In finance, understanding a company’s health involves decoding complex indicators. Liquidity ratios provide a straightforward lens into a company’s short-term financial strength, answering questions about its ability to pay bills and navigate daily expenses.

Let’s look at these ratios, exploring what they are, why they matter for businesses, and how investors and creditors use them.

Key takeaways

- Liquidity ratios, including the current ratio, quick ratio, cash ratio, and operating cash flow ratio, are essential for assessing a company’s ability to meet short-term obligations using its available assets.

- Different stakeholders, such as investors, creditors, and management, use these ratios to evaluate a company’s financial health, risk management, and operational efficiency, although each ratio has its limitations and should be considered alongside industry norms and other financial metrics.

- Improving liquidity ratios involves strategic financial management practices, such as efficient inventory management, negotiating favorable credit terms, streamlining accounts receivable processes, maintaining optimal cash reserves, and exploring short-term financing options.

Empower your business with valuable insights by tracking essential KPIs through Synder Insights. Gain a holistic view of your sales, product performance, and customer behavior, allowing informed decisions to drive your success.

Book a free Synder demo or sign up for a 15-day free trial. Uncover the real numbers behind your business and make strategic choices with confidence.

What is a liquidity ratio, and how to calculate it

By definition, a liquidity ratio is a financial metric evaluating a company’s ability to meet its short-term financial obligations with its readily available assets. It measures the firm’s capacity to convert its current assets, such as cash, marketable securities, and accounts receivable, into cash quickly to cover its current liabilities, which include obligations due within a relatively short period, such as accounts payable and short-term debt.

Related:

What Is Accounts Receivable: Understanding Your AR Accounts

Usually, business operates with several types of liquidity ratios. The most typical are current ratio, quick ratio, current ratio, and operation cash flow ratio.

Let’s look at those in more detail.

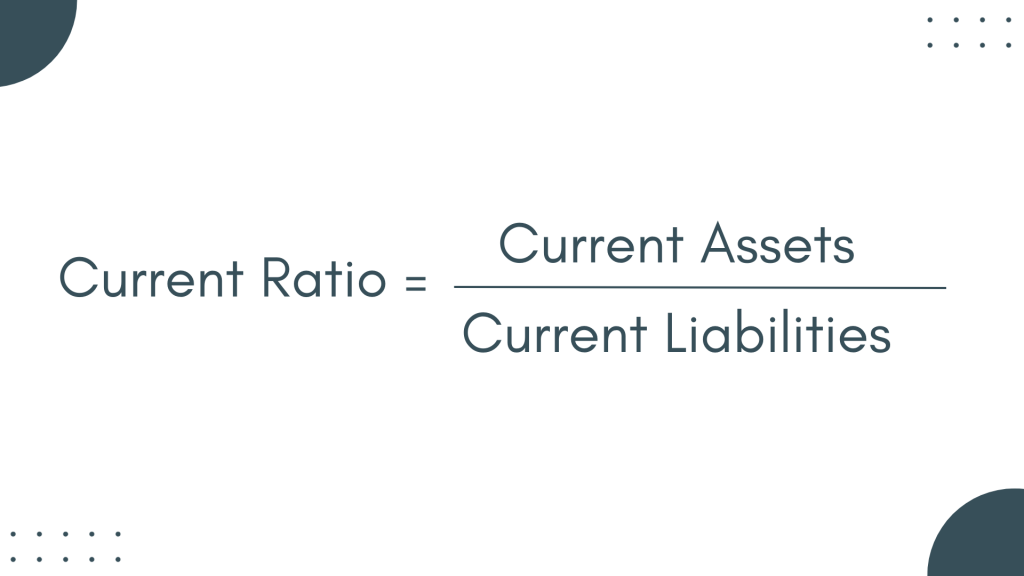

Current ratio

The Current Ratio helps assess a company’s short-term financial health and liquidity, providing valuable insights into its ability to meet immediate financial obligations with readily available resources.

You can calculate it by dividing current assets by current liabilities.

Current Ratio = Current Assets / Current Liabilities

- Current assets are the assets expected to be converted into cash or used up within one year. Examples include cash, accounts receivable, and inventory.

- Current liabilities are obligations due within the next year, such as accounts payable, short-term debt, and other accrued expenses.

The result signifies the number of times a company’s current assets can cover its liabilities. A current ratio above 1 implies the company has more assets than liabilities in the short term, indicating a potentially healthy liquidity position. In other words, it suggests that the company possesses sufficient resources to settle its short-term debts and obligations as they come due.

Related:

Accounts Payable Process: The Ultimate Guide to AP

Implications for stakeholders

- Investors

Investors might consider a current ratio above 1 favorable, suggesting a lower risk of insolvency in the short term. However, investors should not solely rely on this one and consider other financial metrics and industry benchmarks for a comprehensive analysis. - Creditors

Creditors, such as suppliers and lenders, often use the current ratio to assess the company’s ability to fulfill its near-term financial commitments. A higher current ratio may instill confidence in creditors regarding the company’s capacity to meet its obligations. - Management

For company management, monitoring the current ratio is essential for proactive financial management. It helps identify potential liquidity challenges and guide working capital management and financial strategy.

Limitations and considerations

While a current ratio above 1 generally indicates a healthy liquidity position, excessively high ratios might suggest an underutilization of assets.

Moreover, the composition of current assets, such as the quality of accounts receivable and the marketability of inventory, should be considered for a more nuanced assessment.

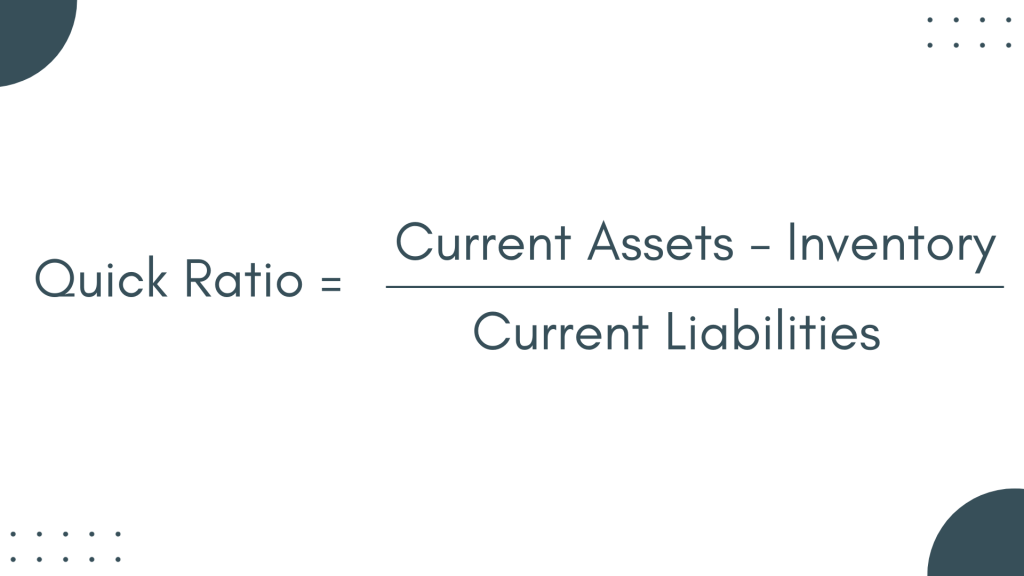

Quick ratio (Acid-test ratio)

The quick ratio, also known as the acid-test ratio, is a refined liquidity metric designed to offer a more conservative assessment of a company’s ability to meet its short-term liabilities without relying on the sale of inventory.

You can calculate it by subtracting inventory from current assets and then dividing the result by current liabilities.

Quick Ratio = (Current Assets – Inventory) / Current Liabilities

The quick ratio provides a more stringent indicator of a company’s immediate liquidity position than the broader current ratio.

A result greater than 1 implies that the company has sufficient liquid assets, excluding inventory, to cover its short-term liabilities, suggesting a strong ability to meet immediate financial obligations without relying on the potentially time-consuming process of selling inventory.

Related:

5 Tips for Optimizing Your Inventory Turnover Rate

Why exclude inventory?

Excluding inventory from current assets allows the quick ratio to focus on assets that a company can quickly convert into cash. This exclusion recognizes that selling inventory might not be an immediate or reliable source of liquidity, especially if market conditions are unfavorable or if the inventory is specialized and not easily marketable.

Implications for decision-making

- Risk management

The quick ratio is valuable for assessing a company’s ability to manage short-term financial risks. Companies with high-value inventory or inventory that is slow to sell may benefit from a more conservative liquidity measure like the quick ratio. - Creditors and suppliers

Creditors and suppliers may use the quick ratio to evaluate the company’s capacity to settle short-term debts promptly. A higher ratio may instill confidence in these stakeholders, indicating a robust ability to meet financial obligations. - Operational efficiency

For management, monitoring the quick ratio provides insights into the efficiency of working capital management and the company’s overall operational liquidity.

Key considerations

While the quick ratio provides a more accurate liquidity assessment, it is not without limitations.

Companies with low inventory turnover or those operating in industries with long sales cycles may find their quick ratios lower than industries with faster inventory turnover. Therefore, it is crucial to consider industry norms and specific business dynamics when interpreting this ratio.

Cash ratio

The Cash Ratio provides a targeted assessment of a company’s immediate financial strength by honing in on its ability to meet short-term obligations using only cash and cash equivalents. In other words, it represents the proportion of short-term liabilities a company can cover with its most liquid assets.

To calculate this ratio, one needs to divide cash and cash equivalents by current liabilities.

Cash Ratio = Cash and Cash Equivalents / Current Liabilities

- Cash and cash equivalents include physical currency, demand deposits, and short-term, highly liquid investments with original maturities of three months or less. Essentially, these assets are quickly convertible into cash with minimal risk of loss.

The cash ratio relies on the most liquid assets within the current asset category – cash and cash equivalents. This way, the ratio provides a conservative measure of a company’s ability to settle its short-term financial commitments without relying on other assets conversion or obtaining external financing.

Related:

What Is an Asset in Accounting? The Impact and Importance of Assets in Business

A cash ratio of 1 or higher suggests that the company has sufficient cash and cash equivalents to cover its short-term liabilities. In other words, it can meet immediate financial obligations without relying on inventory sales, receivables, or other potentially less liquid assets.

Implications for stakeholders

- Risk mitigation

The cash ratio helps assess a company’s resilience to unexpected financial challenges or economic downturns. Companies with a higher cash ratio are more likely to weather short-term financial uncertainties. - Investor confidence

Investors may view a high cash ratio as a positive indicator of financial stability. It suggests the company has a cushion of liquid assets to navigate unforeseen circumstances or capitalize on strategic opportunities. - Strategic decision-making

Management can use the cash ratio as a guide for strategic decision-making related to capital allocation, investments, and short-term financial planning.

Key considerations

While a high cash ratio can indicate a strong liquidity position, excessively high ratios may imply that the company is not efficiently deploying its resources to generate returns. Furthermore, the industry context and specific business dynamics should be considered when interpreting the ratio.

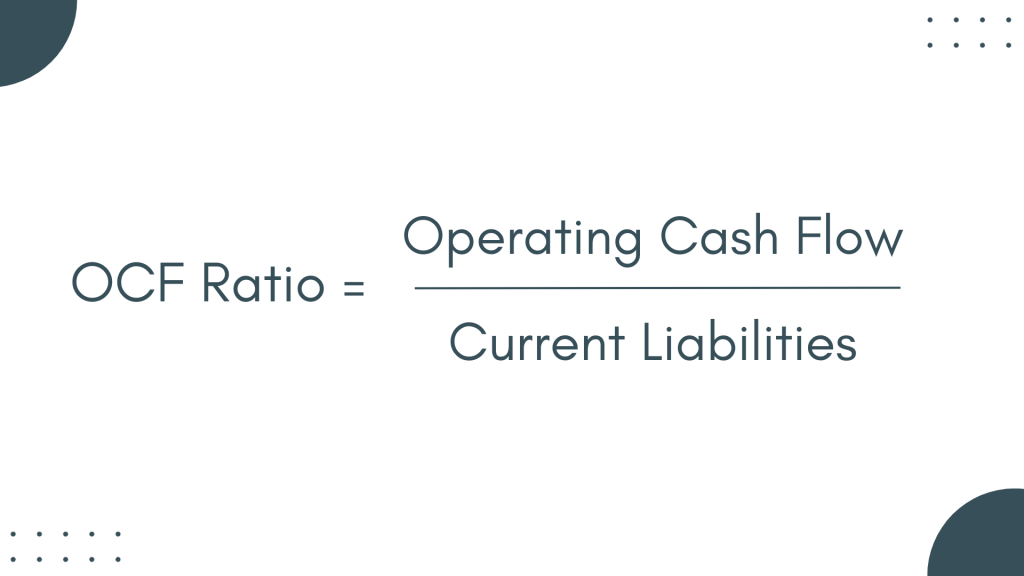

Operating cash flow ratio

The operating cash flow ratio helps evaluate a company’s capacity to satisfy its short-term obligations using the cash generated from its core operating activities.

The operating cash flow ratio emphasizes the ability of a company to generate cash without relying on external financing or the sale of long-term assets. It provides a specific lens into the liquidity derived from the company’s operational prowess, indicating how well it can convert its ongoing business activities into readily available cash for short-term needs.

The operating cash flow ratio calculation is pretty straightforward. You need to divide the quotient of operating cash flow by current liabilities.

Operating Cash Flow Ratio = Operating Cash Flow / Current Liabilities

- Operating cash flow (OCF) represents the cash generated or used by a company’s core operating activities, including revenue generation and operating expenses. It excludes cash flows from financing and investing activities, focusing solely on the cash generated from day-to-day operations.

Related:

What Is Operating Cash Flow: An Introduction to the OCF Basics

A ratio greater than 1 suggests that the company’s operating cash flow is sufficient to cover its short-term liabilities, signifying a robust ability to fund day-to-day obligations with internal resources. Conversely, a lower ratio may indicate that the company relies more heavily on external financing to meet its short-term commitments.

Implications for stakeholders

- Investors and creditors

Investors and creditors often use the Operating Cash Flow Ratio to assess a company’s liquidity risk and ability to manage short-term financial obligations. A higher ratio may instill confidence, indicating that the company produces ample cash from its core operations. - Management decision-making

Company management might want to monitor the operating cash flow ratio to make better strategic decisions. It helps evaluate the effectiveness of operational activities in generating the necessary cash flow to sustain the business and meet short-term financial demands. - Operational efficiency

The ratio also serves as a gauge of the company’s operational efficiency. A higher ratio indicates better efficiency in converting sales and operations into cash.

Key considerations

While a high operating cash flow ratio is generally favorable, it’s essential to consider industry norms and business specifics. Industries with inherently longer cash conversion cycles may naturally have lower ratios. Additionally, management should assess the quality of operating cash flow and its sustainability over time.

What strategies can businesses employ to improve their liquidity ratio?

When it comes to strengthening liquidity ratios, businesses must engage in strategic financial management. Let’s break down some actionable steps that can make a real difference.

Strategy #1 – Efficient Inventory Management

Keeping a close eye on inventory levels is a fundamental step. Businesses should strive to find the sweet spot – having enough products to meet demand without tying up excessive funds in storage. Regularly reviewing and adjusting inventory levels based on demand patterns can optimize cash flow and contribute positively to liquidity ratios.

Strategy #2 – Negotiating favorable credit terms

Building strong relationships with suppliers is not just about goodwill; it’s also a strategic move for liquidity. Negotiating favorable credit terms, such as extended payment periods or discounts for early payments, can significantly impact a company’s ability to maintain a healthy liquidity position. This creates a win-win situation, benefiting both the business and its suppliers.

Strategy #3 – Streamlining accounts receivable processes

Efficiently managing accounts receivable is crucial. Businesses should implement robust invoicing systems, set clear payment terms, and actively follow up on overdue payments. By streamlining these processes, companies can accelerate cash inflows, ensuring that funds are available when needed to cover short-term obligations.

Strategy #4 – Maintaining optimal cash reserves

Cash is the ultimate buffer against uncertainties. Maintaining an optimal level of cash reserves allows businesses to handle unexpected expenses or take advantage of opportunities without jeopardizing their liquidity ratios. Striking the right balance is key – having enough cash to ensure flexibility, but not so much that it hinders investment in growth.

Strategy #5 – Exploring short-term financing options

In the dynamic business landscape, temporary liquidity gaps are not uncommon. Businesses can explore short-term financing options, such as lines of credit, to bridge these gaps. This allows companies to address immediate financial needs without resorting to long-term debt, preserving their financial flexibility.

The key to enhancing liquidity ratios lies in finding the equilibrium between liquidity and operational efficiency. While maintaining ample liquidity is crucial, it should not come at the expense of productive investments. A strategic approach involves aligning financial management practices with the specific needs and goals of the business. By implementing these strategies, businesses can build and sustain a robust financial foundation, ensuring they are well-prepared to meet short-term obligations and navigate financial challenges effectively.

Enhancing financial insight beyond liquidity ratio

While liquidity ratios provide a snapshot of short-term financial health, a more comprehensive understanding requires a closer examination of other financial metrics alongside the ratios in question. This multifaceted approach offers businesses a holistic view of their financial performance, liquidity position, and overall resilience in varying market conditions.

Let’s take a quick look at those.

Cash Conversion Cycle (CCC)

CCC measures how long it takes a company to turn its investments in inventory and other resources into cash flows from sales.

It’s like a detailed cash flow map, showing the entire journey from buying raw materials to collecting money. Understanding this cycle gives a nuanced view of how cash moves through the business.

Working Capital Turnover

This ratio evaluates how efficiently a company uses its working capital to generate sales.

A higher turnover suggests the company is making the most of its working capital, and a lower ratio may indicate there’s room for more effective deployment.

Debt-to-Equity Ratio

The debt-to-equity ratio compares a company’s total debt to equity, reflecting its financial leverage.

It helps understand the balance between debt and equity in the company’s financial structure, offering insights into risk and solvency.

Accounts Receivable Turnover

This metric gauges how efficiently a company collects payments from its customers.

A higher turnover indicates a quicker conversion of receivables into cash, contributing to improved liquidity.

Days Sales Outstanding (DSO)

DSO measures the average number of days it takes for a company to collect payment after a sale.

It provides a specific time frame for accounts receivable collection, influencing cash flow predictability.

Inventory Turnover

The inventory turnover ratio evaluates how frequently a company’s inventory is sold and replaced over a specific period.

A higher turnover suggests efficient inventory management, contributing to liquidity through reduced holding costs.

Operating Cash Flow Margin

Operating cash flow margin assesses the percentage of revenue converted into operating cash flow.

It indicates the efficiency of core operations in generating cash, offering insights into the sustainability of cash flows.

Interest Coverage Ratio

The interest coverage ratio measures a company’s ability to cover interest expenses with its operating income.

It speaks of the company’s ability to meet its interest obligations, providing insights into its financial risk and debt management.

Free Cash Flow (FCF)

FCF represents the cash generated by a company’s operations available for distribution to investors, debt reduction, or reinvestment.

FCF is crucial for assessing a company’s ability to invest in growth, pay dividends, or reduce debt, impacting its long-term liquidity position.

Leveraging accounting solutions for efficient liquidity ratio tracking

Many accounting software can help businesses accurately track their liquidity ratios and other critical financial metrics. Here are a couple of ideas for you to consider.

Synder

Synder is a comprehensive accounting solution designed specifically for online businesses. It seamlessly connects with over 25 platforms, including various e-commerce, payment, and accounting systems.

Synder imports transaction data into accounting with a high level of granularity. It automatically categorizes data for easy analysis, reconciles accounts efficiently, generates financial reports, and allows for customizations to tailor the accounting process to specific business needs.

FreshBooks

FreshBooks is an accounting software tailored for small businesses, offering invoicing, expense tracking, and financial reporting functionalities.

FreshBooks generates real-time reports on current assets, current liabilities, and cash flow, streamlining the calculation of liquidity ratios for a quick assessment of short-term financial health.

QuickBooks Online

QuickBooks Online is a widely used cloud-based accounting platform with tools for invoicing, expense tracking, and financial reporting.

QuickBooks Online provides reports breaking down current assets, current liabilities, and operating cash flow, facilitating efficient calculation of liquidity ratios.

Xero

Xero is a cloud-based accounting platform offering features for invoicing, bank reconciliation, and financial reporting.

Xero’s automation features enable businesses to maintain up-to-date and accurate financial records, facilitating the calculation of liquidity ratios for assessing short-term financial position.

Wave

Wave is a free accounting software that comprises invoicing, accounting, receipt scanning, and more features.

Wave’s transaction categorization functionality makes it easier to track current assets and liabilities, enabling businesses to assess liquidity ratios without extensive manual data entry.

Wrap-up: The critical role of liquidity ratios in business

To wrap it up, liquidity ratios are the unsung heroes of financial health, offering invaluable insights into a company’s ability to navigate short-term challenges. They are not mere numbers on a balance sheet; they are strategic indicators that guide businesses in making sound financial decisions. From the boardroom to the investor’s desk, understanding and interpreting liquidity ratios is essential for all stakeholders. Keeping liquidity position at a healthy level can help businesses survive and thrive in a dynamic financial landscape, building a resilient and agile financial infrastructure that propels businesses toward long-term success.

Continue reading: What are transaction advisory services?

Share your thoughts

What do you think, do liquidity metrics help understand your business better? Share your opinion in the comments section below!