This guide explains how to use the Sync only Payments/Deposits setting for PayPal in Synder. It’s designed for workflows where invoices are created outside of Synder, but PayPal payments still need to be recorded and matched in your accounting platform.

When this setup makes sense

Use this setting if your invoices come from another system and PayPal payments need to be applied to them manually. It’s especially useful when invoice formats don’t match, and automatic matching isn’t possible.

What you’ll get

After enabling this setting, PayPal payments sync as standalone deposits. They remain available so you can manually match them to existing invoices in your accounting platform.

How to enable Sync only Payments / Deposits

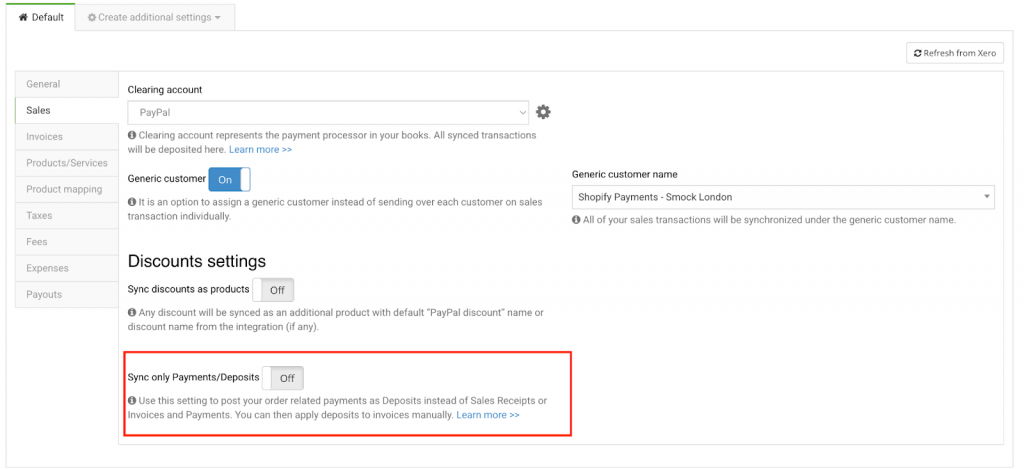

- Open Synder and go to Settings.

- Open the Sales tab.

- In the PayPal settings, turn Sync only Payments/Deposits ON.

- Save your changes and run a PayPal sync.

Note: By default, this setting is turned off.

How payments are recorded after sync

When this setting is enabled, Synder changes how PayPal payments are sent to your accounting platform.

If you use QuickBooks Online, Synder creates a Receive Payment. If you use another accounting platform, Synder creates a Deposit instead.

The payment is sent to the clearing account selected in your Sales tab settings, keeping it available for manual matching. If needed, you can redirect payments to other account types (for example, asset accounts) using Smart Rules.

Note: This setup does not support invoices that are closed using multiple payments.

Payments are not matched automatically and must be applied manually.

Once the sync is complete, open your accounting platform and apply or match the synced payment or deposit to the correct open invoice.

Reach out to the Synder team via online support chat, phone, or email with any questions you have – we’re always happy to help you!