Managing payment terms is crucial for any business. Whether you’re receiving payments for products or services or making payments for them, it’s vital to understand and abide by the payment terms. One of the most common payment terms is net 30. You may have met this phrase on invoices and purchase orders multiple times.

Let’s take a closer look at what net 30 means and how it impacts businesses.

Net 30 payment terms: understanding payment terms

Let’s start with debunking payment terms and their meaning in business management.

Payment terms refer to the conditions and agreements between parties involved in a financial transaction. These terms outline the timing and manner of payments, along with any discounts or penalties that may be associated. They provide a structured framework that governs financial settlements, ensuring clarity and predictability in business transactions.

In other word, payment terms identify the time to which you’re extending credit to your customer.

Period and terms variety businesses might offer

Businesses operate in a diverse landscape, and payment terms usually aim at accommodating this diversity. Various payment terms cater to the unique business relationship requirements and expectations.

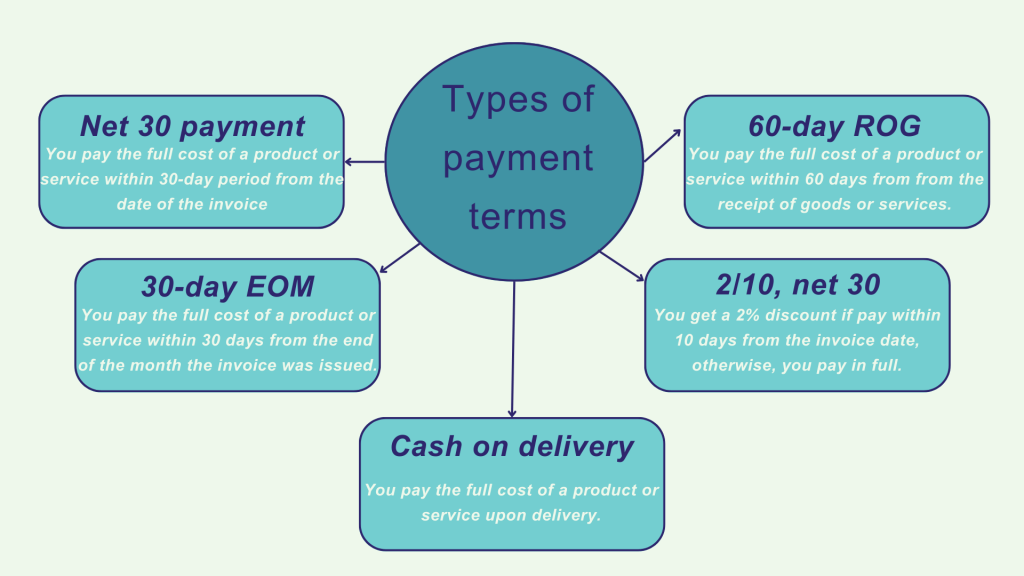

Some of the most common payment terms include:

- Due on receipt (DOR)

This payment term mandates that the invoice amount is due immediately upon receipt of the goods or services. It leaves no grace period and is often used in cases where trust and urgency are paramount. - 30-day EOM (End of Month)

In this scenario, a business anticipates the payment within 30 days from the end of the month the invoice was issued. If, for instance, an invoice date is the 15th of January, the payment would be due by the end of February. - Cash on delivery (COD)

With COD terms, a customer pays at the time of delivery. It’s often used in retail settings, where goods are exchanged directly for payment. - 2/10, net 30

This term offers an early payment discount, encouraging the payer to remit payment within ten days to avail of a 2% discount. When a customer misses the early payment window, the full invoice amount is due within 30 days. - 60-day ROG (Receipt of Goods)

In this case, the 60-day countdown begins not from the invoice date but from the receipt of goods or services. It grants the payer additional time to assess the quality of what was received. - Net payment terms

Net payment terms usually signify the final, undiscounted amount to pay without deductions or concessions. The number following net represents the number of days within which a customer must fulfill the payment. At this point, they can come in various forms, such as net 15, net 20, or net 30, indicating different payment periods. Of them, the net 30 one is the most popular, and we’ll break it down in more detail further.

Why terms of paying are important for businesses

In business transactions, payment terms play a crucial role. They shape the cash flow, risk management, and reputation of businesses. Adhering to these terms is a best practice and a strategic imperative for financial foundations and lasting business relationships. In short, payment terms are indispensable for businesses. Here’s why:

Cash flow management

Payment terms provide a structured framework for businesses to anticipate when they will receive payments and when they need to make payments. This predictability is vital for maintaining healthy cash flow. When you manage cash flow effectively, you can cover your operational expenses, invest in growth, and weather unexpected financial challenges.

Risk mitigation

By defining clear payment expectations, payment terms reduce the risk of disputes and disagreements. They offer a shared understanding of when payments are due, how customers make them, and any applicable discounts or penalties. This clarity minimizes the likelihood of financial misunderstandings and the associated legal or relationship issues.

Credibility and trust

Adhering to payment terms is a testament to a business’s credibility and reliability. When payments are made on time and by the agreed-upon terms, it builds trust between the parties involved. Trust is valuable in business relationships and can lead to better opportunities.

Negotiation power

Payment terms can be a powerful bargaining chip in business negotiations. Companies that consistently make early or on-time payments often have the leverage to negotiate favorable terms with their suppliers. These could mean extended credit limits, discounts on future purchases, or priority treatment in supply chains.

Opportunities for discounts for early paid invoices

Many payment terms offer the allure of early payment discounts. Businesses that take advantage of these discounts can significantly reduce costs and improve their profit margins. This cost-saving mechanism can be especially beneficial in industries with tight profit margins.

Credit management: getting better credit terms

Payment terms play a pivotal role in a business’s credit management strategy. A strong track record of honoring payment terms can lead to improved credit scores, better access to financing, and the ability to secure loans or lines of credit for expansion or unforeseen expenses. Business entities usually acnowledge cusomers steadily paying within the agreed terms, offering credit at better conditions or other perks.

Supplier relationships

For businesses, a strong relationship with suppliers is often synonymous with operational smoothness. Paying according to agreed-upon terms ensures a steady supply of goods and services and fosters a sense of partnership. A robust supplier network can be invaluable in today’s interconnected business world.

Budgeting and financial planning

Payment terms provide a foundational element for budgeting and financial planning. Businesses can forecast their cash flow, allocate resources, and plan for future expenditures confidently, knowing when payments are due and under what conditions.

A closer look at net and 30 in the net 30 terms

As mentioned earlier, net 30 terms are among the most popular and widely used options in business transactions. Let’s break down its constituent parts and how it works in practice.

What does net 30 mean: what net and 30 stand for

When a invoice terms state net, it usually means that the amount mentioned is the final amount to pay, without any deductions, discounts, or concessions. The business receiving the invoice expects to receive the full amount, and it is the total financial commitment that must be honored.

The 30 is the temporal component of net 30. It denotes the number of days, the time frame within which a business expects its customer to fulfill the payment. It commences from the date of the invoice. It gives the payer 30 days to remit the cost of a product or a service received in full, providing enough time to review the invoice, gather the necessary funds for the invoice payments, and fulfill the financial obligation.

Let’s look at how net 30 works in real life.

Suppose you receive an invoice from a supplier for $1,000 with net 30 terms. The 30-day countdown begins from the invoice issuing date, giving you precisely one month to submit the full $1,000 payment.

It sounds pretty simple.

However, such a simple action comprises several steps from a supplier and customer.

Net 30 terms: steps for the business (supplier)

- A business receives a purchase order

It all begins when the customer orders a product or service. This order triggers the creation of an invoice. - Invoice generation

The supplier generates an invoice that details the items or services provided, their costs, and the payment terms (net 30 in our case). The invoice also includes the date of issuance, which marks the start of the 30-day countdown. - Delivery or service completion

The supplier delivers the product or performs the service according to the customer’s order. Upon completion of delivery, the supplier records the transaction and sends the invoice to the customer. - Communication and clarifications

In case of any discrepancies or questions about the invoice, both parties engage in clear and timely communication to resolve issues and ensure an accurate understanding of the terms. - 30-day grace period

The customer has 30 days from the invoice issuing date to pay in full without any deductions. During this time, the customer can review the invoice, verify the goods or services, and arrange payment. - Monitoring and Follow-Up

The supplier diligently monitors the status of the invoice and payment. When they get nothing within the net 30 period, the supplier may send reminders to the customer or follow up regarding the outstanding balance. - Payment Reception

When the customer submits the payment, the supplier acknowledges and records it, completing the financial transaction. At this point, the customer’s commitment is regarded as fulfilled.

Net 30 terms: steps for the customer

- Order placement

The customer initiates the process by placing an order for a product or service with the supplier. This order includes a request for specific goods or services, quantity, and other relevant details. - Invoice receipt

Upon fulfilling the order, the supplier generates an invoice and sends it to the customer. The invoice outlines (as we mentioned above) the due amount, payment terms, and the invoice date. - Review and verification

The customer carefully reviews the invoice to ensure accuracy, confirming that it matches the initial order and accurately reflects the goods or services received. - Payment planning

To meet the net 30 terms, the customer plans the payment and allocates the necessary funds within 30 days. This financial planning is crucial to ensure on-time payment. - Payment submission

Before the deadline arrives, the customer submits the full payment as specified in the invoice. It covers the total due amount without any deductions or discounts. - Acknowledgment and record-keeping

The customer receives acknowledgment of the payment from the supplier, confirming the successful settlement of the invoice. The customer maintains records of this transaction for financial documentation.

Paying within the net 30 window

The golden rule of net 30 payment terms is simple: pay on time. This means that when you receive an invoice with these terms, you should aim to settle the amount due within that 30-day window.

Timely payments not only uphold your reputation but also demonstrate financial responsibility. They showcase your ability to manage cash flow effectively, which can be a significant advantage when seeking future credit or negotiating deals with suppliers.

Late payments, on the other hand, can lead to strained relationships and tarnished credit scores. They might also trigger late payment penalties, which can add to your overall costs. Hence, adhering to the net period is a win-win for all parties involved.

Remember, paying on time doesn’t just mean cutting a check. It involves efficient financial planning to ensure you have the funds available when the invoice comes due. To make this process smoother, some businesses utilize automated systems like Gocardless and Viva, which we’ll explore later in this article.

The perks of paying early

While net 30 sets the standard for when payment is expected, there’s a smart strategy that can work to your advantage: early payment. Paying your invoices before the net 30 deadline offers a range of benefits that can enhance your financial standing in the business world.

One significant perk is the negotiation power it provides. When you consistently make early payments, suppliers are more likely to view you as a reliable and valued customer. This can lead to more favorable terms, such as extended credit limits or discounts on future purchases. In essence, you’re cultivating a reputation that opens doors to better deals.

In addition to negotiation power, early payments can also secure you a payment discount. Many suppliers offer a discount if you pay an invoice within a certain time frame, typically less than the net 30 period. This discount can range from a few percentage points to a substantial sum, depending on the supplier’s policies. For example, a 2/10, net 30 term means, as mentioned above, you can take a 2% discount if you pay within 10 days. Otherwise, the full amount is due within 30 days.

Leveraging your credit score is another benefit of early payment. Your creditworthiness in the business world is influenced by how well you manage your financial commitments. By consistently making early payments, you build a solid credit profile, which can lead to improved credit terms, lower interest rates on loans, and more opportunities for growth.

Payment discount phenomenon

Now that we’ve touched on payment discounts let’s delve deeper into this intriguing phenomenon. Payment discounts are a way for businesses to incentivize early payments and enhance their cash flow.

These discounts are typically expressed in the X/Y, net Z format, where X represents the percentage discount offered, Y is the number of days within which you should make the payment to qualify for the discount, and Z is the total payment due if you don’t meet the early payment criteria.

For buyers, it’s a chance to reduce costs and improve cash flow. The earlier you pay, the more you save. If you have the funds available, it makes financial sense to take advantage of these discounts. However, it’s crucial to weigh the discount against your opportunity cost. Sometimes it might be more advantageous to invest the money elsewhere rather than securing a small discount.

On the flip side, suppliers benefit from this system as well. They receive payments sooner, which helps them manage their own cash flow. In addition, offering discounts can attract more prompt payments, reducing the need to chase late payments and potentially saving on collection costs.

Gocardless and Viva Capital: an example of streamlining net 30 payments

In the digital age, businesses are seeking efficient solutions to manage their net 30 payments. Gocardless and Viva are two platforms that have emerged as champions in this realm, simplifying the payment process and ensuring that businesses stay on track with their payment terms.

Gocardless is a direct debit service that allows businesses to collect payments directly from their customers’ bank accounts. It automates the payment process, reducing the risk of late payments and the need for manual invoicing. With Gocardless,

businesses can set up recurring payments and ensure that invoices are paid on time, every time. This not only streamlines the net 30 payment process but also saves time and resources that can be better utilized in other aspects of the business.

Viva, on the other hand, is a comprehensive payment platform that simplifies payment processing and cash flow management. It offers various features, such as invoice creation, pay reminders, and tracking. With Viva, businesses can effortlessly manage their invoices and monitor payments within the net 30 period, ensuring that they maintain a positive financial reputation and secure any available discounts.

Both Gocardless and Viva are valuable tools for modern businesses seeking to optimize their financial operations. By automating payment processes and reducing the risk of late payments, these platforms make adhering to net 30 easier than ever.

Wrapping up

As you can see, net 30 payment terms are more than just words on an invoice. They represent a critical element in maintaining efficient trade and healthy business relationships. Understanding the meaning of net terms and the 30-day pay period, as well as the perks of early payment can empower you to navigate the financial landscape with confidence.

By paying within the net 30 window, you uphold your professionalism as a business and cultivate trust and reliability in your business partnerships. Embracing early payments can lead to negotiation power, discounts, and a stronger credit profile, all of which can benefit your business in the long run.

So, as you navigate the business world, remember that net pay terms are your ally. They offer a clear path to financial responsibility and can pave the way to stronger business relationships, cost savings, and a brighter financial future.