This guide is for Synder Summary Sync users who want to track income on a cash basis instead of using the default Accounts Receivable (AR) setup. If you manage AR outside of your books or just don’t need the AR workflow in QuickBooks Online, this approach may suit your business better.

With Summary Sync, Synder gives you the flexibility to skip AR and record income based on the actual payment date. This keeps your books cleaner, avoids outdated AR balances, and ensures income shows up only when the money hits your account.

Step-by-step instructions

For new users:

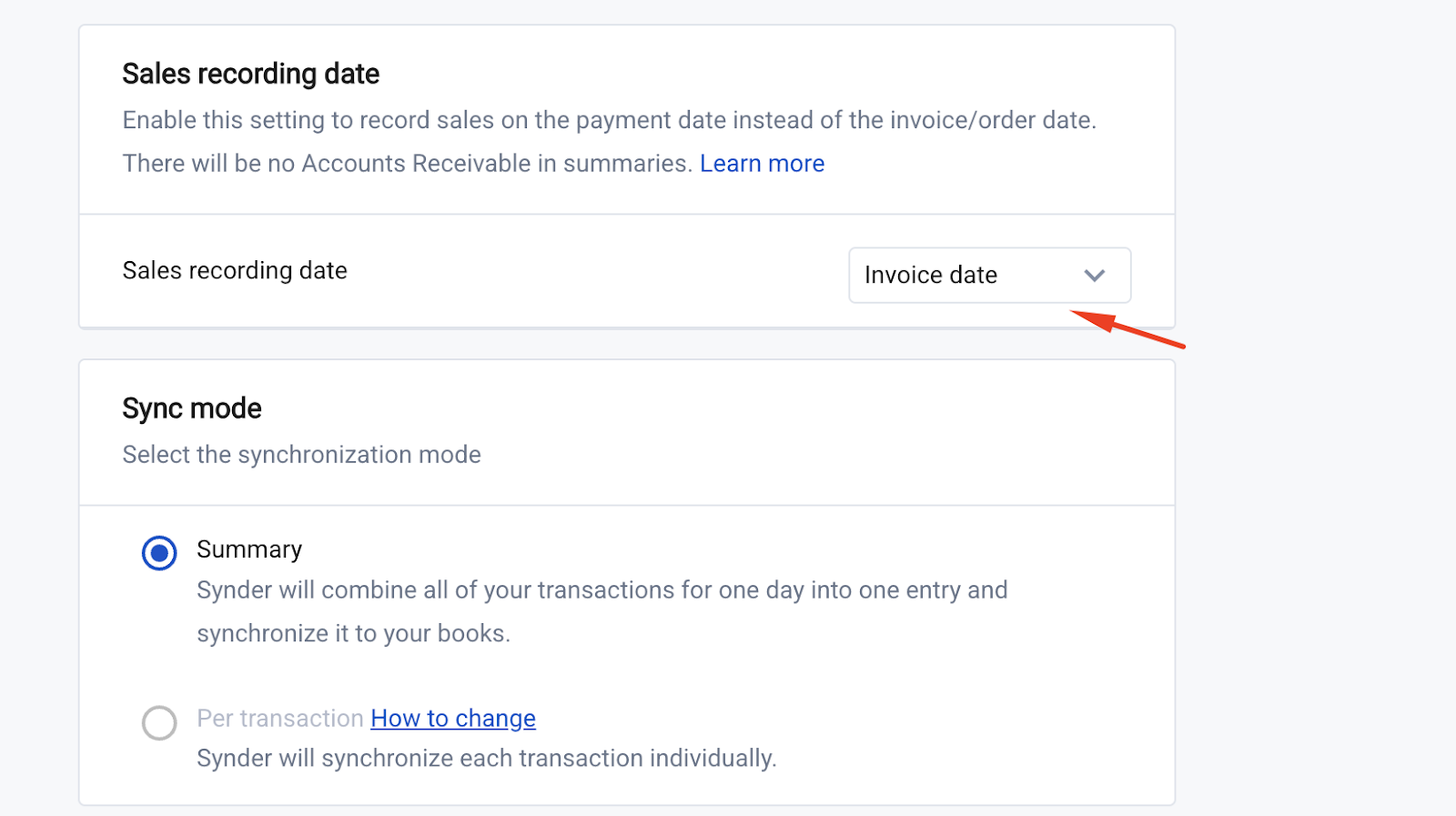

- Navigate to the Summary Sync settings in Synder

- Locate the Sales Recording Date option.

- Change the setting from Invoice Date to Payment Date.

This setup tells Synder to record income only when a payment is actually made, skipping AR entirely. From then on, Synder will create Journal Entries that post sales to your income accounts based on the payment date. Since we’re not tracking open invoices, you won’t see any AR balances in your books..

For existing users (important)

If you’ve already synced data using Invoice Date, switching to Payment Date requires some caution to avoid duplicates or missing records.

- Change the setting:

- Go to Settings → Configure Daily Summary and change the reporting method to Payment Date.

- Go to Settings → Configure Daily Summary and change the reporting method to Payment Date.

- Refresh and resync summaries:

- After changing the setting, refresh all summaries that are not synced.

- Roll back all summaries that are synced.

- Resync all the summaries.

This avoids duplicating data that’s already synced using the previous (Invoice Date) method.

If you want to keep your historical data as-is and make the switch starting from a specific date—say, everything in 2024 stays on the invoice date, and from January 1, 2025, you switch to the payment date—you’ll need to make a few manual adjustments to get things aligned.

- Identify cross-date transactions:

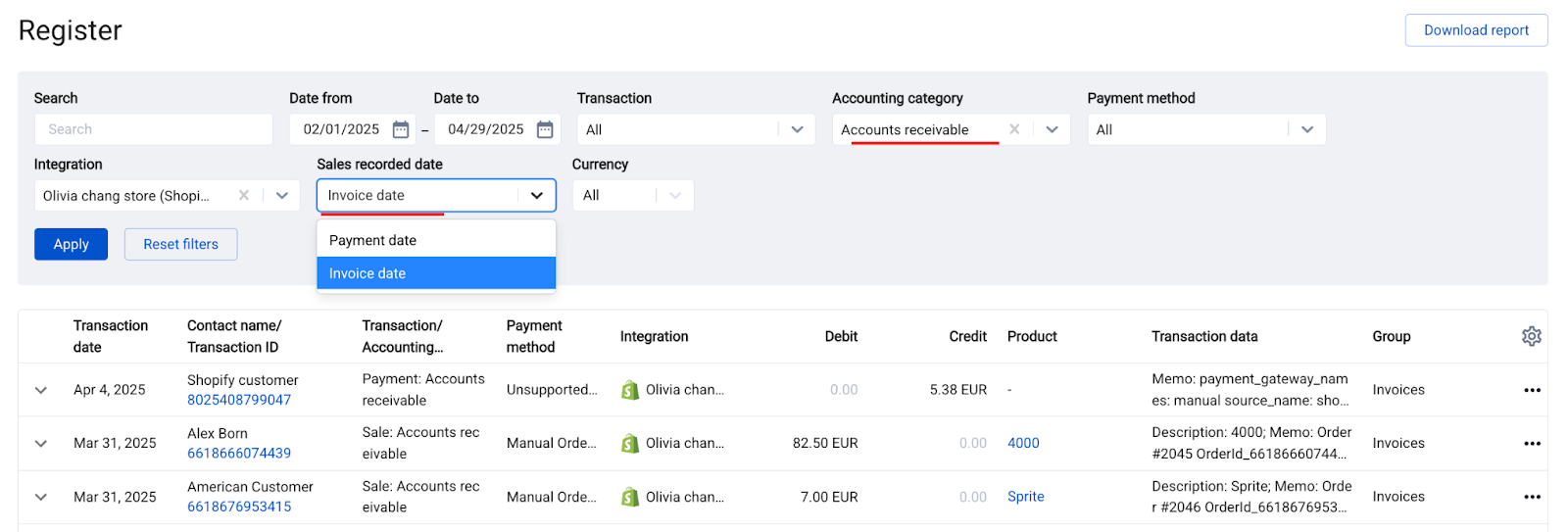

- Use the Register Table in Synder to find invoices created before the switch date but paid after.

- Go to Register → Filters:

- Set Sales Recorded Date = Invoice date.

- Set Accounting Category = Accounts Receivable.

- Set a date range spanning after the switch, to look up payments that were received for the invoices that fall in the ‘before’ period, but were received after

- Set Sales Recorded Date = Invoice date.

- Adjust AR and Sales (One-Time Journal Entry):

- For any invoices that fall before the time of the switch and received a payment after the switch date, you’ll need to manually post a journal entry to cancel out their original AR and sales impact. Just credit AR and debit Sales for the total of those payments to keep your books accurate.

- From that point on, those payments will sync smoothly—hitting your Sales and Cash accounts only, with no AR involved.

- Refresh and sync summaries:

- Refresh and resync the summaries for all dates after the change in the sales recording date.

Best practices and tips

- Make this change at the start of a new fiscal period if possible.

- Use tags or memo fields in journal entries inside QuickBooks Online to mark adjusted periods for later reference.

- If you track AR in a separate system, like spreadsheets, keep it fully disconnected from Synder to avoid confusion.

That’s it. You’re all set to record your transactions on a cash basis, without involving AR.

Reach out to the Synder Team via online support chat, phone, or email with any questions you have – we’re always happy to help you!