NetSuite and Sage Intacct are two very popular cloud-based ERP systems targeting medium-sized businesses. Being SaaS (software-as-a-service) model companies, they provide their clients with financial management tools and follow the dynamics of growing businesses. Both the companies cater to multi-entity businesses operating globally.

To find the best fit for your company, you should get a better understanding of what both solutions can offer and look at the major differences. The aim of this article is to guide you through the comparison of these software providers, looking at their functionality, features, pricing and key consideration points to help you choose the best one for your company.

Contents:

1. What is ERP?

2. NetSuite vs Sage Intacct: Structural difference

3. Sage Intacct: Key features and capabilities

5. Pricing

6. NetSuite: Key features and capabilities

8. Pricing

9. Sage Intacct or NetSuite: What to choose?

Key takeaways:

1. Sage Intacct and NetSuite are both cloud-based SaaS ERP solutions that are considered to be the leaders in the field distinguished by the differences in their structure.

2. While NetSuite is a fully-featured ERP system, Sage Intacct focuses on the financial side integrating with Sage products and other software for added functionality.

3. When you’re choosing between the two, focus on the needs of your business, their specific features, unique benefits and pricing strategies of the software options.

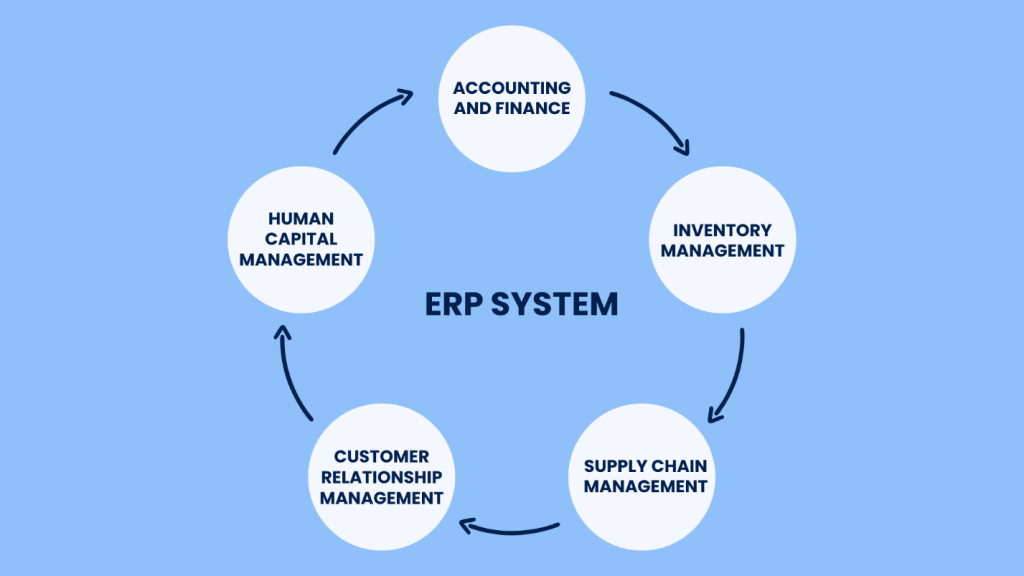

What is ERP?

ERP is short for Enterprise Resource Planning and it’s a type of software system that businesses use to manage and integrate essential parts of their operations. The ERP system reminds of a central hub connecting various departments with their functions. Such systems handle a number of key business tasks:

- Accounting and finance including accounts payable and receivable, general ledger, budgeting.

- Inventory management with tracking stock levels, purchase orders, and warehouse operations.

- Supply chain management that helps control the flow of goods and materials from suppliers to customers.

- Customer relationship management (CRM) which aims at storing customer data, managing sales pipelines, and tracking interactions.

- Human capital management (HCM) that’s responsible for payroll, benefits administration, and employee performance management.

ERP in action is like hitting multiple targets with one tool, using which results in improved efficiency, stronger collaboration between teams and reduced costs. Once your company outgrows entry-level accounting solutions, you may start to shortlist ERP providers to cover the growing and more complex needs.

NetSuite vs Sage Intacct: Structural difference

Sage Intacct and NetSuite are both cloud-based ERP SaaS solutions with multitenant models and date back to the late 1990s. However, we’re not going to get deep into the history of the companies and their acquisitions. Suffice to say that they’re considered to be the first ERP system suppliers.

If we focus on the major difference between them, that would be their structure.

NetSuite is based on an all-in-one approach, bundling various functionalities like CRM, HCM, billing and others into a single suite, which caters to businesses of different sizes and gives them a central hub to manage all sorts of processes with ease.

Sage Intacct, in contrast, has its main priority on cloud-based accounting and finance for smaller and mid-sized businesses, operating as a standalone system that can seamlessly integrate with popular CRMs, HCMs and other applications. This is a more streamlined approach to optimize the financial side.

Having said that, it doesn’t make sense to compare both the companies on the grounds of having their own inbuilt CRM and ERP, for example. As we’ve already mentioned, NetSuite uses its inbuilt CRM, while Sage Intacct integrates with Sage CRM and Sage X3 as well as other popular solutions for additional cost if your company needs them.

Let’s better look at what both the companies have to offer their target clients-mid-sized businesses and their unique benefits.

Sage Intacct: Key features and capabilities

Sage Intacct is a true cloud-based accounting software with core financials, budget planning, HR and payroll capacities.

Financial features

When it comes to its key financial features, Sage Intacct provides the following:

- Accounts receivable and payable

- Intelligent general ledger

- Dimensions

- Dashboards and reporting

- Cash management

- Order management

- Purchasing

- Invoicing and billing

Going beyond core financial features, Sage Intacct has various other features and capacities able to keep your company in the game.

Accounting capabilities

These include generating invoices, managing projects and fixed assets, tax filings, creating custom reports with real-time data and KPIs, and presenting the valuable information on dashboards.

Inventory solution

The inventory management feature helps gain control of stock over multiple warehouses.

Collaboration

Sage Intacct Collaborate is the software that facilitates close collaboration of the team members on non-routine transactions. It allows you to track multiple conversations, leave notes and get rid of countless emails.

Customization

Due to its open architecture, Sage Intacct allows its clients to build custom applications fitting their needs. Sage has a number of products like Sage CRM, Sage X3, Sage HR and others that can be integrated with Sage Intacct.

Support and implementation

It provides a comprehensive knowledge base for ongoing support as well as training and implementation services directly and through their Value Added Reseller network.

Scalability and integrations

The functionality of Sage Intacct is enhanced through a huge number of third-party integrations that can be added depending on the needs of a particular company. Global payment solutions, CRMs (including special partnership with Salesforce to integrate with their CRM), AP automation software, manufacturing software and ecommerce integrations can be a way to cover the needs of your business.

Integration example: Synder Sync

The partnership between Synder Sync and Sage Intacct is a game-changer for ecommerce and SaaS businesses. Synder Sync integrates with Sage Intacct seamlessly to automate bookkeeping for businesses that take online payments offering the following benefits:

1. Centralized data hub

Synder Sync combines data from all your sales channels and payment gateways into one place within Sage Intacct.

2. Effortless reconciliation

Synder helps automatically sync daily transactions with details like fees, sales, and payouts and match bank records for smooth reconciliation.

3. Deeper insights

With Synder, you can gain a complete financial picture with consolidated cash flow analysis, all within a single dashboard.

By automating bookkeeping and centralizing data, Synder and Sage Intacct empower businesses with the best-in-class solutions that automate repetitive processes and accelerate revenue growth, while ensuring a hassle-free accounting experience.

If you’re a Sage Intacct user and want to try the integration, register for a Weekly Public Demo to learn more about Synder or go for a 15-day free trial to see the difference Synder makes first-hand.

Unique benefits

1. Endorsement by the AICPA

Sage Intacct boasts to be the first and only preferred financial management solution endorsed by the AICPA, adding 8.7 out of 10 ranking on TrustRadius.

2. Powerful insights with multi-dimensionality

Sage Intacct goes beyond basic reporting with its unique Dimensions feature. Analyzing data from various perspectives using simple dropdown menus provides a deeper understanding of your business performance. You can use the default 8 dimensions (Location, Department, Vendor, Customer, Employee, Project, Item, Class) as well as rename them to fit your needs.

3. Easy subscription billing

For subscription-based businesses, it offers powerful tools for managing recurring billing and key SaaS metrics. It seamlessly handles revenue recognition, allocations, and even hybrid billing models combining different methods.

4. Intelligent automation and AI-powered insights

Intelligent General Ledger leverages AI power to simplify processing large volumes of transactions. Real-time posting and built-in outlier detection powered by AI help identify potential discrepancies. Additionally, you can set custom parameters for automatic review, which saves time and effort. Sage Intelligent Time, an AI-powered time tracking solution integrates with Sage Intacct and boosts your team’s efficiency.

5. Effortless consolidation across subsidiaries

You can consolidate financials across subsidiaries with ease, as Sage Intacct automates the process, including handling partial ownership scenarios and eliminating intercompany transactions during consolidation.

Pricing

Sage Intacct’s policy is the request for pricing as the price depends on the modules your company needs. The approach is per-user/per-month, which is typical for the industry. It looks more affordable compared to NetSuite as you don’t pay for the whole complex rather add modules and users when necessary. However, Sage Intacct charges for each new entity, which may become expensive if your company adds many subsidiaries.

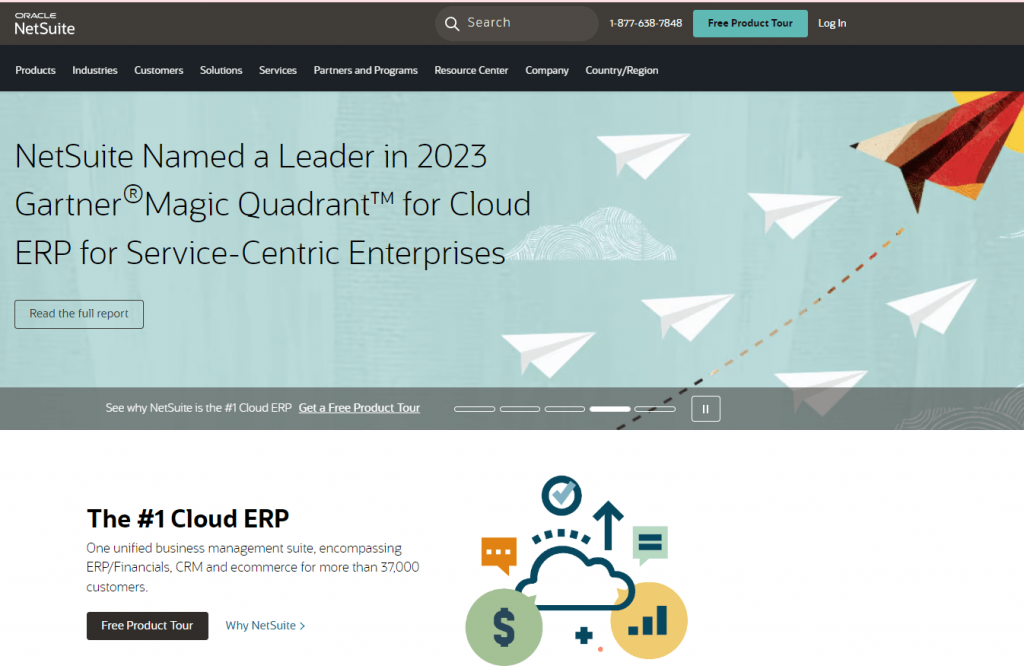

NetSuite: Key features and capabilities

NetSuite is a cloud-based ERP system designed to manage various business processes, and operates in real-time with a central, integrated database.

Core functionalities

Its core functionalities include the following modules:

- Financial management and accounting (including multi currency for global businesses)

- CRM (its own built-in CRM or integration with Salesforce)

- HCM (Human Capital Management)

- PSA (Professional Services Automation)

- Supply chain management

- Inventory and warehouse management

- Omnichannel commerce

- Business intelligence

Accounting features

Accounting features include billing, project accounting, financial planning and reporting, global consolidation, governance, risk and compliance, and revenue recognition.

Planning and budgeting

Planning and budgeting is an add-on module that offers advanced functionalities for financial planning and analysis, including budgeting, forecasting, scenario modeling, and trend analysis. It integrates seamlessly with Microsoft Office and provides insightful dashboards.

Professional services automation

Professional services automation by NetSuite includes analytics, project management, resource management and timesheet management.

Unique benefits

1. Global business management software

NetSuite’s OneWorld module was developed directly for managing multinational businesses, handling complex tasks like consolidation. It supports 27 languages, more than 190 currencies, transactions in more than 90 bank formats, as well as tax and reporting standards for more than 100 countries.

2. Fully-featured Enterprise Resource Planning

NetSuite is a fully-featured ERP system, as it was mentioned before. It provides your business with many types of add-on modules. At the same time, it still allows for integration with other software replacing its own. For example, you can integrate with CRM by Salesforce, which is considered to be best-in-class.

3. SuiteSuccess feature

SuiteSuccess offers its clients faster implementation and smoother workflows. This service provides pre-configured workflows, industry best practices, and key performance indicators (KPIs) tailored to various industries. There’s an option to choose additional modules to fit your specific needs.

4. NetSuite Experience

NetSuite Experience is a product that is responsible for client experience, providing features like mobile access, role-based security, customizable dashboards, and document management.

Pricing

The pricing strategy is based on a significant upfront payment for a variety of functionalities you have by default. It may seem that your business doesn’t need all of it at first, but when it scales, it may become increasingly valuable. The pricing model is per-user/per-month, with some extra monthly fee for additional functionalities. NetSuite charges the same price regardless of the quantity of subsidiaries.

Sage Intacct or NetSuite: What to choose?

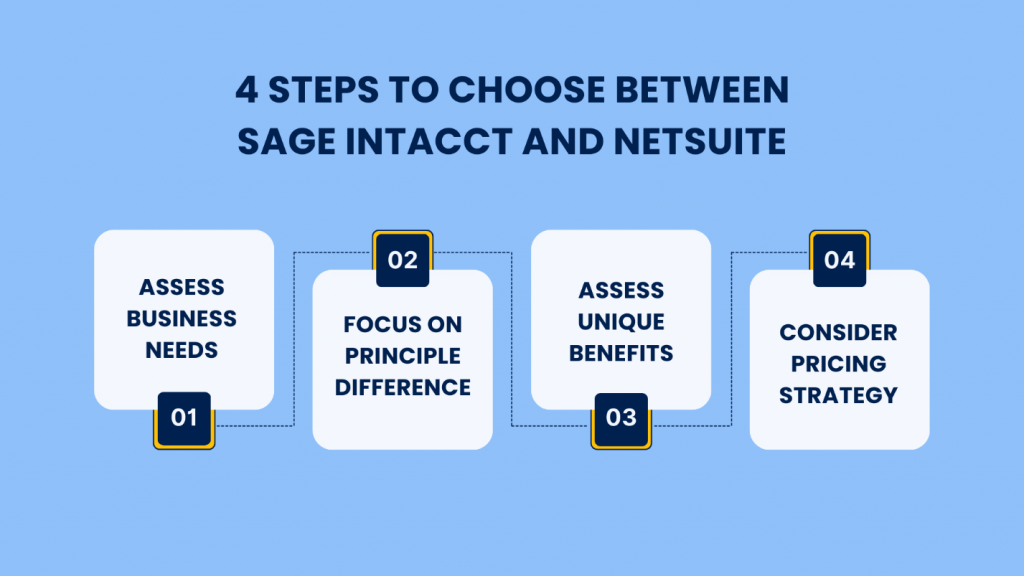

It’s never easy to choose between the leaders in their industry and systems with such experience and client bases, but we’ll try to give a step-by-step guide to help you decide.

Step 1: Assess the needs of your company

Define the current needs of your company and whether the ERP system you’re about to choose satisfies them. You need to consider the size and complexity, think of what functionality to prioritize. One more thing to decide on at the very start is the budget you’re going to allocate.

Step 2: Focus on the principal difference

You have to recognize that NetSuite is an all-in-one solution, offering a range of functionalities typical for an ERP system, while Sage Intacct concentrates primarily on accounting and finance, covering the rest with integrations. You are to define whether you go for an all-in-one-package solution (NetSuite) or a best-in-breed approach with separate systems, each being the best-in-class (Sage Intacct with integrations).

Step 3: Assess the unique benefits of each solution

Focus on the unique features we described above and see which of them are the most useful for you. If your company is global or planning to be and you need a business software that supports other languages than English, you might want to consider NetSuite. On the other hand, if you’re based in the USA and looking for the solution that has the authority, you might want to turn your eye to Sage Intacct with its AICPA endorsement benefit as a clear preference over Oracle NetSuite. In other words, the choice depends on your company and the future you see for it.

Step 4: Consider pricing and implementation

Research the process of implementation and training availability and potential costs for both the competitors. It makes sense to calculate ROI for each of the options. You need to take into consideration initial costs and potential ongoing costs, including subscription costs, implementation and licensing.

Assess the solution’s scalability and integration options you might need to add up. Evaluating efficiency improvements, time saving, revenue generation and cost reduction as a result of implementing the solutions will help you see the potential benefits of both software options. Of course, It won’t be easy for you to quantify the benefits, but it’s the key to choosing the right solution with superior ROI.

We hope that these steps and the information about Sage Intacct and NetSuite provided above can help you decide on the best software option for your company that will align with your goals and fit your budget.

You can also take a look at a side-by-side comparison of Sage Intacct and NetSuite by G2 platform. The comparison is based on the user reviews and shows Sage Intacct scoring 4.3 out of 5 stars based on 3,161 reviews, while NetSuite’s ranking is 4.0 out of 5 stars with 3,099 reviews.

Bottom line

If you feel that you’re outgrowing entry-level accounting software, you might want to consider ERP solutions that will cater to growing businesses and their complex needs.

When choosing between the two software options, it’s necessary to assess the principal difference between them. In the case with Sage Intacct and NetSuite, this difference is their structure. While NetSuite is a fully-featured ERP, Sage Intacct has finance and accounting as its major focus. After looking at the key features and unique benefits both the systems bring to the table, you need to prioritize your business demands and ultimately make the choice between an all-in-one solution (NetSuite) or best-in-breed with integrations (Sage Intacct).

One last valuable tip is to turn to both providers and get their detailed pricing proposals for your company, which will certainly bring some clarity.

Thanks for succinctly comparing Sage intact and Netsuite.

Thank you, David for your kind words!