You: You sell on Shopify, Amazon, eBay — maybe Square or Etsy too. Money comes in from everywhere, fees are different on every platform, and reconciling it all in QuickBooks or Xero is a nightmare. You’ve probably got a spreadsheet “system” that’s held together with prayers.

Synder connects all your sales channels to one accounting file. Here’s how to set it up without losing your mind.

—

Why Multi-Platform Selling Makes Accounting Hard

Each platform has its own:

- Fee structure (Amazon’s referral fees ≠ Shopify Payments’ processing fees ≠ eBay’s final value fees)

- Payout schedule (Amazon holds reserves, Shopify pays daily/weekly, eBay batches differently)

- Data format (different order IDs, different refund flows, different tax handling)

When these all dump into one bank account, you see deposits that don’t obviously trace back to individual sales. Synder solves this by pulling data from each platform *before* it hits your bank, with all the detail intact.

—

Step 1: Create Your Synder Account

- Go to [go.synder.com/signup](https://go.synder.com/signup)

- Sign up as Business Owner

- Select your country and accounting platform

—

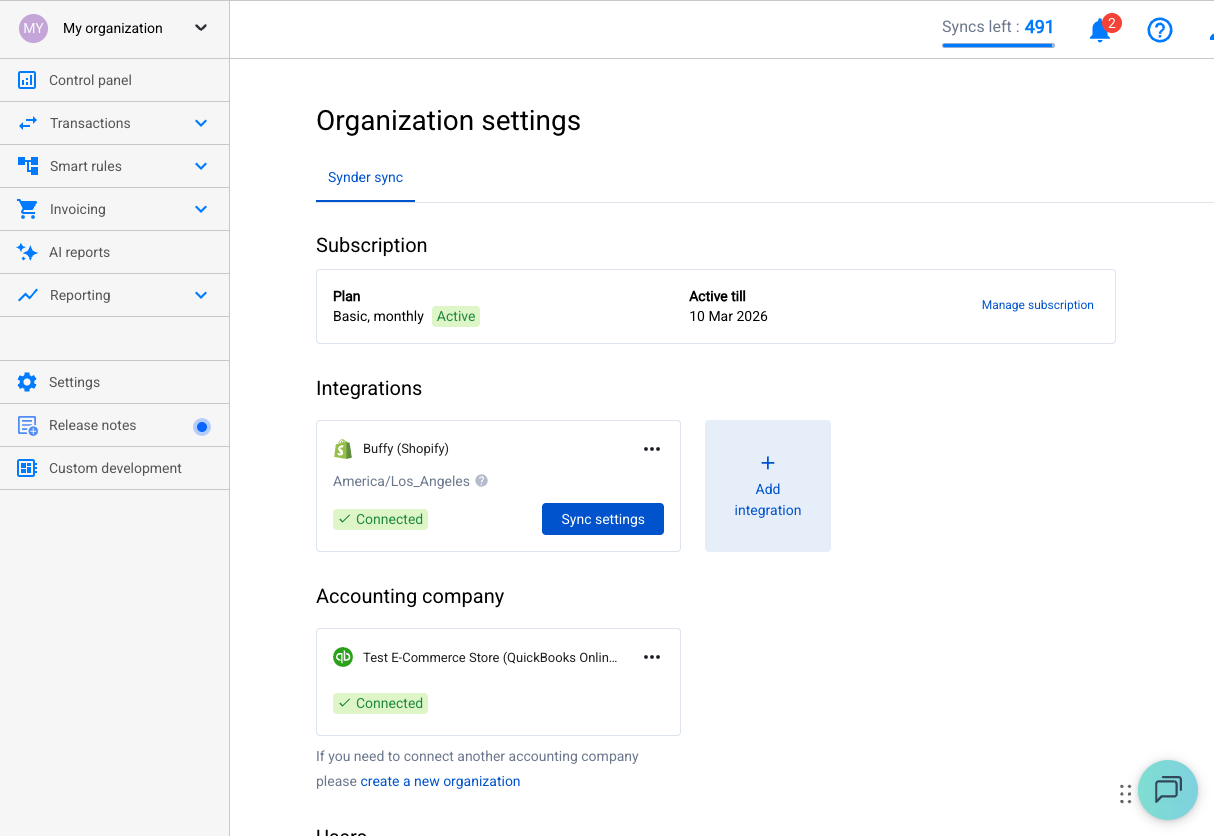

Step 2: Connect ALL Your Sales Channels

Go to Settings → Integrations → + Add and connect each platform:

- Shopify — Authorizes via Shopify admin

- Amazon — Connects via Amazon Seller Central (make sure you connect the right marketplace)

- eBay — Authorizes via eBay account

- Stripe — If you use Stripe for your own website

- PayPal — If any platform pays you via PayPal

- Square — If you also do in-person sales

Critical: Connect every platform that sends you money. Missing one means missing transactions and a reconciliation headache.

—

Step 3: Connect Your Accounting Software

Add your QBO or Xero connection from the same integrations screen.

—

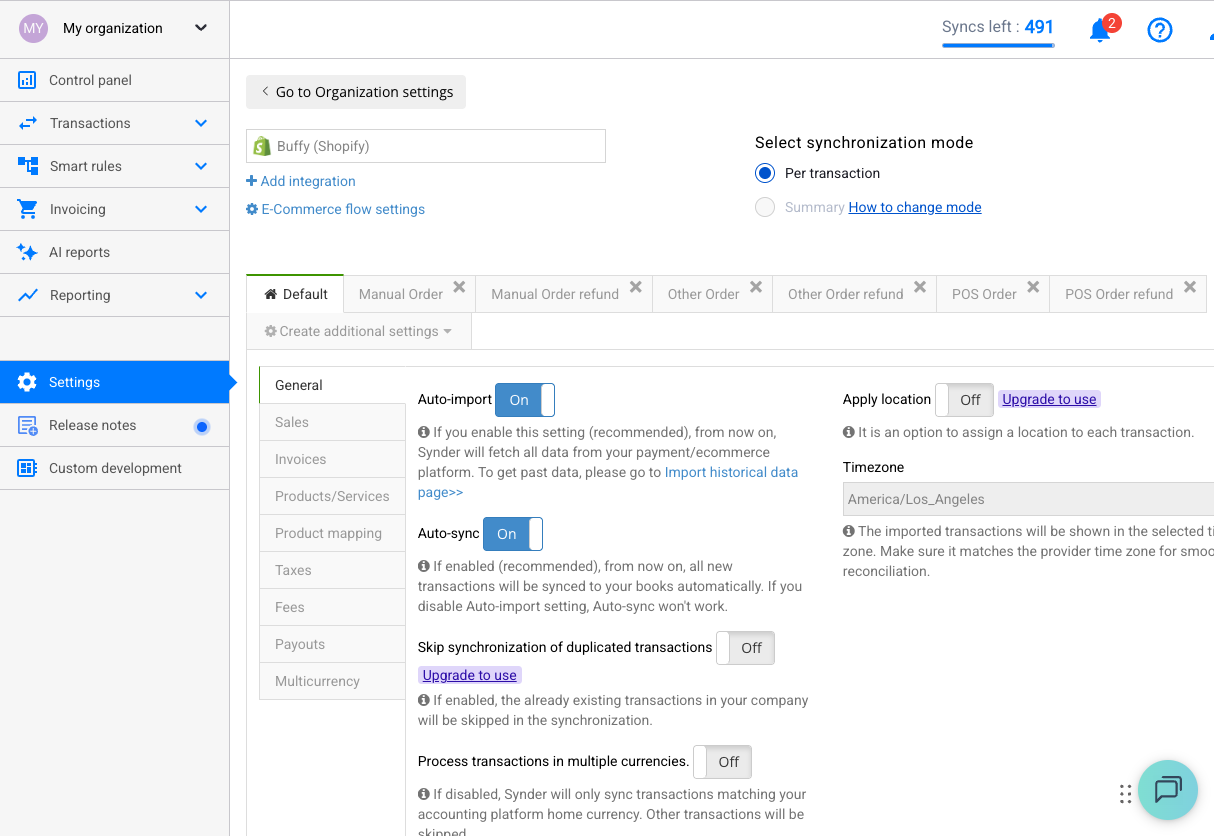

Step 4: Choose Your Sync Mode (This Matters More for You)

As a multi-platform seller, your choice here has big implications:

Per-Transaction Mode

Every sale from every platform = its own entry. Maximum detail, but can get noisy with high volume across multiple channels.

Best if: You want to see “Amazon Order #123” and “Shopify Order #456” individually in your books. Good for sellers doing under ~200 transactions/day total.

Daily Summary Mode

Groups each platform’s daily sales into one journal entry per platform per day. So you’d see “Amazon Sales – Jan 15” and “Shopify Sales – Jan 15” as separate summaries.

Best if: High volume. You care about daily totals per channel, not individual order detail in your books.

Payout Mode

Records match your actual bank deposits. When Amazon sends you $3,247.18, Synder records exactly $3,247.18.

Best if: Your #1 problem is bank reconciliation and you don’t need per-order detail in accounting.

Pro tip for multi-platform: Many sellers use Daily Summary for high-volume channels (Amazon) and Per-Transaction for lower-volume ones (Shopify). You can set different modes per integration.

—

Step 5: Map Accounts Per Platform

This is where multi-platform sellers need to pay extra attention. You probably want separate tracking for each channel:

Option A: Separate Income Accounts Per Platform

- Amazon Sales Income

- Shopify Sales Income

- eBay Sales Income

- Amazon Fees

- Shopify Processing Fees

- eBay Fees

Why: You can see at a glance which platform is actually profitable after fees.

Option B: One Income Account, Track by Class/Location

Use QBO Classes or Xero Tracking Categories to tag transactions by platform while keeping one income account.

Why: Cleaner chart of accounts, still get per-platform reporting.

Set this up in Settings for each integration. Each connected platform has its own settings tab.

—

Step 6: Understand Smart Reconciliation

This is Synder’s killer feature for multi-platform sellers. Here’s the scenario:

- Customer buys on your Shopify store

- Pays via PayPal

- You have both Shopify and PayPal connected to Synder

Without Smart Reconciliation, you’d get two entries — one from Shopify (the order) and one from PayPal (the payment). That’s a mess.

Smart Reconciliation detects this and links them: the Shopify order becomes an invoice, and the PayPal payment gets applied against it. One clean transaction, not a duplicate.

This works automatically for common platform pairs (Shopify + PayPal, Shopify + Stripe, etc.). Just make sure both platforms are connected.

—

Step 7: Handle Amazon’s Complexity

Amazon is the platform that causes the most accounting headaches. Here’s what to know:

- Amazon holds reserves — money from sales that Amazon hasn’t released yet. Synder tracks these.

- Amazon fees are complex — referral fees, FBA fees, storage fees, advertising charges. They all get recorded.

- Payouts are batched — Amazon sends you one lump sum every 2 weeks. Synder breaks down what’s inside that payout.

Common Amazon issue: “Partially synced summaries” in Daily Summary mode. This happens because Amazon data arrives at different times. If some transactions aren’t available when the daily summary runs, you’ll see a partial sync. Solution: re-sync those summaries once all data is available, or switch to a longer summary period.

—

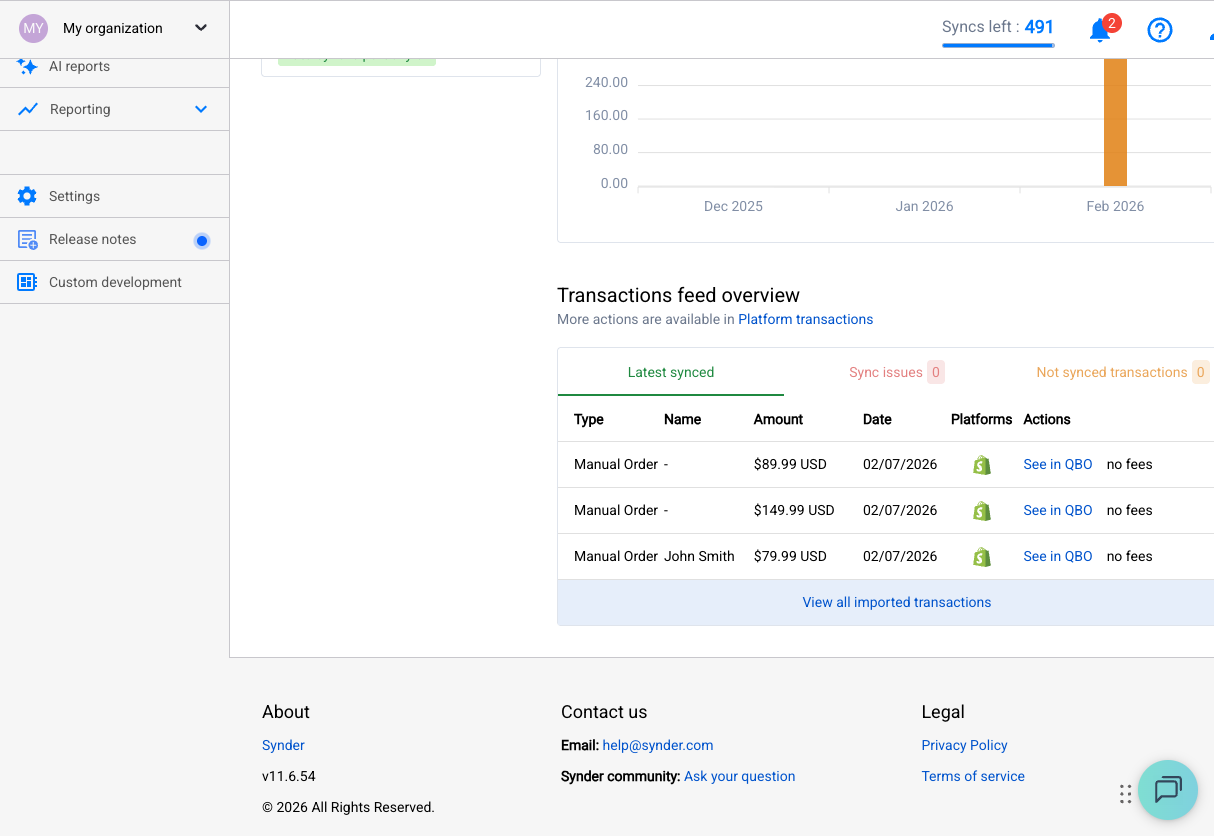

Step 8: Test Each Platform Separately

Before enabling auto-sync:

- Pick 3–5 transactions from each platform

- Sync them manually

- Check in your accounting software:

- Are they categorized to the right accounts?

- Are fees correct per platform?

- Are customer names pulling through?

- No duplicates?

Fix settings per platform as needed, then move on to auto-sync.

—

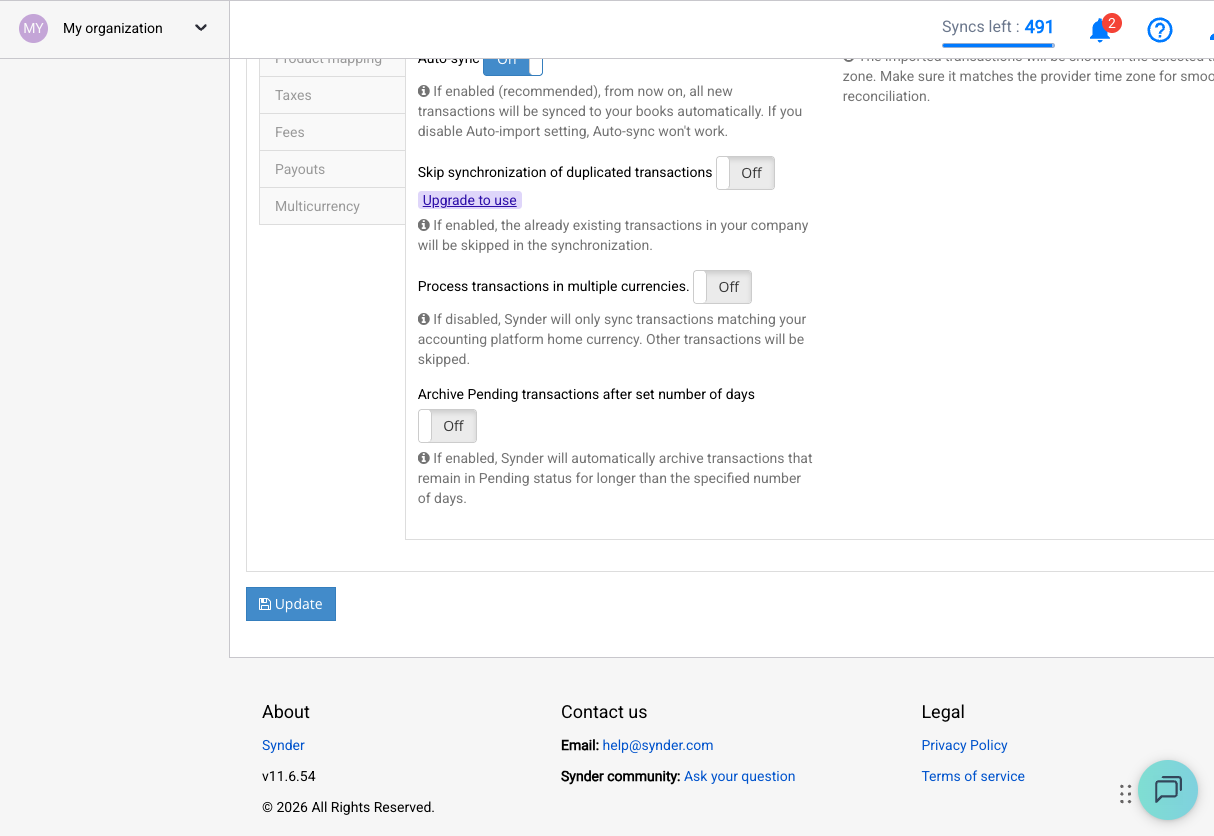

Step 9: Enable Auto-Sync

Enable auto-sync for each integration once you’re confident in the settings. Go platform by platform — don’t turn them all on at once.

Remember: Auto-sync has separate toggles per transaction type (payments, refunds, etc.) and sometimes per settings tab. Check all tabs for each integration.

—

Multi-Platform Reconciliation Tips

- Reconcile by platform, not by date. Pull up one platform’s transactions at a time in your bank feed.

- Use clearing accounts. Each platform should have its own clearing account (Amazon Clearing, Shopify Clearing, etc.). Funds flow: Sales → Clearing Account → Bank Account (when payout hits).

- Watch for cross-platform refunds. Customer paid via PayPal on your Shopify store, then got a refund processed through Shopify. Synder handles this, but verify during your first month.

- Amazon reserves will confuse you at first. Money that Amazon is holding shows in your clearing account. When it’s released, the clearing account zeroes out. This is normal.

—

Common Multi-Platform Issues

“I’m seeing duplicate transactions.”

Check if you have overlapping connections. Example: Stripe connected directly AND through Shopify. You only need one path per transaction.

“Amazon payout doesn’t match my bank deposit.”

Amazon sometimes splits payouts or includes adjustments. Check for pending or partially synced summaries in Synder.

“eBay fees aren’t recording.”

Make sure your eBay fee account is mapped in eBay’s integration settings, not just the default settings.

—

You’re Set

Your multi-channel empire now has clean books. Each platform’s sales, fees, and payouts flow into the right accounts automatically. Month-end reconciliation should take minutes, not days.

Need help? [[email protected]](mailto:[email protected])