Making Tax Digital (MTD) is a fundamental tax programme initiated by the UK government. Its prime goal is to transfer the UK tax system from the world of pen and paper into the digital realm.

The initiative intends to change the way taxes in the UK work in essence, by making tax reporting fully digital. The government believes that the MTD policy is:

- More effective compared to manual tax filing

- More efficient in terms of administration processes

- Easier for taxpayers to file their taxes correctly

Do taxpayers agree? How does this programme transform their established tax routine? And what will be the outcomes of this transformation for professional accountants and small businesses? Let’s discuss.

Contents:

Benefits of Making Tax Digital for business

Impact of Making Tax Digital on accountants

What is Making Tax Digital?

The name “Making Tax Digital” speaks for itself. The governmental programme plans to modernise the tax system in the UK. This goal is to be achieved by digitalising the tax reporting experience for businesses and accountants.

By deploying the MTD programme, Her Majesty’s Revenue and Customs (HMRC) — the department responsible for collecting taxes in the UK — aims to make tax administration simpler. The primary idea of the initiative is based on utilising digital-only tools for keeping records and submitting tax returns to the regulator.

Digital record-keeping tools:

- Improve the tax administration process

- Make services more focused and personalised

- Facilitate doing taxes for businesses

Purpose of Making Tax Digital

What was the purpose of creating such an initiative in the first place? Digital transformation is a costly, time-consuming, and (sometimes) painful process to go through. But it is essential to make the economy ready for the digital era.

The time is ripe for the UK tax services to move from the traditional to the advanced. This obligatory programme works as an impulse for the desired change.

Here’s how Making Tax Digital helps achieve the desired tax system transformation:

- Moving payments closer to the point of transaction. The level of digitalisation is varied among businesses. But many entrepreneurs are using at least some form of digital tools for business purposes. It can be online banking, paying business rates online or using smart meters in their business premises. With MTD, capturing income and expenses much closer to the point of transaction is becoming more accessible and more accurate.

- Supporting taxpayers who want to pay the right amount. They say that machines will never substitute humans, but nothing will outperform the human with the machine. The accuracy of digital record-keeping tools prevents businesses from making costly errors. Technology helps significantly reduce the chance of making some types of mistakes in tax returns, particularly simple arithmetical and transposition errors.

History of Making Tax Digital

The history of Making Tax Digital began in 2017. During the last four years, the programme was unfolding gradually. Businesses, self-employed people and landlords started reporting to HMRC every quarter. The usage of special accounting software was initiated.

Due to the received feedback, the government decided to slow down the expansion of the programme.

It all started with reporting Income Tax and National Insurance obligations. A few years later, the filing of Corporation Tax was added. The full range of HMRC services became available to taxpayers through digital tax accounts.

By 2020, more than 1.4 million businesses had joined the digital initiative, and more than 4 million VAT returns had been submitted online successfully using MTD-compatible software.

The digitalisation of the UK tax landscape leapfrogged ahead:

- Over 83% of liable businesses have registered to the service.

- 95% of those who had enrolled on time successfully made their first tax return.

- More than £41 billion of payments and over £13 billion in repayments have successfully flowed through the new digital tax system.

In 2021 the initiative continues to progress. Starting from April 2022, all UK VAT registered businesses will have to sign up for the programme, regardless of how much they earn.

How Making Tax Digital works

Making Tax Digital introduced a bunch of novelties for taxpayers.

- First, under the old system, businesses reported one tax bill at the end of the year. MTD demands that income and expenditure must be filed quarterly. HMRC says this facilitates a more accurate projection of taxes due.

- Secondly, what businesses were obliged to follow under MTD guidelines was determined by the taxable turnover threshold. This threshold determines which UK VAT registered companies are MTD liable. Only those with turnover above the VAT threshold are required to report.

- Thirdly, taxpayers became obliged to integrate their accounts with software in some way. There are requirements for digital tools for the returns to be accepted by HMRC. The software has to be MTD-compatible.

Let’s dive into more detail.

Keeping Records Digital

According to the terms of Making Tax Digital, liable businesses must:

- keep certain records digitally,

- in their original form,

- and within functional compatible software.

Businesses and accountants do not have to keep all of the necessary records in just one software tool. Digital records can be kept in a range of compatible formats.

Making Tax Digital for VAT

As of today, the threshold for filing and paying VAT online is £85,000. Those whose gains are above the VAT threshold must follow the Making Tax Digital rules by keeping digital records and using software to submit a VAT return.

Those whose taxable earnings are below the VAT threshold can join the service voluntarily. This rule will apply until April 2022, when businesses below the threshold will be expected to file digitally as well.

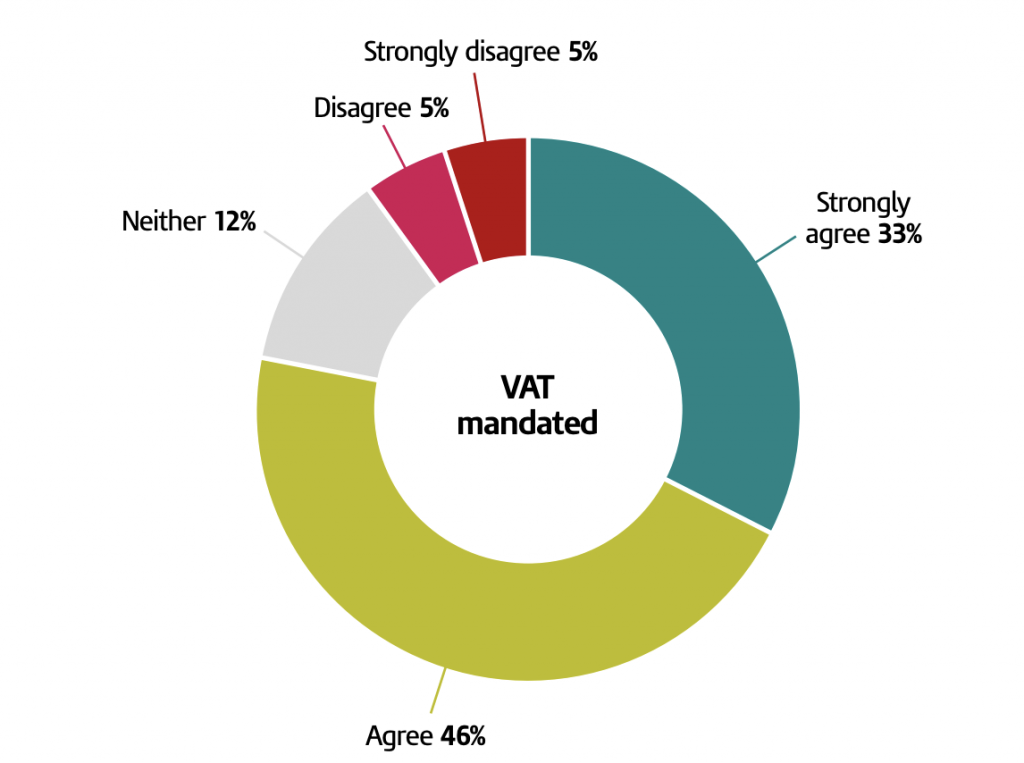

The statistics below depict the level of technology acceptance among taxpayers. As we can see, 79% of UK VAT-mandated businesses agree or strongly agree about using digital tools to manage their tax and business finances.

The End of Manual Data Transfer

HMRC does not accept “copy and paste” as a solution to select and move VAT tax data. It means that manually transferring data is not acceptable under Making Tax Digital. Only digital links are allowed — a digital exchange of information between software programs without the involvement or need for manual intervention.

For example, if you want to pay VAT online, you can’t take tax details from an invoice in one ledger, write them down on a piece of paper, and enter them by hand into another part of the business functional compatible software system. Instead, you need to use software that can import these invoice details itself.

Benefits of Making Tax Digital for business

The benefits of digital tools for doing business finances are evident in the official research conducted since the MTD programme began.

Here’s the short summary:

- For small businesses, online accounting software increased productivity by 11.8%.

- Businesses who fully integrate their accounting and tax software report spending less time on their tax.

- Early adoption of technological services saves one day a week in financial administration for businesses.

In general, the employment of digital accounting tools allows businesses to see the health of their finances. By integrating record-keeping into regular tax activities, companies spend less time overall dealing with their tax affairs. In close to real time, owners can assess which decisions turn out to be profitable and which expenses have become suffocating.

After taxpayers submit the automatically-generated quarterly summary updates of their income and expenses, they receive a calculation of their tax position. It also helps them budget further throughout the year.

By 2020, more than 270,000 smaller businesses, more than a quarter of businesses below the VAT threshold, have joined MTD willingly, even though they were not obliged to pay VAT online. These numbers show that a digital approach to managing taxes online can work for businesses of every size.

Impact of Making Tax Digital on Accountants

For many bookkeepers and accountants in the UK, the rollout of the MTD initiative means shifting their focus towards more advisory services. Instead of sorting out receipts and paper invoices, trying to figure out what they are meant for, professionals can now have more time to concentrate on providing services that add value for their business clients.

Accountants have more time now to apply their insight into the financial health of businesses to help them identify opportunities to maximise productivity and growth. That’s how the accounting services in the age of the digital economy are transforming: less time spent on mechanical tasks that you can delegate to software.

The great thing about MTD is that you can look through all of your information on a system and know that everything is in that return, check the detailed report, make sure everything is correct and then press submit — and it goes. You are just taking out any sort of human error.

Billie McLoughlin, an accountant from Harris, Lacey & Swain in Hull on how Making Tax Digital impacts her work.

Results of Making Tax Digital

After using the Making Tax Digital service, fully and partially automated businesses in the UK observed that their VAT returns became more accurate. They admitted that accounting errors were reduced and developed greater trust in the software.

The principal results of MTD:

- Reduction in error. Input errors and miscalculation errors were reduced. This was because data either only had to be input once or it was automatically imported into the software. And figures are calculated by the software automatically, too.

- Ability to correct errors quickly and easily. Regular and frequent data input, automatic bank reconciliation, and easy-to-use software help manage finances daily and in real time. Mistakes are easier to spot, and their source quicker to determine for instant correction.

- VAT returns are more accurate. With everything fed into software daily, it became more convenient to account for everything and include all records in a VAT return. Overall, taxpayers experienced ease in online accounting.

This change in tax behaviour and a better ability to eliminate avoidable mistakes is believed to lead to additional tax revenue, supporting public services and smoothing the playing field for all businesses.

Bottom Line

What is Making Tax Digital? It is a government initiative, pivotal to transform the UK tax system and digitalise accounting services. An essential part of the plan is to make it easier for individuals and businesses to report and pay VAT online and keep on top of their finances.

What are the benefits of Making Tax Digital for businesses and accountants? Many taxpayers had already recognised the advantages of going digital, automating processes and implementing software. They benefit from saving time and reducing accounting errors when compared with manual methods.

Altogether, the more technologically advanced companies are, the more satisfied they feel about the Making Tax Digital policies. Those who fully automated their processes have a positive experience of filing VAT returns and using digital services.

This was a great read Vladislav. Making tax digital will certainly help my accounting solutions UK business a lot.

Thank you so much for your kind words! I’m glad to hear that you found the article helpful. Making Tax Digital is indeed a significant step forward for many businesses, including accounting solutions in the UK.