Tax seasons are usually benevolent for the proactive and merciless for the reactive. This simple truth underscores why preparation isn’t just helpful but essential. Although that analogy might be exaggerated, for most founders and finance teams, the filing itself isn’t a problem. It’s the chaos that builds up from months of unclear ownership, partial data, and last-minute decisions.

This article breaks down five questions every finance leader should be asking well before tax season begins. Whether you run a high-volume ecommerce business or are scaling a subscription-based SaaS company, these principles apply, with real-world examples that show how early preparation prevents costly mistakes. By addressing these key questions, you can avoid the common pitfalls many teams face.

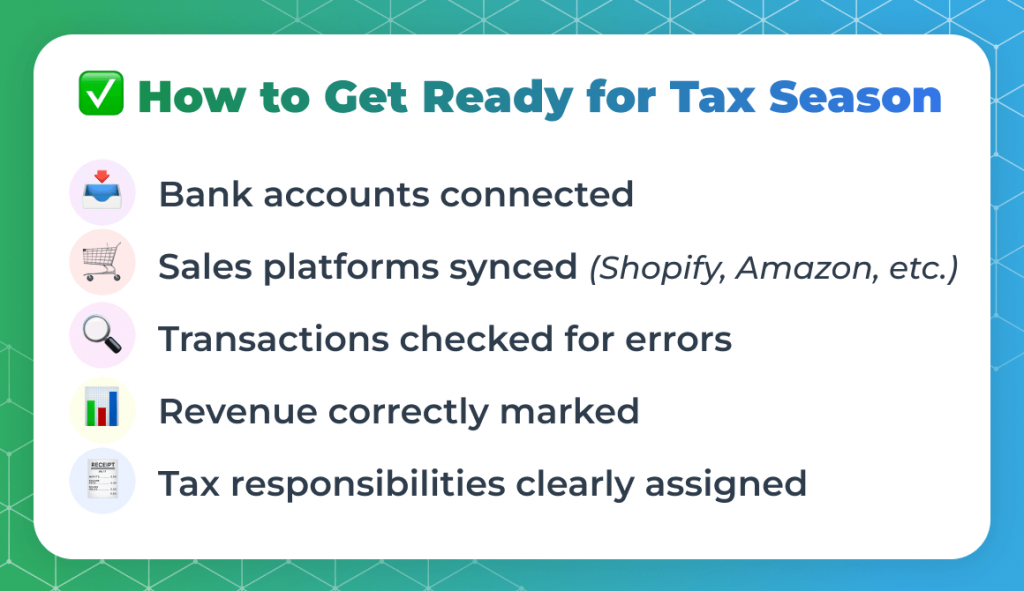

What are the key preparation steps finance teams should take ahead of tax season?

Tax season rarely catches strong finance teams off guard. The ones who navigate it cleanly are those who treat preparation not as a checklist in March, but as an operational discipline that starts months in advance. Think of preparation as an ongoing process rather than a last-minute scramble.

In fast-moving sectors like ecommerce and SaaS, where sales occur across multiple platforms, currencies, and geographies, thorough preparation is essential.

The first priority is to ensure your books are accurate and reconciled through year-end.

This includes:

- Bank feeds

- Merchant processors like Stripe and PayPal

- Marketplace payouts (Amazon, Etsy, Walmart)

- Any sales tax obligations

Inconsistent mapping or untagged transactions will derail your filings. We once helped an online luxury brand that had $300K in duplicate income miscategorized due to Shopify and Stripe settlement overlaps. It took two weeks to unwind. This real-world example highlights why early reconciliation is non-negotiable.

SaaS businesses require a clear understanding of revenue recognition, particularly regarding deferred revenue and prepaid contracts, which can be achieved through a robust accounting and bookkeeping service. Most CPAs will request a schedule showing when revenue was earned versus when it was collected.

If your team can’t generate that from your accounting software, you’ll waste valuable hours manually explaining logic that should be automated.

Synder’s automated accounting features can help streamline this process dramatically by ensuring that sales, fees, and taxes are pulled in cleanly from all your sales channels. This helps you avoid reconciliation issues later.

Also, map out your tax exposure across states or countries. Many businesses also assume they only need to file where they’re registered, but if you crossed economic nexus thresholds, especially in high-population states, you may be on the hook for additional returns.

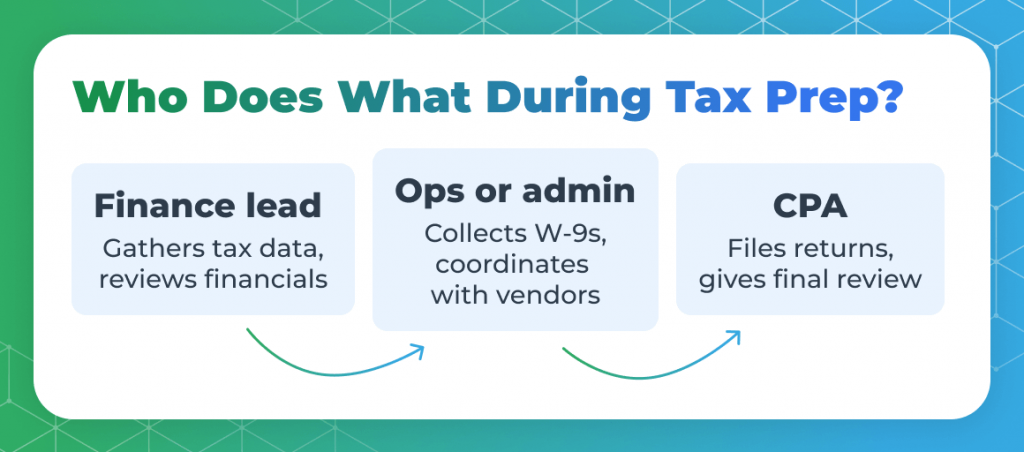

Finally, clarify internal responsibilities:

- Who responds to your external CPA?

- Who owns tax data gathering?

In our experience, most delays happen not because teams are disorganized, but because no one is clearly responsible for critical data or follow-up. Clear ownership can be the difference between a smooth tax season and a stressful one.

Which documents and data sets are critical to consolidate before engaging in tax work?

Your CPA can’t file cleanly if your finance team can’t pull clean data. In both SaaS and ecommerce, pulling data often means untangling multiple systems, exports, and reconciliations, unless the groundwork is already done.

At a minimum, the following datasets must be consolidated and validated:

- P&L and balance sheet through year-end, finalized and reviewed

- Bank and merchant account reconciliations, including Stripe, PayPal, Square, etc.

- Sales tax collected vs. owed, broken down by jurisdiction

- Loan statements and interest payments (PPP, working capital, etc.)

- Payroll tax filings (W-2, 1099, or contractor summaries)

- Inventory valuations and COGS calculations, especially if your accounting method is accrual

- Deferred revenue schedules for SaaS companies using contract-based billing

Gathering these documents early saves time and reduces headaches later on. However, what’s often missed, especially by early-stage founders, is that raw exports aren’t good enough.

Another key point is that the data has to be structured in a way that reflects how it maps to the general ledger. We recently worked with a multi-channel apparel brand using Shopify, Amazon, and Etsy. Each platform recorded refunds and discounts differently, which led to inconsistent revenue figures across three sources. We used Synder to centralize and normalize those transaction-level details, so the final P&L didn’t need a manual cleanup before tax filing.

The earlier you centralize financial data into a consistent, GL-ready format, the smoother your filing will be. Consistency here prevents confusion down the line.

What important timelines or regulatory deadlines should finance leaders keep in scope?

Tax season isn’t one deadline; it’s a delicate sequence. If you’re not tracking the full chain, including 1099 filings, estimated payments, and sales tax remittance, you’re almost guaranteed to create something that causes stress, penalties, or audit risk.

For U.S.-based businesses, these are the major dates every finance lead should track:

- January 31: Deadline to furnish 1099-NEC and 1099-MISC forms to contractors

- March 15: Filing deadline for S Corporations and partnerships (Form 1120-S and 1065)

- April 15: Deadline for C Corporations (Form 1120) and individual filings

- Quarterly estimated taxes: Due April 15, June 15, September 15, and January 15 of the following year

- State sales tax: Filing frequency varies by state. Some are monthly, others quarterly or annually

For SaaS companies, revenue timing matters. If you collect annual prepayments in December but recognize revenue monthly, that affects your tax liability and reporting. You’ll want to ensure your GL and reporting tools reflect this treatment consistently.

For ecommerce sellers, the bigger risk lies in multi-state sales tax compliance. You may be liable to file in more than one state due to economic nexus thresholds, even if you don’t have a physical presence there.

These thresholds can trigger monthly or quarterly filings long before tax season begins. And missing them leads to compounding penalties. A knowledgeable virtual CFO or finance lead can help your business stay compliant and penalty-free.

Real tax strategy means working backwards from every deadline and building those checks into your month-end process. This proactive approach ensures deadlines are not surprises but vital checkpoints on your calendar.

How might recent tax code changes or cross-jurisdictional shifts affect preparation efforts?

The tax landscape changes frequently, especially for ecommerce and SaaS businesses operating across multiple states or countries.

One of the most significant areas today is economic nexus laws, which now exist in nearly every U.S. state. These rules allow states to require sales tax filings even if your business has no physical presence there, just based on transaction volume or revenue volume. What complicates this further is that each state sets its own rules, and these rules are constantly evolving.

Even small regulatory shifts can create new obligations or impact how you track revenue, file returns, or handle digital services taxes (DST). For example, if you’re a U.S.-based SaaS company with paying users in France or India, you may owe DST even without a local entity.

These taxes aren’t well integrated into most accounting tools. If your finance team isn’t flagging them at onboarding or billing, you could end up having to file retroactively.

Across jurisdictions, tools like Synder help you map tax treatments across platforms and track revenue behavior with precision. But automation only works if your systems reflect current rules, which many teams overlook or delay. Staying updated is crucial because ignoring these changes can lead to costly surprises.

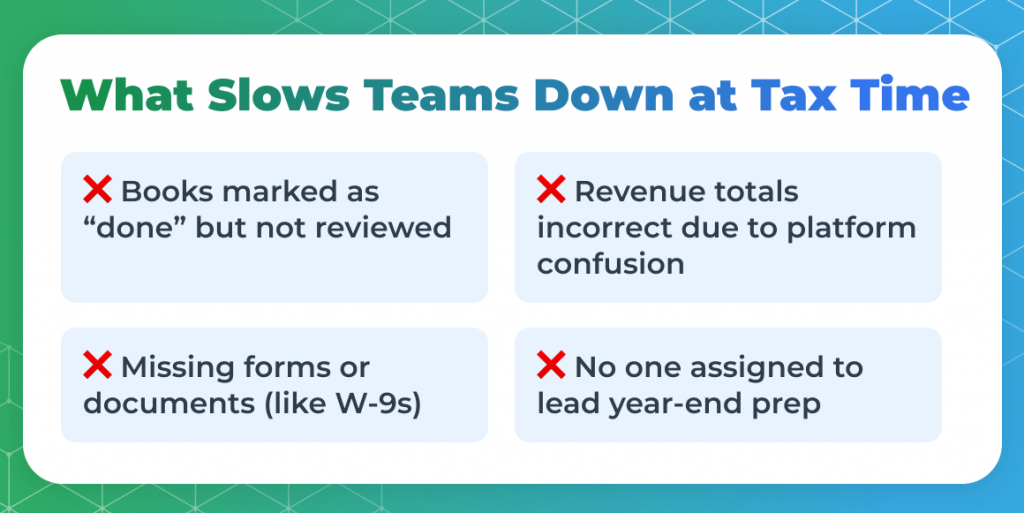

What common oversights in the pre-filing phase can create downstream inefficiencies?

Most tax-season problems don’t come from last-minute filings. They are the result of poor assumptions made months earlier.

A common oversight is assuming your books are accurate simply because they are “done.” But done doesn’t always mean audit-ready. When revenue classifications, expense categories, or account mappings aren’t consistent, downstream inefficiencies multiply. Your CPA spends hours cleaning up reports, deadlines get tight, and accuracy suffers.

For ecommerce sellers, a frequent mistake is treating payout deposits as net revenue, without breaking out:

- Fees

- Refunds

- Sales tax

- Chargebacks

This heavily distorts your income and creates inaccurate tax liabilities to be either understated or overstated.

In SaaS, improper revenue recognition is another issue. If you book prepaid contracts as immediate income instead of deferring it, you might overpay taxes or misrepresent your financial health to investors.

Another common issue is the lack of ownership of the closing calendar. If no one is responsible for consolidating statements, chasing down 1099s, or verifying year-end adjustments, your tax prep becomes an absolute mess. Even just one missing W-9 or uncategorized expense can delay filing, trigger penalties, or trigger audits.

Lastly, too many teams skip monthly reconciliations and year-end reporting and wait until the end of Q1 to begin cleanup. A more efficient approach is to run monthly closes and dry runs of key reports (P&L, balance sheet, AR/AP aging) before year-end. This mindset separates successful teams from those always playing catch-up.

The best finance teams don’t race to finish taxes. They design operations to make tax filing a routine process. That starts with spotting inefficiencies early and building systems that don’t rely on memory or guesswork.

Conclusion

As tax season approaches, remember, success isn’t built in March; it’s precisely engineered throughout the year. Finance teams that embed preparation systems early by tracking nexus changes, managing recognition, and clarifying ownership turn tax compliance into a strategic advantage.

Accounting tools like Synder help ecommerce and SaaS companies reclaim hundreds of hours through automated accounting and multichannel reconciliation, ensuring your financials are coherent and audit-ready.

Don’t wait for deadlines to force clarity for you and your team. Rather, design it, and when you do, tax season becomes a milestone, not a year-round fight.