If you own a business, you know the importance of understanding your net sales in order to accurately gauge your profits. Calculating your business’s net sales can seem like a daunting task, but it doesn’t have to be. With just a few simple steps, you can easily figure out your net sales and make decisions that will help you maximize your profits.

This easy guide will provide you with the information you need to make the most of your business’s insights. We will walk you through the steps of calculating your net sales, from gathering the necessary information to understanding the formula for calculating your final figure.

What are net sales?

Net sales refers to the amount of money taken in by a business after adjusting for discounts, returns, and other sales-related adjustments. A business’s net sales is a useful indicator of its overall performance, as it shows how much money the business is actually earning from its sales activities.

Understanding net sales can give you an idea of how much revenue your company is generating and how successful it is in selling its products and services. it’s crucial to understand the distinction between revenue and sales, as this can impact your strategic decisions. It can also help you to identify which products and services are most profitable and which ones are not. This information can then be used to focus on the more profitable products and services and to make changes to the business strategy.

Net sales is often used by investors, lenders, and other financial professionals to assess the viability of a business. As such, business owners need to understand how to calculate their net sales. To do this, you’ll need to gather a few pieces of information, such as gross sales, discounts, returns, and allowances.

How to calculate net sales

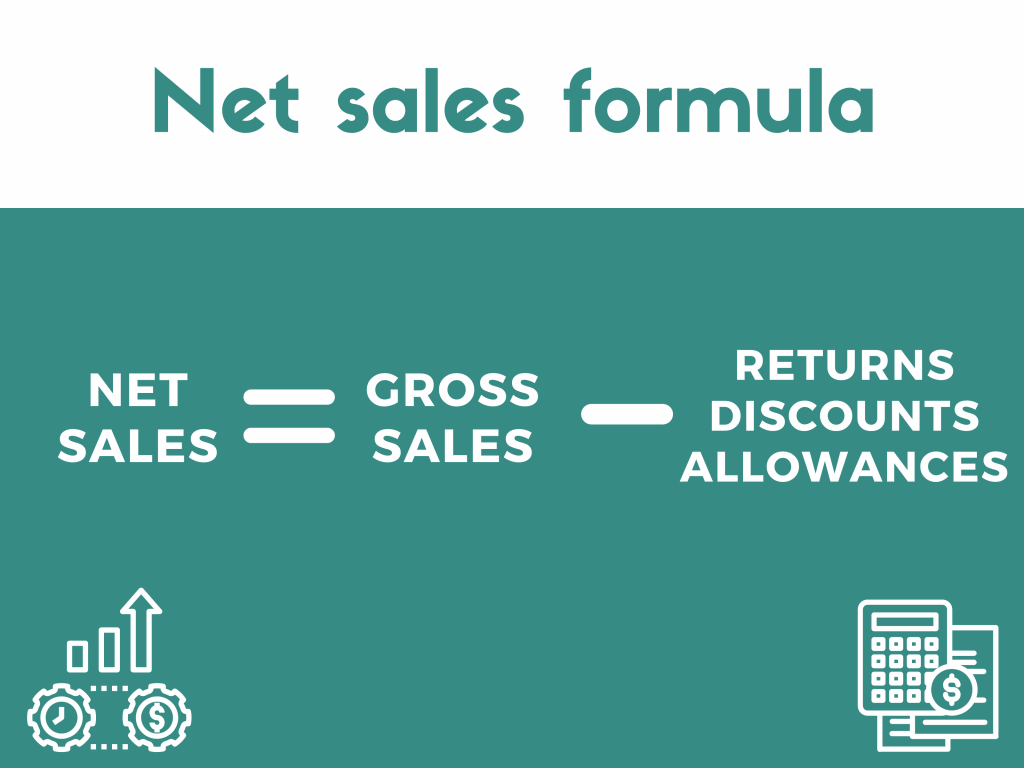

To calculate your business’s net sales, you’ll need to use the following formula:

Net Sales = Gross Sales – Discounts – Returns – Allowances

In which:

- Gross Sales: The total amount of money taken in by a business before any discounts, returns, or other sales-related adjustments.

- Discounts: The amount of money taken off of a sale due to discounts or special offers.

- Returns: The amount of money returned to a customer within a certain number of days for a full refund.

- Allowances: The amount of a partial refund when the item was returned due to a product not meeting their expectations or a mistake in the sale.

Once you have gathered all of the necessary information, you can then use it to calculate your business’s net sales.

Conclusion

Net sales is the lifeblood of any business. It’s an important indicator of the overall health of your business and should be monitored closely. This data can be used to make decisions about pricing, product offerings, and marketing strategies.

Furthermore, net sales provide a good indication of your business performance in general and can help you identify areas for improvement. Leveraging sales tracking software tools can significantly enhance this process, allowing for more efficient and accurate tracking of net sales. By doing so, you can ensure that your business is on the right track and that you are making the most of your sales opportunities.