A savvy business owner knows that automation shouldn’t replace traditional methods of accounting work entirely. Instead, they use automation to supercharge workflows and eliminate those repetitive, time-consuming tasks, freeing up more time for growth and innovation.

That’s exactly what this article is about—uncovering the true potential of automation in finance and why you can’t just jump in without proper preparation.

Without further ado, let’s find out how to handle accounting operations not by reducing human expertise, but by enhancing workflows with smart software solutions.

Key takeaways:

- Financial automation is achieved by integrating software solutions or AI into your workflow.

- A comprehensive automation tool can address multiple issues, eliminating the need for separate solutions for each one.

- Automation aims to enhance and improve processes, not replace human involvement.

Contents:

1. What is financial automation?

2. Examples of financial automation

3. How to set up financial automation

What is financial automation?

Simply put, financial automation means implementing technology to manage and streamline financial operations. In other words, its purpose is to automate manual tasks by adding software solutions, software bots, artificial intelligence (AI), and machine learning (ML) to daily accounting tasks.

Financial automation doesn’t mean that the workflow will be completed without human intervention. It aims to enhance and improve processes, not replace human involvement. In fact, having CFO support for your business can ensure that the implementation of financial automation aligns with your business goals, leveraging human expertise while benefiting from the efficiency of automation.

Examples of financial automation

From theory straight to practice – let’s consider a potential use case.

Meet our imaginary hero, TCloud Solutions, a growing SaaS company that was drowning in the chaos of manual accounting. We’ll walk you through their potential journey, highlighting how automation transformed their financial operations at each step, so you can reflect it on your case and find insights for your business.

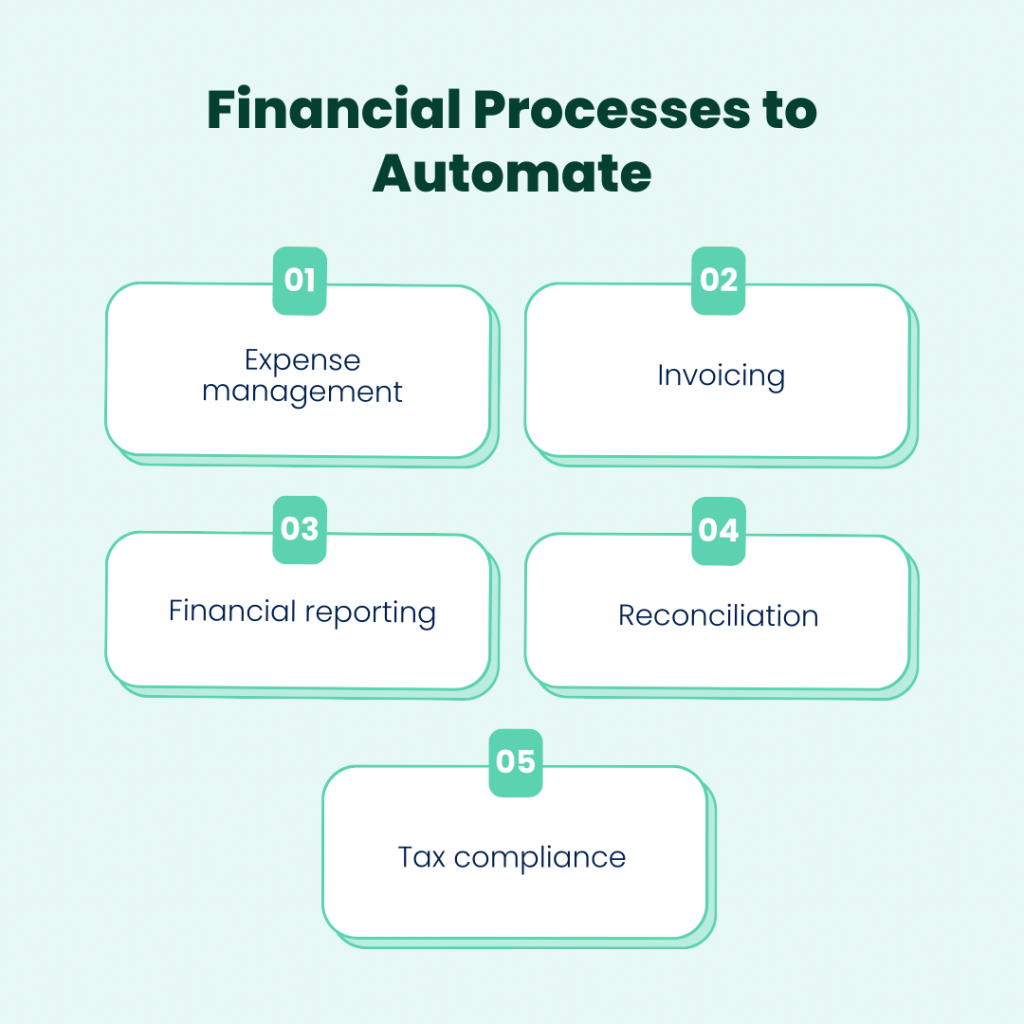

These are the accounting processes that the potential company needs to automate:

Let’s go through typical problems and automated solutions.

Problem #1. Expense management

First things first – TCloud Solutions need to manage the whole cash flow tracking, especially expense reports. It used to be part of manual tasks manual tasks, with employees collecting receipts and entering data into spreadsheets. Now is time for a change.

By adopting an automated expense management tool, employees began using a mobile app to capture receipts, which were automatically categorized and recorded.This transition to automated bookkeeping not only reduced the time spent on expense tracking for the finance department from approximately an hour to 10 minutes or less per report but also ensured greater accuracy and efficiency, saving significant time and effort across the company.

Problem #2. Invoicing

With expenses under control, TCloud Solutions faced delays in sending invoices and tracking payments.

An automated invoice processing solution allowed them to generate and send invoices immediately upon service delivery. Moreover, now the system tracks payments and sends reminders for overdue invoices.

The time spent on invoicing decreased from hours to just a few minutes per invoice.

Problem #3. Financial reporting

Next up was financial statements. TCloud Solutions was lucky to have financial automation. With its help, real-time data was pulled from integrated systems, enabling the generation of accurate and timely financial reports. They also got a bonus as the software supports multicurrency transactions, keeping the records data as accurate as possible.

Valuable insights on financial processes within a matter of hours? Checked!

Problem #4. Reconciliation

Now, they had to manage the reconciliation process. The struggle is real – we’ve been there as a SaaS business ourselves.

The automated system helped the team by matching transactions from bank statements with accounting records, quickly identifying discrepancies and ensuring financial accuracy. With the help of RPA in finance and automation, the system reduced reconciliation time from several days to just a few hours each month, significantly cutting down the need for manual intervention and enhancing financial workflow efficiency.

Problem #5. Tax compliance

Automation helped the financial team manage even this area. The automation system calculates, files, and pays taxes. This ensures adherence to regulations and deadlines, minimizes the risk of penalties and frees up resources previously dedicated to managing tax compliance manually.

As a result, saving time on manual work increased efficiency and accuracy of the TCloud business processes, and their finance teams were able to smoothly close the accounting period.

💡 Tip: Most accounting automation solutions aim to cover multiple functions, and Synder is no exception. It handles 4 out of the 5 processes we’ve discussed, and that’s just a fraction of its capabilities. Having been in your shoes, we understand the challenges. While we’re not saving lives, we’re saving you time. And in the business world, time is a valuable currency.

Let’s now move on to implementing automation into daily operations.

How to set up financial automation

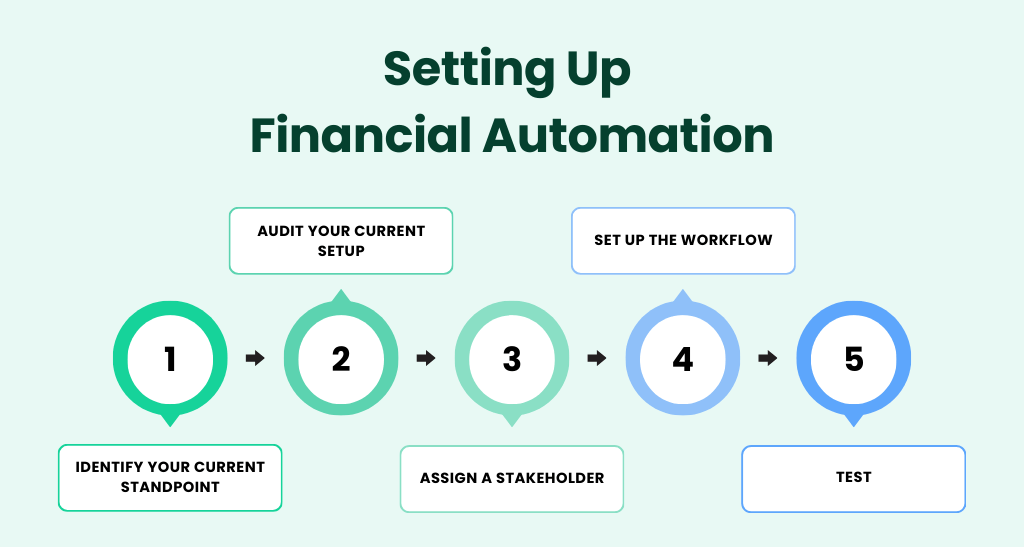

Step #1. Identify your current standpoint

What is the pain point at the moment? Which processes do you want to automate?

Begin by identifying repetitive and time-consuming tasks that can benefit from automation. You can first check the aspects mentioned above, as these are the hottest ones among businesses. List the areas that need automation and prioritize them based on factors like complexity, potential time savings, and impact on your business operations.

Step #2. Audit your current setup

Have you previously implemented any solutions?

Recheck the financial software and tools currently in use within your organization if any. This includes accounting software, ERP systems, invoicing platforms, expense management tools, and any other relevant technologies.

The purpose of this step is to assess if your tools are compatible with potential automation solutions. Ensure that the platforms can integrate seamlessly to allow for smooth data transfer and workflow automation. Determine what additional tools or upgrades are needed to support your automation goals.

Step #3. Assign a stakeholder

Which team member can be in charge of automation?

The thing is that automation isn’t replacing the workforce, it’s enhancing the process giving much more room for finance professionals to maneuver. A professional manager should have a strong understanding of both financial processes and technology.

The stakeholder’s responsibilities typically include coordinating with different departments, ensuring that the project stays on track, and addressing any issues that arise during implementation.

Step #4. Set up the workflow

How do you plan to integrate the software you’ve chosen?

Map out each step of the process and determine how automation will be implemented. Once the tool has been chosen, check whether everything is ready for the integration process.

Customize the workflows to fit your organization’s specific needs. Ensure that the automated processes are flexible enough to handle exceptions and unique scenarios.

Step #5. Test

What can be adjusted?

Test, test, and test again.

From now on, you need to observe the automated workflow, identifying any peculiarities that can be changed and adjusted. Don’t dive into 100% automation from the very beginning. Step by step, test the integration’s capabilities. This will help you identify any issues or areas for improvement before full-scale implementation.

Optimize the automated processes based on the feedback from the departments involved and test results. Once the workflows are thoroughly tested and refined, you can proceed with full-scale implementation across the organization.

Now you can take advantage of better financial planning and data analysis.

Conclusion

Proper process automation reduces human errors, streamlining operations and boosting productivity. There’s no magic or top secret here. The key is to prepare the internal processes so that you have everything in order to manage the automation once it’s set up.

So, gear up, embrace the change, and watch your business grow while handling financial data with ease!

Share your thoughts

How has your experience with accounting process automation been so far? Have you already implemented any automation solutions for data entry? Let us know in the comments below!