What we’ve learned from supporting real beauty brands

The beauty industry is thriving. In 2024, the global beauty and wellness products market was valued at $1,728.53 billion and is projected to reach $3,309.86 billion by 2032, showing an expected CAGR of ~8.6%.

Behind every glossy product launch, skincare brand, or boutique expansion lies a world of financial complexity: inventory management, fees, taxes, and compliance across multiple sales channels. Managing it all manually can quickly become overwhelming.

That’s why beauty businesses are increasingly turning to automated accounting tools like Synder that handle reconciliation, track costs, and keep books accurate without hours of manual data entry.

What is accounting for beauty industry?

Accounting goes beyond compliance – it shows the true state of your business. In the fast-moving beauty sector, success depends on understanding where money flows and how decisions impact profit. When your books are automated, these insights are always available without having to wait for end-of-month reconciliations.

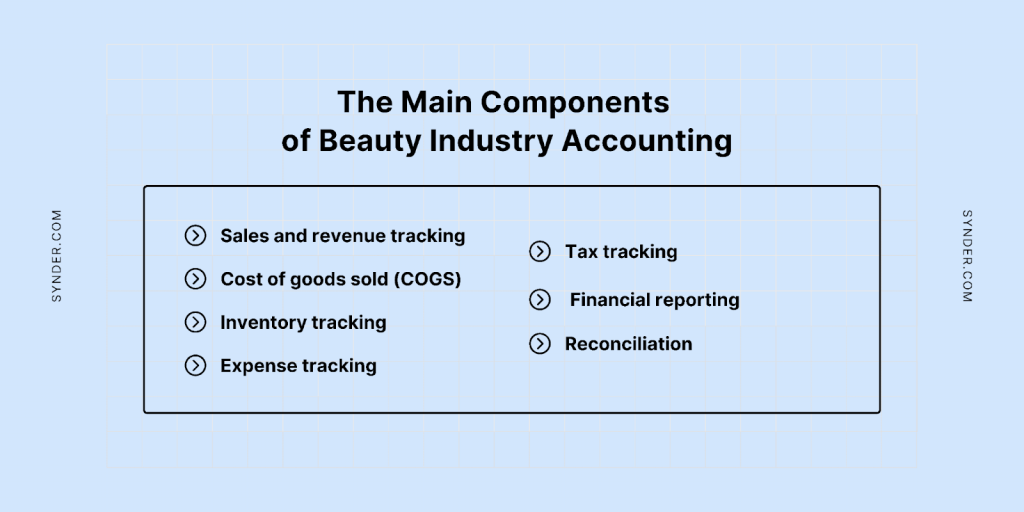

The main components of beauty industry accounting

Every beauty business, regardless of size or model, relies on several key accounting components that form the backbone of financial management:

- Sales and revenue tracking – Captures and organizes all sales data from online and in-store channels.

- Cost of goods sold (COGS) – Reflects the direct costs of producing and selling your products, such as packaging, raw materials, and manufacturing.

- Inventory tracking – Monitors stock levels and product movement to prevent overbuying or stock-outs.

- Expense tracking – Keeps a record of recurring operational costs like marketing, subscriptions, and fulfillment fees.

- Tax tracking – Records all sales tax activity across states, countries, and marketplaces.

- Financial reporting – Combines key financial statements (P&L, Balance Sheet, Cash Flow) to show overall performance.

- Reconciliation – Ensures your accounting records align with actual bank transactions and payouts.

Common accounting challenges for beauty businesses

Managing these components manually is one of the biggest pain points for growing beauty businesses. The more channels you add, the harder it becomes to keep data consistent, accurate, and actionable. These insights come directly from our hands-on experience working with beauty and wellness brands, and here’s what typically stands in the way:

Fragmented sales data

Selling across Shopify, Amazon, and retail POS systems often leads to inconsistent or duplicated data. Manual uploads can cause revenue gaps or misclassified income, leaving reports unreliable. When sales flow through multiple marketplaces, even a small mismatch between platforms can distort your overall financial picture.

Unstable cost structures

The cost side of beauty products is notoriously volatile. Ingredient and packaging prices shift with inflation, while tariffs and import fees fluctuate unpredictably. Without automated tracking, it’s difficult to connect each cost directly to the product sold, making true margin analysis nearly impossible.

Inventory guesswork

Beauty products, especially skincare and cosmetics, have limited shelf lives. Overstocking traps cash in soon-to-expire goods, while understocking causes lost sales and poor customer experience. Without real-time data flowing into accounting, stock control decisions are based on guesswork rather than actual demand.

Hidden overhead costs

Marketplace fees, fulfillment charges, and marketing costs accumulate quietly across systems. Many businesses only discover their real overhead when reconciling at month’s end. Misclassified expenses not only skew profit reports but also complicate forecasting and budgeting.

Tax complexity

The complexity of tax compliance grows with each new platform or sales region. Marketplace-facilitator-collected taxes, cross-border sales, and regional rate changes can all create discrepancies if not tracked at the transaction level. A missed or misapplied tax entry can quickly turn into a costly compliance issue.

Delayed financial insight

When accounting data is fragmented across platforms, financial reports lose their accuracy and timeliness. Instead of guiding business decisions, reports become reactive, showing what happened weeks ago rather than what’s happening now.

Manual reconciliation workload

High transaction volumes and multiple payment processors make manual reconciliation a constant struggle. Deposits rarely match sales totals due to fees, refunds, or delays, and sorting it out by hand consumes hours that could be spent on planning or analysis.

How automation handles these challenges

Automation brings accuracy and consistency to complex accounting workflows. With a unified system like Synder, beauty businesses can automatically sync data across sales, payment, and accounting platforms, ensuring every transaction, fee, and tax entry stays correct and up to date. Here’s how it addresses the key pain points:

| Challenge | How Synder solves it |

| Fragmented sales data across multiple platforms | Automatically syncs detailed transactions, like sales, discounts, refunds, and fees, from Shopify, Amazon, Stripe, and other channels into one accurate, categorized flow within your accounting system. |

| Unstable costs and thin margins | Keeps income, inventory, and COGS in sync by updating your books in real time, showing the true cost and profit of every product sold. |

| Hidden or misclassified expenses | Captures and categorizes recurring platform fees, fulfillment costs, and subscriptions automatically, maintaining consistency across expense accounts. |

| Complex tax compliance | Records sales tax at the transaction level, including marketplace-collected tax, mapping it to the correct accounts for simplified compliance and audit readiness. |

| Delayed financial insight | Generates accurate profit & loss, balance sheet, and cash flow statements from real-time synced data. The Insights dashboard highlights revenue trends, top products, and platform profitability instantly. |

| Time-consuming manual reconciliation | Aligns payouts, refunds, and fees with your accounting records and matches them to bank deposits automatically, cutting hours from month-end close. |

As you can see, automation streamlines accounting for beauty businesses, keeping data accurate and up to date across every sales channel. With our experience working closely with companies in the beauty industry, we understand the challenges they face, from fast-moving inventory to complex compliance, and know how to make their financial processes smooth, reliable, and transparent.

Why Synder is the accounting backbone for beauty industry

From working closely with beauty businesses, we’ve seen that once Synder connects their sales channels and payment systems to their accounting platform or ERP, bookkeeping turns from manual upkeep into a streamlined, insight-driven process that drives smarter decisions and faster growth.

Take Dermeleve, for example. It’s a fast-growing skincare brand that used to rely on manual entry for fees, deposits, and refunds. With Synder’s automated sync to QuickBooks, every transaction now posts accurately, creating complete traceability for compliance and faster audits. Their CFO called Synder “a game changer for accuracy,” noting that reconciliation time dropped by days per month.

In Dermeleve’s case, as with all our clients, automation turned complex, error-prone bookkeeping into a reliable, compliant process with full visibility across every transaction.

The core benefits of using Synder in beauty industry accounting

Synder turns manual accounting into a streamlined, automated process that gives beauty businesses complete financial clarity. Here’s how it drives accuracy, compliance, and growth:

- Automated accuracy at scale: Every sale, fee, and refund from over 30 sales and payment platforms, such as Shopify, Amazon, Stripe, or PayPal, is recorded automatically into accounting software or ERP, like QuickBooks, Xero, Sage Intacct, or NetSuite.

- Built-in compliance: Captures taxes and platform fees precisely, keeping your books audit-ready with minimal effort.

- Real-time financial visibility: Updates payouts and profitability continuously, turning accounting into a forward-looking tool.

- Clean data flow: Syncs all transactions into the general ledger, preventing duplicated SKUs, misclassified income, and missing expenses.

- Strategic finance enablement: Reliable data empowers beauty business finance teams to focus on forecasting, pricing strategy, and profitability, not manual cleanup.

Ready to bring clarity to your books? See how automated accounting can simplify your operations and keep your beauty business growing – book a 1:1 demo today!

Final thoughts

In the beauty industry, growth moves fast, and so do the numbers behind it. Managing sales, fees, and taxes manually across multiple platforms drains time and increases the risk of errors. Synder brings order to that complexity by connecting your sales channels, payment systems, and accounting platform into one accurate, automated workflow.

With all financial data flowing seamlessly into your books, beauty brands gain real-time visibility into sales, inventory costs, and profitability. Not only does Synder simplify accounting, it also gives businesses the clarity and control to scale confidently, stay compliant, and focus on what they do best: creating beauty products customers love.