as withdraw money at ATMs. The requirement to open such an account may be to maintain a minimum balance or sign up for other financial services. Meeting these requirements may even waive a monthly maintenance fee. Traditional checking accounts can be connected to other types of accounts in your bank or other financial institutions.

A premium checking account (aka prime checking account or premier checking account) comes with additional benefits like interest on deposits, bonuses at the price of requiring a higher initial deposit or having a higher monthly maintenance fee. According to Forbes Advisor, the average monthly fee of some major US banks is about $25. Whether the benefits are worth the money in today’s financial environment is up to you.

Student checking accounts

Designed specifically for teenagers and college students, this type of account in many cases comes with such benefits as no ATM fees, no monthly maintenance fees, and sign-up bonuses. It might be a good way to make your first independent financial steps.

Senior checking accounts

Not unlike student checking accounts, this type of account is designed for the age group 55+ and provides the benefits desired by this age group: free checking, free money orders, lower monthly fees (depending on the bank, some would have higher monthly fees than traditional checking accounts), interest rates, etc.

Interest-bearing accounts

As prompted by the name, interest-bearing accounts allow you to earn dividends on your deposit at the cost of meeting some requirements. Such checking accounts are in some ways similar to savings accounts.

Rewards checking accounts

Some checking accounts offer special rewards like debit card cash back, or reward points. It’s always important to read the fine print, which will detail the requirements you have to meet in order to earn these rewards.

Advantage banking

Advantage banking is a term often used to describe specialized checking accounts with a range of benefits and features such as higher interest rates, waived fees, or priority customer service. Advantage banking is designed to provide added value to customers who maintain a higher account balance or have a deeper relationship with the bank.

Advantage SafeBalance

Advantage SafeBalance is a specific type of checking account that places an emphasis on keeping a low balance and preventing overdrafts. It typically doesn’t allow for overdraft protection, meaning that transactions that would result in a negative balance are declined instead.

Business checking accounts

Business checking accounts together with accounting automation software are designed to help a business run smoothly. This type of account may charge extra for transactions over a certain limit. Business checking accounts may serve various purposes like payroll or operating expenses.

Checkless checking accounts

Checking accounts that do not offer the ability to write checks are called checkless and are a great choice for those who rely on debit cards alone. Such accounts don’t have overdraft fees in most cases.

Second-chance checking accounts

This banking option is aimed at the clients who had some problems with their banking history before. It’s the second chance to maintain good standing with a bank. Such accounts would have monthly service fees and a limited number of services.

Note: While checking accounts primarily focus on day-to-day transactions, many banks also offer credit cards as part of their banking services that provide a convenient and widely accepted means of making purchases, with the flexibility to repay the balance over time. Linking a credit card to a checking account can sometimes be used to boost your financial standing.

Overall, when choosing the right account, it’s vital to be aware of all the fees that may come in order to avoid this debacle: I don’t know how much is in my bank account and at this point I’m afraid to look.

Some of the fees were mentioned in the types of accounts, but here is a quick list of the most typical fees for checking accounts:

- Monthly maintenance fees

- Out-of-network ATM fees

- Overdraft fees

- Wire transfer

- Insufficient funds fees

- Early account closing fees

Where and how can you open a checking account?

To open a checking account, you can typically turn to any of the following three types of financial institutions:

- a brick-and-mortar bank

- a credit union

- an online bank

The major principles for opening checking accounts in all these types of financial institutions are more or less the same, with just some peculiarities. Let us give you some details.

Opening checking accounts at a brick-and-mortar bank

Opening a checking account at a brick-and-mortar bank is a traditional and widely accessible option for individuals seeking a reliable banking relationship. With numerous branches and a physical presence, brick-and-mortar banks offer in-person service, convenience, and a wide range of financial products. If you’re considering opening a checking account at a brick-and-mortar bank, here’s a general guide to help you through the process:

Step 1. Research and choose a bank

Start by researching different brick-and-mortar banks in your area. Consider factors such as their reputation, branch locations, fee structure, account features, and customer service. Look for a bank that aligns with your financial needs and preferences.

Step 2. Visit the bank

Once you’ve selected a bank, visit one of their branches during business hours. If possible, choose a branch that is convenient for you in terms of location and operating hours.

Step 3. Meet with a bank representative

When you arrive at the bank, inform a bank representative that you’re interested in opening a checking account. They’ll guide you through the process and provide information on the various account options available to you.

Step 4. Provide identification and documentation

To open a checking account, you’ll typically need to provide identification and documentation. Commonly accepted forms of identification include a valid driver’s license, passport, or government-issued ID. You may also need to provide proof of address, such as a utility bill or lease agreement.

Step 5. Complete the application

Fill out the necessary application forms provided by the bank. These forms will require you to provide personal information, such as your name, address, Social Security number, and employment details. Be thorough and accurate when completing the application.

Step 6. Deposit funds

In order to activate your checking account, you’ll need to deposit an initial amount of money into the account. The bank will inform you of the minimum deposit required, which can vary depending on the bank and type of checking account you choose.

Step 7. Review account terms and conditions

Take the time to carefully review the terms and conditions of your new checking account. This includes understanding the fee structure, minimum balance requirements, overdraft policies, and any additional services provided by the bank.

Step 8. Set up additional services

If desired, inquire about any additional services you may need or be interested in. This could include ordering checks, setting up direct deposit, enrolling in online banking, or exploring other account-linked services such as bill pay or mobile banking apps.

Step 9. Receive account information

Once your application is processed and approved, the bank will provide you with your account information. This typically includes your account number, any associated debit cards or checks, and instructions on how to access your account online or through the bank’s mobile app.

Step 10. Start using your account

With your checking account open, you can begin using it for various banking transactions. You can deposit money, make payments, withdraw cash, and take advantage of other banking services offered by the bank.

Remember, brick-and-mortar banks often prioritize customer service, so don’t hesitate to ask questions or seek assistance if needed. Opening a checking account at a brick-and-mortar bank provides you with the convenience of in-person service, access to a wide network of branches and ATMs, and the opportunity to establish a long-term banking relationship.

Opening a checking bank account at a credit union

Very similar steps are required to open a checking account at a credit union – a member-owned financial institution, offering a unique banking experience that emphasizes personalized service and community focus:

Step 1. Research and select a credit union

Start by researching credit unions in your area and evaluating their offerings. Look for a credit union that aligns with your financial needs, such as low fees, competitive interest rates, convenient branch locations, and robust online banking services.

Step 2. Gather required documentation

Before visiting the credit union, make sure you have the necessary documents to open a checking account. Typically, you’ll need to provide identification, such as a valid driver’s license, passport, or government-issued ID. You may also need proof of address, such as a utility bill or lease agreement.

Step 3. Visit the credit union

Once you’ve chosen a credit union, visit their branch during business hours. Alternatively, some credit unions may allow you to begin the application process online or over the phone.

Step 4. Speak with a representative

When you arrive at the credit union, explain that you’re interested in opening a checking account. A representative will guide you through the process and answer any questions you may have. They may also provide recommendations based on your specific financial goals and needs.

Step 5. Complete the application

Fill out the necessary paperwork to open the checking account. This may include an application form and any additional agreements or disclosures. Be prepared to provide your personal information, such as your name, address, Social Security number, and employment details.

Step 6. Deposit funds

To activate your checking account, you’ll need to deposit an initial amount of money as specified by the credit union. This initial deposit may vary depending on the credit union’s requirements or the type of checking account you’re opening.

Step 7. Review account terms and features

Take the time to carefully review the terms and features of your new checking account. This includes understanding the fee structure, minimum balance requirements, overdraft policies, and any additional services offered, such as online banking, mobile banking, or bill pay.

Step 8. Set up additional services

If desired, inquire about any additional services you may need, such as ordering checks, setting up direct deposit, or linking your checking account to other accounts or services.

Step 9. Receive account information

Once your application is processed and approved, you’ll receive your account information, including your account number and any associated debit cards or checks. Familiarize yourself with the account details and keep this information in a secure place.

Step 10. Begin using your account

With your checking account open, you can start enjoying the benefits of banking at a credit union. You can deposit money, make payments, withdraw cash, and access online banking services as per the credit union’s offerings.

You should bear in mind that credit unions focus on serving their members and building strong relationships, so don’t hesitate to reach out to the credit union if you have any questions or need assistance. Opening a checking account at a credit union can provide you with a community-oriented banking experience and the opportunity to contribute to the well-being of the credit union’s members and local community.

Opening a checking account at an online bank

Quite similar, actually, is this process for online banks that offer a convenient and accessible option for individuals seeking a modern and flexible banking experience. Though, its has some specific features:

Step 1. Research and select an online bank

Start by researching reputable online banks that offer the services and features you need. Look for factors such as competitive interest rates, low fees, robust online banking platforms, and positive customer reviews. Consider the bank’s reputation for security and customer service.

Step 2. Visit its website

Once you’ve chosen an online bank, visit their website to explore their account options and gather information. Online banks typically provide detailed information about their accounts, services, and account opening process on their websites.

Step 3. Choose the right account

Online banks typically offer a range of account types, including checking accounts, savings accounts, and certificates of deposit (CDs). Evaluate your financial needs and select the account that aligns best with your goals.

Step 4. Start the application process

On the online bank’s website, locate the section for opening a new account. Click on the appropriate link to begin the application process. You may be asked to provide personal information such as your name, address, Social Security number, and employment details.

Step 5. Provide identification and documentation

To open an account with an online bank, you’ll need to provide identification and documentation. This usually includes a valid driver’s license, passport, or government-issued ID. Additionally, you may need to provide proof of address, such as a utility bill or lease agreement.

Step 6. Complete the online application

Fill out the necessary information in the online application form. Take your time to provide accurate and up-to-date details. Review the form carefully before submitting it to ensure there are no errors or missing information.

Step 7. Fund your account

Once your application is submitted and approved, you’ll need to fund your new account. Online banks typically provide various options for depositing funds, such as electronic transfers, mobile check deposits, or mailing a check. Follow the instructions provided by the bank to initiate the deposit.

Step 8. Set up online banking access

After your account is funded, the online bank will provide you with online banking access. This usually involves creating a username and password to log into the bank’s online platform. You may also need to set up additional security measures, such as two-factor authentication, to protect your account.

Step 9. Familiarize yourself with account features

Take the time to explore the features and functionalities of your new online bank account. This includes understanding how to view your balance, make transfers, pay bills, access statements, and utilize any other services provided by the bank’s online platform or mobile app.

Step 10. Start using your account

With your online bank account set up, you can start using it for various banking activities. You can make deposits, transfer funds, pay bills electronically, and manage your finances conveniently from your computer or mobile device.

If you’re considering this option, you should remember that online banks often provide customer support through phone, email, or online chat, so don’t hesitate to reach out if you have any questions or need assistance. Opening a bank account at an online bank offers flexibility, convenience, and often competitive features and rates so you’ll embrace the digital banking experience and enjoy the benefits of managing your finances from the comfort of your own home.

Popular examples of financial institutions offering such accounts

PNC

Nowadays, PNC checking accounts are becoming more and more popular, so we decided to give it a detailed overview.

PNC, short for PNC Financial Services Group, is a leading financial institution that offers a wide range of banking products and services to individuals and businesses. Among its offerings, PNC provides a variety of checking accounts tailored to meet the diverse needs of its customers.

Like any other checking account, a PNC checking account serves as a tool for managing your day-to-day finances providing a secure and convenient way to deposit and withdraw money, make payments, and keep track of transactions for individuals or businesses.

When you open a PNC checking account, you gain access to a host of features designed to simplify your banking experience:

PNC offers online and mobile banking platforms that enable you to manage your account from anywhere, anytime.

PNC also employs robust measures to protect your financial information and ensure your transactions are safeguarded like multi-factor authentication, encryption, and fraud monitoring.

This type of PNC’s bank account comes with a range of perks like ATM fee reimbursements, interest earnings, and access to an extensive network of ATMs. Some accounts may also offer overdraft protection, allowing you to avoid costly fees and maintain better control over your finances.

PNC’s commitment to customer service sets them apart. Whether you prefer to reach out in person at a local branch, over the phone, or through online chat, PNC strives to provide excellent support to its customers.

In short, PNC offers a comprehensive range of checking accounts that cater to the needs of individuals and businesses alike. With features such as online and mobile banking, enhanced security measures, and additional benefits, PNC aims to provide a seamless and rewarding banking experience.

NerdWallet

NerdWallet, a well-known personal finance website, has expanded its services beyond financial advice and now offers its own checking account. The NerdWallet Checking Account is designed to provide users with a streamlined and convenient banking experience, coupled with the expertise and resources that NerdWallet is known for.

One of the standout features of the NerdWallet Checking Account is its emphasis on transparency and simplicity. NerdWallet strives to make banking easy to understand by providing clear information about fees, terms, and benefits. This transparency enables users to make informed decisions and avoid any surprises or hidden charges.

The NerdWallet Checking Account also offers a range of features designed to enhance the banking experience:

With mobile and online banking capabilities, users can easily manage their account on the go, track transactions, and access their funds securely.

The account includes a debit card for convenient purchases and ATM withdrawals.

NerdWallet’s commitment to helping users make smart financial choices is reflected in the unique benefits associated with their checking account. For example, the account offers cashback rewards on select purchases, enabling users to earn while they spend.

NerdWallet provides personalized insights and recommendations based on users’ spending patterns, helping them make more informed decisions about their finances.

The NerdWallet Checking Account includes features such as real-time transaction alerts and the ability to freeze your debit card instantly if it’s misplaced or stolen. These measures provide peace of mind and ensure that users’ funds and information are protected.

The company is known for its outstanding customer support helping users navigate complex financial topics including any issues with checking accounts. It ensures that users receive the assistance they need promptly

All in all, the NerdWallet Checking Account is a compelling option for individuals seeking a banking solution that combines convenience, transparency, and financial expertise. With its user-friendly features, cashback rewards, personalized insights, and strong customer support, NerdWallet strives to provide its users with a seamless user experience.

Checking account vs savings account

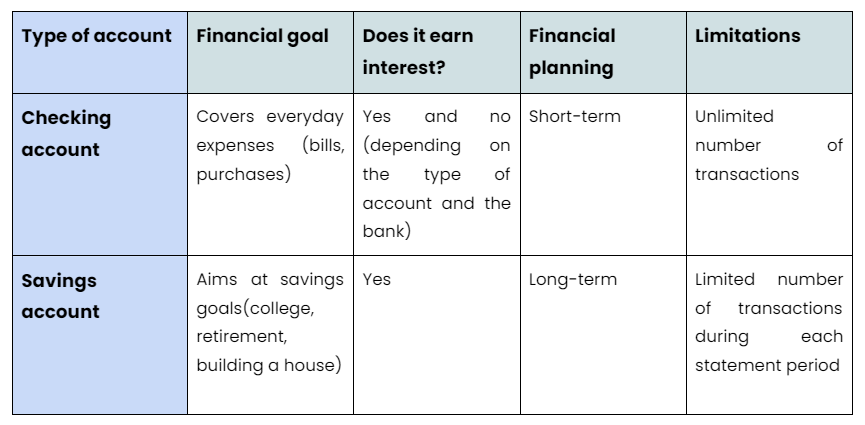

When it comes to comparing checking accounts and savings accounts, they serve different purposes and therefore function differently. One significant point here is that a checking account gives you an easy, fast, every-day access to the money you plan to spend, while a savings account is designed for saving and for earning interest. The table below shows a comparison of the accounts. It would also be relevant to mention a third type of account – clearing account, which serves as a temporary buffer for costs and amounts that should be transferred to another account.

Bottom line

A checking account serves as a cornerstone of personal finance in America, providing individuals with a comprehensive view of their financial transactions and offering a range of advantages. From account protection to bonus rewards, from preferred banking services to opportunities of managing your wealth, checking accounts have become an essential tool in managing one’s financial well-being.

With the convenience of online banking, individuals can easily access and monitor their checking accounts anytime, anywhere. This digital wallet allows for seamless transactions, quick balance checks, and easy bill payments. Moreover, many online checking accounts offer added features such as mobile check deposit and person-to-person payment options, further enhancing the banking experience.

Checking accounts provide a layer of protection for account holders, enabling them to keep their funds safe and secure. With fraud monitoring, account alerts, and insurance coverage, individuals can have peace of mind knowing that their money is protected.

Checking accounts often provide a foundation for additional financial services, such as capital loans and insurance products. Building a relationship with a bank through a checking account can pave the way for accessing credit, obtaining favorable loan terms, or securing necessary insurance coverage.

Overall, a checking account is much more than a simple financial tool. It opens up a world of possibilities, from managing day-to-day transactions to exploring wealth management options. With the convenience of online banking and the various benefits associated with checking accounts, individuals can take control of their financial journey and make the most of their financial resources.

I love that you pointed out how checking accounts are guaranteed and safe because we are not going to lose our money if we lose our debit card which makes it safer than having our money in our purse. I will suggest this to my husband so that we can open an account like that once we find a bank that we can trust, especially if they are a reputable company in our locality. We just need to be wiser regarding our finances so that we are ready with our savings once we finally have our own child next year.

Thank you and best of luck!

Thanks for helping me understand that the only difference between bank checking accounts and savings would be the purpose they serve and their functions. I have been thinking about opening an account for myself to start managing my money better. And I hope that choosing the right option will help me achieve the retirement funds that I would like to have in a couple of years from now.