Selling on Walmart Marketplace opens huge opportunities, but it also brings certain accounting challenges. Many sellers who use QuickBooks Online for their bookkeeping notice the same recurring issue: Walmart data doesn’t align with what shows up in QuickBooks. Between bundled settlements, hidden fees, marketplace facilitator tax, and delayed refunds, your profit and loss (P&L) report quickly becomes inaccurate unless you spend hours untangling it manually.

But there’s a direct solution. By using an accounting automation tool like Synder, you can sync Walmart transaction data to QuickBooks Online, map fees and refunds correctly, track inventory and COGS, and prepare records for reconciliation with just one click.

This article provides a complete guide to making Walmart QuickBooks integration seamless, while also showing how Synder minimizes manual work and ensures accurate financials.

Why Walmart payouts often don’t match your bank feed in QuickBooks

Let’s break down why the deposit Walmart sends might not equal the totals you see in your Walmart sales reports or QuickBooks Online.

- Consolidated settlements

Walmart issues payouts that combine dozens or even hundreds of individual orders into a single lump sum. Without a breakdown, QuickBooks sees just one deposit, leaving you unable to reconcile. - Deductions for fees

Referral fees, transaction fees, and adjustments are automatically deducted before Walmart pays you. If you only record sales in QuickBooks, your revenue will appear overstated and your expenses underreported. - Marketplace facilitator tax

Walmart collects and remits sales tax on behalf of sellers in most states. If this isn’t tracked separately in QuickBooks, your gross revenue gets inflated and your tax liabilities become inaccurate. - Refunds and returns

Customer refunds or returns often appear days later, disconnected from the original sale. Without proper matching, QuickBooks shows inflated revenue while cash in your bank drops. - Inventory and COGS challenges

QuickBooks doesn’t automatically reduce stock levels or post cost of goods sold (COGS) unless you use a tool that pushes SKU-level data from Walmart. That makes gross profit reports misleading.

As a result, your reconciliation becomes messy, P&L statements inaccurate, and you waste time creating manual journal entries to fill in the gaps.

Walmart QuickBooks integration: Manual vs. using Synder

| Aspect | Doing it manually | Using Synder |

| Workflow | Export Walmart order and settlement reports, clean the CSVs, and hand-enter sales, taxes, fees, and refunds into QuickBooks. Build journal entries and manual deposits to match Walmart payouts, then chase timing differences during reconciliation. | Synder posts sales, marketplace-collected tax, fees, and refunds to the right items/accounts automatically. It also handles reserves and timing differences, while reconciliation in QuickBooks can be completed by creating a banking rule that links Walmart deposits in your bank feed to the Clearing account. |

| Error risk | High. Every manual entry introduces the chance of duplicates or misclassifications. | Low. Automation posts consistent, audit-ready entries with full detail. |

| Scalability | Works only for very small volumes; quickly becomes unmanageable as sales grow. | Handles thousands of Walmart transactions and consolidates multiple channels with no extra work. |

| Time spent | Hours each week on spreadsheets and manual adjustments. | Minutes. Set up once, then let automation run in the background. |

The takeaway

Walmart fees, refunds, and inventory are tough to manage manually in QuickBooks Online, but Synder makes it seamless. With automated reconciliation, accurate fee and tax mapping, refund handling linked to original sales, and SKU-level inventory & COGS tracking, your books stay clean and audit-ready. Add in multi-channel support and one-click automation, and Synder becomes the easiest way to keep Walmart and QuickBooks perfectly aligned while saving hours every week.

Resolving Walmart QuickBooks integration challenges with Synder

Synder keeps everything under control: from syncing sales to managing tracking, refunds, and fees, so your QuickBooks stays accurate without extra manual work.

Syncing Walmart sales with QuickBooks via Synder

Synder automatically imports every Walmart order with full detail, keeping QuickBooks complete and audit-ready. All key data, like sales amounts, customer info, SKUs, taxes, and fees, is captured, so your books reflect the real flow of money. If you sell on multiple platforms, you can also connect channels like Amazon, Shopify, or eBay, and manage everything in one place.

Walmart inventory & COGS tracking in QuickBooks via Synder

Inventory and COGS are critical for sellers, but Walmart alone doesn’t manage your accounting records. Synder ensures every sale, refund, and stock movement is reflected properly in QuickBooks. Here’s how it works:

- SKU-level tracking. Every Walmart sale is imported with product-level detail, so QuickBooks reduces inventory automatically.

- COGS posting. When stock is reduced, cost of goods sold entries are posted automatically in QuickBooks.

- Accurate margins. With both revenue and COGS synced, your gross profit reports always reflect reality.

Handling refunds, returns, and adjustments

Refunds and returns are where many Walmart sellers lose track in QuickBooks. Synder solves this by:

- Recording refunds as separate transactions. Synder creates a refund entry in QuickBooks that offsets the original sale, bringing the account back to zero and preventing overstated revenue.

- Reversing tax correctly. Marketplace facilitator tax is reversed when refunds are processed, so you don’t carry tax on revenue you didn’t keep.

- Adjusting fees. If Walmart reverses fees after a return, Synder captures that adjustment automatically.

The net result is that QuickBooks always shows the true revenue, tax, and expense position after refunds.

Fee mapping and marketplace tax setup

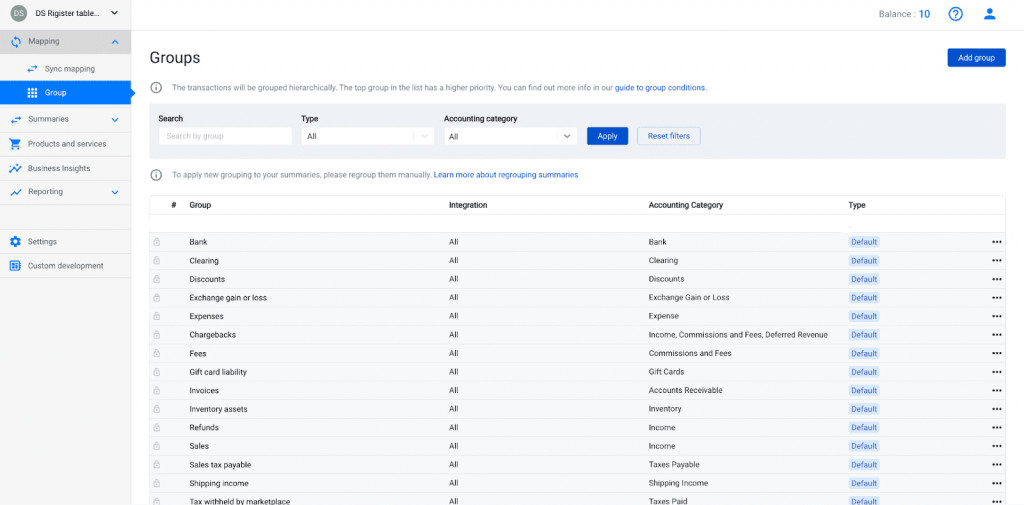

Walmart charges several types of fees, like referral fees, transaction fees, shipping service fees, and adjustments. Misclassifying them leads to distorted P&L. With Synder:

- Map each fee separately. You can assign referral fees to one expense account, transaction fees to another, and so on.

- Gain visibility. Fee mapping gives you precise insight into how Walmart fees affect profitability.

This setup is essential for accurate bookkeeping and tax reporting.

Ready to see how Synder can streamline your Walmart QuickBooks integration? Book a demo today and discover how easy it is to keep your books accurate, reconciled, and audit-ready.

Setting up Walmart QuickBooks Online integration via Synder

Here’s how to set up Walmart QuickBooks integration using Synder.

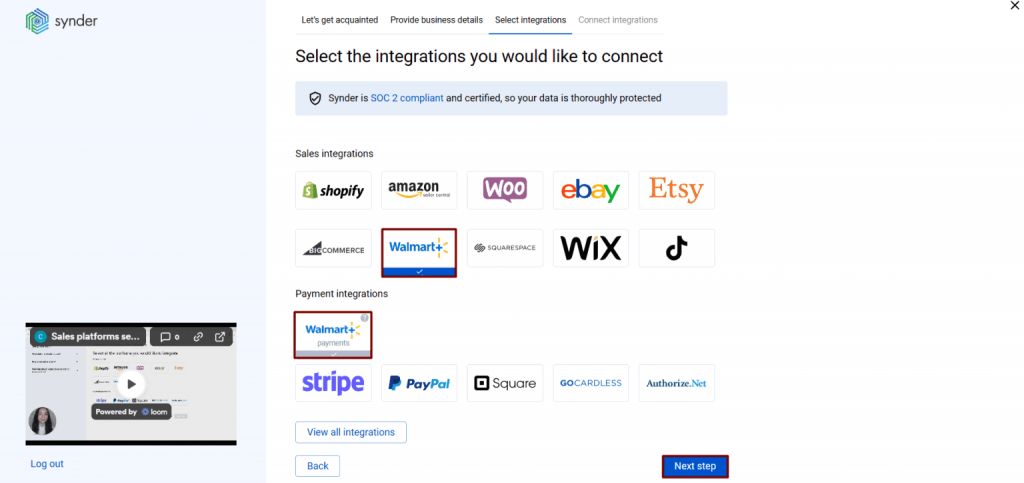

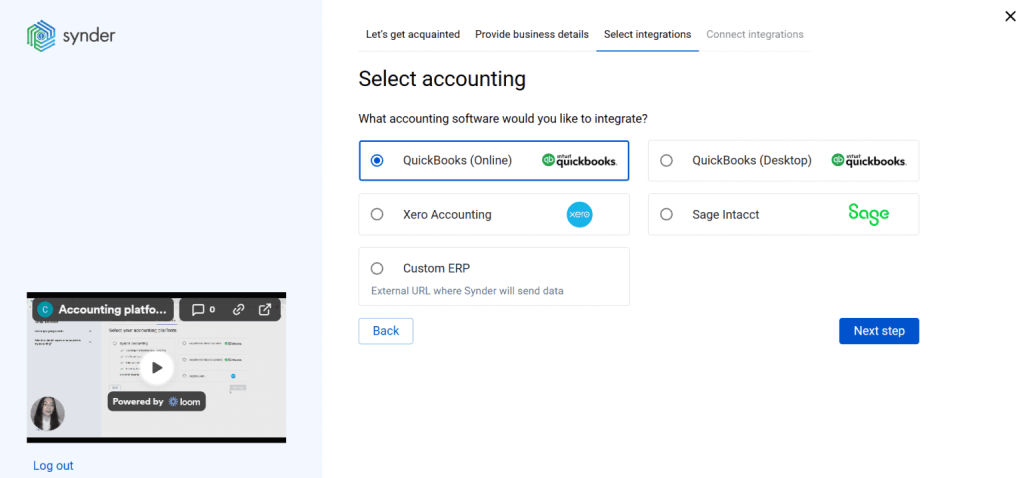

Step 1: Connect Walmart and QuickBooks Online in Synder

Start by creating a Synder account and connecting Walmart first by selecting it from the list of available platforms. Once Walmart is linked, add your QuickBooks Online company to complete the setup. To authorize the connection, you’ll need your Walmart API credentials (Client ID and Client Secret), which can be generated in Walmart’s Developer Portal. Once entered into Synder, the connection is complete, and Synder will start importing Walmart order and return data.

Step 2: Configure mapping setup

After connecting, configure how Walmart data flows into QuickBooks. In Synder, set up account mapping so that Walmart sales, refunds, and taxes are categorized properly. You can choose which income, expense, liability, or contra-income accounts these should post to in QuickBooks.

Step 3: Sync Walmart transactions to QuickBooks Online

Once mapping is in place, you can run a manual sync or enable auto-sync. Synder will then import all new Walmart orders and returns, posting sales, refunds, fees, and taxes into QuickBooks. This gives you full transaction-level detail in your books, aligned with your Walmart records.

Step 4: Reconcile Walmart payouts in QuickBooks Online

Currently, Walmart payouts aren’t supported directly through the API. To reconcile, you can create banking rules in QuickBooks that tie Walmart deposits in your bank feed to the corresponding Clearing account or accounts set up in Synder. This way, your net deposits still match your gross activity minus fees and refunds, keeping reconciliation smooth and reliable.

FAQ

How should I map different Walmart fees to expense accounts in QuickBooks?

It’s best to create separate expense accounts for each fee type (referral fees, transaction fees, shipping fees). In Synder, you can map each Walmart fee type to its correct expense category, giving you better visibility and accurate expense reporting.

How do I record Walmart returns, refunds, or replacements so revenue and tax are correctly adjusted?

Synder automatically syncs refund data from Walmart, linking it to the original order in QuickBooks. This ensures revenue is reversed, marketplace facilitator tax is adjusted, and fees are accounted for.

Can I sync inventory & track COGS for products sold via Walmart using Synder?

Yes. Synder imports SKU-level data, reduces inventory in QuickBooks if you have Per transaction Sync enabled, and posts COGS entries automatically. This keeps your gross profit margins accurate.

How far back can I import historical Walmart transactions without creating duplicate entries?

You can import Walmart data going back about 180 days, as far as Walmart makes history available. Synder prevents duplicates when re-importing its own synced data, but manually recorded entries in QuickBooks may not always be recognized.

Can I reconcile Walmart payouts in QuickBooks Online automatically?

For the time being, not directly. Walmart’s API doesn’t provide payout data, so Synder can’t create transfers automatically the way it does for other platforms. Instead, you’ll reconcile by creating banking rules in QuickBooks that link Walmart deposits in your bank feed to the Clearing account set up in Synder. This way, your net deposits still line up with your detailed sales, fees, and refunds, and reconciliation remains smooth and accurate.