Efficiently managing and reconciling sales transactions is crucial for any business, particularly when integrating payment processors like Stripe with accounting systems like Oracle NetSuite. In this article, we’ll focus on the process of reconciling sales and payouts for Stripe and NetSuite integration using Synder.

Matching daily summaries to Stripe balance reports

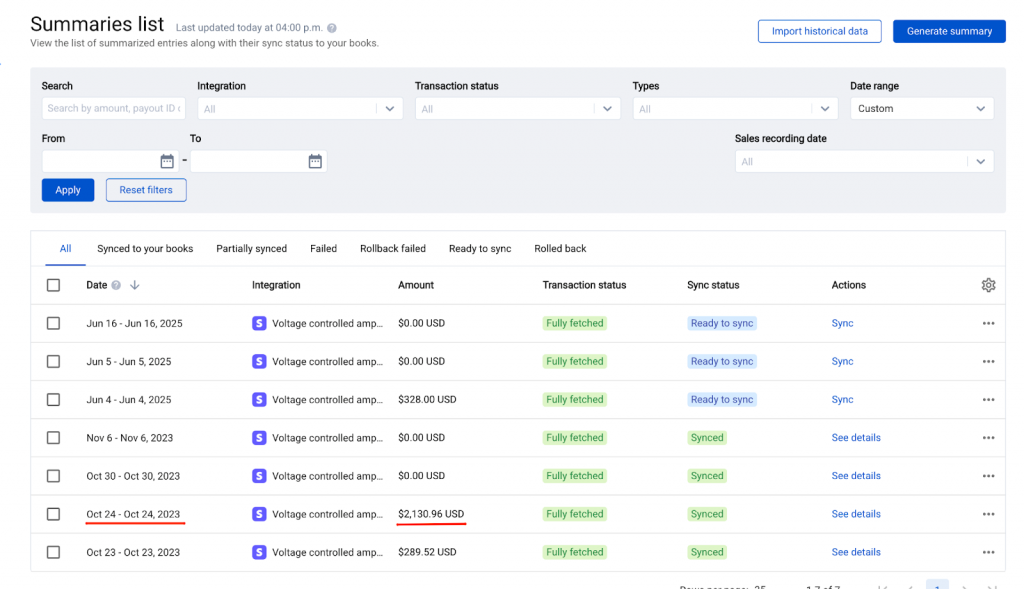

Once you are onboarded to Synder and have connected your Stripe account, you’ll be able to import individual transactions that will form daily summaries of Stripe sales, and sync them to your books.

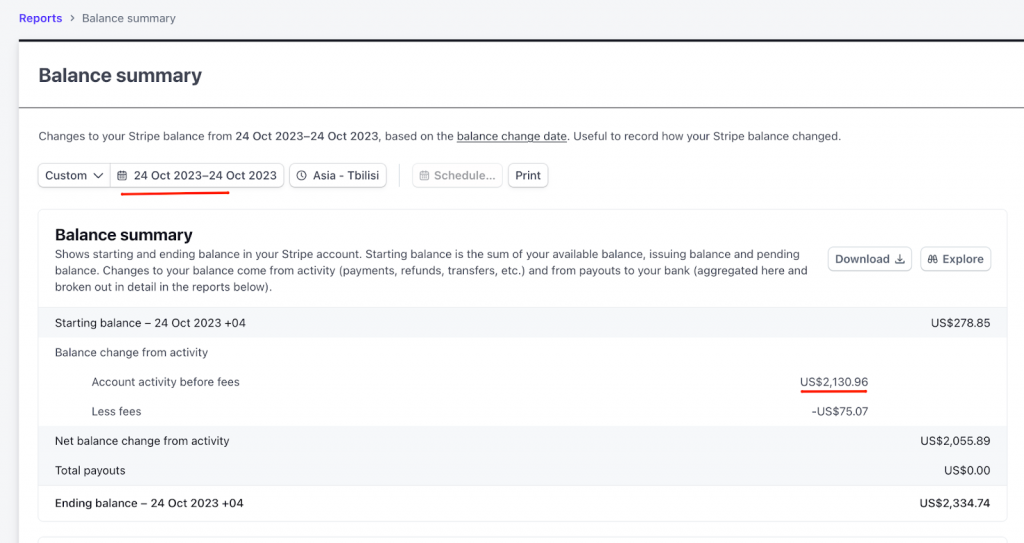

Each daily summary represents the net amount of sales and payment activity for that day (sales, refunds, fees already factored in).

This number should match and reconcile against the daily balance change shown in your Stripe balance report for the same date.

⚠️ Make sure the dates are aligned: Stripe reports in UTC, so double-check your time zone settings in Synder to avoid mismatches.

Clearing account in NetSuite

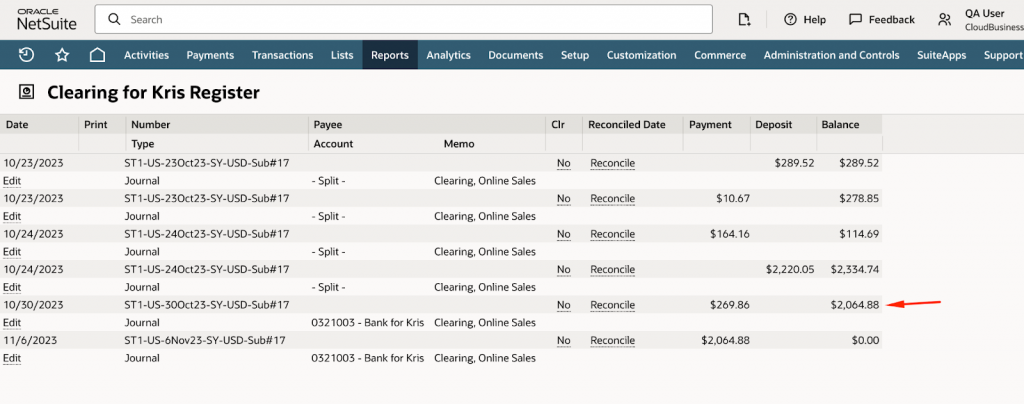

For Stripe, Synder will need a Stripe clearing account in NetSuite.

- This account mirrors the Stripe balance.

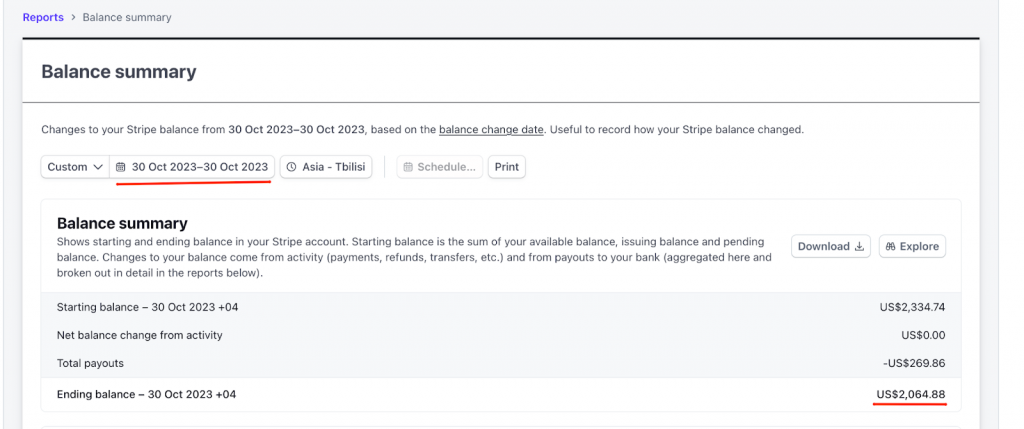

- The ending balance in the Stripe clearing account should match Stripe’s ending balance when dates align.

This allows you to track and reconcile all daily sales, refunds, and fees, making sure they are properly recorded before payouts move to your bank account.

Reconciling Stripe payouts to bank deposits

When Stripe sends payouts to your bank, Synder syncs these as transfers from the Stripe clearing account to your designated checking account in NetSuite. These transactions are essential for automatic reconciliation.

To reconcile:

- Ensure your bank is connected to Oracle NetSuite.

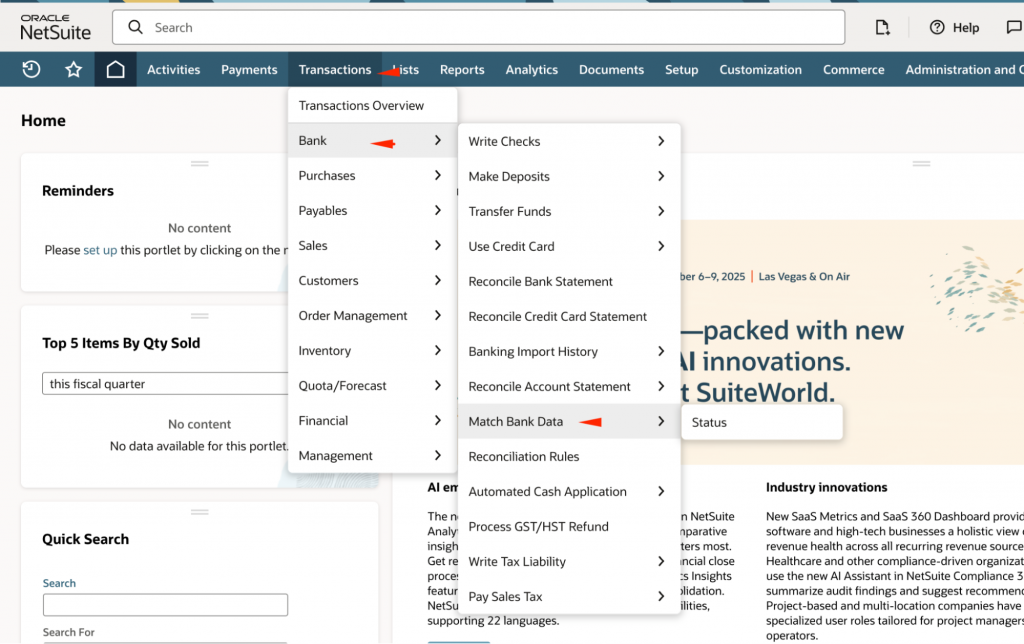

- Navigate to Transactions → Bank → Match Bank Data.

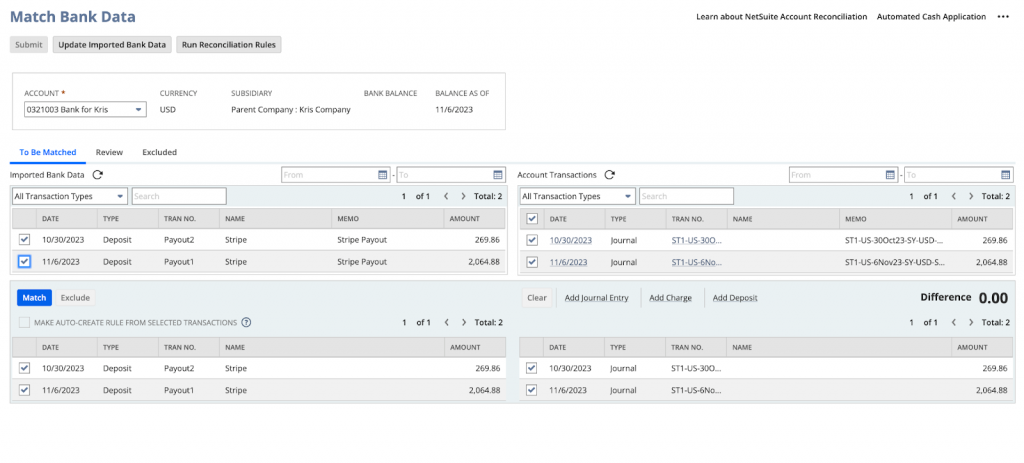

- Select the checking account where Stripe deposits arrive.

- Left side: Deposits from your bank feed.

- Right side: Payout transfers from Stripe created by Synder.

- Left side: Deposits from your bank feed.

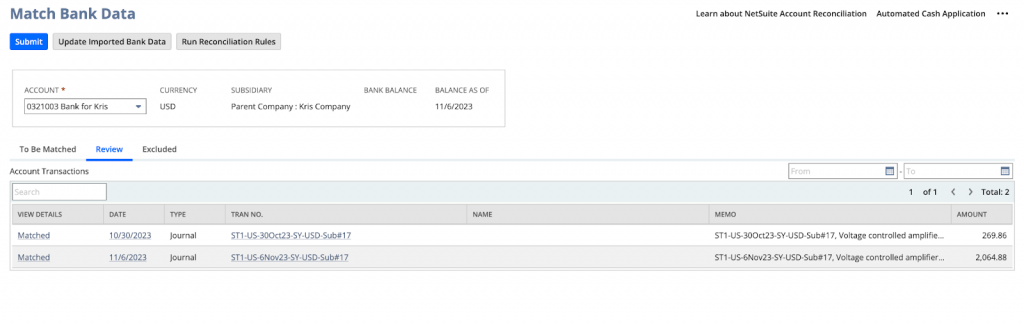

- Match the amounts by selecting the correct transactions linked to Stripe bank deposits. Once matched, the Stripe payout is reconciled against your bank statement.

By following this workflow, your Stripe activity in NetSuite will always align with Stripe’s reports and your bank deposits, keeping your books accurate and audit-ready.

For more information about Oracle NetSuite integration or other Synder features, visit our Help Center or reach out to Synder Team via online support chat or email.