Some countries levy taxes not only on sales, but also on fees that you pay to payment platforms. Even if the taxes are zero-rated, proper accounting demands that they are recorded as such.

Lots and lots of our users have requested us to add the opportunity to record those taxes on expenses (as fees are considered expenses) – and so we did!

Overview:

How Do I Enable It?

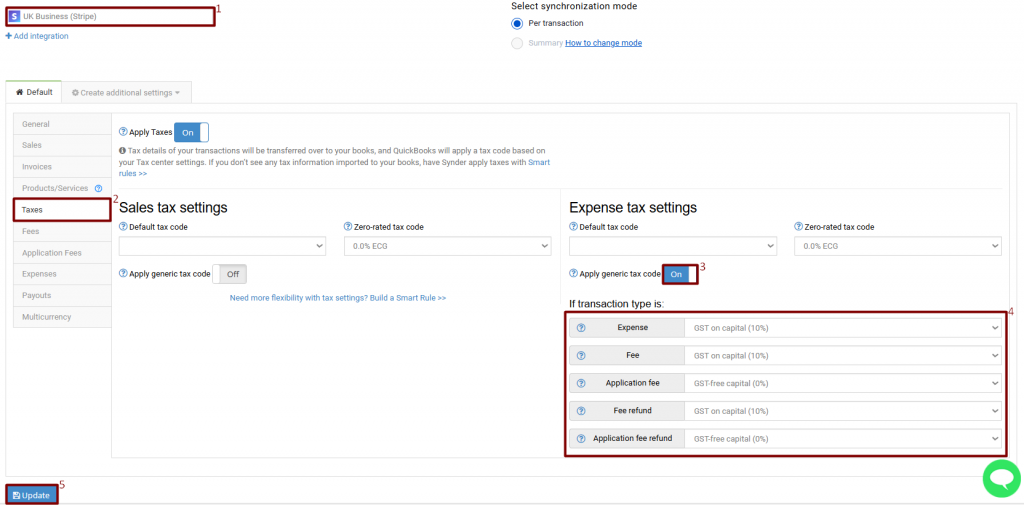

- Go to Settings on the left menu of the page —>make sure you have the integration you need selected at the top of the page.

- Navigate to the Taxes tab.

- Toggle Apply generic tax code to ON in the Expense tax settings.

- Select the appropriate tax lines to be applied to fees (paid directly to the payment processor) and application fees (paid to other third parties connected to your payment processor). Tax codes in the dropdowns are taken from your accounting company (QuickBooks/Xero), so make sure you have the tax needed there before you can choose it in Synder.

- Click Update to save changes.

- Sync your transactions.

What Will I Get As A Result?

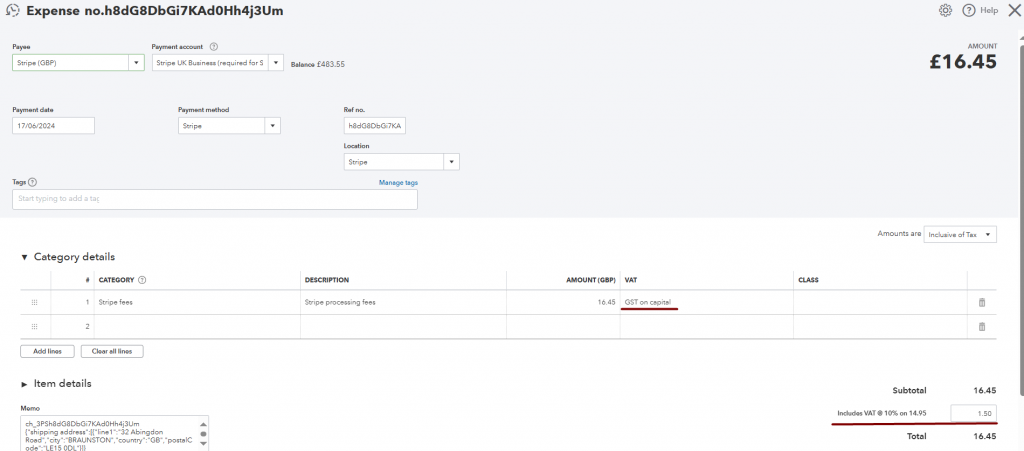

Here is an example of what you will see in QuickBooks after syncing your transactions with taxes on fees enabled. Synder will apply the selected tax code to each and every Expense/Fee transaction synchronized and taxes will be reflected in tax reporting.

That’s it! Now you know how to apply taxes on fees.

Reach out to the Synder Team via online support chat, phone, or email with any questions you have – we’re always happy to help you!