When you accept payments through Stripe and handle your accounting in NetSuite, reconciliation can quickly become complicated. Stripe groups transactions, takes out processing fees, and sends out lump-sum payouts. This makes it very hard to match deposits to individual sales by hand.

The best way to reconcile Stripe payments in NetSuite is to use a dedicated integration tool like Synder. It automates transaction syncs, accurately accounts for fees and refunds, and matches every Stripe payout with your NetSuite records without using spreadsheets.

Why reconciling Stripe in NetSuite is so challenging

Reconciling Stripe payouts isn’t just about matching a payment to a bank statement. Stripe uses a rolling payout schedule. It bundles multiple customer payments, applies platform fees, and sends a single deposit. This process makes it hard to connect a Stripe deposit back to the appropriate sales and customers.

Businesses often face these issues:

- Stripe fees that don’t appear in bank feeds

- Partial refunds and chargebacks across different periods

- Timing differences between transactions and payouts

- No clear record for adjustments or disputes

These challenges turn manual reconciliation into a slow and error-prone task. That’s where a smart Stripe NetSuite integration tool like Synder can help.

Automating Stripe reconciliation in NetSuite with Synder

Here’s how Synder helps you reconcile Stripe payouts in NetSuite with full automation, clean mappings, and minimal manual intervention.

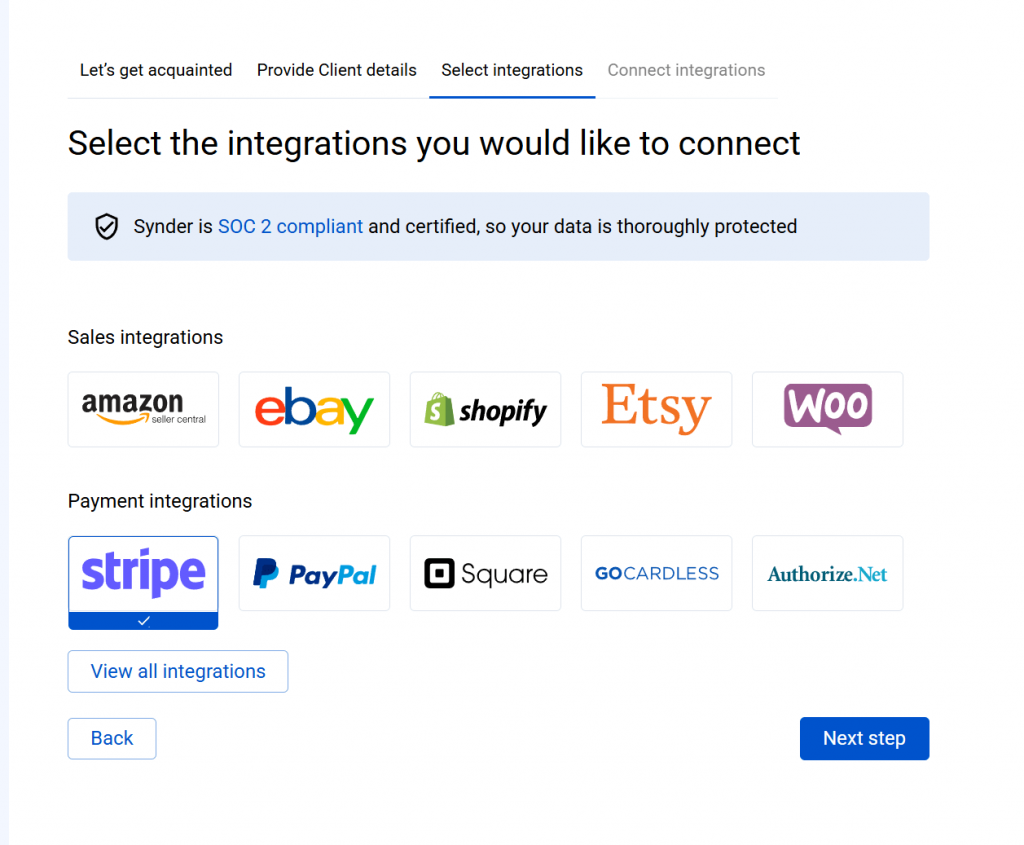

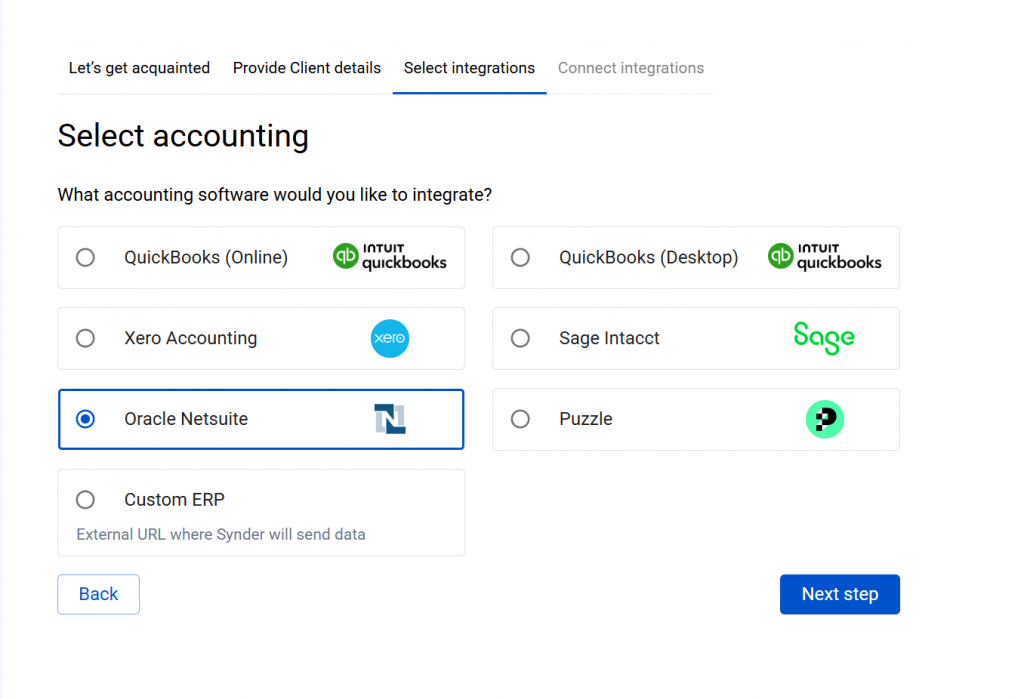

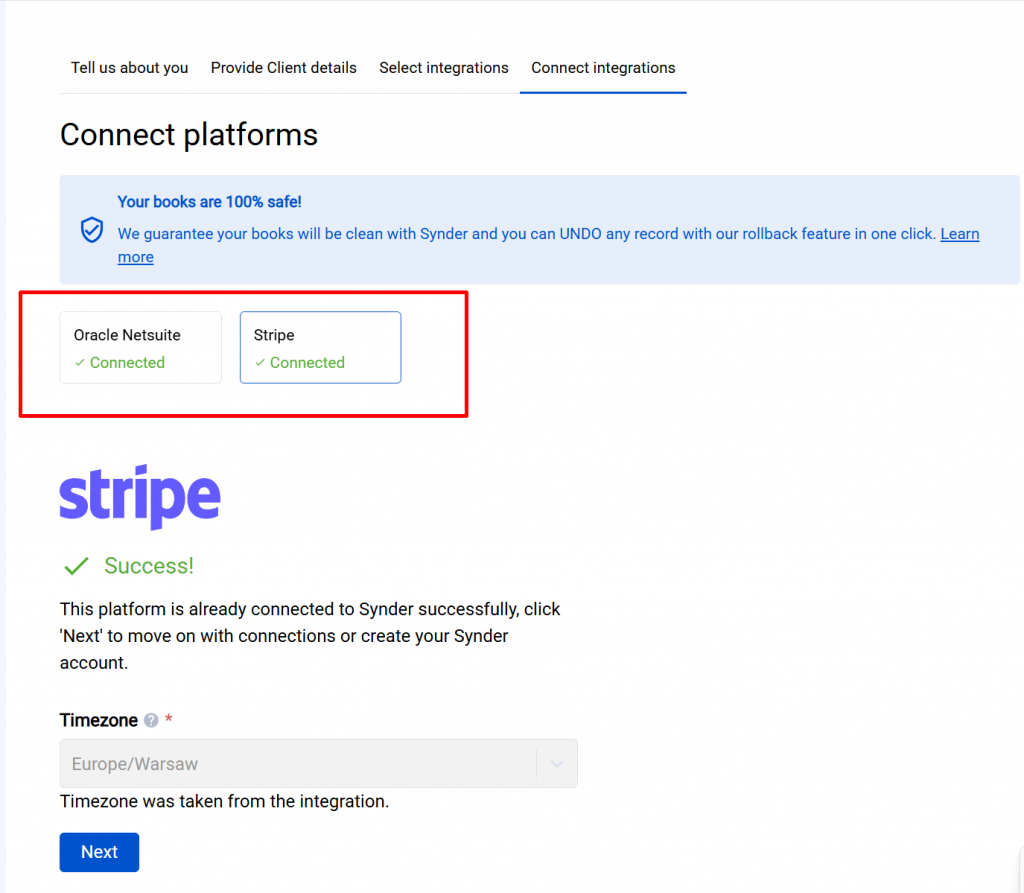

1. Connect Stripe and NetSuite to Synder

To get started, create an account with the 15-day free trial and connect both your Stripe account and Oracle NetSuite to Synder using the built-in integration flow. Learn more from our setup guide.

Once connected, Synder will start pulling in your Stripe data, including:

- Payments

- Refunds

- Stripe fees

- Payouts

- Disputes and chargebacks

Everything flows directly into your NetSuite account without any extra exports or uploads.

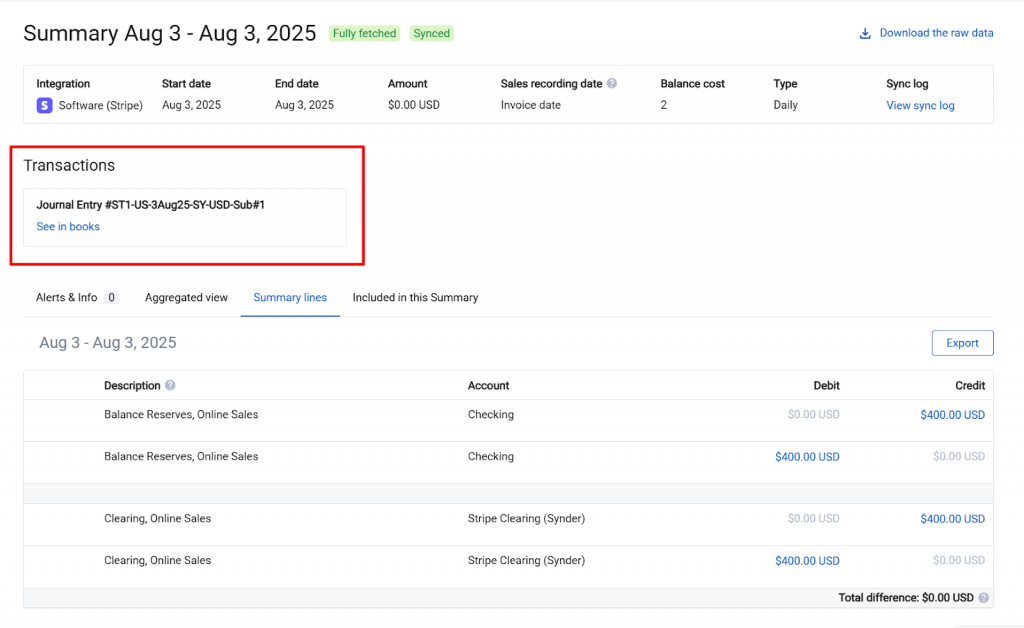

Note: For Netsuite, Synder offers the Summary Sync mode, which generates a single summarized journal entry for each Stripe payout, reflecting all associated activity.

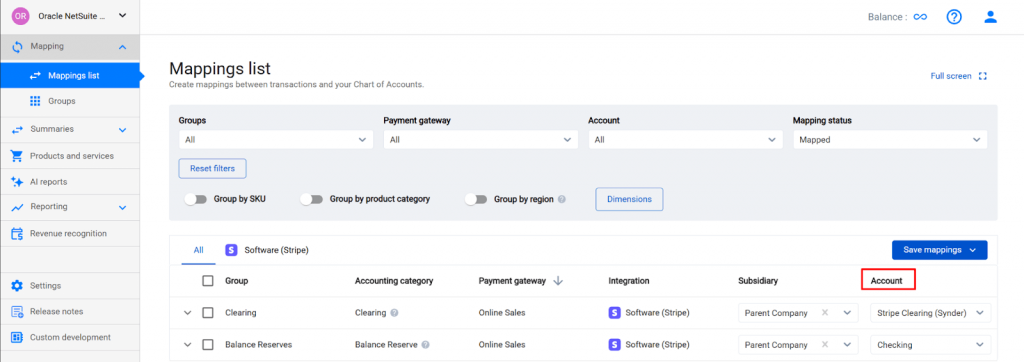

2. Set up account mapping

Next, define how each type of Stripe transaction is recorded in NetSuite.

Synder allows precise mapping of:

- Sales revenue (to the correct GL income accounts)

- Stripe processing fees (to expense accounts)

- Refunds (to credit memo workflows or refund income categories

- Disputes and chargebacks (to reserve, suspense, or custom accounts)

This ensures all financial data is categorized correctly in your chart of accounts and supports clean audit trails.

3. Automatically sync and post Stripe data

With your mappings and sync settings in place, Synder begins posting transactions to NetSuite in real time (or on a schedule you choose).

It handles:

- Accurate posting of gross payments, fees, and net amounts

- Auto-application of refunds to original payments or customer records

- Full tracking of disputes, including updates as cases are resolved

- Journal entries for each Stripe payout that match your actual bank deposits

It doesn’t matter if you’re syncing daily or closing the month, this process keeps your records clean, accurate, and ready for reconciliation.

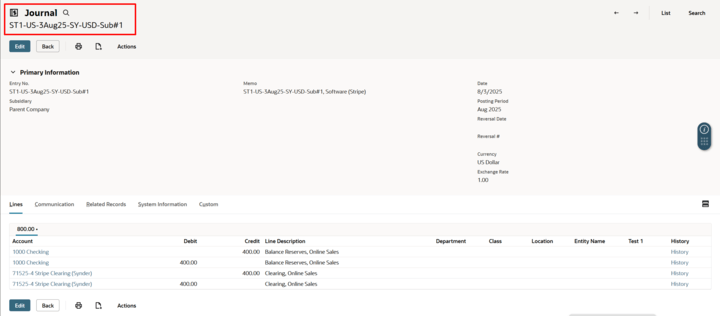

How Synder uses clearing accounts for Stripe payout reconciliation

To reconcile Stripe payouts, Synder uses clearing accounts to reflect the flow of funds.

What’s a clearing account and why use one?

This account acts as an internal waiting room for Stripe funds. Since Stripe deposits arrive in batches and are delayed, this buffer keeps your general ledger clean and easy to follow.

Here’s how it works with Synder:

- Each transaction, like sale, fee, or refund, first gets posted to the Stripe clearing account.

- When a payout comes in, Synder makes a journal entry that transfers the net payout from the clearing account to your bank account register.

- This process ensures that the clearing account balances out after each payout.

This setup makes Stripe reconciliation in NetSuite easier by aligning with Stripe’s logic rather than opposing it.

Smart grouping of transactions

When using the Summary Sync mode, Synder groups Stripe transactions based on their actual payout batch. This means:

- Every journal entry aligns with a specific Stripe deposit

- Transaction timing stays accurate

- Stripe fees and refunds are cleanly recorded

- Your books are cleaner, with fewer daily line items

Why use Synder for Stripe–NetSuite reconciliation

Here’s what Synder brings to the table for businesses using Stripe and Netsuite:

- Automated reconciliation of Stripe payouts, fees, refunds, and disputes: Synder automatically matches Stripe transactions to NetSuite records. This ensures everything links to the correct bank deposit without any manual work.

- Real-time syncs or custom schedules based on your financial close: You can choose between instant syncing or scheduled updates to match your month-end close process and internal controls.

- Detailed mapping of all transaction types for audit-readiness: Each Stripe payment, fee, refund, or dispute is linked to the right NetSuite account. This supports accurate financial reporting and compliance.

- Multicurrency support for global businesses: Synder manages transactions in various currencies and applies the correct exchange rates. This keeps your international sales reconciled.

- Consolidated journal entries that reduce GL clutter: Instead of overwhelming your general ledger with separate records, Synder can summarize Stripe activity for each payout into one clean entry.

- Back sync support to bring in historical Stripe data: If you need to reconcile past months, Synder allows you to import and sync historical Stripe payouts and transactions into NetSuite.

See how much smoother your workflow can be—join us for a live demo.

FAQ

Can I import historical Stripe payouts into NetSuite?

Yes, Synder allows you to import past Stripe transactions and payouts. You can back-sync by selecting a custom date range, even if it spans months or years. Please note that this option includes 3 months free on the Pro plan and unlimited access at no cost on the Premium plan.

How are Stripe fees and processing deductions recorded?

Stripe fees are automatically identified and posted to the expense account of your choice, ensuring net vs. gross revenue are cleanly separated in NetSuite.

Do Stripe refunds generate credit memos in NetSuite?

They can. Based on your configuration, Synder creates either credit memos or directly applies the refund to the original customer transaction.

What happens if a payout doesn’t match?

Synder flags discrepancies and helps you trace any missing or mismatched items between Stripe, Synder, and NetSuite.

How are disputes and chargebacks handled?

Synder tracks Stripe disputes and applies them to the proper accounts with full detail on amount, date, and outcome, keeping your records clean and complete.