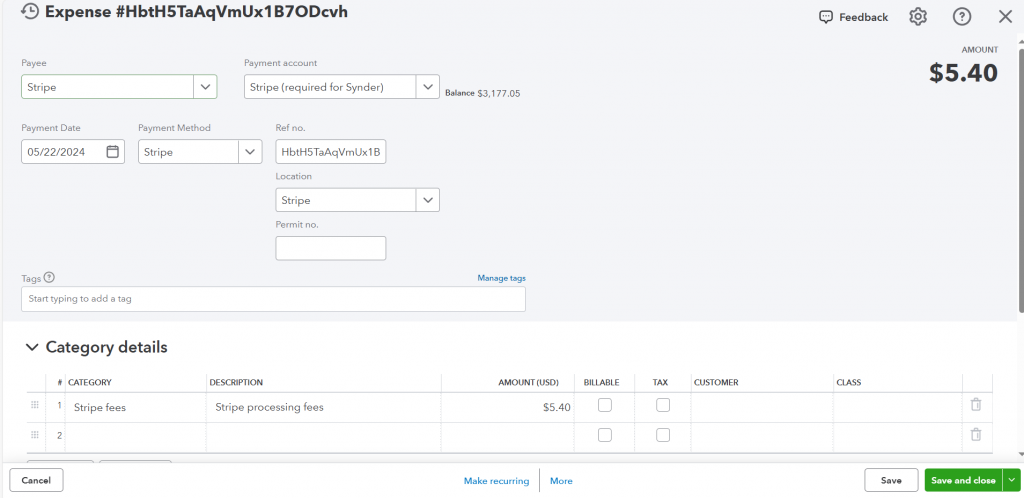

Once you sync a transaction from the payment processor into your accounting company, the Sales Receipt (or Invoice + Payment) for the total amount of sale and the Expense for payment processor fees will be created on QuickBooks side.

To check an Expense created in your accounting company, follow the simple steps below:

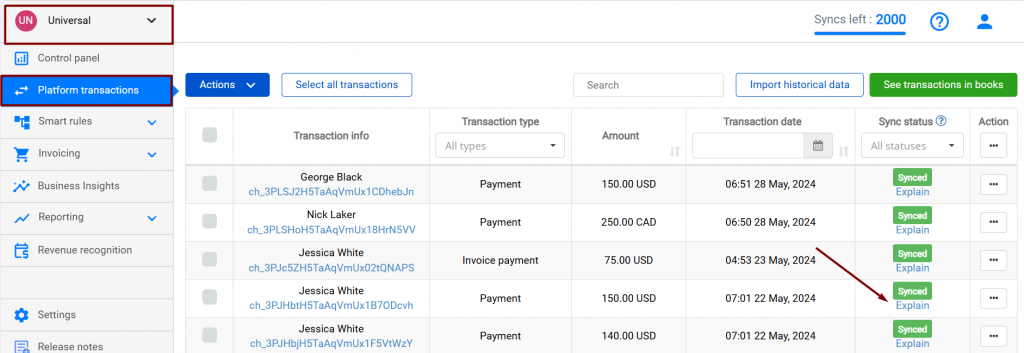

- Select the Organization needed at the top right of the page → go to the Platform transactions tab on the left menu → click on the Explain button under the Synced status of the transaction needed.

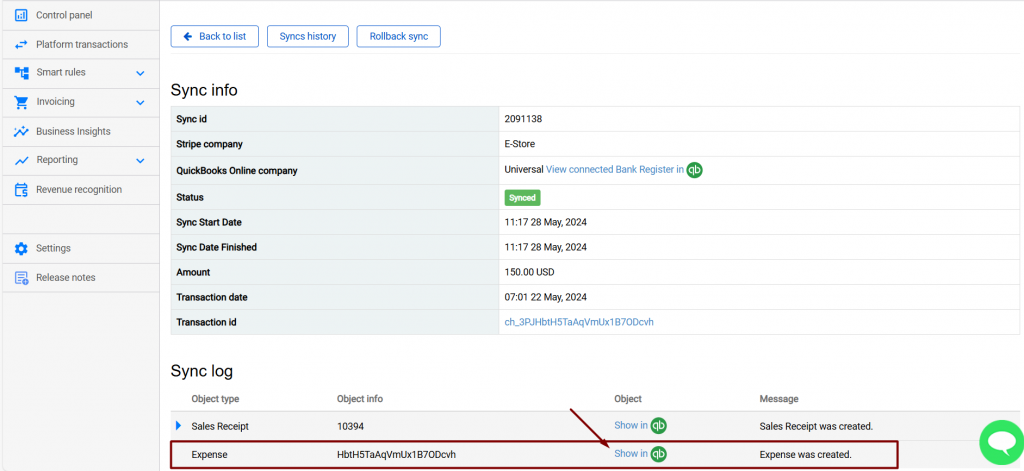

- Under the Sync log tab, click on the Show in QB button.

- This is how the payment processing fees appear for a Stripe transaction synchronized with QuickBooks Online. Fees are deposited into a clearing account — Stripe (required for Synder) and are categorized according to your Synder settings (in this case to the Stripe fees category from Chart of Accounts).

Now you know how Synder accounts for payment processor fees!

Reach out to the Synder Team via online support chat, phone, or email with any questions you have – we’re always happy to help you!